2023 Volvo Xc40 Recharge Pure Electric Twin Ultimate on 2040-cars

Tomball, Texas, United States

Engine:Electric Engine

Fuel Type:Gasoline

Body Type:--

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): YV4ED3UM0P2112544

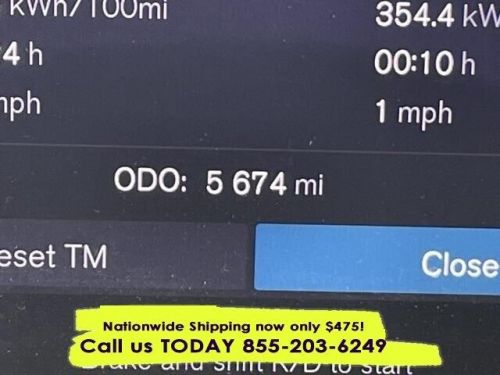

Mileage: 5674

Make: Volvo

Model: XC40 Recharge Pure Electric

Trim: Twin Ultimate

Drive Type: AWD

Features: --

Power Options: --

Exterior Color: Silver

Interior Color: Other

Warranty: Unspecified

Volvo XC40 Recharge Pure Electric for Sale

2024 volvo xc40 recharge pure electric plus(US $59,650.00)

2024 volvo xc40 recharge pure electric plus(US $59,650.00) 2023 volvo xc40 recharge pure electric ultimate(US $35,595.00)

2023 volvo xc40 recharge pure electric ultimate(US $35,595.00) 2022 volvo xc40 recharge pure electric p8 ultimate(US $20,996.50)

2022 volvo xc40 recharge pure electric p8 ultimate(US $20,996.50)

Auto Services in Texas

Xtreme Customs Body and Paint ★★★★★

Woodard Paint & Body ★★★★★

Whitlock Auto Kare & Sale ★★★★★

Wesley Chitty Garage-Body Shop ★★★★★

Weathersbee Electric Co ★★★★★

Wayside Radiator Inc ★★★★★

Auto blog

Volvo's oldest model earns IIHS Top Safety Pick+ award [w/video]

Thu, 07 Nov 2013Volvo ought to be tooting its horn over this one. The XC90, an SUV that has essentially been on sale for over 10 years, just captured a Top Safety Pick+ award from the Insurance Institute for Highway Safety. The TSP+ is a new title, reserved for cars that earn "Good" or "Acceptable" ratings on each IIHS crash test.

This is a difficult feat for a new car - Toyota's new Corolla infamously failed to net a Top Safety Pick+ earlier this year - largely because of the new small overlap front tests, which have left many automakers struggling. But Volvo, somehow, was able to conquer the tests with a car that predates the original iPhone by a few years. The XC90 earning a Top Safety Pick+ is like Betty White taking the gold in the decathlon. With Volvo in the midst of working on the XC90's replacement, we're curious to see just how well a more modern version does in crash testing. Take a look down below for the crash test video and a press release from IIHS.

Apple announces CarPlay in-car iPhone interface

Mon, 03 Mar 2014Apple, maker of tech items like the iPhone, iPad and Mac line of computers, is extending its reach into the automotive market, making a fairly big announcement ahead of the Geneva Motor Show. No, it hasn't bought Tesla (yet). Instead, Apple has announced CarPlay, an all-new means of controlling an iPhone through your car.

Now, this doesn't strike us as some gimmicky thing. It's become increasingly common for automakers to take advantage of the high-speed data streams its customers enjoy on their smartphones in order to integrate navigation, traffic, audio and other infotainment items into a car's touchscreen interface. The Chevrolet Spark and Sonic are two prime examples of this move, using an iPhone's data stream for Siri integration and data for a third-party navigation app.

Owners will be able to plug in their iPhones to their cars via the USB port and gain control of a number of the device's functions, all through a car's touchscreen.

Leno drives Volvo P1800 from Roger Moore's The Saint

Thu, 18 Sep 2014Outside of a few notable exceptions, Volvo usually isn't associated with making beautifully curvaceous vehicles. But in the 1960s and early '70s the company proved with the P1800 that its cars didn't only have to be safe but staid family transportation. Underneath that shapely styling were a lot of components from the brand's parts bin, but that didn't bother Roger Moore when he drove one of these in the TV series The Saint. Actually, the future James Bond actor didn't just get behind of one of these; he owned this exact 1967 P1800 S. It's this week's highlight on Jay Leno's Garage.

Moore was the car's original owner, but it also appeared in studio scenes of The Saint. Despite its famous provenance, when owner Bill Krzastek bought the P1800 in England, it was in pretty rough shape. The Volvo underwent a nine-month restoration to get it back into shape, which included some new body panels and wheels. Krzastek claims that much of the interior is original, though.

Krzastek comes off has a little bit nerdy, but you have to give him credit. He absolutely loves his Volvo and knows something about practically every detail of his car's history. Krzastek even refinanced his house to fund the purchase and restoration of the P1800. Although, with the right maintenance these old Swedes have been known to go millions of miles. Enjoy this look at one that was a star of the screen in the '60s.