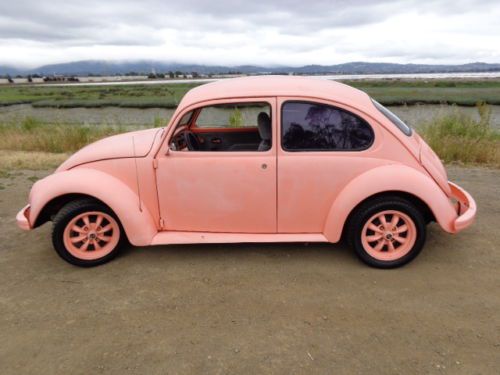

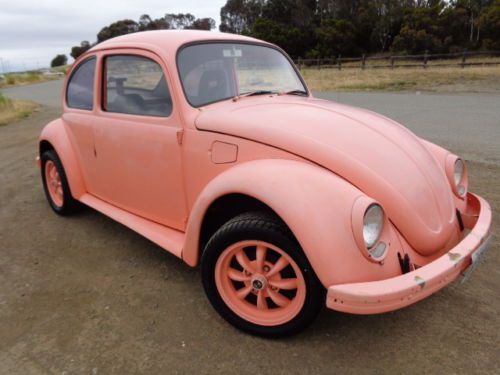

1973 Volkswagen Beetle / Cal Bug Custom - No Reserve on 2040-cars

Redwood City, California, United States

Volkswagen Beetle - Classic for Sale

1960 vw ragtop bug

1960 vw ragtop bug 1958 volkswagen beetle - very original, great patina, nice driver

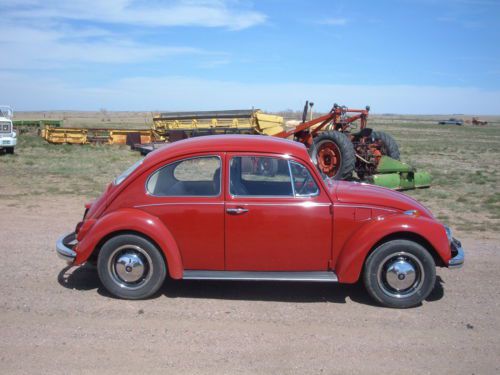

1958 volkswagen beetle - very original, great patina, nice driver 1978 vw volkswagon super beetle, red, karmann edition.

1978 vw volkswagon super beetle, red, karmann edition. 1969 volkwagen cabriolet convertable(US $10,000.00)

1969 volkwagen cabriolet convertable(US $10,000.00) 1974 volkswagen super beetle classic totally restored(US $6,500.00)

1974 volkswagen super beetle classic totally restored(US $6,500.00) 1968 volkswagen bug beetle classic passenger car with tow bar

1968 volkswagen bug beetle classic passenger car with tow bar

Auto Services in California

Z Auto Sales & Leasing ★★★★★

X-treme Auto Care ★★★★★

Wrona`s Quality Auto Repair ★★★★★

Woody`s Truck & Auto Body ★★★★★

Winter Chevrolet - Honda ★★★★★

Western Towing ★★★★★

Auto blog

Volkswagen adding R-Line trim to Touareg, Tiguan for 2014

Fri, 11 Jan 2013Volkswagen introduced its aggressive R-Line appearance package on the CC and Beetle last year, but later this year, this treatment will also be applied to VW's crossovers, the Tiguan and Touareg. Both sporty-looking utility vehicles will be unveiled next week at the Detroit Auto Show.

The 2014 Tiguan R-Line comes standard with bi-xenon headlights and LED daytime running lights, and the package adds 19-inch wheels, grey fender extensions, body-color side skirts and a liftgate spoiler. Inside, the R-Line adds a flat-bottom sport steering wheel with paddle shifters, a black headliner and numerous metallic trim accents such as the stainless scuff plates, the aluminum pedals and metallic finish on the instrument and door panels. The Tiguan R-Line will be offered in front- and all-wheel drive configurations.

As for the 2014 Touareg R-Line (shown above), this model gets an ever more distinctive look with an aggressive front fascia, 20-inch wheels and dual oval-shaped exhaust outlets in addition to the painted side skirts and LED taillights. Similar metallic interior trim pieces found inside the Tiguan R-Line will also make their way into the Touareg as well as gloss black accents on the instrument panel and center stack.

Volkswagen officially grants access to UAW in Tennessee

Tue, Dec 9 2014An audit at the Volkswagen factory in Chattanooga, TN has revealed that at least 45 percent of the facility's workers support unionization, leading the German company to grant access rights to the United Auto Workers. This is a tremendous step in the UAW's long-running and at times contentious pursuit of the workforce at Chattanooga. With this latest move, "local leadership is ready to move forward with additional conversations with the company," the union said in a statement obtained by The Detroit News. "As a starting point, UAW Local 42 will take advantage of the company's offer to establish bi-weekly meetings with Volkswagen Human Resources and the Volkswagen Chattanooga Executive Committee." The News reports that UAW Secretary-Treasurer Gary Casteel, shown above speaking at the Chattanooga plant last summer, claimed these meetings "will remind Human Resources and the Chattanooga Executive Committee of the mutually agreed-upon commitments that were made by Volkswagen and the UAW last spring in Germany. Among those commitments: Volkswagen will recognize the UAW as the representative of our members. We believe Volkswagen made this commitment in good faith and we believe the company will honor this commitment." It's important to note that despite Casteel's remarks, this is not a collective-bargaining agreement, Harley Shaiken, a labor professor at University of California, Berkeley, told The News. "But it is a step in the direction of recognition, which ultimately could lead to collective bargaining. This is not the end point," Shaiken said. "We don't know what's next. We're in unchartered territory."

Defying Trump, major automakers finalize California emissions deal

Tue, Aug 18 2020WASHINGTON ó The California Air Resources Board (CARB) and major automakers on Monday confirmed they had finalized binding agreements to cut vehicle emissions in the state, defying the Trump administration's push for weaker curbs on tailpipe pollution. The agreements with¬†carmakers Ford Motor Co, Volkswagen AG, Honda Motor Co and BMW AG were first announced in July 2019 as voluntary measures prompting anger from U.S. President Donald Trump. A month later, the Justice Department opened an antitrust probe into the agreements. The government ended the investigation without action. The Trump administration in March finalized a rollback of U.S. vehicle emissions standards to require 1.5% annual increases in efficiency through 2026. That is far weaker than the 5% annual increases in the discarded rules adopted under President Barack Obama. The 50-page California agreements, which extend through 2026, are less onerous than the standards finalized by the Obama administration but tougher than the Trump administration standards. The automakers have also agreed to electric vehicle commitments. Volvo¬†Cars, owned by China's Geely Holdings, said in March it planned to join the automakers agreeing to the California requirements. It has also finalized its agreement. The settlement agreements say California and automakers agreed to resolve "potential legal disputes concerning the authority of¬†CARB" and other states that have adopted California's standards. In May, a group of 23 U.S. states led by California and some major cities, challenged the Trump vehicle emissions rule. Other major automakers like General Motors Co, Fiat Chrysler Automobiles NV and Toyota Motor Corp did not join the California agreement. Those companies also sided with the Trump administration in a separate lawsuit over whether the federal government can strip California of the right to set zero emission vehicle requirements. Ford said the "final agreement will reduce emissions in our vehicles at a more stringent rate, support and incentivize the production of electrified products, and create regulatory certainty." BMW said "by setting these long-term, predictable, and achievable standards, we have the regulatory certainty that is necessary for long-term planning that will not only reduce greenhouse gas emissions but ultimately benefit consumers as well."¬†