Auto blog

Tue, Oct 29 2019

Fiat Chrysler and Peugeot owner PSA are in talks to combine in a deal that could create a $50 billion automaker, the Wall Street Journal reported on Tuesday, citing sources. The deal could be in the form of an all-stock deal, the report said. Fiat Chrysler shares rose sharply after the report and were up more than 7% in late afternoon trading. Fiat Chrysler and Peugeot had no comment. Investors have speculated for several years that Fiat Chrysler was hunting for a merger partner, encouraged by the rhetoric of the company's late chief executive, Sergio Marchionne. In 2015, Marchionne outlined the case for consolidation of the auto industry, and tried unsuccessfully to interest General Motors in a deal. Peugeot and Fiat Chrysler had discussed a combination earlier this year, before Fiat Chrysler proposed a $35 billion merger with French automaker Renault SA. Fiat Chrysler Chairman John Elkann broke off talks with Renault in June after French government officials intervened, and pushed for Renault to first resolve tensions with its Japanese alliance partner, Nissan. Following the collapse of the Renault merger plan, Fiat Chrysler CEO Mike Manley left the door open for talks with would-be partners, but said the Italian-American automaker could go it alone despite mounting costs to develop electric vehicles and comply with tougher emissions rules in Europe, the United States and China. Peugeot CEO Carlos Tavares dismissed the idea of a combination with Fiat Chrysler during a discussion with reporters at the Frankfurt auto show last month. "We don't need it," Tavares said when asked whether he was still interested in a deal with Fiat Chrysler. Fiat Chrysler has a commercial vehicle partnership with Peugeot.

Fri, Sep 27 2019

In this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Senior Editor, Green, John Beltz Snyder and Associate Editor Joel Stocksdale. This week, they focus on the cars they're driving, starting with the hardcore, four-door Mercedes-AMG GT 63 S. Then they move on to the aging Lexus GX 460 and the plucky Fiat 124 Spider Abarth. They discuss the practical-yet-luxurious Lincoln Nautilus, as well as the state of Lincoln as a whole (did you hear it just got a new design boss?). Finally, they help pick a modern vehicle for someone with a hankering for the look of the classic Ford Bronco. Autoblog Podcast #596 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown 2019 Mercedes-AMG Four-Door GT 63 S 2019 Lexus GX 460 2019 Fiat 124 Spider Abarth 2019 Lincoln Nautilus Spend My Money Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Fri, Aug 30 2019

In this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by West Coast Editor James Riswick and Associate Editor Joel Stocksdale. To begin, Greg takes a moment to remember the fastest woman on four wheels and former host of Autoblog's "The List," Jessi Combs, who died this week. Then our editors turn their attention to the cars they've been driving, including the Lincoln Aviator, Ford Ranger and Nissan Frontier, as well as Joel's recent stint in the Fiat 500 Abarth and Fiat 124 Spider Abarth, including track time at Laguna Seca. Finally, they turn their attention to a listener in Germany who is looking to replace an aging Volkswagen Eos with a newer convertible in this week's "Spend My Money" segment. Autoblog Podcast #593 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Remembering Jessi Combs 2020 Lincoln Aviator and Aviator Grand Touring 2019 Ford Ranger 2019 Nissan Frontier 2019 Fiat 500 Abarth and 124 Spider Abarth at Laguna Seca Spend My Money Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Â

Mon, Aug 5 2019

DETROIT — Fiat Chrysler Automobiles Chief Executive has a message for Renault SA and other would-be partners: We are happy to talk, but we can go it alone. "Strategically, we have a solid future and clear plans that are being invested in and are underway now," Mike Manley said during a session with reporters the day after the company released better than expected second-quarter results. "That isn't to say if there is a better future through an alliance or partnership or merger we wouldnÂ’t be open and interested to it." Fiat Chrysler is open to re-starting merger negotiations with French automaker Renault, Manley said, but added the French car maker is not the only potential partner to gain scale or plug gaps in Fiat Chrysler's technology or vehicle lineup. "To say are they the only opportunity, the answer to that question would be a definitive ‘No,Â’" Manley said. Fiat Chrysler in June withdrew a $35 billion merger proposal with Renault after French government officials intervened in the talks and sought to delay a decision on the deal. The Wall Street Journal reported on Friday that Renault and Nissan are trying again to reshape their alliance and resolve disagreements that helped to derail the merger talks with Fiat Chrysler. Fiat Chrysler has a commercial vehicle partnership with French rival Peugeot SA, and the two companies discussed a broader combination before Fiat Chrysler made its offer to Renault, people familiar with the situation have said. Manley said automakers are not the only potential partners. "There are cooperations that can help in specific technologies. There are cooperations as we think about the consumer-car interface," he said. "You could see collaborations that never would be there in the past." Fiat Chrysler's North American business is strong thanks to Ram trucks and Jeep SUVs, but in other markets the automaker faces continued challenges. The company is overhauling its mass-market business in Europe, which is anchored by the Fiat brand. Fiat Chrysler's Europe, Middle East and Africa operations were marginally profitable in the second quarter and achieved 1.8% profit margin in 2018. Manley has set a goal of 3% operating margins, well short of the 10% margins the company forecast for North America.

