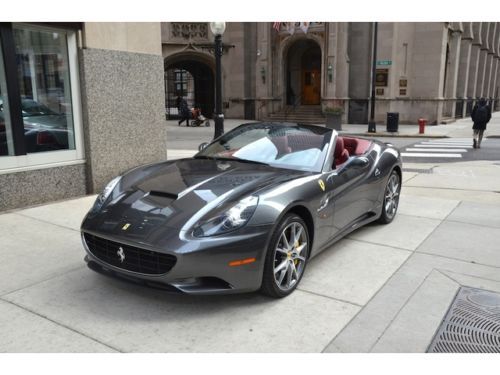

2012 ferrari california -carbon sw w/leds,magneride,park sensors w/cam,daytonas!(US $199,500.00)

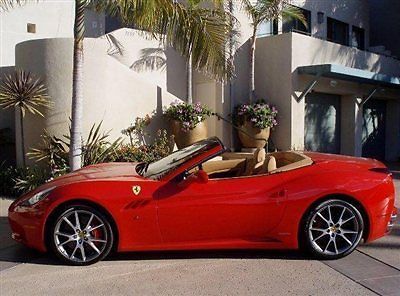

2012 ferrari california -carbon sw w/leds,magneride,park sensors w/cam,daytonas!(US $199,500.00) 2010 ferrari california convertible daytona's ipod magna ride 20s carbon fiber!!(US $169,800.00)

2010 ferrari california convertible daytona's ipod magna ride 20s carbon fiber!!(US $169,800.00) Carbon fiber driving zone with led's, 20 inch diamond finish sport wheels

Carbon fiber driving zone with led's, 20 inch diamond finish sport wheels 2009 used 4.3l v8 32v automatic rear wheel drive convertible premium(US $153,995.00)

2009 used 4.3l v8 32v automatic rear wheel drive convertible premium(US $153,995.00) 1961 ferrari 250 gt california spider "prototype modena"

1961 ferrari 250 gt california spider "prototype modena" 2012 ferrari california grigio titanio metallic penske wynn ferrari 702-770-2000(US $219,000.00)

2012 ferrari california grigio titanio metallic penske wynn ferrari 702-770-2000(US $219,000.00) 2010 ferrari(US $175,900.00)

2010 ferrari(US $175,900.00) 2010 ferrari(US $169,900.00)

2010 ferrari(US $169,900.00) 2013 ferrari california electrical seats daytona parking camera scuderia 20" rim(US $225,900.00)

2013 ferrari california electrical seats daytona parking camera scuderia 20" rim(US $225,900.00) 2013 ferrari california roadster

2013 ferrari california roadster California 2 owner florida car clean carfax

California 2 owner florida car clean carfax Matte grey/ carbon fiber 1 of a kind ferrari california, 1 owner, loaded

Matte grey/ carbon fiber 1 of a kind ferrari california, 1 owner, loaded 1961 ferrari 250 gt california spider "prototype modena"

1961 ferrari 250 gt california spider "prototype modena" Call fleet @ 480-421-4530, led steering wheel, daytona & power seats, clean nero(US $164,999.00)

Call fleet @ 480-421-4530, led steering wheel, daytona & power seats, clean nero(US $164,999.00) 2012 ferrari california novitec, black/tan, 1200 miles!, $60k in upgrades!(US $219,888.00)

2012 ferrari california novitec, black/tan, 1200 miles!, $60k in upgrades!(US $219,888.00) 2011 ferrari california grigio over rosso red interior very nice 20" wheels!(US $174,995.00)

2011 ferrari california grigio over rosso red interior very nice 20" wheels!(US $174,995.00) 13 ferrari california 30 - daytona scuderia carbon handling package - 2855 miles(US $234,995.00)

13 ferrari california 30 - daytona scuderia carbon handling package - 2855 miles(US $234,995.00) 2011 ferrari california red 1 owner low mile year end special price reduced $10k(US $159,988.00)

2011 ferrari california red 1 owner low mile year end special price reduced $10k(US $159,988.00) 2010 ferrari california 10k miles loaded rosso corsa paint(US $158,700.00)

