2004 sebring gtc convertible, low miles, leather, nice, runs and drives great!!!(US $5,499.00)

2004 sebring gtc convertible, low miles, leather, nice, runs and drives great!!!(US $5,499.00) 2005 chrysler sebring touring convertible, low miles, loaded, must see(US $5,999.00)

2005 chrysler sebring touring convertible, low miles, loaded, must see(US $5,999.00) 2000 chrysler sebring jxi convertible ice cold a/c clean 110k ...no reserve!

2000 chrysler sebring jxi convertible ice cold a/c clean 110k ...no reserve! 2007 chrysler sebring 4dr(US $8,964.00)

2007 chrysler sebring 4dr(US $8,964.00) 2002 chrysler sebring runs & drive can drive it home

2002 chrysler sebring runs & drive can drive it home 2004 chrysler sebring convertible mechanics special needs head gasket clean

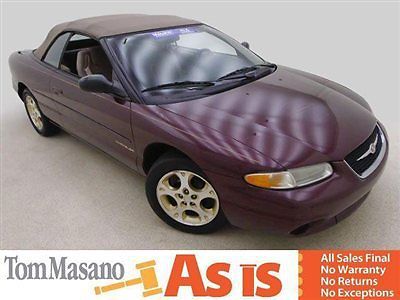

2004 chrysler sebring convertible mechanics special needs head gasket clean 1999 chrysler sebring (53012a) ~ absolute sale ~ no reserve

1999 chrysler sebring (53012a) ~ absolute sale ~ no reserve 2000 chrysler sebring convertible - florida car(US $4,500.00)

2000 chrysler sebring convertible - florida car(US $4,500.00) Low low mile excellent condition, lady driven only on special occasions

Low low mile excellent condition, lady driven only on special occasions 2006 sebring touring edition dark blue 4 door sedan nice ride(US $4,500.00)

2006 sebring touring edition dark blue 4 door sedan nice ride(US $4,500.00) 2004 chrysler sebring base sedan 4-door 2.4l

2004 chrysler sebring base sedan 4-door 2.4l 2006 chrysler sebring touring sedan 4-door 2.7l

2006 chrysler sebring touring sedan 4-door 2.7l 2008 sebring convertable(US $7,900.00)

2008 sebring convertable(US $7,900.00) 2004 4dr sdn lx sedan automatic gasoline 2.4l 4 cyl bright silver metallic

2004 4dr sdn lx sedan automatic gasoline 2.4l 4 cyl bright silver metallic 2005 chrysler sebring convertible limted low miles v6 autostick heated seats(US $9,950.00)

2005 chrysler sebring convertible limted low miles v6 autostick heated seats(US $9,950.00) 1997 chrysler sebring convertible in orlando, florida(US $2,200.00)

1997 chrysler sebring convertible in orlando, florida(US $2,200.00) 2004 chrysler sebring gtc convertible 2-door 2.7l - no reserve

2004 chrysler sebring gtc convertible 2-door 2.7l - no reserve 2000 chrysler sebring jxi convertible 57k 80+ photos see description must see!!!

2000 chrysler sebring jxi convertible 57k 80+ photos see description must see!!! 2001 chrysler sebring convertible(US $1,999.00)

2001 chrysler sebring convertible(US $1,999.00) 2002 chrysler sebring lxi convertible 2-door 2.7l

2002 chrysler sebring lxi convertible 2-door 2.7l 2002 chrysler sebring--needs work or great for parts!

