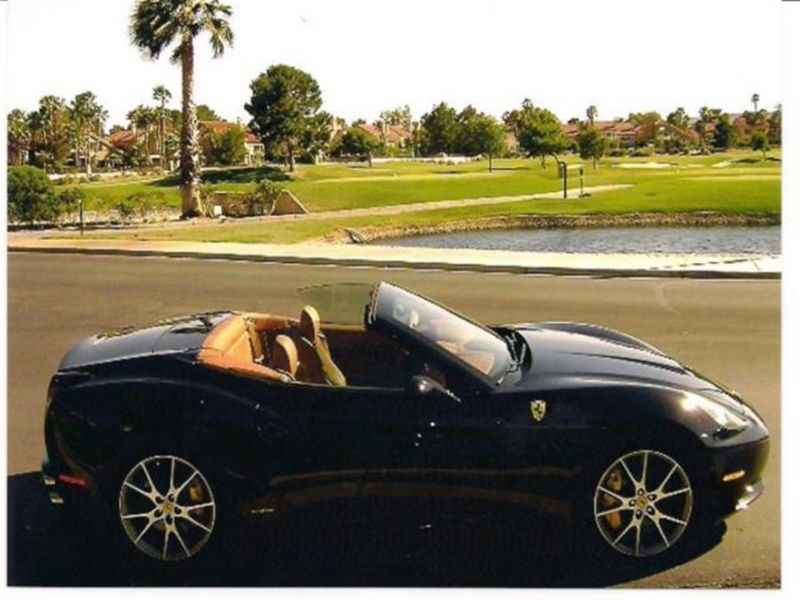

2013 Ferrari California on 2040-cars

Alexandria, Louisiana, United States

I am always available by mail at: jeannettajccartier@leedsfans.com .

Car has been serviced by Ferrari of Houston. There is no charge for service when brought to a Ferrari dealer until

year 2020. Comes with Car cover and Ferrari Battery Charger. Just had clear bra installed by Ferrari of

Houston.Covers complete hood, front fenders and side mirrors. Stored in Air conditioned garage. Excellent

condition. Just had service done in November. If you are thinking about a California this one is a must Options include

Yellow Brake Calipers

Scuderia Ferrari Shields

Parking Camera

20" Diamond Finish Sport Wheels

Satellite Radio

Red Stitching

Tire Pressure Monitor System

Ferrari California for Sale

2012 ferrari california base convertible 2-door(US $55,500.00)

2012 ferrari california base convertible 2-door(US $55,500.00) 2011 ferrari california gt(US $49,500.00)

2011 ferrari california gt(US $49,500.00) 2011 ferrari california convertible(US $59,400.00)

2011 ferrari california convertible(US $59,400.00) 2010 ferrari california base convertible 2-door(US $69,000.00)

2010 ferrari california base convertible 2-door(US $69,000.00) 2015 ferrari california california t my15(US $99,000.00)

2015 ferrari california california t my15(US $99,000.00) 2014 ferrari california model 30 naturally aspirated(US $74,200.00)

2014 ferrari california model 30 naturally aspirated(US $74,200.00)

Auto Services in Louisiana

TOS Of Slidell ★★★★★

Select Autosport ★★★★★

Rodolfo`s Auto Sales ★★★★★

Rock & Roll Wrecker Service ★★★★★

Riverside Used Auto Parts ★★★★★

Riverside Used Auto Parts ★★★★★

Auto blog

Touring Superleggera Berlinetta Lusso makes us swoon [w/video]

Wed, Mar 4 2015For the past three years, we've been fortunate enough to have the folks at Carrozzeria Touring Superleggera bring something very special to the Geneva Motor Show: the Alfa Romeo 8C-based Disco Volante. First, it showed up in red (twice), and then last year, arrived in a very stunning shade of green. If we're honest, we were kind of hoping there'd be a further evolution of the Disco on display at this year's show, but then Touring unveiled the beauty you see here. Meet the Ferrari F12-based Berlinetta Lusso. What we really like about the Berlinetta Lusso is how closely it resembles the F12 on which its based, but with some rough edges smoothed out. Despite looking similar, almost the entire body is new, with smoother creases and more retro-inspired design cues. Honestly, to our eyes, it looks better than the Prancing Horse's original. Mechanically, it's pretty much all F12 underneath, right down to the screaming 6.3-liter V12 with 703 horsepower. We certainly don't have any complaints about that. Get a load of this beauty in the images above, and video below.

