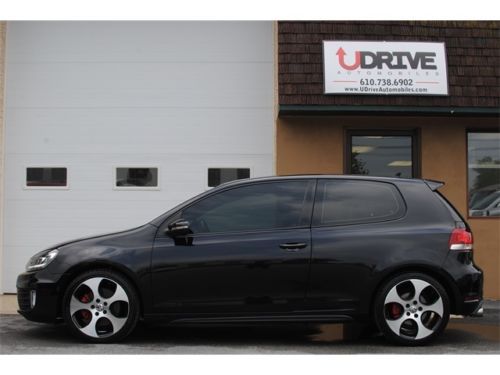

2004 Volkswagen Golf R32 Hatchback 2-door 3.2l Vr5 Mk4 on 2040-cars

Plainville, Connecticut, United States

|

***CLEAN CARFAX***, 25 SERVICE RECORDS SHOW REGULAR DEALERSHIP SERVICE. Koni Adjustable Coilovers, EBC Greenstuff Front Pads. APR Reflash. ***NEW TIRES*** Aftermarket Ipod/AUX inputs. VIPER ALARM w/ Additional Security Modification. |

Volkswagen Golf for Sale

2009 volkswagen gti stunning white automatic 50k miles(US $14,995.00)

2009 volkswagen gti stunning white automatic 50k miles(US $14,995.00) 2002 volkswagen golf gls 4-door 1.9l tdi diesel mk4 5sp, manual, sunroof, 43 mpg(US $6,900.00)

2002 volkswagen golf gls 4-door 1.9l tdi diesel mk4 5sp, manual, sunroof, 43 mpg(US $6,900.00) 2012 vw golf tdi lowered with two sets of wheels and tires(US $19,800.00)

2012 vw golf tdi lowered with two sets of wheels and tires(US $19,800.00) Mk4 vw golf gti vr6 turbo(US $6,500.00)

Mk4 vw golf gti vr6 turbo(US $6,500.00) Tdi - turbo diesel - 5-speed manual stick - no reserve - mechanic special

Tdi - turbo diesel - 5-speed manual stick - no reserve - mechanic special 1 owner 6 speed gti sunroof heated seats apr exhaust intake upgrades we finance(US $19,900.00)

1 owner 6 speed gti sunroof heated seats apr exhaust intake upgrades we finance(US $19,900.00)

