2011 chrysler 300 c hemi sunroof nav rearview cam 8k mi texas direct auto(US $26,980.00)

2011 chrysler 300 c hemi sunroof nav rearview cam 8k mi texas direct auto(US $26,980.00) 2012 chrysler 300 ltd heated seats leather rear cam 50k texas direct auto(US $20,480.00)

2012 chrysler 300 ltd heated seats leather rear cam 50k texas direct auto(US $20,480.00) 2008 chrysler 300 touring(US $12,999.00)

2008 chrysler 300 touring(US $12,999.00) Extra clean ready to hit the highway or cruise in town. the all new 300

Extra clean ready to hit the highway or cruise in town. the all new 300 2006 chrysler 300c v-8 hemi auto leather sunroof runs perfect no reserve

2006 chrysler 300c v-8 hemi auto leather sunroof runs perfect no reserve 2010 chrysler 300 touring 3.5l leather alloy wheels 47k texas direct auto(US $14,980.00)

2010 chrysler 300 touring 3.5l leather alloy wheels 47k texas direct auto(US $14,980.00) Hemi 2006 chrysler 300, under 16000 miles white mint condition full package(US $20,000.00)

Hemi 2006 chrysler 300, under 16000 miles white mint condition full package(US $20,000.00) 1 owner - chrysler 300c hemi - loaded with options. low miles. nonsmoker.(US $16,500.00)

1 owner - chrysler 300c hemi - loaded with options. low miles. nonsmoker.(US $16,500.00) Bluetooth heated leather 6 cylinder

Bluetooth heated leather 6 cylinder Chrysler:300s 2013 rear cam heated leather bluetooth xm remote start beats audio(US $25,988.00)

Chrysler:300s 2013 rear cam heated leather bluetooth xm remote start beats audio(US $25,988.00) 2005 chrysler 300c(US $7,500.00)

2005 chrysler 300c(US $7,500.00) 2012 chrysler 300c, 5.7l, low miles, beautiful car, low miles, arizona car

2012 chrysler 300c, 5.7l, low miles, beautiful car, low miles, arizona car 2006 chrysler 300 srt 8 6.1l hemi only 32,000 miles runs amazing beautiful car(US $21,500.00)

2006 chrysler 300 srt 8 6.1l hemi only 32,000 miles runs amazing beautiful car(US $21,500.00) 2006 chrysler 300 srt8(US $13,800.00)

2006 chrysler 300 srt8(US $13,800.00) 2010 sedan used gas v6 3.5l/215 4-speed automatic rwd leather white(US $14,995.00)

2010 sedan used gas v6 3.5l/215 4-speed automatic rwd leather white(US $14,995.00) 1969 chrysler 300 convertible 440 v8, documented low miles, only 1 of 1,933 made(US $27,500.00)

1969 chrysler 300 convertible 440 v8, documented low miles, only 1 of 1,933 made(US $27,500.00) Convertible

Convertible Low reserve red rolls royce grille black premium cloth v6 2.7l great mpg

Low reserve red rolls royce grille black premium cloth v6 2.7l great mpg Financing available awd leather cruise power seat heated seats a/c cd aux alloys(US $21,998.00)

Financing available awd leather cruise power seat heated seats a/c cd aux alloys(US $21,998.00) 2005 chrysler 300 limited on 24" rims & tires

2005 chrysler 300 limited on 24" rims & tires We finance!! 2013 chrysler 300s hemi nav pano roof beats audio texas auto(US $27,998.00)

We finance!! 2013 chrysler 300s hemi nav pano roof beats audio texas auto(US $27,998.00) We finance!! 2012 chrysler 300c luxury awd hemi pano roof nav 17k mi texas auto(US $31,998.00)

We finance!! 2012 chrysler 300c luxury awd hemi pano roof nav 17k mi texas auto(US $31,998.00) 2014 s new 3.6l v6 24v automatic sedan premium

2014 s new 3.6l v6 24v automatic sedan premium 2012 chrysler 300 limited, v6, navigation, adaptive cruise control!!!

2012 chrysler 300 limited, v6, navigation, adaptive cruise control!!! Gray 2013 chrysler 300 s 3.6l v6 leather navigation sedan financing available!