2002 chrysler sebring--needs work or great for parts! 2002 chrysler sebring gtc convertible 2-door 2.7l(US $5,995.00)

2002 chrysler sebring gtc convertible 2-door 2.7l(US $5,995.00) 02 chrysler sebring fun in the sun convertible!! fla trucks!!(US $3,900.00)

02 chrysler sebring fun in the sun convertible!! fla trucks!!(US $3,900.00) 2001 chrysler sebring lxi limited convertible 2-door 2.7l

2001 chrysler sebring lxi limited convertible 2-door 2.7l Time to go topless - sebring convertible lxi

Time to go topless - sebring convertible lxi 2006 chrysler sebring base convertible 2-door runs good no reserve economical

2006 chrysler sebring base convertible 2-door runs good no reserve economical 2008 chrysler sebring lx convertible 2-door 2.4l

2008 chrysler sebring lx convertible 2-door 2.4l 2002 chrysler sebring lx sedan 4-door 2.4l

2002 chrysler sebring lx sedan 4-door 2.4l 2002 chrysler sebring limited convertible 2-door 2.7l ***wrecked & running***

2002 chrysler sebring limited convertible 2-door 2.7l ***wrecked & running*** 2002 chrysler sebring lxi convertible 2-door 2.7l(US $3,450.00)

2002 chrysler sebring lxi convertible 2-door 2.7l(US $3,450.00) Low miles ! 2004 chrysler sebring lxi convertible low miles !(US $6,550.00)

Low miles ! 2004 chrysler sebring lxi convertible low miles !(US $6,550.00) 2004 green 2004.5 convertible!

2004 green 2004.5 convertible! 2001 chrysler sebring convertible low miles loaded leather very clean fun nr(US $3,200.00)

2001 chrysler sebring convertible low miles loaded leather very clean fun nr(US $3,200.00) 2006 chrysler sebring touring sedan 4-door 2.7l- clean-dodge-plymouth-chevy-ford(US $3,200.00)

2006 chrysler sebring touring sedan 4-door 2.7l- clean-dodge-plymouth-chevy-ford(US $3,200.00) 2000 chrysler sebring lxi coupe 2-door 2.5l(US $500.00)

2000 chrysler sebring lxi coupe 2-door 2.5l(US $500.00) Sebring convertible jxi limited southern california garaged low mileage 69,961(US $3,990.00)

Sebring convertible jxi limited southern california garaged low mileage 69,961(US $3,990.00) 1998 chrylser sebring, no reserve

1998 chrylser sebring, no reserve Blue convertible 2door automatic transmission v6 power equipped

Blue convertible 2door automatic transmission v6 power equipped 1998 chevy sebring no rserve

1998 chevy sebring no rserve 2008 chrysler sebring convertible(US $7,500.00)

2008 chrysler sebring convertible(US $7,500.00) 2005 chrysler seabring very clean(US $4,500.00)

2005 chrysler seabring very clean(US $4,500.00) 1999 chrysler jxi(US $6,490.00)

1999 chrysler jxi(US $6,490.00) 2002 chrysler sebring lxi sedan 4-door 3.0l

2002 chrysler sebring lxi sedan 4-door 3.0l 2008 chrysler sebring -- convertible -- excellent condition -- automatic -(US $9,990.00)

2008 chrysler sebring -- convertible -- excellent condition -- automatic -(US $9,990.00) 2008 sebring convt touring~only 9,261 miles~1 owner~heated leather~power top~new(US $15,900.00)

2008 sebring convt touring~only 9,261 miles~1 owner~heated leather~power top~new(US $15,900.00) 2006 chrysler sebring touring sedan 4-door(US $4,100.00)

2006 chrysler sebring touring sedan 4-door(US $4,100.00) 2004 chrysler sebring convertible(US $3,600.00)

2004 chrysler sebring convertible(US $3,600.00) 2010 chrysler sebring sedan super nice, very economical & power everything!