Race recap: 2016 Hungarian Grand Prix was the pits

Mon, Jul 25 2016The Hungarian Grand Prix hasn't seen a race this calculated since 2012, when Lewis Hamilton – driving for McLaren – led from pole position to the checkered flag. We don't expect massive action from the Hungaroring, but Hamilton's first win for Mercedes in 2013, the thrilling wet mess in 2014, and Ferrari's surprising dominance in 2015 made us hope for more on-track commotion this year. Hungary denied us that. Hamilton parked his Mercedes-AMG Petronas in second on the grid but stole the lead through Turn 1 and never looked back. Teammate Nico Rosberg yo-yoed behind him in second place, getting into DRS range on a few occasions but never close enough to pass. Red Bull's Daniel Ricciardo kept the leading duo honest, but the Aussie couldn't put genuine fear into the German team and finished third. This is the third year in a row for Ricciardo on the Hungary podium. The pits provided our few scraps of excitement. During a stretch when Ricciardo managed to close on Rosberg, Mercedes told Hamilton to speed up. When Hamilton said he couldn't go faster, Mercedes said they'd pit second-place Rosberg first instead. Suddenly, Hamilton found the extra pace. Ricciardo pitted in early, hoping that fresh tires and fast laps could allow him to pass one or both Mercedes drivers when they pitted, but once Hamilton hit the throttle the Red Bull couldn't respond. Further down the lineup, Jenson Button came in on Lap 5 so McLaren could fix his brake pedal problem. The radio exchange before the stop included one forbidden instruction to Button, though, so the Englishman had to return to the pits for a drive-through penalty. Renault's Jolyon Palmer beat Force India's Nico Hulkenberg in a straight-up pit stop battle on Lap 40, but threw the good work away on Lap 49 with a spin on track that cost him three places. A pit wall miscommunication meant the Force India pit crew wasn't ready for Sergio Perez when the Mexican arrived for his second stop on Lap 43. And Daniel Kvyat's regrettable run at Toro Rosso continued, first with car issues, then a drive-through penalty for speeding in the pit lane. Sebastian Vettel brought his Ferrari home fourth, sniffing Ricciardo's gearbox at the flag but unable to get around the Red Bull. Max Verstappen enacted a replay of the final stages of the Spanish Grand Prix, finishing fifth by holding Ferrari's Kimi Raikkonen behind for 19 laps.

Race Recap: Belgian Grand Prix sings Waltzing Matilda

Mon, 25 Aug 2014Changeable. Each commentator will use that word at least 6,072 times over the Belgian Formula One

Grand Prix weekend. It is almost always applied to the weather, because the Spa-Francorchamps Circuit - perhaps all of Belgium - resides in some sort of climatological Narnia, its ADD skies totally unable to settle on a reliable behavior.

A dry Friday turned into a thoroughly wet qualifying on Saturday. When Q3 had done, Nico Rosberg would line up on pole position for the fourth race in a row for Mercedes AMG Petronas, after teammate Lewis Hamilton had another brake problem, this time glazing on one of the discs. Infiniti Red Bull Racing engineered a low-downforce setup and Sebastian Vettel took the best advantage, lining up third and making us wonder if the magic was back. Fernando Alonso drove the first Ferrari to fourth, the Spaniard saying he thought a podium was possible. Daniel Ricciardo put the second Infiniti Red Bull Racing in fifth, Valtteri Bottas behind him in the first Williams, then Kimi Räikkönen in the second Ferrari, Felipe Massa in the second Williams and Jenson Button in the sole McLaren in the top ten.