Wed, Jul 31 2019

MILAN/DETROIT — Fiat Chrysler took the market by surprise by sticking to its full-year profit guidance on Wednesday after a strong performance from its Ram pickup truck in North America helped it defy an industry slowdown. Chief Executive Mike Manley, in FCA's first earnings release since a failed attempt to merge with France's Renault, also left the door open to that or other deals. "We are open to opportunity," Manley said on a call with analysts. "I have no doubt why there still would be interest in it," he added, when pressed on what it would take to revive talks with Renault. Manley declined to comment further. FCA last month abandoned its $35 billion merger offer for Renault, blaming French politics for scuttling what would have been a landmark deal to create the world's third-biggest automaker. Manley said a merger was not a must-have and Fiat Chrysler's business plan was strong. The company said it remained confident its adjusted earnings before interest and tax (EBIT) would top last year's 6.7 billion euros ($7.5 billion). Given disappointing forecasts from other automakers this earnings season, FCA's confirmation of the outlook sent Milan-listed shares in the Italian-American automaker, whose other brands include Jeep, up over 4%. A broad-based auto sales downturn has rattled the sector, forcing FCA's competitors — including Renault, Daimler and Aston Martin — to cut their sales forecasts after second-quarter results, while U.S. carmaker Ford gave a weaker-than-expected 2019 profit outlook. Japan's Nissan, a long-term partner of Renault, said it would cut 12,500 jobs by 2023 after its earnings collapsed. In the second quarter FCA's adjusted EBIT totaled 1.52 billion euros, versus analysts' expectations of 1.43 billion euros, according to a Reuters poll. FCA's U.S. shipments were down 12% in the second quarter but the group said that the successful performance of its Ram brand resulted in an enhanced share of the large pickup truck market of 27.9%, up 7 percentage points from last year. Adjusted EBIT margin in North America rose to 8.9% from 6.5% in the first quarter, thanks to strong demand for the heavy-duty Ram and the new Jeep Gladiator pickup. Chief Financial Officer Richard Palmer also said FCA expected to report up to 10% margins in the region in both the third and fourth quarters.

Thu, Jul 18 2019

PARIS — European car sales dropped 7.9% in June, led by bigger declines for Nissan, Volvo and Fiat Chrysler (FCA), according to industry data published on Wednesday. Registrations fell to 1.49 million cars last month from 1.62 million a year earlier across the European Union and EFTA countries, the Brussels-based Association of European Carmakers said in a statement. Calendar effects resulted in two fewer sales days in most markets, accentuating the decline. Registrations for the first half closed 3.1% lower, ACEA said. For European carmakers, weakening demand at home compounds the pressure from a sharper contraction in China and emerging markets that may yet bring more profit warnings. NissanÂ’s aging model lineup contributed to a 26.6% June sales slump while Volvo Cars, owned by ChinaÂ’s Geely, saw deliveries tumble 21.7%. Registrations also fell 13.5% last month at FCA, 10.1% at BMW, 9.6% at Volkswagen Group and 8.2% for both Mercedes parent Daimler and FranceÂ’s PSA Group. The Peugeot makerÂ’s domestic rival Renault suffered less, posting a 3.9% decline. By the Numbers BMW Chrysler Fiat Nissan Volkswagen Volvo Peugeot Renault