Gray 2013 chrysler 300 s 3.6l v6 leather navigation sedan financing available! Awesome family sports car

Awesome family sports car Chrysler 300 4dr sedan 300c automatic gasoline 5.7l 8 cyl gray(US $12,988.00)

Chrysler 300 4dr sedan 300c automatic gasoline 5.7l 8 cyl gray(US $12,988.00) Limited 3.6l white int black ext chrome wheels alpine stereo system tachometer(US $16,439.00)

Limited 3.6l white int black ext chrome wheels alpine stereo system tachometer(US $16,439.00) Mopar limited edition 465 navigation heated cooled leather blind spot panoramic

Mopar limited edition 465 navigation heated cooled leather blind spot panoramic Limited 3.6l cd rear wheel drive power steering abs 4-wheel disc brakes(US $18,971.00)

Limited 3.6l cd rear wheel drive power steering abs 4-wheel disc brakes(US $18,971.00) Low miles awd loaded 1 owner we finance head turner backup cam nav moonroof(US $27,500.00)

Low miles awd loaded 1 owner we finance head turner backup cam nav moonroof(US $27,500.00) 2006 chrysler 300 series srt8(US $7,000.00)

2006 chrysler 300 series srt8(US $7,000.00) 2006 chrysler 300 series srt8(US $7,000.00)

2006 chrysler 300 series srt8(US $7,000.00) 2005 - chrysler 300 series(US $7,000.00)

2005 - chrysler 300 series(US $7,000.00) 2006 - chrysler 300 series(US $7,000.00)

2006 - chrysler 300 series(US $7,000.00) 1961 - chrysler 300 series(US $20,000.00)

1961 - chrysler 300 series(US $20,000.00) Chrysler 300 series 4 door see pictures(US $1,000.00)

Chrysler 300 series 4 door see pictures(US $1,000.00) Chrysler 300 series custom(US $1,000.00)

Chrysler 300 series custom(US $1,000.00) Chrysler 300 series 300c(US $2,000.00)

Chrysler 300 series 300c(US $2,000.00) Chrysler 300 series 300c fully loaded(US $2,000.00)

Chrysler 300 series 300c fully loaded(US $2,000.00) Chrysler 300 series limited(US $10,000.00)

Chrysler 300 series limited(US $10,000.00) Chrysler 300 series 300k(US $2,000.00)

Chrysler 300 series 300k(US $2,000.00) Chrysler 300 series leather(US $2,000.00)

Chrysler 300 series leather(US $2,000.00) Chrysler 300 series touring(US $2,000.00)

Chrysler 300 series touring(US $2,000.00) Chrysler 300 series base sedan 4-door(US $2,000.00)

Chrysler 300 series base sedan 4-door(US $2,000.00) Chrysler 300 series convertible(US $8,000.00)

Chrysler 300 series convertible(US $8,000.00) Chrysler 300 series 2-door sport coupe(US $14,000.00)

Chrysler 300 series 2-door sport coupe(US $14,000.00) Chrysler other touring sedan 4-door(US $10,000.00)

