1962 Chevrolet Impala Ss on 2040-cars

Saint Louis, Missouri, United States

Engine:6.2L LS3 V8

Fuel Type:Gasoline

Body Type:Convertible

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 218678265534

Mileage: 2350

Make: Chevrolet

Trim: SS

Drive Type: --

Features: --

Power Options: --

Exterior Color: Black

Interior Color: Black

Warranty: Unspecified

Model: Impala

Chevrolet Impala for Sale

1958 chevrolet impala(US $53,000.00)

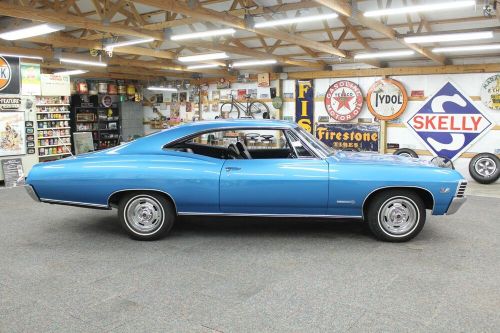

1958 chevrolet impala(US $53,000.00) 1967 chevrolet impala ss - numbers matching 396, beautiful low mile restoration(US $47,500.00)

1967 chevrolet impala ss - numbers matching 396, beautiful low mile restoration(US $47,500.00) 1961 chevrolet impala impala(US $130,000.00)

1961 chevrolet impala impala(US $130,000.00) 1964 chevrolet impala super sport(US $21,100.00)

1964 chevrolet impala super sport(US $21,100.00) 1964 chevrolet impala(US $10,099.00)

1964 chevrolet impala(US $10,099.00) 1960 chevrolet impala(US $39,500.00)

1960 chevrolet impala(US $39,500.00)

Auto Services in Missouri

Wyatt`s Garage ★★★★★

Woodlawn Tire & Auto Center ★★★★★

West County Auto Body Repair ★★★★★

Tiger Towing ★★★★★

Straatmann Toyota ★★★★★

Scott`s Auto Repair ★★★★★

Auto blog

Basic configurator for 2021 Chevy Colorado and GMC Canyon slips online

Mon, May 18 2020TFLnow discovered basic configurators for the 2021 Chevrolet Colorado and GMC Canyon are already online at GM's site for employee discounts. These aren't the fully-featured whiz-bang configurators that will show on the retail websites soon, but they include a bunch of the relevant info a shopper would be looking for. After trim changes detailed earlier this year, the 2021 Colorado offers the most choice, even with the two-door base model gone. Cutting the entry-level Colorado also means the entry-level price has gone up by $3,900; the 2020 Colorado could be had for $22,495, but the 2021 model starts at $26,395 after the $1,195 destination charge. That gets you the extended cab with a standard bed in two-wheel drive. The 2WD crew cab with a short bed starts at $28,295, and the 2WD crew cab with a standard bed starts at $30,595. At the top end, the ZR2 model runs $44,395, which is $200 more than the 2020 version. The color palette isn't complete, but the options page shows a number of choices for packages. The Redline Special Edition Package goes up $10 to $2,690, the Tonneau and Step Package increase $100 to $1,195, a new Chrome Package puts shiny stuff in places like the door handles and steps for $300, while the Black Bowtie Emblem Package drops $80 to $140. The one-inch front leveling kit, which was thought to cost $150 based on early order information GM Authority had seen, is here listed for $450 and available on the Colorado but not the Canyon. The Canyon makes matters a tad simpler by having many options locked in depending on which one starts with — 2WD Elevation Standard starting at $27,595, 2WD Elevation for $31,195, 4WD AT4 with a cloth interior for $39,395 or AT4 with leather for $41,195, the least expensive Denali starting at $42,095 for a crew cab short box with 2WD. The Elevation includes items like the Convenience Package that are options on the base model, and also offers a $1,400 High Elevation Package conferring heated and power black leather seats, plus a heated steering wheel, that can't be optioned on the Elevation Standard. The pinnacle is the crew cab with a standard bed in Denali 4WD trim for $45,895. Colors and many of the final options and accessories, such as the AT4 Off-Road Performance Edition Package we've heard about, are also missing here, but there's heaps to play around with to get an idea of what you'll be in for if you're considering a 2021 Canyon. Related Video:  Â

Question of the Day: What's the most irritating car name?

Wed, Mar 9 2016You hear a lot about how the Chevrolet Nova was a sales flop in Mexico because "No va" means "it doesn't go" in Spanish; in fact, the Nova sold pretty well south of the border, and in any case most Spanish-speakers know that "Nova" means "new" in Latin and Portuguese. However, General Motors doesn't deserve to be let off the hook for bad car names, because the Oldsmobile Achieva— no doubt inspired by the excruciating "coffee achievers" ads of the 1980s— scrapes the biggest fingernails down the screechiest chalkboard in the US-market car-name world. That is, unless you think Daihatsu's incomprehensible choice of Charade was worse. Meanwhile, Japanese car buyers could get machines with cool names like Mazda Bongo Friendee or Honda Life Dunk. It's just not fair! So, what car name drives you the craziest? Related Video: Auto News Design/Style Chevrolet Honda Mazda Daihatsu Automotive History questions car names

Recharge Wrap-up: Toyota FCV Rally Car To Compete, Barra bullish on Chevy Volt

Fri, Oct 31 2014The Toyota FCV will compete in the last stage of the 2014 Japanese Rally Championship. The sport-tuned hydrogen-powered car will tackle the 177-mile Shinshiro Rally on November 1 and 2, emitting no greenhouse gases in the process. The rally course will help prove the safety of the vehicle before it goes on sale in Japan in the next several months. The Toyota FCV, rumored to be called "Mirai" in Japan, will begin sales there before April, according to Toyota, and in the summer in the US and Europe. Read more in the press release below. Carsharing is becoming more popular, and more visible, throughout the world, including the US. According to WardsAuto columnist John McElroy, 18 percent of US drivers have used some sort of carsharing service. Additionally, he says 60 percent of Americans are familiar with Zipcar and Uber. Mercedes' Harald Kroeger says promotions like free parking for carshares in Stuttgart are encouraging growth for Daimler's carsharing service, Car2go. Read more at WardsAuto. Ethanol is being help up by rail transport, according to ethanol producer Green Plains. More and more stations are carrying E15 blend gasoline, but grain producers have complained that crude oil is given higher priority by the rail lines shipping it, which rail companies deny. Union Pacific and BNSF Railway say they are stepping up service to make sure that ethanol can be shipped reliably to customers. Read more at Omaha World-Herald. General Motors "has placed a significant bet [on] the electrification of the automobile," says CEO Mary Barra. In a speech to the Detroit Economic Club this week, she spoke about the Chevrolet Volt, and its importance to GM's future. While Barra admits the Volt's success has been "not everything we wanted," it has provided experience, and shows that EVs have "an important role in the future of GM." The new Volt is more refined, stores more energy, has longer range, uses less fuel and is a big investment for Michigan. She announced that the new Volt's electric drive system will be built in Warren, and that all of its major components will be made in Michigan. "Silicon Valley doesn't have a corner on the market for innovation, creativity and drive," says Barra. "These qualities exist here – in this region – as well." See the speech's highlight video and read more in the transcript below. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.