2013 Volkswagen Jetta 2.5l Sel on 2040-cars

Tomball, Texas, United States

Engine:Other

Fuel Type:Gasoline

Body Type:--

Transmission:Automatic

For Sale By:Dealer

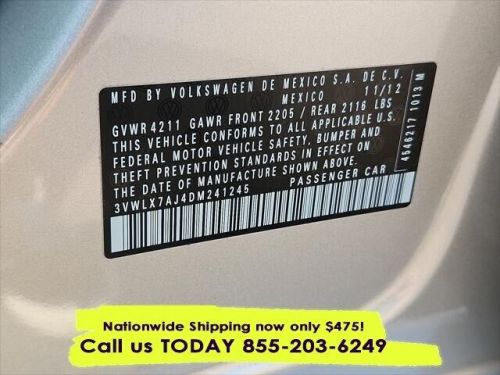

VIN (Vehicle Identification Number): 3VWLX7AJ4DM241245

Mileage: 35151

Make: Volkswagen

Trim: 2.5L SEL

Drive Type: FWD

Features: --

Power Options: --

Exterior Color: Other

Interior Color: Other

Warranty: Unspecified

Model: Jetta

Volkswagen Jetta for Sale

2005 volkswagen jetta(US $6,000.00)

2005 volkswagen jetta(US $6,000.00) 2004 volkswagen jetta gli(US $5,200.00)

2004 volkswagen jetta gli(US $5,200.00) 2016 volkswagen jetta sel 1.8t one owner a/t(US $13,566.00)

2016 volkswagen jetta sel 1.8t one owner a/t(US $13,566.00) 2021 volkswagen jetta 2.0t autobahn(US $23,700.00)

2021 volkswagen jetta 2.0t autobahn(US $23,700.00) 2024 volkswagen jetta 40th anniversary edition(US $28,500.00)

2024 volkswagen jetta 40th anniversary edition(US $28,500.00) 2021 volkswagen jetta r-line(US $21,990.00)

2021 volkswagen jetta r-line(US $21,990.00)

Auto Services in Texas

Wolfe Automotive ★★★★★

Williams Transmissions ★★★★★

White And Company ★★★★★

West End Transmissions ★★★★★

Wallisville Auto Repair ★★★★★

VW Of Temple ★★★★★

Auto blog

Porsche-Piech buy 10% stake in VW's holding company

Tue, 18 Jun 2013In August, 2009, as the scuttled merger of Porsche and Volkswagen had gone bad and Porsche was backed up against the ropes, Porsche Automobil Holding SE (PAHSE) relinquished a ten-percent stake in itself to Qatar Holdings as well as options it held on 17 percent of VW shares. The sale meant that, for the first time since the founding of the company 61 years before, an entity outside the Porsche and Piech families had a say in the running of PAHSE.

Buying that ten-percent stake back returns full ownership to the two families, the holding company's sole possession being ownership of 50.7 percent of VW's common shares. The price paid wasn't disclosed, but at market rates the purchase would be worth close to $1.25 billion. Qatar intends to hold onto the 17-percent stake it has in Volkswagen.

Porsche CEO Oliver Blume will be installed as head of the VW brand

Wed, Jun 3 2020Volkswagen Chief Executive Herbert Diess is planning to promote Porsche CEO Oliver Blume to take over as the head of the VW brand, according to a report from Auto Motor und Sport. Citing company sources, the German site said Bernhard Maier, who currently sits at the head of VW's Skoda brand, will lead Porsche in Blume's place. A shuffle at VW isn't surprising. The last thing Volkswagen needs as it transitions away from its long-running "clean diesel" TDI fiasco and into a clean electric ID future is negative press surrounding its burgeoning electrified lineup. Unfortunately, the ID.3 launch has been marred by software issues, with Manager magazine citing company engineers saying "the basic architecture was developed too hastily." Because of that underlying issue, various modules "often do not understand each other" and suffer dropouts. The brand-new eighth-generation Golf launch was also troubled and pushed back due to software problems. And more recently, Volkswagen was forced to pull an advertisement after admitting it was racist and insulting. That marketing misstep, according to the report, will lead to the firing of Chief Marketing Officer Jochen Sengpiehl. Related Video:

Volkswagen taps Porsche chief for board

Mon, Feb 23 2015Matthias Mueller was promoted to the top position at Porsche in 2010 after a successful stint of developing model lines during his 36 years with the company, mainly at Audi. Having shown the same prowess while overseeing Porsche for the past five years, German outlet Frankfurter Allgemeine Zeitung reports that Mueller will be promoted to the management board of the Volkswagen Group, according to a leaked copy of an agenda for the meeting. It's said that a new spot is being created for him, one that will put him in charge of "overseeing cooperation" among Audi, Bentley, Bugatti, Lamborghini, and Porsche. While other group executives are known to hold positions on the board and with brands, or across brands, it isn't clear yet whether Mueller will keep his spot at the CEO of Porsche after the promotion. One thing that is certain is the 61-year-old Mueller doesn't see himself in line for Volkswagen Group CEO Martin Winterkorn's job in 2016, having told FAZ this month, "It's no solution to put a 63-year-old at the head of Volkswagen." News Source: Reuters, Automotive News - sub. req.Image Credit: Geoff Robins/AFP/Getty Images Hirings/Firings/Layoffs Porsche Volkswagen Performance volkswagen group matthias mueller promotion