Engine:1,986 cc B20B/E/F I4 4 Cylinder

Fuel Type:Gasoline

Body Type:--

Transmission:Manual

For Sale By:Dealer

VIN (Vehicle Identification Number): 00000000000000000

Mileage: 128078

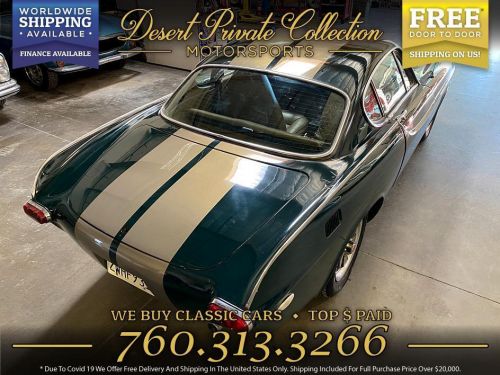

Make: Volvo

Model: P1800

Trim: E

Drive Type: --

Features: --

Power Options: --

Exterior Color: Red

Interior Color: Black

Warranty: Vehicle does NOT have an existing warranty

Volvo P1800 for Sale

1971 volvo p1800(US $21,750.00)

1971 volvo p1800(US $21,750.00) 1965 volvo p1800 s(US $9,200.00)

1965 volvo p1800 s(US $9,200.00)

Auto blog

Volvo shows inflatable child seat concept [w/video]

Mon, 14 Apr 2014Volvo is bringing its emphasis on safety and design to the littlest members of the family with its concept for an inflatable, rearward facing child safety seat. The design is meant to help traveling families by offering a lighter and less bulky alternative to traditional car seats.

The design is quite ingenious. The seat is covered in drop-stitched fabric, which fills with air to create the form of the seat. An electric motor in it allows inflation and deflation in less than 40 seconds, according to Volvo. It weighs less than 5 kilograms (11 pounds) and folds small enough when collapsed to fit into a bag. It even has a Bluetooth connection, so parents can begin expanding it remotely.

The inflatable seat in the brainchild of Lawrence Abele, Volvo's design manager at its Monitoring and Concept Center in Los Angeles, CA. "For many, travelling with young children is a challenge; any assistance to simplify the parents' life with young children is a great thing," he said in a statement released by Volvo. The chair remains a concept for now, and the automaker isn't saying whether it's going to put it into production, but it's a clever solution to a common problem. Scroll down for a video showing it in action and to read the release.

2017 North American Car, Truck, and Utility of the Year entries announced

Wed, Jul 6 2016Over 40 vehicles will compete for the 2017 North American Car, Truck, and Utility of the Year awards. If that name looks a little strange, it's because the competition added a third category. In years past, pickup trucks, crossovers, SUVs, commercial vans, and minivans competed for the same award. That's why there were occasionally weird comparisons, like last year's competition between the Volvo XC90 and Nissan Titan XD. The new format separates pickups and commercial vans into the truck contest and CUVs, SUVs, and minivans into the utility competition. A complete list of eligible vehicles is below, but here are a few highlights. For one, the entire list of entries has a luxurious lean. Of the 43 vehicles, nearly half of them are from premium brands. There are two eligible Bentleys – the Bentayga and Mulsanne – the Rolls-Royce Dawn, Jaguar F-Pace, Audi Q7, and the Mercedes-Benz GLS-, E-, and S-Class Maybach. The performance ranks are lofty, too, with the Audi R8, Acura NSX, Alfa Romeo Giulia, Mercedes SL- and SLC-Class, Porsche 718, and F-150 Raptor. The mainstream entries are just as comprehensive. From the Chrysler Pacifica to the Chevrolet Cruze to the Fiat 124 Spider to the Mitsubishi Mirage, NACTOY has covered an enormous price range with this year's contestants. Of course, these are only the eligible vehicles. They'll need to run through three rounds of judging, starting in September at NACTOY's traditional Hell, MI, test drive. The Canadian and American journalists involved in the judging will announce this year's nine finalists – three in each category – on December 6. Cars Acura NSX Alfa Romeo Giulia Audi A4 Audi R8 Bentley Mulsanne Buick Cascada Buick LaCrosse Cadillac CT6 Chevrolet Bolt Chevrolet Cruze Fiat 124 Genesis G90 Hyundai Elantra Infiniti Q60 Jaguar XE Kia Cadenza Lincoln Continental Mercedes-Benz E-Class sedan Mercedes-Benz S550 Maybach Mercedes-Benz SL-Class Mercedes-Benz SLC-Class Mini Clubman Mitsubishi Mirage/G4 Porsche 718 Boxster and Cayman Rolls-Royce Dawn Toyota Prius Prime Volvo S90 SUVs Audi Q7 Bentley Bentayga Buick Envision Cadillac XT5 Chrysler Pacifica GMC Acadia Infiniti QX30 Kia Sportage Mercedes-Benz GLS-Class Jaguar F-Pace Mazda CX-9 Nissan Armada Trucks Ford F-Series Super Duty pickups Ford F-150 Raptor Honda Ridgeline Nissan Titan half-ton Related Video: Featured Gallery Bentley Bentayga View 23 Photos News Source: Automotive News - sub.

Volvo demos autonomous self-parking car concept

Thu, 20 Jun 2013A number of companies are developing autonomous vehicle technology - Google and Audi come to mind - but Volvo is applying its work in the area to a particular usage case: parking. The Swedish automaker has the technology up and running in a concept vehicle, which it says can be dropped off at the curb by its owner and left to its own devices to enter and navigate a car park, then find and park in an available parking spot. Volvo says the process can even be reversed when the owner is ready to go, with the car leaving the car park on its own to meet its key-holder again at the curb.

The vehicle first interacts with Vehicle 2 Infrastructure technology, which places transmitters in the road itself to inform the car (and driver) if the self-parking service is available. The driver then hops out, activates the Self Parking function on his or her smartphone and then leaves the car to do its work. The car uses sensors, all seemingly hidden from view (an advancement of its own in this field), to autonomously navigate the car park, which includes interacting and adjusting to other cars, people and objects.

The technology used here builds off of Volvo's other work in autonomous vehicle research, namely the Safe Road Trains for the Environment (SARTRE) project in which the company managed to create a train of four cars autonomously following a lead truck at speeds up 56 miles per hour. Volvo says the first application of its autonomous research in a production vehicle will happen at the end of 2014 with some level of autonomous steering available in the next-generation XC90. See the system in action by watching the video below.