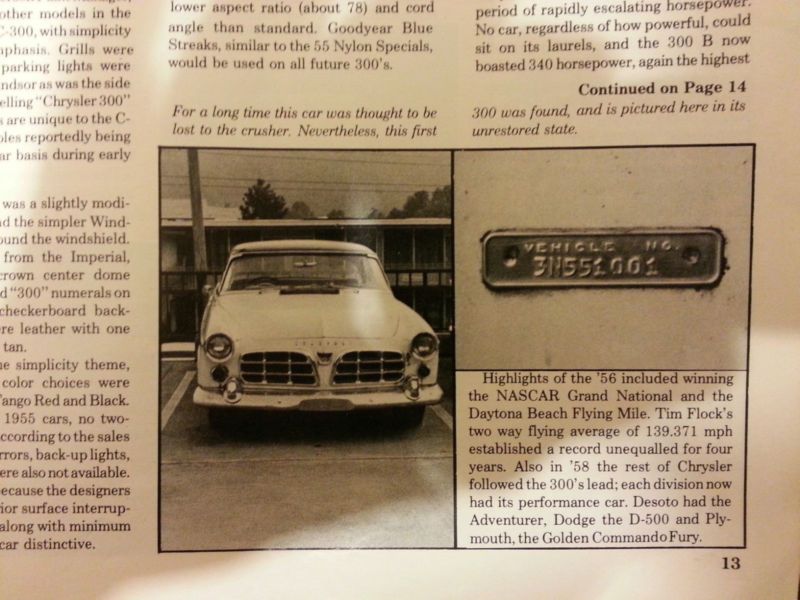

Chrysler other touring sedan 4-door(US $10,000.00) 1955 chrysler 300 series 1955-3n551001-hemi-first 300 built!(US $22,600.00)

1955 chrysler 300 series 1955-3n551001-hemi-first 300 built!(US $22,600.00) 1958 chrysler 300 series(US $13,200.00)

1958 chrysler 300 series(US $13,200.00) 2013 chrysler 300 series(US $19,600.00)

2013 chrysler 300 series(US $19,600.00) 2012 chrysler 300 series(US $14,700.00)

2012 chrysler 300 series(US $14,700.00) Chrysler 300 series s(US $4,000.00)

Chrysler 300 series s(US $4,000.00) 2013 chrysler 300 series srt(US $18,200.00)

2013 chrysler 300 series srt(US $18,200.00) 1961 chrysler 300 series(US $21,400.00)

1961 chrysler 300 series(US $21,400.00) 2014 chrysler 300 series s(US $15,900.00)

2014 chrysler 300 series s(US $15,900.00) 1957 chrysler 300 series 300c(US $21,400.00)

1957 chrysler 300 series 300c(US $21,400.00) Chrysler: 300 series limo(US $34,000.00)

Chrysler: 300 series limo(US $34,000.00) 2015 chrysler 300 awd c-edition (premium)(US $11,800.00)

2015 chrysler 300 awd c-edition (premium)(US $11,800.00) 2015 chrysler 300 s-edition(US $12,800.00)

2015 chrysler 300 s-edition(US $12,800.00)

Chrysler 300 Series Price Analytics

About Chrysler 300 Series

Auto blog

PSA reportedly ditching its two tiny gasoline city cars ahead of merger

Thu, Oct 15 2020The Peugeot 108. ¬† PARIS ó PSA is ending the production of Peugeot and Citroen small city cars, three sources told Reuters, withdrawing from an increasingly unprofitable market as its starts a strategic review ahead of its planned merger with Fiat Chrysler. While PSA had already agreed to sell its stake in its Czech joint venture with Toyota where the Peugeot 108 and Citroen C1 models are made, the decision to stop selling the gasoline cars altogether has just been taken, the sources said. Carmakers are reviewing the production of vehicles with combustion engines as they need to fit costly exhaust filtering systems to meet tighter emissions laws. That's pushing up the cost of some so-called entry-level A segment cars to the point where they are hard to justify economically. "PSA is getting out of both the factory and the A segment business, as it is offered today, and on which manufacturers have arguably lost the most money in Europe," one of the sources familiar with the matter said. PSA declined to comment on the future of the two small cars. It said it was reviewing which products would best meet customer expectations in the A segment and cope with European carbon emissions targets. "This means a reflection with fresh and disruptive ideas," a spokesman for the French carmaker said. The European Commission is planning to tighten its emissions limits for cars under new proposals designed to cut the bloc's greenhouse gas output further by 2030. PSA's merger project with FCA has also increased the options available, two of the sources said, as the Italian-U.S. company has no intention of abandoning its small best-selling Panda and 500 models. Both already have hybrid versions and the 500 is also available in full electric mode. "Current projects could be replaced by new ones made possible by the merger with FCA", another source said. "The merger is turning all the cards around, especially when you consider that the A segment, from the very first 500 to the Panda, is inseparable from Fiat history". FCA declined to comment. PSA and FCA aim to finalize their merger in the first quarter next year to create a new company called Stellantis, which will be the fourth-biggest automaker in the world. Market contraction The European market for frugal city cars has been shrinking for several years.

