Haldex 4motion Matte Black Wrap Rare Low Miles on 2040-cars

Chicago, Illinois, United States

Vehicle Title:Clear

Engine:3.2L 3189CC V6 GAS DOHC Naturally Aspirated

For Sale By:Dealer

Body Type:Hatchback

Fuel Type:GAS

Make: Volkswagen

Warranty: Unspecified

Model: Golf

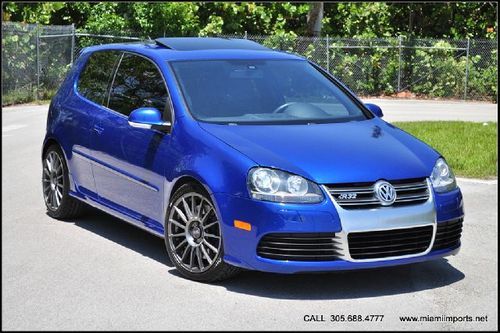

Trim: R32 Hatchback 2-Door

Options: Sunroof

Power Options: Power Locks

Drive Type: AWD

Mileage: 77,943

Number of Doors: 2

Sub Model: 2dr HB 6-spd

Exterior Color: Black

Number of Cylinders: 6

Interior Color: Black

Volkswagen R32 for Sale

2008 volkswagen r32 base hatchback 2-door 3.2l(US $19,900.00)

2008 volkswagen r32 base hatchback 2-door 3.2l(US $19,900.00) Clean carfax. navigation,leather. like new! number 1628 of 5000 made. low miles.(US $19,500.00)

Clean carfax. navigation,leather. like new! number 1628 of 5000 made. low miles.(US $19,500.00) 2008 vw r32 all wheel drive automatic(dsg) navigation private seller(US $16,250.00)

2008 vw r32 all wheel drive automatic(dsg) navigation private seller(US $16,250.00) We finance! r32 v6 awd leather roof automatic 1owner no bidding! own it now!(US $13,900.00)

We finance! r32 v6 awd leather roof automatic 1owner no bidding! own it now!(US $13,900.00) 2004 volkswagen r32 , mint !!! lowest miles(US $26,000.00)

2004 volkswagen r32 , mint !!! lowest miles(US $26,000.00) 2008 volkswagen r32 hatchback 2-door 3.2l v6 blue awd(US $16,995.00)

2008 volkswagen r32 hatchback 2-door 3.2l v6 blue awd(US $16,995.00)

Auto Services in Illinois

Universal Transmission ★★★★★

Todd`s & Mark`s Auto Repair ★★★★★

Tesla Motors ★★★★★

Team Automotive Service Inc ★★★★★

Sterling Autobody Centers ★★★★★

Security Muffler & Brake Service ★★★★★

Auto blog

Volkswagen is not cool with a Fiat Chrysler merger

Wed, Mar 8 2017Volkswagen CEO Matthias Mueller shot down Fiat Chrysler CEO Sergio Marchionne's overtures for a merger in blunt fashion this week. Mueller told Reuters at the Geneva Motor Show, "We are not ready for talks about anything ... we have other problems. I haven't seen Marchionne for months." The unusually candid – and icy – response from one chief executive to another comes after Marchionne similarly pursued General Motors (again) this week. The FCA boss suggested GM might be looking for a new European partner as it prepares to unload its troubled Opel and Vauxhall divisions to PSA. A GM spokesman told USA Today that the company is not interested. Marchionne has been openly suggesting a GM merger since at least 2015, despite GM never reciprocating interest. VW's "other problems," as Mueller notes, include legal proceedings, fines, recalls, and other issues related to its long-running diesel scandal. Marchionne has long sought industry consolidation, arguing that automakers don't get a proper return on their investments in technologies, some of which are relatively similar. He's suggested sharing chassis and powertrain components could be a benefit to the collective auto sector. Skeptics argue FCA, which is smaller than GM, VW, Toyota, and others, needs a partner to survive, while its rivals already have the necessary scale to remain competitive. Related Video:

