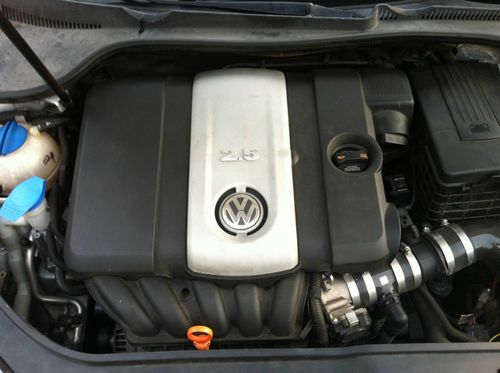

2008 Volkswagen Jetta S Sedan 4-door 2.5l on 2040-cars

Enterprise, Alabama, United States

Body Type:Sedan

Engine:2.5L 2480CC 151Cu. In. l5 GAS DOHC Naturally Aspirated

Vehicle Title:Clear

Fuel Type:GAS

For Sale By:Private Seller

Number of Cylinders: 5

Make: Volkswagen

Model: Jetta

Trim: S Sedan 4-Door

Warranty: Vehicle does NOT have an existing warranty

Drive Type: FWD

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Mileage: 76,835

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows

Sub Model: S

Exterior Color: Silver

Interior Color: Black

Number of Doors: 4

Volkswagen Jetta for Sale

2006 volkswagen jetta gli,2.0 turbo,6 speed,runs great,look $99.00 no reserve

2006 volkswagen jetta gli,2.0 turbo,6 speed,runs great,look $99.00 no reserve 2012 vw jetta tdi diesel 2.0l 6spd manual wagon 45mpg panoramic new nav loaded @

2012 vw jetta tdi diesel 2.0l 6spd manual wagon 45mpg panoramic new nav loaded @ 2011 volkswagen jetta 2.5 se automatic cruise ctrl 38k texas direct auto(US $15,480.00)

2011 volkswagen jetta 2.5 se automatic cruise ctrl 38k texas direct auto(US $15,480.00) Used volkswagen jetta tdi turbo diesel 4dr sedan 6 speed manual we finance autos

Used volkswagen jetta tdi turbo diesel 4dr sedan 6 speed manual we finance autos 2006 volkswagen jetta! 2.5l 5cyl! new vw gti wheels! new tires! tint! 1 owner!

2006 volkswagen jetta! 2.5l 5cyl! new vw gti wheels! new tires! tint! 1 owner! 2.5l cd traction control stability control front wheel drive wheel covers abs

2.5l cd traction control stability control front wheel drive wheel covers abs

Auto Services in Alabama

Trax Tires Inc ★★★★★

Tod`s Auto Repair & Tire ★★★★★

Street Scene Automotive ★★★★★

Roy`s Discount Tire Center ★★★★★

Ronnie Watkins Ford ★★★★★

Pensacola Used Cars ★★★★★

Auto blog

CEO says Volkswagen's buying spree is over

Mon, 03 Sep 2012

After adding Italian motorcycle icon Ducati to its stable and spending $5.6 billion on the rest of Porsche, Volkswagen CEO Martin Winterkorn says he's done shopping for a while.

"We have enough to do at the moment in taking our twelve brands to where we want to be," Winterkorn tells German newspaper Handelsblatt.

2018 Buick Regal TourX vs. wagon competitors: How it compares on paper

Wed, Jan 31 2018To the great joy of auto enthusiasts nationwide, wagons are back! Well, at least there's a few more of them. The latest is the 2018 Buick Regal TourX, which we just had our first drive of and found to actually be quite good with pleasant handling, solid power and plenty of space. But, how does the TourX compare to other cladded wagons? Well, let's dive into the specs and fire up the ol' spreadsheet maker for Buick Regal TourX vs Subaru Outback vs Audi A4 Allroad vs VW Alltrack vs Volvo V60 Cross Country. True, some are from mainstream brands and others are from luxury marques, but Buick straddles both realms, so it's appropriate to look at them all. Of course, there's more to these cars than just the numbers, but they're still important, and in the case of this class of crossover-aping wagons, can vary more than you'd expect. So check out the specs in the chart below, which are followed by more analysis and photos of each. Discover and compare other wagons and crossovers with our Car Finder and Compare tools. Engines and Transmissions When comparing powertrains, the Buick is far-and-away the winner as far as torque is concerned, and is in a nearly three-way tie for horsepower. Its 295 pound-feet of torque is 22 lb-ft more twist than the next-most-grunty Audi A4 Allroad. And in regards to power, the Buick's 250-horsepower engine is only down 6 hp to the most-powerful Subaru and its optional naturally aspirated flat-six, and just 2 hp less than the Audi. At the bottom of the pack is the Subaru Outback with the standard naturally aspirated flat-four, which only makes 174 hp and 174 lb-ft of torque. That may not seem too bad compared with the VW Golf Alltrack, which only makes 170 hp and 199 lb-ft of torque, but the VW is much lighter by between 200 and 300 pounds. Transmission-wise, there's quite a bit of variation in the group. The Regal TourX and the Volvo V60 Cross Country rely on eight-speed automatics, all Outbacks use CVTs, and the Alltrack and Allroad have dual-clutch automated manual transmissions with six and seven gears, respectively. But for people that want to shift for themselves, the only option is the Volkswagen, which offers a traditional six-speed manual transmission on the Golf Alltrack. Cargo and Interior Space One of the main reasons to buy a wagon is for the body style's large cargo capacity. And for the most space for things and stuff, you'll want to check out the Subaru and the Buick.

VW Beetle R is one mean bug

Wed, 02 Oct 2013Volkswagen's R lineup currently consists of the Golf R in North America, and the too-cool-for-school Scirocco R in Europe. It hasn't exactly been a secret as to which VW would next get the R treatment; the German manufacturer reportedly confirmed that a hotter Beetle would be coming to the US. That announcement, in August 2011, was followed up by a production-ready Beetle R Concept at the 2011 Frankfurt Motor Show.

After some wait, we're finally seeing spy shots of the Beetle R in Germany. The mule shown in the images here is wearing the R-Line bodykit, which adds sportier front and rear fascias, side skirts, dual exhausts and a not-so-subtle spoiler. Topped off with Volkswagen's traditional, five-spoke R wheels, we'd be just fine with the Beetle R coming to market as is.

Our spy photographer, though, seems to think that the production R will get even sportier sheetmetal, which we take to mean the more assertive look shown on the Frankfurt show car. Larger intakes on the front fascia, a bigger rear spoiler and vertical vents on the rear bumper could all be upcoming. Whether a production model will include the concept's polished wheels (R cars haven't traditionally embraced that look), vented hood and the quad-tipped exhausts remains to be seen.