To grease the skids for Stellantis, PSA offers to boost Toyota's fortunes

Sun, Sep 27 2020BRUSSELS/MILAN ó Peugeot maker PSA has offered to boost Japanese rival Toyota to try to address EU antitrust concerns about its plan to create the world's fourth-biggest¬†carmaker, to be called Stellantis, by merging with Fiat Chrysler, people familiar with the matter said on Friday. PSA has offered to increase the production capacity for Toyota in their van joint venture, one of the sources said. Another source said the French company would sell the vans at close to cost. PSA makes vans for Toyota in its Sevelnord plant in northern France. The van collaboration started in 2012. PSA submitted its offer to the European Commission earlier on Friday, three months after the EU enforcer opened a full-scale investigation into the deal with FCA on concerns that it would hurt competition in small vans in 14 EU countries and Britain. "As of now, the transaction has obtained merger clearance in 14 jurisdictions. As previously stated, closing of the transaction is expected to occur in the first quarter of 2021," PSA and FCA said in a joint statement. The Commission, which temporarily halted its investigation into the deal in July while waiting for the companies to provide requested data, did not set a deadline for its decision. "The deadline is still suspended. This procedure in merger investigations is activated if the parties fail to provide, in a timely fashion, an important piece of information that the Commission has requested from them," the EU executive said. It is now expected to seek feedback from customers and rivals before deciding whether to demand more concessions, or either clear or block the deal. Government/Legal Chrysler Fiat Peugeot Stellantis

Fiat Chrysler shares get a boost after revised Stellantis merger deal with PSA

Tue, Sep 15 2020MILAN ó Shares in Fiat Chrysler (FCA) rose sharply in Milan on Tuesday after the car maker and French partner PSA revised the terms of their merger deal, with FCA's shareholders getting a smaller cash payout but a stake in another business. FCA and PSA, which last year agreed to merge to give birth to Stellantis, the world's fourth largest car manufacturer, said late on Monday they had amended the accord to conserve cash and better face the COVID-19 challenge to the auto sector. Milan-listed shares in Fiat Chrysler rose almost 8% by 1000 GMT, while PSA gained 1.5%. Under the revised terms, FCA will cut from 5.5 billion euros ($6.5 billion) to 2.9 billion euros the cash portion of a special dividend its shareholders are set to receive on conclusion of the merger. However, PSA will for its part delay the planned spinoff of its 46% stake in car parts maker Faurecia until after the deal is finalized. That means all Stellantis shareholders ¬ó and not just the current PSA investors - will get shares in a company which has a market value of 5.8 billion euros. Based on Stellantis' 50-50 ownership structure, FCA and PSA respective shareholders will each receive a 23% stake in Faurecia. Analysts welcomed the 2.6 billion euros in additional liquidity for Stellantis' balance sheet as well as the increase in projected synergies to more than 5 billion euros from 3.7 billion. There was also further reassurance as the two companies confirmed they expected the deal to close by the end of the first quarter of 2021. "All told, the two players emerge as winners," broker ODDO BHF said in a note. "Of the two, FCA might be a bit more of a winner in the short term given the structure of the deal and the numerous payouts to shareholders to come in the quarters ahead (potentially close to 5 billion euros versus the current capitalization of around 16 billion euros)." The special dividend for FCA shareholders had proved contentious after Italy offered state guarantees for a 6.3 billion euro loan to the company's Italian business. "These announcements should, at last, end the debate over the financial terms of the merger, which had become a big topic and was still penalizing the two groups' share performances," ODDO BHF said. PSA and FCA said they would consider paying out 500 million euros to shareholders in each firm before closing or else a 1 billion euro payout to Stellantis shareholders afterwards, depending on market conditions and company performance and outlook.

