1999 Volvo C70 Convertible Low Miles Candy Red Super Nice No Reserve ! on 2040-cars

Philadelphia, Pennsylvania, United States

For Sale By:Dealer

Engine:2.4L 2435CC l5 GAS DOHC Turbocharged

Transmission:Automatic

Body Type:Other

Vehicle Title:Clear

Used

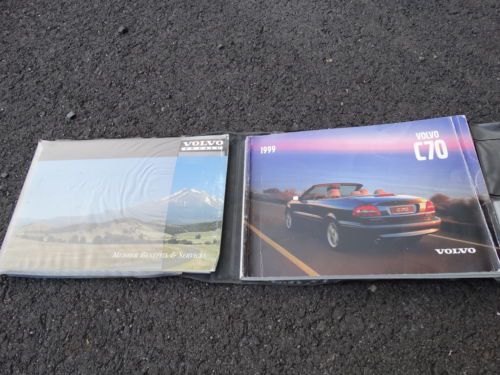

Year: 1999

Options: Cassette Player

Make: Volvo

Power Options: Power Locks

Model: C70

Mileage: 55,555

Sub Model: LT A CV 2dr

Trim: Base Convertible 2-Door

Exterior Color: Red

Number of Cylinders: 5

Drive Type: FWD

Warranty: Unspecified

Volvo C70 for Sale

2004 volvo c70 convertible runs great 101k no rust needs some cosmetics 1 owner

2004 volvo c70 convertible runs great 101k no rust needs some cosmetics 1 owner Volvo c70 coupe ht no reserve

Volvo c70 coupe ht no reserve Mint volvo c70 2011 convertible hard top silver with tan leather(US $11,500.00)

Mint volvo c70 2011 convertible hard top silver with tan leather(US $11,500.00) 2007 volvo c70 t5, hardtop convertable, one owner, like new(US $11,950.00)

2007 volvo c70 t5, hardtop convertable, one owner, like new(US $11,950.00) 1999 volvo c70 base convertible 2-door 2.4l ((( 119k on miles)))

1999 volvo c70 base convertible 2-door 2.4l ((( 119k on miles))) 1999 volvo c70 convertible perfect southern carfax!(US $4,700.00)

1999 volvo c70 convertible perfect southern carfax!(US $4,700.00)

Auto Services in Pennsylvania

Wyoming Valley Kia - New & Used Cars ★★★★★

Thomas Honda of Johnstown ★★★★★

Suder`s Automotive ★★★★★

Stehm`s Auto Repair ★★★★★

Stash Tire & Auto Service ★★★★★

Select Exhaust Inc ★★★★★

Auto blog

Bronco, Yukon, Hummer and a CES recap | Autoblog Podcast #610

Fri, Jan 17 2020In this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Consumer Editor Jeremy Korzeniewski and Assistant Editor Zac Palmer. They kick things off by talking about recent news, including the revival of the Hummer name as an electric pickup, revealing Ford Bronco spy shots and the unveiling of the 2021 GMC Yukon. Then Zac tells about his time in Las Vegas attending CES 2020. They talk about the cars they've been driving: a JCW-tuned Mini Clubman, the long-term Subaru Forester with its new gold wheels, a Volvo S60 PHEV that's been added to the long-term fleet, and a Camry Hybrid. Last, but not least, they help a listener decide how to spend his money on a sports car. Autoblog Podcast #610 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Hummer returning as an electric GMC pickup The latest on the Ford Bronco 2021 GMC Yukon CES 2020 recap Cars we're driving:2020 John Cooper Works Mini Clubman 2020 Subaru Forester long-termer (now with gold wheels!) 2020 Volvo S60 T8 Inscription 2019 Toyota Camry Hybrid XLE Spend My Money Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Verizon buys Telogis in connected vehicle market push

Wed, Jun 22 2016(Note/disclaimer: We are owned by Verizon, by way of AOL. This gives us no inside track whatsoever when it comes to news.) With a lot of tech companies and automakers staking their claims in the connected car space, now there are signs that others are looking to move in, too. Today, telecoms giant Verizon announced that it is acquiring Telogis, a California-based company that develops cloud-based solutions for mobile workforces, and specifically telematics, compliance and navigation software used by Ford, Volvo, GM and other car companies, as well as Apple and AT&T. Financial terms of the deal have not been disclosed, although we'll try to find out. Considering that Verizon in 2015 reported full-year revenues of $131.6 billion, the price would have to be very high to be considered "material" and may not be made public for some time, if ever. Telogis in its time as a startup raised a substantial amount of money, just over $126 million in all, including $93 million in 2013, supposedly ahead of an IPO, all from Kleiner Perkins Caufield & Byers. Back in 2013 when KPCB made its investment (which was the first from a VC firm in the company), Telogis told TechCrunch it was profitable and forecasting revenues of $100 million annually for the year. It's not clear what size those revenues are now, but if it was on the same growth trajectory as before the funding, sales would be around $150 million annually, with profitability, at the moment. Other investors include some very notable strategics: the investment arm of General Motors, and Fontinalis Partners, which also invests in Lyft and was co-founded by Bill Ford, the executive chairman of the Ford Motor Company. Before the acquisition, Verizon actually had a business in fleet management and telematics; in fact, the two companies competed against each other for business from the trucking and other industries. Verizon Telematics, as the business is called, is active in 40 countries. But in a way, Verizon buying Telogis is a sign that the latter may have proved to be the more superior, and the one with the key customer deals.

Volvo Cars leaps 22% in IPO stock debut — a big endorsement for EVs

Fri, Oct 29 2021Volvo Cars CEO Hakan Samuelsson at the automakers' stock market opening bell on Friday in Stockholm. (Getty Images)  STOCKHOLM — Volvo Cars shares surged 22% on their Stockholm market debut on Friday after wrapping up Europe's biggest IPO of the year so far, in a boost for new issues markets and carmakers' vision of an electric future. The Gothenburg-based company cut the size of its listing and priced it at the bottom of a previously-announced range UPDATE 3-Volvo Cars gives itself $18 bln price tag as cuts IPO size - Reuters News on Monday, valuing it at just over $18 billion and making it Sweden's second largest listing yet. But the successful deal and strong market reaction — which propels the valuation to about $22 billion — is a lift for a European automotive industry that has embarked on a challenging transition towards electric vehicles (EVs). It also shows that while the euphoria over initial public offerings (IPO) in the first half of 2021 is over, the market is open for new listings of big companies with a story to tell. Volvo Cars Chief Executive Hakan Samuelsson said the listing showed a recognition of its transition plans, adding it would be key for Volvo to demonstrate it is on track to be the "fastest transformer." "There's a much bigger interest in the market to invest in electric car makers than in the conventional ones. So we better do what we said we would," he told Reuters in an interview. Shares in the carmaker, which is majority owned by China's Geely Holding, were trading at 64.70 Swedish crowns ($7.59) at 1057 GMT, after being priced at 53 crowns in the IPO. Polestar Apart from Volvo's commitment to becoming a purely electric carmaker by 2030, it also has a 49% stake in EV venture Polestar, which said in September it would go public through a $20 billion deal. Samuelsson said Polestar had a "good valuation." "They are already electric... showing in a way what the potential would be for Volvo if this (the transformation) is done in the right way." A source familiar with Volvo's transaction said the outcome of this week's IPO was good, even though investors had pushed back and forced Volvo to price at the bottom of the announced range. "The company had to compromise on size and the governance structure. They were hoping for a read across on Polestar, but they were clearly not getting that," the source said, requesting anonymity because they were not authorised to speak to the press.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.093 s, 7900 u