2010 chrysler sebring sedan super nice, very economical & power everything! We finance! 80949 miles 2008 chrysler sebring touring premium

We finance! 80949 miles 2008 chrysler sebring touring premium 2008 chrysler sebring limited hard top convertiable(US $13,500.00)

2008 chrysler sebring limited hard top convertiable(US $13,500.00) 2005 chrysler sebring base sedan 4-door 2.4l

2005 chrysler sebring base sedan 4-door 2.4l 2002 chrysler sebring lx plus sedan 4-door 2.4l

2002 chrysler sebring lx plus sedan 4-door 2.4l 2004 chrysler sebring convertible gt sport manual transmission(US $3,250.00)

2004 chrysler sebring convertible gt sport manual transmission(US $3,250.00) 2000 chrysler sebring jxi convertible 2-door 2.5l

2000 chrysler sebring jxi convertible 2-door 2.5l 2006 chrysler sebring touring sedan 4-door 2.7l

2006 chrysler sebring touring sedan 4-door 2.7l 2002 chrysler sebring lx convertible 2-door 2.7l

2002 chrysler sebring lx convertible 2-door 2.7l 2004 chrysler sebring base sedan 4-door 2.4l hi bid wins

2004 chrysler sebring base sedan 4-door 2.4l hi bid wins 1999 chrysler sebring lxi, no reserve, looks and runs great, low miles

1999 chrysler sebring lxi, no reserve, looks and runs great, low miles No reserve! 1997 chrysler sebring 2d v6 2.5l

No reserve! 1997 chrysler sebring 2d v6 2.5l 2005 chrysler sebring touring convertible 2-door 2.7l

2005 chrysler sebring touring convertible 2-door 2.7l

Chrysler Sebring Price Analytics

About Chrysler Sebring

Auto blog

FCA CEO Manley says alliances are still possible but aren't necessary

Mon, Aug 5 2019DETROIT — Fiat Chrysler Automobiles Chief Executive has a message for Renault SA and other would-be partners: We are happy to talk, but we can go it alone. "Strategically, we have a solid future and clear plans that are being invested in and are underway now," Mike Manley said during a session with reporters the day after the company released better than expected second-quarter results. "That isn't to say if there is a better future through an alliance or partnership or merger we wouldnÂ’t be open and interested to it." Fiat Chrysler is open to re-starting merger negotiations with French automaker Renault, Manley said, but added the French car maker is not the only potential partner to gain scale or plug gaps in Fiat Chrysler's technology or vehicle lineup. "To say are they the only opportunity, the answer to that question would be a definitive ‘No,Â’" Manley said. Fiat Chrysler in June withdrew a $35 billion merger proposal with Renault after French government officials intervened in the talks and sought to delay a decision on the deal. The Wall Street Journal reported on Friday that Renault and Nissan are trying again to reshape their alliance and resolve disagreements that helped to derail the merger talks with Fiat Chrysler. Fiat Chrysler has a commercial vehicle partnership with French rival Peugeot SA, and the two companies discussed a broader combination before Fiat Chrysler made its offer to Renault, people familiar with the situation have said. Manley said automakers are not the only potential partners. "There are cooperations that can help in specific technologies. There are cooperations as we think about the consumer-car interface," he said. "You could see collaborations that never would be there in the past." Fiat Chrysler's North American business is strong thanks to Ram trucks and Jeep SUVs, but in other markets the automaker faces continued challenges. The company is overhauling its mass-market business in Europe, which is anchored by the Fiat brand. Fiat Chrysler's Europe, Middle East and Africa operations were marginally profitable in the second quarter and achieved 1.8% profit margin in 2018. Manley has set a goal of 3% operating margins, well short of the 10% margins the company forecast for North America.