Henrik Fisker interview, and driving the Polestar 2 | Autoblog Podcast #643

Thu, Sep 3 2020In this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Senior Editor, Green, John Beltz Snyder. They've been driving the updated 2021 Honda Odyssey, the 2020 Mercedes-AMG GLC 43 and the new Polestar 2 electric sedan. After reviewing those, they talk about how the Chrysler 300 appears to be withering on the vine. Next, they take time to talk to legendary automotive designer and eponymous Chairman & CEO of Fisker Inc., Mr. Henrik Fisker himself, about jeans, horses and, of course, electric cars. Finally, they help a listener pick a $100,000 supercar in the "Spend My Money" segment. Autoblog Podcast #643 Get The Podcast iTunes Ė Subscribe to the Autoblog Podcast in iTunes RSS ¬Ė Add the Autoblog Podcast feed to your RSS aggregator MP3 ¬Ė Download the MP3 directly Rundown Cars we're driving 2021 Honda Odyssey 2020 Mercedes-AMG GLC 43 2020 Polestar 2 Chrysler 300 soldiers on for 2021 with pared-down range, higher price Henrik Fisker interview Spend My Money Feedback Email ¬Ė Podcast@Autoblog.com Review the show on iTunes Related Video:

Stellantis ó seriously? Exploring the pros and cons of Chryslerís new name

Fri, Jul 17 2020I took Wednesday off. I came in Thursday and Chrysler was renamed Stellantis. Aside from lighting Twitter on fire and drawing a lot of snarky responses from car journalists, the name is actually decent. Letís look at it from a few angles. For starters, Chrysler, the 95-year-old automaker founded in Detroit by Walter P. Chrysler (his name still adorns everything from a major freeway in Michigan to an iconic art deco skyscraper in New York), isn¬ít actually Chrysler. It¬ís FCA, which stands for Fiat Chrysler Automobiles. The name change actually happened in 2014, which you might have easily missed. The American unit, formerly Chrysler, is known as FCA US in some legal matters, but does not operate independently.¬†¬† The Stellantis name takes effect in 2021. Here¬ís why it¬ís needed: Fiat Chrysler is merging with Group PSA. (Peugeot and Citroen) to form a transatlantic alliance that will be larger than even Ford. Stellantis sounds a lot better than FCA-PSA. Or PSA-FCA. You might poke fun at it, but it beats the alternatives. Or at least it could be worse. Stellantis is the name for the corporate entity that will house Chrysler, Fiat, Peugeot, Citroen, and oh by the way, Opel and Vauxhall, which PSA bought in 2017 when GM unloaded its European arm.¬† Your Jeep will not say Stellantis on the fender. Your Hemi Hellcat won¬ít say ¬ďpowered by Stellantis¬Ē under the hood. Your Fiat 500 or Alfa Romeo Giulia will not have a script ¬ďStellantis" crest. Speaking of that, roll call: Here¬ís all of the brands that will be housed under the Stellantis umbrella: Chrysler, Dodge, Jeep, Fiat, Fiat Professional, Mopar, Alfa Romeo, Maserati, Abarth, Ram, Lancia, Peugeot, Citroen, DS, Opel and Vauxhall. There¬ís also a couple of lesser-known subsidiaries, Comau and Teksid, that sell parts. That¬ís 18 brands. They have origins in Detroit, Paris, Turin, Chalton (England), Russelsheim (Germany) and several other places. All of these carmakers have deep histories. No one was going to agree on using someone else¬ís name. You might notice Chrysler is still in there. Chrysler as the brandname for the 300 sedan and Pacifica minivan lives on. Stellantis replaces FCA, which replaced Chrysler, as the name of the parent company. Yes, it's a little confusing. Here¬ís more perspective. Chrysler was once owned by Cerberus, a three-headed dog that guards the gates of hell, according to mythology.