2010 ferrari california 10k miles loaded rosso corsa paint(US $158,700.00) Adv1 wheels,tubi,carbon fiber diffuser,144 month financing,trades accepted(US $159,900.00)

Adv1 wheels,tubi,carbon fiber diffuser,144 month financing,trades accepted(US $159,900.00) Magnaride suspension power seats backup camera navigation leather luggage 2 keys

Magnaride suspension power seats backup camera navigation leather luggage 2 keys 2012 ferrari california parking camera satellite radio carbon fiber(US $197,900.00)

2012 ferrari california parking camera satellite radio carbon fiber(US $197,900.00) 2011 ferrari california convertible parking camera satellite radio daytona seats(US $189,900.00)

2011 ferrari california convertible parking camera satellite radio daytona seats(US $189,900.00) 2011 ferrari california *low miles* *video*(US $189,900.00)

2011 ferrari california *low miles* *video*(US $189,900.00) Ferrari approved cpo california 30 with 7 year maint low miles lots of warranty(US $226,888.00)

Ferrari approved cpo california 30 with 7 year maint low miles lots of warranty(US $226,888.00) 2010 ferrari california(US $62,999.00)

2010 ferrari california(US $62,999.00) Ferrari california leather navigation loaded carbon fiber

Ferrari california leather navigation loaded carbon fiber Ferrari california low miles $231,729 msrp(US $171,995.00)

Ferrari california low miles $231,729 msrp(US $171,995.00) Msrp $257k daytona power seats carbon fiber steering whl rear camera pristine(US $229,900.00)

Msrp $257k daytona power seats carbon fiber steering whl rear camera pristine(US $229,900.00) 2011 ferrari california base convertible 2-door 4.3l(US $174,488.00)

2011 ferrari california base convertible 2-door 4.3l(US $174,488.00) 1961 ferrari 250 gt cailifornia modena replica(US $175,000.00)

1961 ferrari 250 gt cailifornia modena replica(US $175,000.00) 2010 ferrari california base convertible 2-door 4.3l(US $174,488.00)

2010 ferrari california base convertible 2-door 4.3l(US $174,488.00) 2011 ferrari california base convertible 2-door 4.3l(US $174,488.00)

2011 ferrari california base convertible 2-door 4.3l(US $174,488.00) Ferrari california, all options, immaculate(US $172,888.00)

Ferrari california, all options, immaculate(US $172,888.00) Carbon fiber driving zone with led's, 20 inch diamond finish sport wheels

Carbon fiber driving zone with led's, 20 inch diamond finish sport wheels 10 nero 4.3l v8 f1 convertible 2+2 *navigation *afs *magneride dual mode *low mi

10 nero 4.3l v8 f1 convertible 2+2 *navigation *afs *magneride dual mode *low mi 2010 ferrari california 2dr conv(US $163,000.00)

2010 ferrari california 2dr conv(US $163,000.00) Loaded daytona seats shields 20" diamond carbon steering wheel hifi magneride

Loaded daytona seats shields 20" diamond carbon steering wheel hifi magneride Msrp $257k daytona power seats carbon fiber steering whl rear camera pristine(US $229,900.00)

Msrp $257k daytona power seats carbon fiber steering whl rear camera pristine(US $229,900.00) Daytona seats scuderia shields rear camera 20" diamond wheels yellow tach

Daytona seats scuderia shields rear camera 20" diamond wheels yellow tach 1961 ferrari 250 gt cailifornia modena replica(US $160,000.00)

1961 ferrari 250 gt cailifornia modena replica(US $160,000.00) 1961 ferrari modena 250gt california(US $97,000.00)

1961 ferrari modena 250gt california(US $97,000.00) 2013 ferrari california, navigation, back up camera, 20" wheels, great leases!(US $229,995.00)

2013 ferrari california, navigation, back up camera, 20" wheels, great leases!(US $229,995.00) 2012 california 1 owner car 231 original sticker call chris 630-624-3600(US $213,000.00)

2012 california 1 owner car 231 original sticker call chris 630-624-3600(US $213,000.00) Convertible 4.3l nav cd rear wheel drive locking/limited slip differential abs