Fiat Chrysler's profit boosted by Ram and Jeep in North America

Wed, Jul 31 2019MILAN/DETROIT — Fiat Chrysler took the market by surprise by sticking to its full-year profit guidance on Wednesday after a strong performance from its Ram pickup truck in North America helped it defy an industry slowdown. Chief Executive Mike Manley, in FCA's first earnings release since a failed attempt to merge with France's Renault, also left the door open to that or other deals. "We are open to opportunity," Manley said on a call with analysts. "I have no doubt why there still would be interest in it," he added, when pressed on what it would take to revive talks with Renault. Manley declined to comment further. FCA last month abandoned its $35 billion merger offer for Renault, blaming French politics for scuttling what would have been a landmark deal to create the world's third-biggest automaker. Manley said a merger was not a must-have and Fiat Chrysler's business plan was strong. The company said it remained confident its adjusted earnings before interest and tax (EBIT) would top last year's 6.7 billion euros ($7.5 billion). Given disappointing forecasts from other automakers this earnings season, FCA's confirmation of the outlook sent Milan-listed shares in the Italian-American automaker, whose other brands include Jeep, up over 4%. A broad-based auto sales downturn has rattled the sector, forcing FCA's competitors — including Renault, Daimler and Aston Martin — to cut their sales forecasts after second-quarter results, while U.S. carmaker Ford gave a weaker-than-expected 2019 profit outlook. Japan's Nissan, a long-term partner of Renault, said it would cut 12,500 jobs by 2023 after its earnings collapsed. In the second quarter FCA's adjusted EBIT totaled 1.52 billion euros, versus analysts' expectations of 1.43 billion euros, according to a Reuters poll. FCA's U.S. shipments were down 12% in the second quarter but the group said that the successful performance of its Ram brand resulted in an enhanced share of the large pickup truck market of 27.9%, up 7 percentage points from last year. Adjusted EBIT margin in North America rose to 8.9% from 6.5% in the first quarter, thanks to strong demand for the heavy-duty Ram and the new Jeep Gladiator pickup. Chief Financial Officer Richard Palmer also said FCA expected to report up to 10% margins in the region in both the third and fourth quarters.

European new car sales drop nearly 8% in first half of 2019

Thu, Jul 18 2019PARIS — European car sales dropped 7.9% in June, led by bigger declines for Nissan, Volvo and Fiat Chrysler (FCA), according to industry data published on Wednesday. Registrations fell to 1.49 million cars last month from 1.62 million a year earlier across the European Union and EFTA countries, the Brussels-based Association of European Carmakers said in a statement. Calendar effects resulted in two fewer sales days in most markets, accentuating the decline. Registrations for the first half closed 3.1% lower, ACEA said. For European carmakers, weakening demand at home compounds the pressure from a sharper contraction in China and emerging markets that may yet bring more profit warnings. NissanÂ’s aging model lineup contributed to a 26.6% June sales slump while Volvo Cars, owned by ChinaÂ’s Geely, saw deliveries tumble 21.7%. Registrations also fell 13.5% last month at FCA, 10.1% at BMW, 9.6% at Volkswagen Group and 8.2% for both Mercedes parent Daimler and FranceÂ’s PSA Group. The Peugeot makerÂ’s domestic rival Renault suffered less, posting a 3.9% decline. By the Numbers BMW Chrysler Fiat Nissan Volkswagen Volvo Peugeot Renault

FCA-Renault revival may hinge on willingness to cut Nissan stake

Mon, Jun 10 2019Fiat Chrysler Automobiles and Renault are looking for ways to resuscitate their collapsed merger plan and secure the approval of the French carmaker's alliance partner Nissan, according to several sources close to the companies. Nissan is poised to urge Renault to significantly reduce its 43.4% stake in the Japanese company in return for supporting a FCA-Renault tie-up, two people with knowledge of its thinking also told Reuters. It is still far from clear whether any concerted effort to revive the complex and politically fraught deal can succeed. FCA Chairman John Elkann abruptly withdrew his $35 billion merger offer in the early hours of June 6 after the French government, Renault's biggest shareholder, blocked a vote by its board and demanded more time to win Nissan's backing. Nissan representatives had said they would abstain. The failure, which FCA and Renault blamed squarely on the French government, deprived both companies of an opportunity to create the world's third-biggest carmaker with 5 billion euros ($5.6 billion) in promised annual synergies. It also shone a harsh light on Renault's relations with Nissan, which have gone from frayed to fried since the November arrest of former alliance Chairman Carlos Ghosn, now awaiting trial in Japan on financial misconduct charges he denies. REVIVAL TALKS Italian-American FCA — whose brand stable encompasses Fiat runabouts, Jeep SUVs, RAM pickups, Alfa Romeo luxury cars and Maserati sports cars — has so far turned a deaf ear to suggestions by French officials that its merger proposal could be revisited. But since the breakdown, Elkann and his French counterpart Jean-Dominique Senard have had talks about reviving the plan that left the Renault chairman and his Chief Executive Thierry Bollore upbeat about that prospect, three alliance sources said. Renault and a spokesman for FCA declined to comment. One of Elkann's senior advisors on the Renault merger bid, Toby Myerson, was expected at Nissan headquarters in Yokohama on Monday for exploratory discussions with top management, two people with knowledge of the matter said. Nissan CEO Hiroto Saikawa is likely to attend. Myerson did not respond to a message from Reuters seeking comment. The meeting comes amid mounting strains that may preclude compromise, after Senard warned Saikawa that Renault was prepared to block key Nissan governance reforms in a dispute over board committees.