The company formerly known as Chrysler is now Stellantis

Wed, Jul 15 2020Introducing Stellantis. Talk to your doctor before using Stellantis as side effects may include model redundancy, the overwhelming urge to apply Dodge badges to Peugeot crossovers, and weak stream. Honestly, how can you not poke just a little fun at the name chosen for the new multi-national corporation that will result once the merger of Fiat Chrysler Automobiles (FCA) and Peugeot S.A. (Groupe PSA) is completed in the first quarter of 2021. According to the press release, "Stellantis is rooted in the Latin verb 'stello' meaning 'to brighten with stars' ... The name's Latin origins pay tribute to the rich history of its founding companies while the evocation of astronomy captures the true spirt of optimism, energy and renewal driving this industry-changing merger." The "Latin origins" of the French company Peugeot and the Italian Fiat are obvious. Chrysler, on the other hand, was founded by a man born in Kansas whose father was a Canadian-American of German and Dutch ancestry (thanks Wikipedia). His mother was also of German ancestry. So yeah, the name Stellantis is really only related to the Peugeot and Fiat bits. The Americans are just along for the ride with their Jeeps and Hellcats.  And it should be noted that we will henceforth never write "Stellantis" in ALL CAPS as the corporation does because it's silly and we don't do it for Hummer, Mini, etc. Admittedly, Fiat could go either way since it's literally an acronym, but Fiat doesn't even bother doing that any more.   The name Stellantis will only be applied at the corporate level, so effectively in place where you previously would've said Fiat-Chrysler or FCA. There won't be a Stellantis Challenger.  We produced a list last year of all the cars that are currently made by the brands within Stellantis. Here's also a list of all the names that the company we generically know as "Chrysler" has gone through over the years. Chrysler Corporation (1925-1998) DaimlerChrysler (1998-2007) Chrysler LLC (2007-2009) Chrysler Group (2009-2014) Fiat Chrysler Automobiles (2014-2021) Stellantis  There have also been secondary corporate entities. There was Diamond Star Motors from 1985 to 2015, a manufacturing joint venture between Mitsubishi and whatever Chrysler was called at the time. It resulted in the Plymouth Laser, a randomly selected example pictured above, amongst other automotive diamonds.

Italy reportedly guarantees $7.1 billion loan to Fiat Chrysler

Wed, Jun 24 2020ROME ó Italy has approved a decree offering state guarantees for a 6.3-billion euro ($7.1 billion) loan to Fiat Chrysler's (FCA)¬† Italian unit, a source said, paving the way for the largest crisis loan to a European carmaker. The source said Italy's audit court had signed off on the decree, in a final step of what had been a lengthy and contested process to get the loan approved. The court's approval follows an earlier endorsement by the economy ministry. "The audit court authorized the decree," said a source close to the matter, asking not to be named because of its sensitivity. FCA's Italian division has tapped Rome's COVID-19 emergency financing schemes to secure a state-backed, three-year facility to help the group's operations in the country, as well as Italy's car sector in which about 10,000 businesses operate, weather the crisis triggered by the coronavirus emergency. The loan will be disbursed by Italy's biggest retail bank Intesa Sanpaolo, which has already authorized it pending the approval of guarantees the government will provide on 80% of the sum through export credit agency SACE. The request for state support has sparked controversy because FCA is working to merge with French rival PSA and the holding for the Italian-American carmaker is registered in the Netherlands. FCA's global brands include Fiat, Jeep, Dodge and Maserati. It was not immediately clear what conditions, if any, Italy has set as part of the guarantees and whether they would affect FCA's planned 5.5 billion euro ($6.2 billion) extraordinary dividend, which is a key element in the merger with PSA. FCA, whose shares were down 0.5% by 0908 GMT, had no immediate comment. ¬† Earnings/Financials Chrysler Fiat Peugeot Italy

Vans aren't glamorous, but they're key to EU blessing FCA-PSA merger

Thu, Jun 18 2020MILAN/PARIS ó Their silhouettes don't stir dreams of adventure like a sports car or trendy SUV, but vans are a rare source of profit for European carmakers, which is why EU regulators are focused on them as they decide whether to back an industry mega-merger. European competition regulators are worried that Fiat Chrysler and Peugeot maker PSA's proposed merger may harm competition in small vans. With a total of 755,000 vans sold last year in Europe, the combined Fiat Chrysler (FCA) and PSA would get a market share of around 34%, based on industry data, more than double that of Renault and Ford, with shares around 16% each. Volkswagen and Daimler follow with market shares of 12% and 10% respectively. "Commercial vans are important for individuals, SMEs and large companies when it comes to delivering goods or providing services to customers," European Union competition chief Margrethe Vestager said in a statement, announcing an in-depth investigation into the proposed merger. "They are a growing market and increasingly important in a digital economy where private consumers rely more than ever on delivery services." Dario Duse, a managing director at consultancy firm AlixPartners, said demand for vans was not based on people's disposable income, as for cars, but rather on GDP and industrial trends, and in particular the logistics industry, where big players such as Amazon or DHL operate. "Logistics is a business segment which is having a significant growth, for several reasons including e-commerce, where you need efficient and agile vans for interurban and city deliveries," he said. "LCVs (light commercial vehicles) may recover faster than passengers cars in the post-COVID-19 phase." Sales of vans up to 3.5 tonnes in Europe amounted to 2.2 millions vehicles last year, compared to 15.8 million for passenger cars, according to data provided by the European Auto Industry Association (ACEA). The light commercial vehicles (LCVs) market may be secondary in terms of volumes, but it remains highly profitable in an industry where margins are constantly under pressure. Margins are generally higher than on passenger cars, up to 5-10 additional percentage points, AlixPartners says. "With LCVs you don't have to fulfill a series of consumer expectations that drive additional complexity and costs, such as for interiors. LCV customers are more rational and business driven," Duse said. And while electrification in heavy trucks is complicated, it might come sooner for LCVs.

