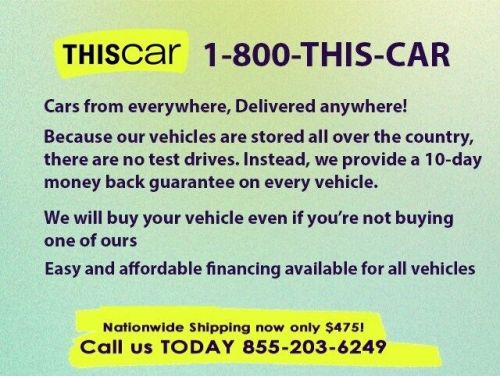

2020 Volvo Xc40 T5 R-design on 2040-cars

Tomball, Texas, United States

Engine:4 Cylinder Engine

Fuel Type:Gasoline

Body Type:--

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): YV4162UM0L2336796

Mileage: 31517

Make: Volvo

Model: XC40

Trim: T5 R-Design

Drive Type: AWD

Features: --

Power Options: --

Exterior Color: Other

Interior Color: Gray

Warranty: Unspecified

Volvo XC40 for Sale

2025 volvo xc40 b5 awd plus dark theme(US $50,025.00)

2025 volvo xc40 b5 awd plus dark theme(US $50,025.00) 2025 volvo xc40 b5 awd plus dark theme(US $50,825.00)

2025 volvo xc40 b5 awd plus dark theme(US $50,825.00) 2023 volvo xc40 b5 plus dark theme(US $36,988.00)

2023 volvo xc40 b5 plus dark theme(US $36,988.00) 2021 volvo xc40 r-design(US $28,997.00)

2021 volvo xc40 r-design(US $28,997.00) 2022 volvo xc40 t4 momentum(US $16,026.50)

2022 volvo xc40 t4 momentum(US $16,026.50) 2020 volvo xc40 t5 momentum sport utility 4d(US $20,944.00)

2020 volvo xc40 t5 momentum sport utility 4d(US $20,944.00)

Auto Services in Texas

Zeke`s Inspections Plus ★★★★★

Value Import ★★★★★

USA Car Care ★★★★★

USA Auto ★★★★★

Uresti Jesse Camper Sales ★★★★★

Universal Village Auto Inc ★★★★★

Auto blog

2021 Volvo XC90 Review | What's new, prices, fuel economy, pictures

Tue, Sep 15 2020The 2021 Volvo XC90 is the biggest vehicle in Volvoís lineup, serving up three rows of Swedish luxury. It¬ís an attractive crossover that¬ís instantly recognizable as a Volvo, serving as the flagship that led the brand¬ís revival a few years back. Volvo offers choices galore with the XC90, whether that be through trim levels or powertrain options. None of them are distinct performance models in the vein of the BMW X5 M or the Mercedes-AMG GLE 63, but the XC90¬ís appeal isn¬ít held in 0-60 mph times and freakish handling. Instead, Volvo focuses on what it does best: Safety, efficiency and classic styling that makes us swoon. It¬ís spacious and cosseting when fully decked out. And while the price can rise quickly, Volvo has entry-level versions that are attainable and priced below the competition. Despite this generation starting to age, Volvo keeps it updated enough to conceal its graying areas. Those looking for something shiny and flashy should look elsewhere, because even if the snappy tech and diverse powertrain lineup are intriguing, the XC90 still flies under the radar. It¬ís the luxury crossover for a family that doesn¬ít wish to boast about its bank account, but still wants a taste of the finer things in life. There¬ís even a plug-in hybrid version for those wanting something that¬ís both quick and efficient. What¬ís new for 2021? Volvo has added to the list of standard features for the new year. Now, you get adaptive LED headlights, wireless phone charging and front park assist as standard. Rear passengers gain two USB-C chargers, and the heated wipers are made available as part of the Climate Package. The T8 plug-in hybrid model is renamed as the XC90 Recharge, and it gets a new entry-level Inscription Express trim. The R-Design model gets a new glossy black grille design. Volvo¬ís 112-mph speed limiter goes into effect across the lineup this year. Lastly, Volvo has done some color and interior trim shuffling, but nothing major. 2020 Volvo XC90 T8 Inscription View 31 Photos What are the XC90 interior and in-car technology like? No matter the trim level, the 2021 Volvo XC90¬ís cabin is a lesson in minimalism. The vibe is different from any of the German or Japanese luxury machines. Where BMW and Mercedes dashes are festooned with design flourishes and obvious luxury, the XC90 is laid back and staid. Muted wood inlays grace the dash of luxury models, whereas metal inlays are used on sportier builds.

