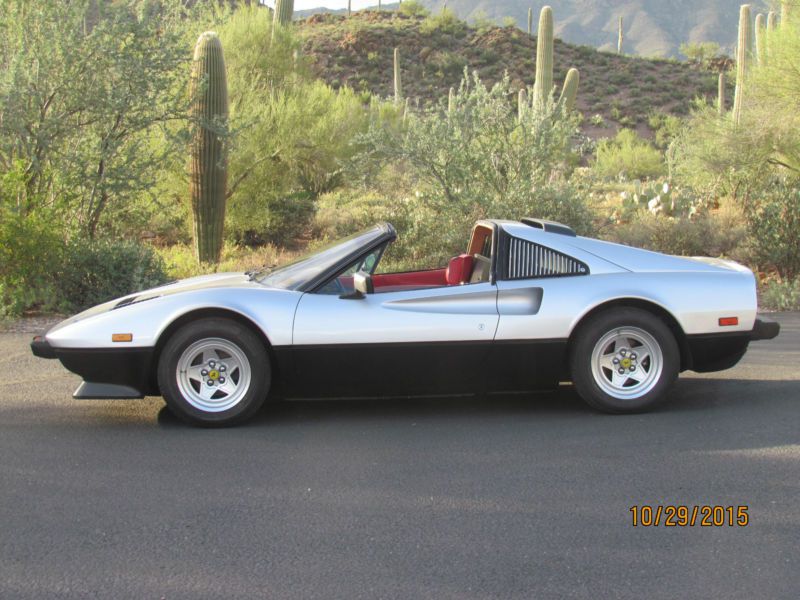

1982 Ferrari 308 Gtsi on 2040-cars

Cloverdale, California, United States

Please email me with any questions or requests for additional pics or something specific at: collenecrrensch@clubducati.com .

1982 Ferarri 308 GTSi

Wonderful Engine and Bay

30K Mile Belt Service

Desireable Factory Fuel-Injection

Factory Tools & Service Manuals

This 1982 Ferrari 308 GTSi two-seat mid-engined coupe is considered by many Ferrari enthusiasts as the “true successor” to the goregous and highly collectible Dino 246, the marque named after the founder’s late son, Alfredo "Dino" Ferrari.

Ferrari 308 for Sale

1984 ferrari 308 gtsi quattrovalvole(US $26,000.00)

1984 ferrari 308 gtsi quattrovalvole(US $26,000.00) ferrari 308(US $38,000.00)

ferrari 308(US $38,000.00) 1980 ferrari 308 gtb(US $20,900.00)

1980 ferrari 308 gtb(US $20,900.00) 1978 ferrari 308(US $19,200.00)

1978 ferrari 308(US $19,200.00) 1983 ferrari 308 gtsi quattrovalvole(US $37,300.00)

1983 ferrari 308 gtsi quattrovalvole(US $37,300.00) Ferrari: 308 base coupe 2-door(US $7,000.00)

Ferrari: 308 base coupe 2-door(US $7,000.00)

Auto Services in California

Z Best Auto Sales ★★★★★

Woodland Hills Imports ★★★★★

Woodcrest Auto Service ★★★★★

Western Tire Co ★★★★★

Western Muffler ★★★★★

Western Motors ★★★★★

Auto blog

Do we finally know which hybrid hypercar is fastest?