Ford Expedition, F-150 Limited and Cadillac V Series | Autoblog Podcast #583

Fri, Jun 7 2019In this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Consumer Editor Jeremy Korzeniewski and Assistant Editor Zac Palmer. First, they talk about the cars they've been driving, including the Ford Expedition, Ford F-150 Limited and the Mini Cooper JCW Knights Edition. Then they discuss the news, including Ian Callum stepping down from Jaguar, Cadillac's V cars and the latest in the saga between FCA and Renault. Autoblog Podcast #583 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Cars we're driving: Ford Expedition Ford F-150 Limited Mini Cooper JCW Knights Edition Ian Callum resigns from Jaguar Cadillac V FCA backs down from Renault merger talks Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video:

Nissan didn't have much say in merger talks, but it had what FCA wanted

Fri, Jun 7 2019TOKYO — Nissan wasn't consulted on the proposed merger between its alliance partner Renault and Fiat Chrysler, but the Japanese automaker's reluctance to go along may have helped bring about the surprise collapse of the talks. While Nissan Motor Co. had a weaker bargaining position from the start, with its financial performance crumbling after the arrest last year of its star executive Carlos Ghosn, it still had as its crown jewel the technology of electric vehicles and hybrids that Fiat Chrysler wanted. The board of Renault, meeting Thursday, didn't get as far as voting on the proposal, announced last week, which would have created the world's third biggest automaker, trailing only Volkswagen AG of Germany and Japan's Toyota Motor Corp. When the French government, Renault's top shareholder with a 15% stake, asked for more time to convince Nissan, Fiat Chrysler Chairman John Elkann abruptly withdrew the offer. Although analysts say reviving the talks isn't out of the question, they say trust among the players appears to have been broken. "The other companies made the mistake of underestimating Nissan's determination to say, 'No,' " said Katsuya Takeuchi, senior analyst at Mitsubishi UFJ Morgan Stanley Securities in Tokyo. The Note, an electric car with a small gas engine to charge its battery, was Japan's No. 1 selling car, the first time in 50 years that a Nissan beat Toyota and Honda. Renault and Fiat Chrysler highlighted possible synergies that come from sharing parts and research costs as the benefits of the merger. But what Fiat Chrysler lacks and really wanted was what's called in the industry "electrification technology," Takeuchi said. With emissions regulations getting stricter around the world, having such technology is crucial. Yokohama-based Nissan makes the world's best-selling electric car Leaf. Its Note, an electric car equipped with a small gas engine to charge its battery, was Japan's No. 1 selling car for the fiscal year through March, the first time in 50 years that a Nissan model beat Toyota and Honda Motor Co. for that title. Nissan is also a leader in autonomous-driving technology, another area all the automakers are trying to innovate. "Although Nissan had no say, its cautionary stance on the merger ended up being very meaningful," Takeuchi said.