Auto Services in Connecticut

Vertucci Automotive Inc. ★★★★★

Stop & Go Transmissions & Auto Center ★★★★★

Starlander Beck Inc ★★★★★

RJ`s Auto Sales & Service ★★★★★

Rad Auto Machine ★★★★★

Mike`s Auto Repair ★★★★★

Auto blog

2015 VW e-Golf gets cheaper Limited Editon, starts at $33,450*

Thu, Mar 5 2015Typically when an automaker announces a new limited edition of one of its models, it comes at a premium. Maybe the extra cost turns out to be worth it due to bundled options, but there's almost always a cost. But not with the new Volkswagen e-Golf Limited Edition. For this model, VW has gone the opposite direction by cutting equipment out of the electric hatchback and charging less for it. Compared to the SEL Premium model, the Limited Edition of the e-Golf drops the alloys in favor of 16-inch steel wheels, halogen headlights in place of LEDs, cloth upholstery instead of leatherette, and drops the heat-pump system. As a result, the e-Golf costs $2,000 less, priced at $33,450 (*before delivery) and available to lease for $229 per month. For that, you still get the electric motor with 199 pound-feet of torque, 24.2 kWh lithium-ion battery and 7.2 kW onboard charger and class-leading energy consumption. VOLKSWAGEN ANNOUNCES A NEW TRIM LINE FOR THE FULLY-ELECTRIC 2015 e-GOLF - e-Golf Limited Edition model goes on sale with a starting price of $33,450 - Drivetrain consists of 24.2 kWh lithium-ion battery and an electric motor with 199 pound-feet of torque; 7.2 kW onboard charger is standard - Standard fast charging capability allows up to 80 percent battery charge in 30 minutes - EPA estimated fuel economy rating of 116 combined MPGe puts e-Golf at top of the 2015 EPA Compact Size Class - A great value, with a host of features that include KESSY® Keyless access with push-button start, navigation system, LED Daytime Running Lights (DRL) with C-shaped light signature, and more Herndon, VA – Volkswagen of America, Inc., today, announced that a lower-priced version of the fully-electric 2015 Volkswagen e-Golf will go on sale at participating dealerships. The 2015 e-Golf Limited Edition is priced nearly $2,000 less than its SEL counterpart at $33,450, without compromising performance, quality, or versatility. The e-Golf Limited Edition is also available at a monthly lease price of $229, plus applicable fees. The e-Golf Limited Edition is built on the same sporty Modular Transverse Matrix (MQB) platform as the rest of the award-winning Golf family. It is powered by a compact electric motor and a 24.2 kWh lithium-ion battery (built in-house at the Volkswagen facility in Braunschweig, Germany), and offers 115 horsepower and class-leading torque of 199 pound feet.

The best cars we drove this year

Tue, Dec 30 2014Six hundred and fifty. That's roughly how many cars pass through the hands of Autoblog editors every year, from the vehicles we test here at home, to the cars we drive on new product launches, testing roundups, long-term cars, and so on. Of course, our individual numbers vary due to several reasons, but at the end of the day, our team's repertoire of automotive experience is indeed vast. But let's be honest, some cars certainly stand out more than others. So as the year's about to turn, and as we're readying brand-new daily cat calendars for our cubicles, our editors are all taking time to reflect on the machinery that made this year so special, with one simple, open-ended question as the guide – a question that we're asked quite frequently, from friends, family, colleagues, and more. "What's the best car you drove this year?" Lamborghini Huracan When I review the list of everything I drove in 2014, picking an absolute favorite becomes almost impossible. I mean, how does one delineate between the joy offered by cars as different as the Alfa Romeo 4C, Volkswagen Golf R, Mercedes-AMG GT S and even the humble-yet-wonderful Chevy Colorado? Okay fine, I'll just pick the Lamborghini. I drove the Lamborghini Huracan LP 610-4 on a racetrack, in the mountains, and along southern coast of Spain. It felt like the king of the car jungle in all of those places, sucking the eyeballs of observers nearly out of their heads as it drove by, and almost melting my brain with its cocktail of speed and grip and intense communication. It feels a little easy to say that the one new supercar I drove this year was also my favorite, but the fact is that the Huracan is one of the finest cars I've driven during my career, let alone 2014. Judge me if you must. – Seyth Miersma Senior Editor Rolls-Royce Wraith There are a couple of ways to look at the question, "What's the best car you drove this year?" In terms of what was so good I'd go out and buy one tomorrow, that'd be my all-time sweetheart, the Volkswagen GTI. Or if I'm just talking about sheer cool-factor, maybe something like the Galpin GTR1, BMW i8, or Mercedes-Benz G63 AMG. But instead, I'm going to write about the sheer opulence of being the best of the best. The hand-crafted, holier-than-thou, shut-your-mouth-when-I'm-talking-to-you supremacy. I'm picking the Rolls-Royce Wraith. I drove the Wraith for a week in April, and was really, really impressed. This car does everything, perfectly.

Submit your questions for Autoblog Podcast #366 LIVE!

Mon, 27 Jan 2014We're set to record Autoblog Podcast #366 tonight, and you can check out the topics below, drop us your questions and comments via our Q&A module, and don't forget to subscribe to the Autoblog Podcast in iTunes if you haven't already done so. To take it all in live, tune in to our UStream (audio only) channel at 10:00 PM Eastern tonight.

Discussion Topics for Autoblog Podcast Episode #366

2015 Lincoln Navigator