Sun, Oct 11 2015In order to properly compare and contrast the performance characteristics of competitive automobiles, a number of variables have to be sorted out. For instance, to diminish the human component, the same driver must be used for each lap, that driver has to be capable of wringing the maximum level of performance from each vehicle, and they should all be checked and prepared to make sure they are within manufacturer specs before hitting the track. Speaking of which, the conditions at the track – and, of course, it goes without saying that the cars have to be tested at the same location, on the same day – have to be as similar as possible. Naturally, arranging all of these variables is difficult, if not impossible, and that's especially true when the contenders are the Ferrari LaFerrari, McLaren P1, and Porsche 918 Spyder. As range-topping models from well-established performance players, these three hybrid hypercars are often lumped into the same category. But which one is fastest? Well, that's been a tough nut to crack, in part because the manufacturers themselves haven't always been willing to play along when it comes time to test these machines head-to-head-to-head. And so, with all that (probably unnecessary) preamble out of the way, we present to you the video above, in which this particular vehicular pedestal is toppled. All three cars are owned by a man named Paul Bailey, they were tested on the same day at the Silverstone circuit in England, and each had British Touring Car driver Mat Jackson at the helm. We're not going to spoil the results, other than to say that all three vehicles were incredibly fast and within spitting distance of one another at the finish line, as you would expect. Intriguingly, this video is said to be part one in a three-part series, so we have more Ferrari vs. McLaren vs. Porsche action to look forward to. Related Video: News Source: TheSUPERCARDRIVER via YouTube Green Ferrari McLaren Porsche Convertible Coupe Hybrid Performance Supercars Videos porsche 918 spyder mclaren p1 silverstone hypercar ferrari laferrari laferrari

Ferrari lawsuit argues Italian sports charity should drop Purosangue name

Mon, Feb 3 2020Ferrari announced plans for its first SUV back in 2018 by trotting out the name Purosangue, which translates loosely to “thoroughbred” or literally to “pure blood.” Only one problem: ThereÂ’s a tiny anti-doping sports charity active in Italy and Africa that already claims that name. No problem, Ferrari says. The Financial Times reports the famous Italian brand has opted to sue the nonprofit Purosangue Foundation, claiming that its registration should be removed because of a lack of use over the past five years. The matter will be heard in a court in Bologna on March 5. A lawyer representing the nonprofit pro-bono told FT “This is David versus Goliath” and said the brand has been in constant use, including a partnership to produce branded sneakers and clothing with Adidas, which is a sponsor of the charity. A Ferrari spokesman said the company does not comment on pending litigation. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Purosangue Foundation describes itself as an “international solidarity running project” that has been active since 2011 to promote clean and social sports. It also operates training camps in Kenya, Mozambique and Italy, and it runs projects to conduct health check-ups for the elderly and send running shoes to Africa. The organization is registered in London with the UK Charities Commission. “I am an athlete, used to getting up at 4:30 a.m. to train, so I have a certain mentality,” Max Monteforte, one of the nonprofitÂ’s founders and running coaches, told FT. “I am not going to be scared off, even knowing that we are up against one of the most important brands in the world.” As for FerrariÂ’s version of the Purosangue, the SUV FUV, short for Ferrari Utility Vehicle, is expected to launch in 2022 or 2023. ItÂ’ll be built on a modular platform shared with other front-engined cars planned as part of CEO Louis CamilleriÂ’s three-year, 15-new-product roadmap. Reports have suggested it will offer a height-adjustable suspension and a plug-in hybrid powertrain using a new, twin-turbo V6, with a pure-combustion V12 likely to serve as the flagship. Ferrari hasnÂ’t said much about its first high-riding ‘ute, and all weÂ’ve seen of it so far was footage of a mule version back in 2018.

Ferrari reveals pair of tailor-made specials in Shanghai

Fri, 20 Jun 2014For most people, buying a new Ferrari - heck, even a used one - would be a special occasion all on its own, not to mention a rare privilege. But to make the experience all the more special, the Prancing Horse marque offers its Tailor-Made personalization program. The service just reached the Asia-Pacific region for the first time with the new Tailor-Made Centre in Shanghai, and to mark its inauguration, Ferrari has revealed two new special editions - both based on V12 GTs and inspired by horses - specifically for the Chinese market.

First up is the F12 Berlinetta Polo Edition pictured above. The special F12 is distinguished by a white and blue theme, the exterior decked out in Bianco Italia Opaco (read: fancy white) with navy blue offset racing stripes, and the interior carrying an inverse take on the same featuring dark blue leather upholstering with white stitching, stripes and trim.

Those looking for more traction and versatility might be more intrigued by the FF Dressage Edition. The four-seat, four-wheel special gets a piano black exterior and a reddish saddle brown leather interior with grid-pattern stitching (pictured inset at right).