PSA shares rise following FCA's breakup with Renault

Thu, Jun 6 2019Shares in Groupe PSA, parent company of automakers Peugeot, Citroen and the DS brand, rose on Thursday as analysts considered the possibility that Fiat Chrysler could turn back to PSA after withdrawing its $35 billion merger offer for Renault. "Both parties have acknowledged the need for scale or [mergers and acquisitions] and may pursue other opportunities. If Nissan was an obstacle (to an FCA-Renault deal) PSA-FCA discussions could resume," wrote brokerage Jefferies. Back in March at the Geneva Motor Show, rumors started swirling that PSA was interested in a potential merger with FCA. Mike Manley, who took over at the helm of Fiat Chrysler following the death of Sergio Marchionne, had indicated a willingness to look into potential partnership options. Of course, that was all before FCA proposed a merger with Renault — with that deal now off the table, attention naturally turns back to PSA, which is also based in France. "We expect both shares to react negatively but see FCA having wider strategic options and Renault shares more downside risk near-term," said Jefferies. According to Reuters, PSA shares were up 1.5% at the time this was published, making it the top-performing stock on France's benchmark CAC-40 Index. Renault saw its shares slump 7%. Shares for FCA fell 3% in early trading on the Milan Stock Exchange. Considering that FCA said in its statement confirming the withdraw of its merger offer with Renault that "political conditions in France do not currently exist for such a combination to proceed successfully," we have to wonder how keen the company is to begin negotiations with another French automaker like PSA. Those thoughts were similarly voiced by Bernstein Research analyst Max Warburton, who said (via Forbes), "Expect PSA to rise on unrealistic hopes it may be FCA's next date." Earnings/Financials Chrysler Fiat Mitsubishi Nissan Citroen Peugeot Renault FCA renault-nissan

France tries to dodge blame for blowing up FCA-Renault merger deal

Thu, Jun 6 2019PARIS — France sought to fend off a hail of criticism on Thursday after it was blamed for scuppering a $35 billion-plus merger between carmakers Fiat-Chrysler and Renault only 10 days after it was officially announced. Shares in Italian-American FCA and France's Renault fell sharply in early trading after FCA pulled out of talks, saying "the political conditions in France do not currently exist for such a combination to proceed successfully." French finance minister Bruno Le Maire said the government, which has a 15% stake in Renault, had engaged constructively, but had not been prepared to back a deal without the endorsement of Renault's current alliance partner Nissan. Nissan had said it would abstain at a Renault board meeting to vote on the merger proposal. However, a source close to FCA played down the significance of Nissan's stance in the discussions, believing French President Emmanuel Macron was looking for a way out of the deal after coming under pressure at home. Context The FCA-Renault talks were conducted against the backdrop of a French public outcry over 1,044 layoffs at a General Electric factory. The U.S. company had promised to safeguard jobs there when it acquired France's Alstom in 2015. The collapse of the deal, which would have created the world's third-biggest carmaker behind Japan's Toyota and Germany's Volkswagen, revives questions about how both FCA and Renault will meet the challenges of costly investments in electric and self-driving cars on their own. The merger had aimed to achieve 5 billion euros ($5.6 billion) in annual synergies, with FCA gaining access to Renault's and Nissan's superior electric drive technology and the French firm getting a share of FCA's lucrative Jeep and Ram brands. FCA has long been looking for a merger partner, and some analysts say its search for a deal is becoming more urgent as it is ill-prepared for tougher new regulations on emissions. It previously held unsuccessful talks with Peugeot maker PSA Group, in which the French state also owns a stake. French budget minister Gerald Darmanin said the door should not be closed on the possibility of a deal with Renault, adding Paris would be happy to re-examine any new proposal from FCA. "Talks could resume at some time in the future," he told FranceInfo radio.