Convertible 4.3l nav cd rear wheel drive locking/limited slip differential abs 2012 ferrari california novitec, black/tan, 1200 miles!, $60k in upgrades!(US $219,888.00)

2012 ferrari california novitec, black/tan, 1200 miles!, $60k in upgrades!(US $219,888.00) 2012 ferrari california base convertible 2-door 4.3l(US $109,000.00)

2012 ferrari california base convertible 2-door 4.3l(US $109,000.00) Matte grey/ carbon fiber 1 of a kind ferrari california, 1 owner, loaded(US $166,750.00)

Matte grey/ carbon fiber 1 of a kind ferrari california, 1 owner, loaded(US $166,750.00) 2010 ferrari california - extremely low miles - like new - just traded

2010 ferrari california - extremely low miles - like new - just traded 2012 ferrari california - black -only 6200 miles!!!(US $189,000.00)

2012 ferrari california - black -only 6200 miles!!!(US $189,000.00) Carbon wheel wleds/ bridge/ rear/ front wing,black top,magneride,$265k msrp!(US $199,500.00)

Carbon wheel wleds/ bridge/ rear/ front wing,black top,magneride,$265k msrp!(US $199,500.00) Garage kept ferrari california red tan cruise control daytona seats loaded 241k(US $179,900.00)

Garage kept ferrari california red tan cruise control daytona seats loaded 241k(US $179,900.00) 7yr maintenance+nav+special handling pkg+cruise c+scuderia shields+sport grilles(US $219,999.00)

7yr maintenance+nav+special handling pkg+cruise c+scuderia shields+sport grilles(US $219,999.00) 2010 ferrari california/ nero over cuoio/ hard top convertible(US $172,990.00)

2010 ferrari california/ nero over cuoio/ hard top convertible(US $172,990.00) 2010 ferrari california for $1369 a month with $34,000 dollars down(US $166,900.00)

2010 ferrari california for $1369 a month with $34,000 dollars down(US $166,900.00) 2012 california 7 year maint ferrari approved cpo warranty low miles(US $179,000.00)

2012 california 7 year maint ferrari approved cpo warranty low miles(US $179,000.00) California 30 like new 7 year maint ferrari approved cpo warranty low miles(US $218,888.00)

California 30 like new 7 year maint ferrari approved cpo warranty low miles(US $218,888.00) California 30 warranty low miles remaining 7 year maint ferrari approved cpo(US $209,000.00)

California 30 warranty low miles remaining 7 year maint ferrari approved cpo(US $209,000.00) 1961 ferrari 250 gt california spider "prototype modena"(US $1,000,000.00)

1961 ferrari 250 gt california spider "prototype modena"(US $1,000,000.00) 2010 ferrari california white/beige ceramics 20 wheels 5300 miles(US $178,900.00)

2010 ferrari california white/beige ceramics 20 wheels 5300 miles(US $178,900.00)

Ferrari California Price Analytics

About Ferrari California

Auto blog

Ferrari building 350 unique special editions for its 70th anniversary

Fri, Jul 1 2016Ferrari has been in business since 1947, which makes 2017 the automaker's 70th birthday. To celebrate its old age, the company has reportedly decided to create 350 bespoke special editions, each different from the next. According to Autocar, the company made the announcement to 100 owners and collectors in Venice, Italy, last weekend during the Ferrari Cavalcade. The 350 unique models will come from Ferrari's current lineup, and will include 70 each of the California T, 488 GTB, 488 Spider, GTC4 Lusso, and F12 Berlinetta. The Italian automaker chose 70 of the most iconic vehicles from its past to inspire the upcoming special editions, with each of the 350 examples being unique. To get this level of exclusivity, the Tailor-Made division, which handles the company's extra-custom orders, will lend a helping hand in design. The hardest thing for Ferrari, however, won't be putting 350 unique models on the road, but deciding how to pick which owners and collectors get the opportunity to purchase them. According to Ferrari boss Sergio Marchionne, that is "the most difficult part of what I do." Yep, sounds like a tough job, turning away millionaires. Autocar reports that Ferrari will reveal the 350 special-edition models at the Paris Motor Show in October, but that sounds like a difficult task. We're guessing they won't all be present, but that would sure be a sight to see. Related Video:

Race Recap: 2016 European GP was a cakewalk for Rosberg

Mon, Jun 20 2016Formula 1 teams had no setup data or tire information for the six-kilometer Baku City Circuit hosting the European Grand Prix, and that's the reason for much of the weekend's excitement. Nico Rosberg snatched pole position after Mercedes-AMG Petronas teammate Lewis Hamilton hit the wall during qualifying. When the lights went out, Rosberg put in a clinical drive way out front to score his second career grand slam: pole position, leading every lap, fastest lap, and victory. Sebastian Vettel put in a similarly lonely drive in his Ferrari to second. The German had little to do on track other than get around his teammate on Lap 28, and that came courtesy of team orders. Sergio Perez started from second on the grid, but a gearbox change after clouting the wall during Free Practice dropped him to seventh. The Mexican cut his way through the field after his sole pit stop on Lap 17 of the 51-lap race, passing Ferrari's Kimi Raikkonen for third on the final lap. It's Perez's second podium in three races after finishing third in Monaco. Force India has five podium finishes in its eight-year history, and Perez's name is on four of them. Raikkonen followed in fourth. Stewards hit the Finn with a five-second penalty for crossing the pit-entry line during the race, so even if Perez hadn't passed him on track, Raikkonen would have been classified fourth. Hamilton's up-and-down weekend ended with a burst of radio messages and a whimper. He climbed from tenth on the grid to fifth in the race, then his energy recovery system began harvesting in the wrong places. The snafu cost Hamilton two seconds per lap compared to the leaders. The trouble came from a switch turned to the incorrect position, but the FIA ban on driver assistance meant Hamilton's engineer couldn't tell the driver how to fix the problem. At one point when Hamilton said he was going to reset the whole car, his engineer replied, "Um, we don't advise that, Lewis." Hamilton finally found the proper setting on Lap 43, but turned the engine down again when he realized he couldn't catch the leaders. Mercedes said that Rosberg had the same issue, but Rosberg fixed it on his own. Valtteri Bottas got his Williams across the line four seconds behind Hamilton. Red Bull teammates Daniel Ricciardo and Max Verstappen couldn't get their tires to work, forcing both racers to pit twice before finishing seventh and eighth.

24 Hours of Le Mans live update part three

Sun, Jun 19 2016We tasked surfing journalist Rory Parker to watch this year's live stream of the 2016 24 Hours of Le Mans. What follows is an experiment to experience the world's greatest endurance race from the perspective of a motorsports novice. Parker lives in Hawaii and has an associates degree in dropping f-bombs. For Part One, click here. Part Two is here. Really hoped I'd be able to grab an hour or two of sleep before the sun rose over Le Mans. Dark dark dark, couldn't figure out what was going on. Commentators struggled at times as well. But I couldn't do it. Endurance racing is just too exciting. Grabs my attention with both fists. Screams, "watch these men DRIVE!" A neighbor invited me over for drinks. Told him, "Can't do it, gotta watch Le Mans!" Maybe not exactly. I'll admit, at times my attention wandered. I did a load of laundry. Ate some snacks. Half listened to the commentary. Threw a hump at my wife. I learned that Patrick Long, driving #88, is big brother to Kevin "Spanky" Long. Spanky's a bit of a legend in the skate world. Always weird how top notch talent can run in families like that. Kind of surprised I've never heard that before. Worked for a skate mag for a years, met Spanky a handful of times. Someone must've told me that he has an older brother who drives race cars. Dash cams at night are scary. High powered headlights in the P1s reach almost 300 meters. Cars outrun that distance easy. Seems like they're just steering into the black and hoping for the best. But that can't be the case. People'd be dropping dead let and right. Very amused by how the guys in GT are like, "Dude, stop flashing your fucking lights before you pass." But the LMP's are all, "Suck a dick! I do what I want." Top three stayed neck and neck nearly all night long. As the sun gets ready to creep back over the horizon the top three are separated by only eleven and a half seconds. Toyota 5 and 6, Porsche 2. Audi 8 is two laps behind Porsche, beleaguered 7 is dealing with constant trouble eleven laps from the front. GTE Pro sees Ferrari 82 in first, Ford 68 and 69 right behind. To win you've gotta drive perfect, build perfect. Fours cars retired so far. I'm beginning to appreciate the endurance aspect a little more fully. Only really considered the drivers at first. The mental and physical stress driving these cars at these speeds at length would inflict. But keeping the damn things running is the real deal. To win you've gotta drive perfect, build perfect.