Fiat/PSA's dominance in small vans hangs up EU's merger approval

Mon, Jun 8 2020BRUSSELS ó EU antitrust regulators are concerned about Fiat Chrysler and Peugeot / PSA's combined high market share in small vans and may require concessions to clear their $50 billion merger, people familiar with the matter said. The companies, which are seeking to create the world's fourth biggest carmaker, were told of the European Commission's concerns last week. If Fiat and PSA fail to dispel the European Commission's doubts in the next two days and subsequently decline to offer concessions by Wednesday, the deadline for doing so, the deal would face a four-month-long investigation. The EU competition enforcer, which has set a June 17 deadline for its preliminary review, declined to comment. Fiat was not immediately available for comment while PSA had no immediate comment. Hiving off overlapping businesses, usually a regulatory demand to ensure more competition, could prove tricky for the carmakers because of the technicalities. Fiat and PSA are looking to merge to help offset slowing demand and shoulder the cost of making cleaner vehicles to meet tougher emissions regulations. The deal puts under one roof the Italian carmaker's brands such as Fiat, Jeep, Dodge, Ram, Maserati and the French company's Peugeot, Opel and DS. Related Video: Government/Legal Chrysler Dodge Fiat Jeep Maserati RAM Citroen Opel Peugeot

Peugeot maker PSA posts record profits ahead of FCA merger

Wed, Feb 26 2020PARIS ó Peugeot maker PSA Group said its profitability reached a record high in 2019 but the French carmaker forecast falling industry sales in Europe this year as it pursues its merger with Fiat Chrysler, which is strong in North America. PSA has trimmed costs in areas such as the procurement of components as it has integrated its acquisition of Opel and Vauxhall, boosting operating margins to 8.5% last year. The group, which also produces cars under the Citroen and DS brands, offset a slump in vehicle sales by selling pricier SUV models, with launches including the Citroen C5 Aircross helping to lift revenues by a higher-than-expected 1% to $81.2 billion (74.7 billion euros). That helped it stand out in a car market where some rivals including France's Renault have struggled with sliding revenues and profits, amid a broader downturn in demand. PSA's group net profit increased 13.2% to a record 3.2 billion euros, and the company increased its dividend against 2019 results to 1.23 euros per share, up 58% from 2018 levels. The carmaker was "once again very solid", analysts at brokerage Oddo-BHF said in a note, adding the results confirmed the company's "best-in-class status." However PSA forecast a 3% contraction in Europe's car market this year, by far its biggest market. The tie-up with Fiat Chrysler will help it gain exposure to that group's strong presence in North America with brands like Jeep. The two companies struck a deal in December to create the world's No.4 carmaker, to better cope with market turmoil and the cost of making less-polluting vehicles. Fiat also posted more upbeat results than most rivals this year. CORONAVIRUS WEIGHS PSA boss Carlos Tavares told a news conference that the two groups were both in good shape and well placed to face market challenges together. He said he did not expect any major regulatory hurdles to the merger, adding it had so far submitted 14 approval requests to competition authorities out of the 24 it needs. There are no immediate plans to change anything in the large portfolio of brands within the combined group, he added. However the companies still face problems this year, including the coronavirus outbreak which has paralyzed production in China and hits carmakers' supply chain. PSA said the coronavirus impact was still difficult to assess. It factories in Wuhan, at the epicenter of the outbreak, are due to reopen in the second week of March.