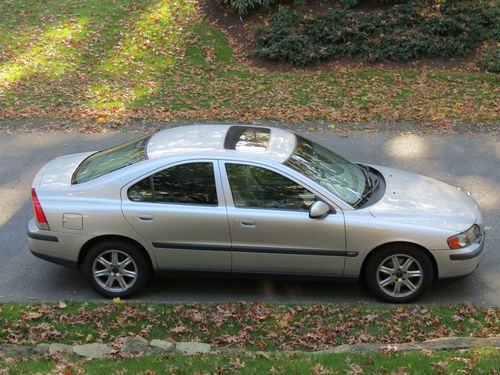

2007 S60r At Titanium/nordkap 75k, Northeast, Ohio on 2040-cars

Canfield, Ohio, United States

Volvo S60 for Sale

Leather alloy wheels push button start cruise control off lease only(US $21,999.00)

Leather alloy wheels push button start cruise control off lease only(US $21,999.00) 2002 volvo s60 awd--best price on ebay

2002 volvo s60 awd--best price on ebay 2005 volvo s60 2.5t sedan 4-door 2.5l nice salvage

2005 volvo s60 2.5t sedan 4-door 2.5l nice salvage 2005 volvo s60 2.5t sedan 4-door 2.5l nice salvage

2005 volvo s60 2.5t sedan 4-door 2.5l nice salvage 2005 volvo s60 r awd sedan all ori leather fully loaded relisted reserve lowered

2005 volvo s60 r awd sedan all ori leather fully loaded relisted reserve lowered 2002 volvo s60 - low mileage and great condition(US $6,450.00)

2002 volvo s60 - low mileage and great condition(US $6,450.00)

Auto Services in Ohio

World Auto Parts ★★★★★

West Park Shell Auto Care ★★★★★

Waterloo Transmission ★★★★★

Walt`s Auto Inc ★★★★★

Transmission Engine Pros ★★★★★

Total Auto Glass ★★★★★

Auto blog

Junkyard Gem: 1983 Volvo 240 DL Sedan

Sat, Nov 6 2021The most iconic of all the Volvos — all the Swedish cars, for that matter — sold in the United States is and always will be the brick-shaped 200 series, which could be purchased new here from the 1975 model year all the way through 1993. Though it was an evolution of the earlier 140 series and looked nearly identical to its ancestor from any rear angle, the 240 (and, to a much lesser extent, 260) remains the most recognizable Volvo ever made. Because these cars were quite sturdy and inspired such devotion from their owners, plenty of them remain on the road to this dayÂ… and that means plenty of them wear out every year and end up taking that final tow-truck ride to the boneyard. Here's a bread-and-butter mid-1980s 244, with the sensible four-on-the-floor overdrive manual transmission and well-oxidized Richelieu Red paint, found in a self-service yard near Denver, Colorado. Prior to the 1980 model year, U.S.-market Volvo 200s were named according to a very logical system: the model name was a three-digit number, with the first digit indicating the car series, the second digit representing the number of engine cylinders, and the third digit showing the number of doors. Typically, the trim level would come after that. Just to confuse everyone, Volvo did away with everything but the trim levels when identifying these cars. Thus, this car would have been badged as a 244 DL during the 1975-1979 period, but for the first half of the 1980s it was called simply the Volvo DL. Of course, everyone who knows old Volvos today just calls this a 244, period. DL stood for Deluxe, so of course it was the cheapest trim level. The list price on this car started at $11,085, or about $31,090 in 2021 dollars. That was cheaper than a new BMW 320i ($13,290 or $37,275 now), but more expensive than more luxurious and powerful Japanese competitors such as the Datsun 810 Maxima by Nissan ($10,869 or $30,485 today) and Mazda 626 Luxury Sedan ($8,895 or $24,950 today). If you insisted on an automatic transmission in your '83 DL sedan, the price tag went up an additional 390 bucks, or about $1,094 now. This car has the base four-speed manual with the overdrive actuated by a switch on the shift knob. With 107 horsepower from this 2.3-liter straight-four engine, this car wasn't particularly quick. However, it weighed less than 3,000 pounds (despite its blocky appearance), so it got out of its own way well enough when equipped with a manual transmission.

10 best new car deals in late September 2021

Wed, Sep 29 2021New car sales were drastically affected in 2020 due to the ongoing coronavirus pandemic, but things started to show signs of recovery toward the end of the year before really coming on strong in the early months of 2021. Now there's an ongoing shortage of microchips causing a great deal of pricing fluctuation and a limited supply of certain vehicles. That doesn't mean there aren't still great deals on new cars, though. Using data provided by TrueCar, we’ve compiled a list of some of the best automotive deals for September 2021. WeÂ’ve noted the original MSRP, the average transaction price, and the total savings in both dollars and as a percentage of the original sticker price. Basically, weÂ’ve done all the hard work for you! So now, all you need to do is compare deals, go on a few test drives, and maybe drive away in a great car (and an even better bargain).

Daimler rebuffs Geely offer to buy stake

Wed, Nov 29 2017HONG KONG/BEIJING - Daimler AG has turned down an offer from China's Geely to take a stake of up to 5 percent via a discounted share placement, as the German automaker has long been reluctant to see existing shareholdings diluted, sources with knowledge of the talks said. A stake of that size would be worth $4.5 billion at current market prices. Although Daimler declined the offer, it told Geely it was welcome to buy shares in the open market, the sources added. Carmakers in China have embarked on a flurry of dealmaking, as they scramble to boost production of electric and plug-in hybrid vehicles ahead of tough new quotas to be imposed by Beijing, which wants to reduce urban smog and lower the country's reliance on oil. People with knowledge of Geely's thinking said the company was keen to access Daimler's electric car battery technology and wanted to establish an electric car joint venture in Wuhan, the capital of Hubei province. Geely, which also owns Swedish car maker Volvo, is still hopeful it can secure a deal in some form over the coming weeks, they added. The two automakers met in Beijing in recent weeks at Geely's behest. There, the Chinese firm, formally known as Zhejiang Geely Holding Group, offered to take a stake of between 3 percent and 5 percent if Daimler would issue new shares at a discount, the sources said. It was not immediately clear what kind of discount for the shares Geely had in mind or whether Geely was interested in buying the shares on the open market. A spokesman for Geely declined to comment. A spokesman for Daimler said the company was "very happy with our shareholder structure at present", but added that it would welcome new investors with a long-term interest in the company. Shares in Daimler were up 1 percent in early Wednesday trade, in line with the broader market.DAIMLER ALREADY TIED TO BAIC, BYD Geely, which has a market value of some $32 billion, is the leading domestic brand in China with a 5 percent market share, according to an analysis by Nomura Securities. A stake of 5 percent would establish it as Daimler's third-largest shareholder behind the Kuwait Investment Authority and BlackRock, who hold 6.8 percent and 6 percent respectively, according to Reuters data.