Mon, Jun 10 2019

Fiat Chrysler Automobiles and Renault are looking for ways to resuscitate their collapsed merger plan and secure the approval of the French carmaker's alliance partner Nissan, according to several sources close to the companies. Nissan is poised to urge Renault to significantly reduce its 43.4% stake in the Japanese company in return for supporting a FCA-Renault tie-up, two people with knowledge of its thinking also told Reuters. It is still far from clear whether any concerted effort to revive the complex and politically fraught deal can succeed. FCA Chairman John Elkann abruptly withdrew his $35 billion merger offer in the early hours of June 6 after the French government, Renault's biggest shareholder, blocked a vote by its board and demanded more time to win Nissan's backing. Nissan representatives had said they would abstain. The failure, which FCA and Renault blamed squarely on the French government, deprived both companies of an opportunity to create the world's third-biggest carmaker with 5 billion euros ($5.6 billion) in promised annual synergies. It also shone a harsh light on Renault's relations with Nissan, which have gone from frayed to fried since the November arrest of former alliance Chairman Carlos Ghosn, now awaiting trial in Japan on financial misconduct charges he denies. REVIVAL TALKS Italian-American FCA — whose brand stable encompasses Fiat runabouts, Jeep SUVs, RAM pickups, Alfa Romeo luxury cars and Maserati sports cars — has so far turned a deaf ear to suggestions by French officials that its merger proposal could be revisited. But since the breakdown, Elkann and his French counterpart Jean-Dominique Senard have had talks about reviving the plan that left the Renault chairman and his Chief Executive Thierry Bollore upbeat about that prospect, three alliance sources said. Renault and a spokesman for FCA declined to comment. One of Elkann's senior advisors on the Renault merger bid, Toby Myerson, was expected at Nissan headquarters in Yokohama on Monday for exploratory discussions with top management, two people with knowledge of the matter said. Nissan CEO Hiroto Saikawa is likely to attend. Myerson did not respond to a message from Reuters seeking comment. The meeting comes amid mounting strains that may preclude compromise, after Senard warned Saikawa that Renault was prepared to block key Nissan governance reforms in a dispute over board committees.

Fri, Jun 7 2019

In this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Consumer Editor Jeremy Korzeniewski and Assistant Editor Zac Palmer. First, they talk about the cars they've been driving, including the Ford Expedition, Ford F-150 Limited and the Mini Cooper JCW Knights Edition. Then they discuss the news, including Ian Callum stepping down from Jaguar, Cadillac's V cars and the latest in the saga between FCA and Renault. Autoblog Podcast #583 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Cars we're driving: Ford Expedition Ford F-150 Limited Mini Cooper JCW Knights Edition Ian Callum resigns from Jaguar Cadillac V FCA backs down from Renault merger talks Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video:

Fri, Jun 7 2019

TOKYO — Nissan wasn't consulted on the proposed merger between its alliance partner Renault and Fiat Chrysler, but the Japanese automaker's reluctance to go along may have helped bring about the surprise collapse of the talks. While Nissan Motor Co. had a weaker bargaining position from the start, with its financial performance crumbling after the arrest last year of its star executive Carlos Ghosn, it still had as its crown jewel the technology of electric vehicles and hybrids that Fiat Chrysler wanted. The board of Renault, meeting Thursday, didn't get as far as voting on the proposal, announced last week, which would have created the world's third biggest automaker, trailing only Volkswagen AG of Germany and Japan's Toyota Motor Corp. When the French government, Renault's top shareholder with a 15% stake, asked for more time to convince Nissan, Fiat Chrysler Chairman John Elkann abruptly withdrew the offer. Although analysts say reviving the talks isn't out of the question, they say trust among the players appears to have been broken. "The other companies made the mistake of underestimating Nissan's determination to say, 'No,' " said Katsuya Takeuchi, senior analyst at Mitsubishi UFJ Morgan Stanley Securities in Tokyo. The Note, an electric car with a small gas engine to charge its battery, was Japan's No. 1 selling car, the first time in 50 years that a Nissan beat Toyota and Honda. Renault and Fiat Chrysler highlighted possible synergies that come from sharing parts and research costs as the benefits of the merger. But what Fiat Chrysler lacks and really wanted was what's called in the industry "electrification technology," Takeuchi said. With emissions regulations getting stricter around the world, having such technology is crucial. Yokohama-based Nissan makes the world's best-selling electric car Leaf. Its Note, an electric car equipped with a small gas engine to charge its battery, was Japan's No. 1 selling car for the fiscal year through March, the first time in 50 years that a Nissan model beat Toyota and Honda Motor Co. for that title. Nissan is also a leader in autonomous-driving technology, another area all the automakers are trying to innovate. "Although Nissan had no say, its cautionary stance on the merger ended up being very meaningful," Takeuchi said.