Junkyard Gem: 1984 Volvo 760 Turbo

Sun, Jul 31 2022When it came time for Volvo to replace the aging 200 Series (which debuted in 1974 but looked nearly identical to the mid-1960s-design 140 it was based on), the result was the 700 Series. This car first hit Volvo showrooms in 1982, and the initial models were all upscale 760 sedans with the same PRV V6 engine that powered the DeLorean DMC-12. The cheaper four-cylinder 740 appeared in North America for the 1984 model year, which didn't stop Volvo from selling a 760 with a turbocharged four-banger in the same showrooms. That's what we've got for today's Junkyard Gem, a first-model year Volvo 760 Turbo in a Colorado self-service yard. As it turned out, the 740/760/780 not only didn't replace the 240/260, it didn't even outlast it. 240 sales continued all the way through 1993, while the 760/780 and 740 got the axe in 1990 and 1992, respectively (to be fair, the later 900 Series was based on the 700 Series and was available new here until the very last 1998 S90s and V90s were sold). During the 1984 model year, American Volvo shoppers could choose between a new 240 Turbo (in two-door, four-door, and wagon forms) or the 760 sedan with their choice of oil- or gasoline-burning turbocharged engines. Yes, the 1980s truly were The Turbo Decade. For 1985, a turbocharged version of the 740 sedan was added to the lineup, though that was also the final year here for the 240 Turbo. This engine is a 2.3-liter "red block" four-cylinder, rated at 160 horsepower when new. That was two fewer horsepower than the more angrily boosted 2.2 in the 240 Turbo that year. The 740/760 scaled in at just a few more pounds than the 240, though it seemed bigger at a glance. Supposedly you could get a U.S.-market 760 Turbo with a four-speed manual transmission, but every example I've ever seen had the four-speed automatic. This one racked up just a bit over 200,000 miles during its life. Not bad, though I've found a 740 Turbo wagon that got close to 500,000 miles before ending up in the junkyard. The interior looks decent enough for its age, though I suspect these cloth seats replaced the original leather ones after the cowhide fell apart beneath the High Plains sun. It's hard to get more 1980s than a graphic equalizer/sound effector.  This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Zero to 55 in 7 seconds flat!

Volvo prices revamped 2014 lineup

Thu, 01 Aug 2013Volvo has made quite a few changes to its US lineup for the 2014 model year. The C30 hatchback and C70 convertible are gone; the S60, S80, XC60 and XC70 have all been reschnozzed; and in a few months, Volvo will bring its V60 wagon across the pond for Stateside consumption. Only the range-topping XC90 carries on unchanged, though a brand new version is expected to launch sometime next year.

The S60 starts as low as $32,400 for the entry level T5 model, and reaches as high as $45,700 for the T6 R-Design Platinum trim. The larger S80 sedan starts at $39,900, with its range-topping T6 Platinum version commanding $48,150. XC70 pricing ranges anywhere from $34,500 for the 3.2 FWD to $45,650 for the T6 Platinum, XC60 numbers span from $34,850 to $49,800, and XC90 prices start as low as $39,700 and as high as $45,400. None of these prices include $895 for destination, and pricing for the swoopy V60 wagon has not been released just yet.

While the majority of Volvo's 2014 model year enhancements are visual, some neat updates have been made mechanically, as well. There's a new Advanced Quick Shift mode for the six-speed automatic transmission that's paired with the turbocharged six-cylinder engine, and Volvo says that the S60 R-Design will now scoot to 60 miles per hour two-tenths of a second quicker (5.3 versus 5.5). In the XC60 R-Design, AQS improves 0-60 acceleration by four-tenths of a second, down to 6.2 from 6.6 seconds.