Volkswagen's new Passat Alltrack ready to scale the Alps

Thu, Feb 19 2015Volvo may be stepping up its off-roading game with a greater variety of Cross Country models tumbling out the factory in Gothenburg, but the other (larger) European automaker whose name starts with the letters V-O-L is also broadening and updating its range of road-going automobiles equipped to handle a little soft-road duty. Aside from Audi's Allroad line, Skoda's Scout models and the new Seat Leon X-Perience, the Volkswagen brand itself has recently showcased Alltrack versions of the Golf, Multivan and of course the Passat. And now it's announced a new version of the latter for the European market. Based on the Euro-spec Passat Variant, the new VW Passat Alltrack follows a familiar formula: take a station wagon, equip it with all-wheel drive, jack up the suspension, add some lower body cladding and some new trim and – voila! – you've got a pseudo rough-roader on your hands. Set to debut in just a couple of weeks from now at the 2015 Geneva Motor Show, the new Passat Alltrack is visually distinguished by its new bumpers, underbody protection, beefed-up wheel arch moldings and a ride height increased by over an inch to the benefit of ground clearance as well as approach and departure angles. European buyers who like to leave the road every once in a while (or give the impression that they do) will be able to choose from a range of five engines: two burning gasoline with either 148 horsepower or 217, and three diesels available in 148-, 187- or 237-hp states of tune. The base TSI and TDI engines are mated to a six-speed manual, while the top three are hooked up to a six-speed DCT, but they all come with 4Motion all-wheel drive as standard. All but the base TSI model boast a towing capacity of 1,800 kg, enhanced by a Trailer Assist system that automatically lines the vehicle up to a trailer. It even comes equipped with an off-road mode that incorporates Hill Start Assist and Hill Descent Assist to make any journey across the Alps a breeze. Wolfsburg / Geneva, 19 February 2015 World premiere of the new Passat Alltrack All-wheel drive all-rounder combines the best of on-road and off-road driving - Passat Alltrack: 100 per cent 4MOTION – from 150 PS to 240 PS - Superior off-road performance with off-road mode and all-wheel drive Ten important facts about the world premiere of the Passat Alltrack: 1. Permanent 4MOTION all-wheel drive as standard. 2. Distinctive off-road look with new bumpers, underbody protection, door sill and wheel arch trims. 3.

Volkswagen posts quarterly profit despite drop in sales

Thu, Oct 29 2020Volkswagen returned to profit in the third quarter as surging Chinese demand for luxury cars helped offset a 1.1% drop in vehicle deliveries due to the pandemic, sending its shares as much as 3% higher on Thursday. The German automaker's return to the black comes amid spiking coronavirus cases in Europe that led governments in France and Germany to order their countries back into strict national lockdowns on Wednesday. "The coronavirus remains a central problem," Volkswagen Chief Financial Officer Frank Witter said in a conference call with reporters. "This situation now is anything but relaxed." But Witter said the group expected the economic recovery to continue and did "not anticipate any nationwide lockdowns in larger markets." Witter said the takeover of U.S. truck maker Navistar International by Volkswagen's trucking unit Traton was an important acquisition, but the "current economic climate will not make this easy." Volkswagen reiterated it expects to post a profit for the full year, saying its business "recovered noticeably" in the third quarter as sales in China of premium vehicles, including Audi and Porsche sports cars, rose 3%. The quarterly performance was also aided by a series of cost-cutting measures launched earlier this year. Volkswagen said its net liquidity rose to 24.8 billion euros from 18.7 billion at the end of the second quarter. Excluding one-time items, third-quarter operating profit was 3.2 billion euros ($3.8 billion), down from 4.8 billion euros a year earlier, but up from a second quarter loss of 1.7 billion. In a note to clients, Jefferies analyst Philippe Houchois described the results as a "solid performance with strong cash, but relatively muted in the context of the (auto) sector recovery." Last week, German rival Daimler reported a record 24% jump in Chinese demand for its Mercedes-Benz cars, boosting its margins in the third quarter. Italian-American Fiat Chrysler Automobiles and Peugeot manufacturer PSA Group both also posted solid results this week. Witter said Volkswagen could not say for sure whether it would meet EU CO2 emissions targets this year, adding "it will be a tough race." At 1030 GMT, Volkswagen shares were up 2.9% at 129.20 euros. Related Video: Earnings/Financials Audi Bentley Bugatti Lamborghini Porsche Volkswagen