24 Hours of Le Mans live update part two

Sun, Jun 19 2016We tasked surfing journalist Rory Parker to watch this year's live stream of the 2016 24 Hours of Le Mans. What follows is an experiment to experience the world's greatest endurance race from the perspective of a motorsports novice. Parker lives in Hawaii and can hold his breath longer than he can go without swearing. For Part One, click here. Or you can skip ahead to Part Three here. I write about surfing for a living. If you can call it a living. Basically means I spend my days fucking around and my wife pays for everything. Because she's got a real job that pays well. Brings home the bacon. Very progressive arrangement. Super twenty first century. I run a surf website, beachgrit.com, with two other guys. It's a strange gig. More or less uncensored. Kind of popular. Very good at alienating advertisers. My behavior has cost us a few bucks. I'm terrible at self-censorship. Know there's a line out there, no idea where it lies. I still don't understand any of the technical side. Might as well be astrophysics or something. For contests I do long rambling write ups. They rarely make much sense. Mainly just talk about my life, whatever random thoughts pop into my head. "Can you do something similar for Le Mans?" "Sure, but I know absolutely fuck-all about racing." "That's okay. Just write what you want." "Will do. But you're gonna need to edit my stuff. Probably censor it heavily." So here I am. I spent the last week trying to learn all I can about the sport of endurance racing. But there's only so much you can jam in your head. And I still don't understand any of the technical side. Might as well be astrophysics or something. While I rambled things were happening. Tracy Krohn spun into the gravel on the Forza chicane. #89 is out of the race after an accident I missed. Pegasus racing hit the wall on the Porsche curves. Bashed up front end, in the garage getting fixed. Toyota and Porsche are swapping back and forth in the front three. Ford back in the lead in GTE Pro. #91 Porsche took a stone through the radiator, down two laps. Not good. The wife and I are one of those weird childless couples that spend way too much time caring for the needs of their pet. French bulldog, Mr Eugene Victor Debs. Great little guy. Spent the last four years training him to be obedient and friendly. Nice thing about dogs, when you're sick of dealing with them you can just lock 'em in another room for a few hours. You don't need to worry about paying for college.

24 Hours of Le Mans live update part one

Sat, Jun 18 2016We tasked surfing journalist Rory Parker to watch this year's live stream of the 2016 24 Hours of Le Mans. What follows is an experiment to experience the world's greatest endurance race from the perspective of a motorsports novice with a profanity-laden stream-of-consciousness writing style. Parker lives in Hawaii and spends far more time spearfishing than behind the wheel of a car. Jump ahead to Part Two here, and Part Three here. Big Money and billionaire hobbyists and rockets on wheels. Jets belching French color smoke overhead. Balance of power fuckery. Plenty of water on the ground this morning. Absurdly expensive motorcars lined up in the pissing rain. Fast twitch lunatics behind the wheel. Chomping at the bit. Let's go let's go let's go! Race hasn't even started, Ford #67 maybe dealing with clutch issues. Karma? That beautiful bastard Brad Pitt's out on the track, waving the tricolor flag. It's a standing start in "Noah's Ark" weather and the 2016 24 hours of Le Mans is go! First lap takes place behind the safety car, finished in a record setting 8 minutes 27 seconds. Wrong kind of record maybe, but this is the first time I've set my mind to watching the whole damn race. Feel like I'm part of history. 3:00 AM on Kauai, a little too early for life. Sucking down coffee like a maniac. Don't fall back asleep. Got my hands on four hours of rest, how much more can I need? Better be enough for the next twenty four hours. Gonna get kinda punchy toward the end. Jason Statham on the scene. Four feet of solid muscle, non-existent hairline. Lovely wife peanut gallery sitting next to me calls him the "best race car drive in the world." Not sure if she's serious. Toss up, could go either way. Statham's a funny guy. Heir to the Bruce Willis comedy action crown. Really good in the movie where the fat comedy lady plays a spy. Ford's on the road. Problems with gearbox pressure, apparently. Nearing a half hour in and the safety car is still on the track. Hellish amounts of water on the ground, in the air. Visibility is garbage. Getting better. Twitter wags, "Not with a bang but a whimper." Just building suspense. Mother Nature felt like killing some people today, race officials need to dial back the drivers until it dries a tad. Normal inclination would've seen 'em flying, guaranteed early lap wrecks. Sad news for that bloodthirsty part of my lizard brain I try and keep suppressed. Good news for humanity. #12 in the pit for a bit.