Thu, Jun 6 2019

Shares in Groupe PSA, parent company of automakers Peugeot, Citroen and the DS brand, rose on Thursday as analysts considered the possibility that Fiat Chrysler could turn back to PSA after withdrawing its $35 billion merger offer for Renault. "Both parties have acknowledged the need for scale or [mergers and acquisitions] and may pursue other opportunities. If Nissan was an obstacle (to an FCA-Renault deal) PSA-FCA discussions could resume," wrote brokerage Jefferies. Back in March at the Geneva Motor Show, rumors started swirling that PSA was interested in a potential merger with FCA. Mike Manley, who took over at the helm of Fiat Chrysler following the death of Sergio Marchionne, had indicated a willingness to look into potential partnership options. Of course, that was all before FCA proposed a merger with Renault — with that deal now off the table, attention naturally turns back to PSA, which is also based in France. "We expect both shares to react negatively but see FCA having wider strategic options and Renault shares more downside risk near-term," said Jefferies. According to Reuters, PSA shares were up 1.5% at the time this was published, making it the top-performing stock on France's benchmark CAC-40 Index. Renault saw its shares slump 7%. Shares for FCA fell 3% in early trading on the Milan Stock Exchange. Considering that FCA said in its statement confirming the withdraw of its merger offer with Renault that "political conditions in France do not currently exist for such a combination to proceed successfully," we have to wonder how keen the company is to begin negotiations with another French automaker like PSA. Those thoughts were similarly voiced by Bernstein Research analyst Max Warburton, who said (via Forbes), "Expect PSA to rise on unrealistic hopes it may be FCA's next date." Earnings/Financials Chrysler Fiat Mitsubishi Nissan Citroen Peugeot Renault FCA renault-nissan

Fiat 1100D(1)

Fiat 1100D(1) Fiat 1200(1)

Fiat 1200(1) Fiat 1200 Spider(2)

Fiat 1200 Spider(2) Fiat 124(5)

Fiat 124(5) Fiat 124 Spider(27)

Fiat 124 Spider(27) Fiat 124 Sport Spider(1)

Fiat 124 Sport Spider(1) Fiat 131(1)

Fiat 131(1) Fiat 1500(2)

Fiat 1500(2) Fiat 1500 Series(2)

Fiat 1500 Series(2) Fiat 1800 Spider(2)

Fiat 1800 Spider(2) Fiat 2000(2)

Fiat 2000(2) Fiat 30623(1)

Fiat 30623(1) Fiat 500(2167)

Fiat 500(2167) Fiat 500 Abarth(3)

Fiat 500 Abarth(3) Fiat 500c Abarth(1)

Fiat 500c Abarth(1) Fiat 500e(9)

Fiat 500e(9) Fiat 500e BATTERY ELECTRIC(1)

Fiat 500e BATTERY ELECTRIC(1) Fiat 500F(1)

Fiat 500F(1) Fiat 500L(26)

Fiat 500L(26) Fiat 500X(21)

Fiat 500X(21) Fiat 600(3)

Fiat 600(3) Fiat 600 Jolly(1)

Fiat 600 Jolly(1) Fiat 600D(1)

Fiat 600D(1) Fiat 850(4)

Fiat 850(4) Fiat 850 Spider(1)

Fiat 850 Spider(1) Fiat Barchetta(1)

Fiat Barchetta(1) Fiat Bianchina(1)

Fiat Bianchina(1) Fiat Convertible(1)

Fiat Convertible(1) Fiat DINO(1)

Fiat DINO(1) Fiat Dino 2000 Spider(1)

Fiat Dino 2000 Spider(1) Fiat Ghia 1500 GT(1)

Fiat Ghia 1500 GT(1) Fiat JOLLY(5)

Fiat JOLLY(5) Fiat Not Specified(1)

Fiat Not Specified(1) Fiat Other(4)

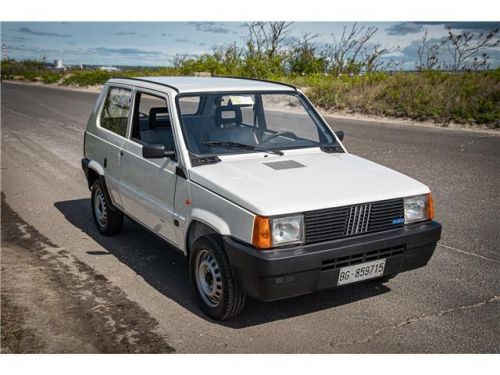

Fiat Other(4) Fiat Panda(2)

Fiat Panda(2) Fiat Pininfarina(1)

Fiat Pininfarina(1) Fiat SEICENTO(1)

Fiat SEICENTO(1) Fiat Spider(3)

Fiat Spider(3) Fiat SPIDER 124(1)

Fiat SPIDER 124(1) Fiat Spider 2000(3)

Fiat Spider 2000(3) Fiat Sport(1)

Fiat Sport(1) Fiat Spyder 2000(1)

Fiat Spyder 2000(1) Fiat Topolino(1)

Fiat Topolino(1) Fiat Torpedo(1)

Fiat Torpedo(1) Fiat X 1-9(1)

Fiat X 1-9(1) Fiat X 1/9(1)

Fiat X 1/9(1) Fiat X-1/9(2)

Fiat X-1/9(2) Fiat X1/9(4)

Fiat X1/9(4)