FCA withdraws its offer to merge with Renault

Thu, Jun 6 2019UPDATE: Fiat Chrysler Automobiles released a statement confirming that it has withdrawn its merger offer, saying "it has become clear that the political conditions in France do not currently exist for such a combination to proceed successfully." The full statement can be read below our original story, which continues below. Fiat Chrysler has withdrawn its $35 billion merger offer for Renault, the Wall Street Journal and Bloomberg News reported on Wednesday. A source said that FCA had informed Renault it had withdrawn the offer after Renault's board of directors failed to reach a decision on the merger during a meeting that ran late into the night Wednesday. Instead, the board granted the French government's request to postpone its vote. The government wanted time to persuade Renault's reticent alliance partner Nissan. Renault's board issued a press release that said simply that it was "unable to take a decision due to the request expressed by the representatives of the French State to postpone the vote to a later Council." WSJ reported that Nissan's two members on Renault's board were balking, while the rest of the board favored the merger. The French government wouldn't it back the deal unless Nissan agreed to maintain its role in the Renault-Nissan alliance, sources said. Nissan had received little advance warning of the merger proposal and was balking. Apparently the French government thought Nissan could be brought around if given more time. "We should take our time to make sure that things are done well," French Finance Minister Bruno Le Maire told French television on Wednesday. When the French requested a delay and Renault's board granted it, FCA withdrew. The French state, which owns 15% of Renault, had also been seeking more influence over the merged company, firmer job guarantees and improved terms for Renault shareholders in return for blessing the $35 billion tie-up. The merger would have created the world's third-biggest automaker with combined sales of 8.7 million vehicles per year, and was intended to cut costs as the parties develop electric and autonomous vehicles. Read Fiat Chrysler Automobile's full statement below: FCA withdraws merger proposal to Groupe Renault June 5, 2019 , London - IMPORTANT NOTICE The Board of Fiat Chrysler Automobiles N.V. ("FCA") (NYSE: FCAU / MTA: FCA), meeting this evening under the Chairmanship of John Elkann, has resolved to withdraw with immediate effect its merger proposal made to Groupe Renault.

Renault delays decision on merger with Fiat Chrysler

Wed, Jun 5 2019PARIS — Renault has delayed a decision on whether to merge with Fiat Chrysler Automobiles, a deal that could reshape the global auto industry as carmakers race to make electric and autonomous vehicles for the masses. The deal still looks likely, but faced new criticism Tuesday from Renault's leading union and questions from its Japanese alliance partner Nissan. The French government is also putting conditions on the deal, including job guarantees and an operational headquarters based in France. The French carmaker's board will meet again at the end of the day Wednesday to "continue to study with interest" last week's merger proposal from FCA, Renault said in a statement. A Renault board meeting Tuesday to study the deal was inconclusive. The company didn't explain why, but a French government official said board members don't want to rush into a deal and are seeking agreement on all parts of the potential merger. The official, who spoke on condition of anonymity in line with government policy, told The Associated Press the conditions outlined by France's finance minister still "need to be met." France and Italy are both painting themselves as winners in the deal, which could save both companies 5 billion euros ($5.6 billion) a year. But workers worry a merger could lead to job losses, and analysts warn it could bog down in the challenges of managing such a hulking company across multiple countries. And a possible loser is Japan's Nissan, whose once-mighty alliance with Renault and Mitsubishi is on the rocks since star CEO Carlos Ghosn's arrest in November. Nissan CEO Hiroto Saikawa cast doubt Tuesday on whether his company will be involved in a Renault-Fiat Chrysler merger — and suggested adding Fiat Chrysler to the looser Renault-Nissan-Mitsubishi alliance instead. Saikawa said in a statement that the Renault-Fiat Chrysler deal would "significantly alter" the structure of Nissan's longtime partnership with Renault, and Nissan would analyze its contractual relationships to protect the company's interests. If Renault's board says "yes" to Fiat Chrysler, that would open the way for a non-binding memorandum of understanding to start exclusive merger negotiations. The ensuing process — including consultations with unions, the French government, antitrust authorities and other regulators — would take about a year. A merger would create the world's third-biggest automaker, worth almost $40 billion and producing some 8.7 million vehicles a year.