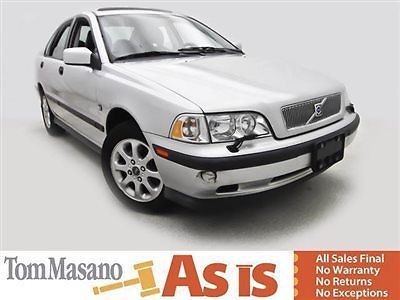

2005 Volvo S40 I Sedan 4-door 2.4l on 2040-cars

Frisco, Texas, United States

|

It is a beautiful car. It drives and handles well. The exterior looks good for the age. The interior is clean. The seats still look good and the leather is soft. Tires still have tread left. The AC is very cold. It has had the Volvo TSB services done. Including the oil housing / Flame trap. The check engine light is on and reads P0171, but it still drives great. Everything else is fine to my knowledge. There is no reserve, so good luck. Feel free to ask me any questions, and I will try to answer them as best as I can.

|

Volvo S40 for Sale

*t5* 69k miles free shipping / 5-yr warranty! 6-speed leather sunroof must see!(US $10,995.00)

*t5* 69k miles free shipping / 5-yr warranty! 6-speed leather sunroof must see!(US $10,995.00) 2000 volvo s40 (f9746b) ~ absolute sale ~ no reserve ~

2000 volvo s40 (f9746b) ~ absolute sale ~ no reserve ~ 2001 volvo s40 1.9 l 1948 cc l4 dohc 232,000 miles

2001 volvo s40 1.9 l 1948 cc l4 dohc 232,000 miles 2007 volvo s 40 -- good parts car or builder

2007 volvo s 40 -- good parts car or builder 2007 volvo s-40 2.4ti 4-door sedan auto fw dr titanium grey 20,389miles(US $11,798.00)

2007 volvo s-40 2.4ti 4-door sedan auto fw dr titanium grey 20,389miles(US $11,798.00) 2000 volvo s40 all options no reserve

2000 volvo s40 all options no reserve

Auto Services in Texas

Zepco ★★★★★

Xtreme Motor Cars ★★★★★

Worthingtons Divine Auto ★★★★★

Worthington Divine Auto ★★★★★

Wills Point Automotive ★★★★★

Weaver Bros. Motor Co ★★★★★

Auto blog

Recharge Wrap-up: Formula E car swap video, Lyft adds carpooling, new Tesla book

Fri, Aug 8 2014Curious to see how the Formula E car swap goes down? During each hour-long race (or ePrix, as the series calls them), drivers have to make a pit stop to switch cars as the battery runs down. Of course, they want to do it as quickly as possible. It's kind of a tricky dance extricating oneself from the cockpit of one car and slipping into the seat of another facing the opposite direction. See the maneuver in the video below and read more at Jalopnik. A new report forecasts that the CNG and LPG vehicle market will be worth nearly $5.2 billion by 2019. The report cites fluctuating gasoline and diesel prices, and the relatively low prices of these alternative fuels, for their growing popularity. The report also breaks down the popularity of natural gas and propane vehicles in different parts up the world. In the Asia-Pacific region, China is the largest consumer. In Europe, CNG thrives in Italy, while LPG is most popular in Turkey and Poland. Meanwhile, CNG remains a tough sell in America, while South America has a healthy market. Learn more in the press release below or at Markets and Markets. The Ports of Los Angeles and Long Beach are testing trucks connected to overhead electric wires to reduce emissions and improve air quality. The eHighway, as the project is called, will cost $13.5 million and will use battery electric and hybrid trucks to move cargo around the ports along a one-mile stretch of wires. The trucks, made by Siemens and Volvo, also have the ability to disconnect from the wires and drive under their own power. See more in the video below or read more at ABC7. Lyft is introducing its own carpooling feature to its car-hailing app. Yesterday, we reported that its competitor Uber is testing UberPool, and Lyft is now doing something similar to encourage people to share rides. Lyft Line offers discounted rides, and matches passengers who are going to nearby destinations around the same time. Lyft Line offers passengers a guaranteed price before they accept the ride. Lyft is launching the carpooling service in San Francisco, and hopes to expand it from there. Read the in-depth article at The New York Times. A new book is available called Tesla Motors: How Elon Musk and Company Made Electric Cars Cool, and Sparked the Next Tech Revolution. Written by Charles Morris, senior editor of Charged, it chronicles the history of the famed electric automaker, its achievements in business and technology and the people responsible for Tesla's success.

Five vehicles named Top Safety Pick+ including new Civic, MKZ

Fri, 08 Mar 2013In an attempt to help push vehicle safety to a higher level, the Insurance Institute for Highway Safety created a stricter Top Safety Pick+ rating last year, which incorporates a brutal small overlap test and requires cars to get Good ratings in four out of the five categories (and no less than Acceptable in the fifth). Joining the list of the safest cars of 2013, the 2013 Volvo XC60, Lincoln MKZ, Honda Civic (sedan and coupe) and the 2014 Mazda6 have all received the coveted TSP+ rating.

The Mazda6 and Lincoln MKZ have both been completely redesigned, and both received Acceptable ratings in the small overlap test. The Honda Civic, coming off its emergency refresh for 2013, is the first small car to be subjected to the small overlap test, and IIHS says that one of the car's many upgrades includes a stiffer front structure allowing it to receive Good ratings in all categories. Similarly, the XC60 gets all Good ratings thanks to, according to IIHS, Volvo updating the airbag software allowing the side airbags to inflate during the small overlap test.

The 2014 Subaru Forester has not yet been subjected to the small overlap test, so it must make do with just a Top Safety Pick rating until the IIHS tests small utility vehicles, which is expected to happen later in the spring.

Chip maker Nvidia adds Volvo to list of self-driving partners

Tue, Jun 27 2017Chipmaker Nvidia Corp announced on Monday it was partnering with Volvo Cars and Swedish auto supplier Autoliv to develop self-driving car technology for vehicles due to hit the market by 2021. Volvo is owned by China's Geely Automobile Holdings. Silicon Valley-based Nvidia also announced a non-exclusive partnership with German automotive suppliers ZF and Hella for artificial intelligence technology for autonomous driving. Nvidia came to prominence in the gaming industry for designing graphics processing chips, but in recent years has been a key player in the automotive sector for providing the so-called "brain" of the autonomous vehicle. The company, whose many partners already include Tesla, Toyota, Ford, Audi, BMW, and tier one supplier Robert Bosch, announced its latest deals at an automotive electronics show in Ludwigsburg, Germany. Nvidia's Drive PX artificial intelligence platform is used by Tesla in its Models S and X and upcoming Model 3 electric vehicles. Volkswagen AG's Audi is also using the system to reach full autonomous driving by 2020. In a call with reporters, Nvidia's senior automotive director Danny Shapiro said carmakers and their main suppliers are now moving away from the research and development phase of autonomous vehicles and into concrete production plans. The system developed jointly by ZF and Hella, and using Nvidia's Drive PX platform, will combine front cameras with radar and software to create technology meeting the Euro NCAP safety certification for so-called "Level 3" driving, in which some, but not all, driving is performed by the car. Volvo is already using the Drive PX for the self-driving cars in its "Drive Me" autonomous pilot program. Volvo's production vehicles built on Nvidia's platform, as announced on Monday, are planned for sale by 2021.Reporting By Alexandria SageRelated Video: Auto News Green Tesla Toyota Volvo Technology Emerging Technologies Autonomous Vehicles nvidia autoliv