2012 Fiat 500 Gucci Edition Sunroof All Power Bluetooth Automatic Call Shaun on 2040-cars

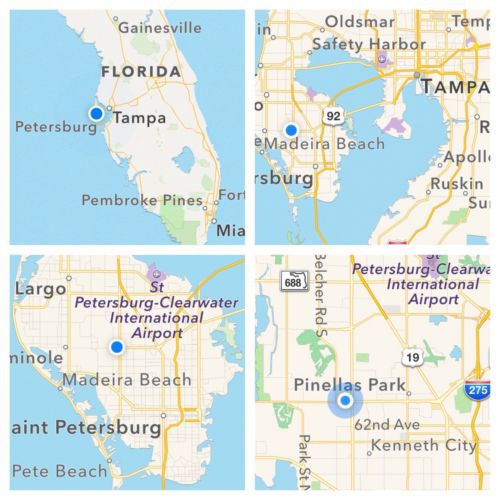

Pinellas Park, Florida, United States

Fiat 500 for Sale

2012 4cyl automatic leather/cloth seats bluetooth sirius one owner(US $14,991.00)

2012 4cyl automatic leather/cloth seats bluetooth sirius one owner(US $14,991.00) (C $26,700.00)

(C $26,700.00) Video 13 fiat 500 sport, white, clean carfax, like new, have 12 in stock! call!

Video 13 fiat 500 sport, white, clean carfax, like new, have 12 in stock! call! Video 13 abarth red turbocharged 5 speed convertible, we have 12 assorted! call!

Video 13 abarth red turbocharged 5 speed convertible, we have 12 assorted! call! Brand new 2013 fiat abarth cabrio - 13 in stock, all at $7,000 off msrp!!(US $20,150.00)

Brand new 2013 fiat abarth cabrio - 13 in stock, all at $7,000 off msrp!!(US $20,150.00) 2014 fiat 500l easy damaged salvage must see!! like new export welcome l@@k!!(US $9,950.00)

2014 fiat 500l easy damaged salvage must see!! like new export welcome l@@k!!(US $9,950.00)

Auto Services in Florida

Zephyrhills Auto Repair ★★★★★

Yimmy`s Body Shop & Auto Repair ★★★★★

WRD Auto Tints ★★★★★

Wray`s Auto Service Inc ★★★★★

Wheaton`s Service Center ★★★★★

Waltronics Auto Care ★★★★★

Auto blog

Ram to go on a Rampage with new small pickup?

Wed, 16 Jul 2014When people look back at today's automotive industry, what do you think they'll remember us for? The emergence of hybrids? Ever more expensive and exotic supercars? The dawn of the self-driving car? All likely scenarios, but so is the blurring of lines between one bodystyle and another, giving rise to hardtop convertible coupes and crossovers of every shape and size. But one bodystyle the North American auto industry has stayed largely away from in the past couple of decades is a car nose and chassis with a pickup bed.

It's a bodystyle immortalized by the Chevrolet El Camino, but with few exceptions, we haven't seen too many of these automotive platypuses in recent years on our turf. Subaru tried with the Baja and the low-volume Honda Ridgeline soldiers along largely unchanged, but the genre's biggest adherents are still Down Under, where ute versions of the Holden Commodore and Ford Falcon live. With a few other examples scattered to the four corners of the earth, that's really about it. But if these spy shots are anything to go by, it looks like Fiat Chrysler Automobiles could be working to bring it back.

Spied undergoing testing in Michigan, what we appear to be looking at is a heavily disguised Fiat Strada being prepared - like the Fiat Ducato-based Ram ProMaster and the smaller Doblo-based ProMaster City - for Stateside duty as a Ram product. The Strada, for those unfamiliar, is a product of Fiat Automóveis in Brazil and is based on the Palio economy car. The nameplate has been around South America since 1996 and was originally designed by Giorgetto Giugiaro (long before Volkswagen monopolized his talents), and takes a more rugged approach in the form of the Strada Adventure.

Least favorite vehicles of 2017

Fri, Dec 22 2017The Autoblog staff has driven a lot of vehicles in 2017. This video showcases our least favorite vehicles from this year, along with some thoughts on why they made the list. Wanna read more head over to https://www.autoblog.com/photos/least-favorite-cars-2017/ BMW Fiat Lexus Nissan RAM Toyota Autoblog Minute Videos Original Video nismo nissan sentra fiat 500x Arts and Entertainment 500x bmw m240i rogue

Barracuda's Dodge branding no biggie, but what about engines?

Thu, Aug 27 2015Rumors about a revival of the Barracuda nameplate have been circulating for years now, though which brand it might fall under has been a bit of a mystery. Initial speculation had the car labeled an SRT product, but that acronym has since returned to its former role as a sub-brand for top-performance Mopars. Thanks to leaks from a recent FCA dealership event, we know the Barracuda is back on the table but will be sold under the Dodge umbrella, a move that has been generating a bit of ire from Pentastar fanatics, as the car was originally part of the defunct Plymouth brand. Given what's known about the new model, however, the badge is the least of my concerns about the new car. Let's start with the re-branding itself. This isn't the first time Chrysler has shuffled models around to different brands. The current-generation Viper spent two years as the flagship model under the SRT banner, only to return to Dodge for 2015 when SRT resumed its former role as a sub-brand. Years ago, the Neon was sold as a Plymouth, a Dodge, and a Chrysler model, depending on where you shopped for one. When Plymouth ceased to exist, the last few years of Prowler production got Chrysler badges instead. Then there's the new Jeep Renegade, a model whose name was born out of a trim level. The Barracuda might not turn out to be a muscle car in the way we currently define them. Further examples of naming liberties taken throughout automotive history could fill a book, but suffice it to say that these days a model's name has very little to do with the vehicle itself or any legacy it might have. The Barracuda name might be a particularly sacred cow with enthusiasts, but to me, a much bigger concern is the fact that the car might not turn out to be a muscle car in the way we currently define them. News from the Fiat Chrysler dealer briefing earlier this week indicates that when the next Charger debuts it will share its platform with the Barracuda, much the way the Charger and Challenger are twinned now. One difference is that the Barracuda is tipped to be offered as a convertible, while the modern Challenger is tintop-only. The Charger and Barracuda will use the rear-drive platform developed for Alfa Romeo's new Giulia, itself designed as a BMW M3 fighter both from a dimensional and dynamic standpoint; the Barracuda is expected to be slightly smaller than the current Challenger.