Ford GT dominates Le Mans qualifying, gets slapped with performance adjustment

Fri, Jun 17 2016Fifty years after Bruce McLaren and Chris Amon drove the Ford GT40 to victory at the 24 Hours of Le Mans, Ford is poised for a historic return to the Circuit de la Sarthe. The new Ford GT took the top two qualifying positions in the LMGTE Pro class, and four of the top five. Ferrari's 488 filled in the rest of the spots in the top seven, the first two from AF Corse. In other words, we're primed for a reboot of the classic Ford-Ferrari feud at this year's race. Or not, as the ACO, which organizes the 24 Hours of Le Mans, announced sweeping pre-race Balance of Performance (BOP) adjustments this morning that make this year's GT class anybody's race. In LMP1, last year's overall winner Porsche locked up the top two spots with the 919 Hybrid and will lead the entire field at race start. Toyota's two-car factory effort followed with qualifying times 1.004 and 2.170 seconds behind the pole lap. Audi rounds out the manufacturer-backed LMP1 class in fifth and sixth. Full qualifying results can be found here. The storyline for the GT cars is perfect - some say too perfect. Ford's class-leading times came after BOP adjustment to the Corvette Racing C7.R before qualifying. BOP is intended to level the playing field in the class by adjusting power, ballast, and fuel capacity. (Check out this explainer video for more, or even just if you love French accents.) But the process is riddled with unknowns and ripe for accusations of sandbagging. That is, if the Ford cars were intentionally slow in practice they could hope for BOP adjustment to improve their race chances. On the Corvette side, last year's GTE Pro winner went from the top of the field to the bottom, barely improving from practice to qualifying. If you think Le Mans is as rigged at the NBA Playoffs, well, it's not that simple. Because if Ford and Ferrari held back until qualifying - the eighth-place Porsche 911 RSR is three-and-a-half seconds off the class pole time - it was a pretty dumb strategy. This morning, the ACO tried to put things back in order by limiting the boost in the Ford GT's twin-turbo V6 and adding 11 pounds of ballast. Ferrari was also given extra weight but allowed more fuel capacity. The Corvette and Aston Martin teams were both given breaks on their air restrictors, which will allow their engines to make more power. Both Ford and Porsche also received extra fuel capacity.

Ferrari F12 TdF shrieks like a banshee on the Gumball

Wed, Jun 15 2016With all the exotic metal (or carbon) participating in the Gumball 3000 rally each year, it takes something truly exceptional to turn heads. The new Ferrari F12 TdF is up to the challenge. For those who may have missed the reveal back in October (and this week's episode of Top Gear), the F12 TdF could very well be the ultimate naturally-aspirated twelve-cylinder Prancing Horse. And by "ultimate," we mean possibly the last, before turbochargers and hybrids take over Maranello completely. Named after the legendary Tour de France (for automobiles, not cyclists), Maranello's latest is based on the F12 Berlinetta, but like the 599 GTO before it, the TdF pushes the envelope even further. Its 6.3-liter atmospheric V12 revs all the way up to 8,900 rpm, producing a monstrous 769 horsepower and 520 pound-feet of torque along the way – enough, in other words, to put the Lamborghini Aventador SV (and most anything else) to shame. It'll reach 62 miles per hour from a standstill in less than three seconds, top out at over 211 mph, lap Fiorano faster than any road car this side of LaFerrari, and slide around all day and all night with its four-wheel steering system. And it screams. Don't take our word for it: turn up the speakers, hit "play," and listen to the F1-like shriek it emits out in the wild. Related Video: News Source: Marchettino via YouTube Ferrari Coupe Performance Videos ferrari f12 gumball 3000 ferrari f12 tdf

2016 Canadian Grand Prix: A tale of 3 starts and 2 stops

Mon, Jun 13 2016The first curve in the Canadian Formula 1 Grand Prix happened before Turn 1. Lewis Hamilton sat on pole in the Mercedes-AMG Petronas, Sebastian Vettel in a Ferrari behind. That order changed as soon as the lights went out. Hamilton and teammate Nico Rosberg started well enough, but Vettel flew off the line, passing Hamilton in just a few meters. Vettel led through Turn 1 while Hamilton defended against Rosberg trying to pass on the outside by using the entire track. Hamilton bumped his teammate, sending Rosberg into the concrete runoff with an " infuriating but fair" maneuver Hamilton blamed on understeer. The Brit stayed second, his teammate fell to ninth by the time he rejoined the circuit and got back on the gas. The Ferrari finally looked an even match for the Mercedes, Vettel slowly building a gap out front. On Lap 11 the Honda in Jenson Button's McLaren self-ignited just after the hairpin, forcing Button to pull over on the Casino Straight. A Virtual Safety Car slowed the field, convincing Ferrari to pit its drivers. Vettel came in, handing the lead to Hamilton. The marshals cleared Button's car more quickly than expected, so the scuderia didn't get the full time advantage it expected, sending Vettel back on track seven seconds behind the Mercedes. Button's and Ferrari's unplanned stops decided the race. Ferrari had always planned to run a two-stopper, but the early pit didn't give the team a chance to gauge the ultra-soft Pirelli. The ultra-softs lasted longer than anyone expected. Hamilton only pitted once, Vettel had to pit again, and the Ferrari simply couldn't close the gap to the Mercedes even with newer tires. Post-race commentary accused Ferrari of two blunders: giving up track position, and not taking advantage of Mercedes' only known weakness of not being nearly as good in dirty air. If the ultra-softs had fallen off a performance cliff, however, Ferrari's play would have been considered daring and brilliant. Hamilton took his second win of the season, followed by a hard-driving Vettel five seconds later. Valtteri Bottas and Williams got everything right, the Finn taking advantage of a one-stop strategy, a perfectly-timed pit stop, and more unusual Red Bull issues to finish third. It's Williams' first podium of the year. Max Verstappen claimed fourth after two pit stops, holding off a frustrated Rosberg who had to make an unscheduled stop to remedy a slow puncture.

Jay Leno's Garage kicks off season 2 Wednesday

Mon, Jun 13 2016A few days ago, we wrote about the upcoming season of Jerry Seinfeld's Comedians in Cars Getting Coffee. Now the second season of Jay Leno's Garage is nearly here with a full 12-episode run. The previous season did well. The first episode was CNBC's most-watched original series ever, with 916,000 viewers tuning in when it aired in early October. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. The first episode of season two launches on CNBC on Wednesday, June 15th, and it focuses on supercars. Nick Cannon is one of the stars in this week's episode, and he shows off his Ferrari California – a car which Cannon likes to drive at cruising speeds. The other guests during the second season include actor-turned-racecar-driver Patrick Dempsey, comedians Tim Allen and Dan Aykroyd, musician Brad Paisley, and Caitlyn and Kendall Jenner, according to TVNewser. Related Video: News Source: CNBC via AdweekImage Credit: Getty Images Auto News Celebrities Ferrari Special and Limited Editions Supercars Jay Lenos Garage jerry seinfeld cnbc

Faraday Future Hires Ferrari Exec. | Autoblog Minute

Sat, Jun 11 2016Ex Ferrari man Marco Mattiacci will join Faraday Future as a key high-ranking executive. Ferrari Autoblog Minute Videos Original Video faraday future marco mattiacci