2003 Volkswagen Golf Vr6 on 2040-cars

Milton, Wisconsin, United States

Fuel Type:Gasoline

For Sale By:Private Seller

Vehicle Title:Clean

Engine:2.8L Gas V6

VIN (Vehicle Identification Number): 9BWDH61J834069445

Mileage: 85945

Trim: VR6

Number of Cylinders: 6

Make: Volkswagen

Drive Type: FWD

Model: Golf

Exterior Color: Black

Volkswagen Golf for Sale

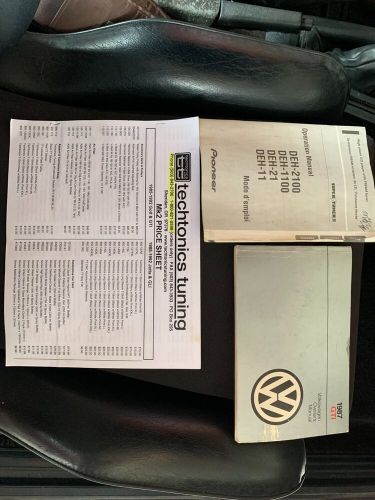

1987 volkswagen golf(US $6,100.00)

1987 volkswagen golf(US $6,100.00) 2017 volkswagen golf s hatchback sedan 4d(US $16,994.00)

2017 volkswagen golf s hatchback sedan 4d(US $16,994.00) 2022 volkswagen golf gti 2.0t autobahn manual(US $30,950.00)

2022 volkswagen golf gti 2.0t autobahn manual(US $30,950.00) 2003 volkswagen golf vr6(US $1,500.00)

2003 volkswagen golf vr6(US $1,500.00) 2000 volkswagen golf glx(US $3,800.00)

2000 volkswagen golf glx(US $3,800.00) 2024 volkswagen golf se(US $25,387.50)

2024 volkswagen golf se(US $25,387.50)

Auto Services in Wisconsin

Witt Ford Lincoln ★★★★★

Waukehas Best Used Cars ★★★★★

Truck & Auto Elegance ★★★★★

The Muffler Shop ★★★★★

Swant Graber Motors ★★★★★

Stolze`s Wausau Auto Repair ★★★★★

Auto blog

Volkswagen says goodbye to Eos, Routan in 2015 updates

Wed, 23 Jul 2014Usually automakers announce changes to their lineup individually on a vehicle-by-vehicle basis, but sometimes it all comes at once - especially when the changes are ones we either expected or might not otherwise notice. That's the path Volkswagen has gone with changes to its US lineup for 2015.

The biggest change is what we already knew: that the new Golf arrives for the 2015 model year, bringing with it the new GTI, Golf R, e-Golf and Golf SportWagen (to replace the previous Jetta wagon). But there are some new details as well.

For starters, Volkswagen has finally confirmed that both the Eos and the Routan - both long rumored to be on their way out - will be exiting this year. The Eos hardtop convertible, pictured above, will linger for one last year, its Sport trim replaced by a new Final Edition with 18-inch wheels, two-tone leather interior and enhanced equipment.

KBB: VW diesel prices have dropped 16%

Fri, Oct 23 2015There are a lot of post-scandal theories and metrics concerning Volkswagen's performance during the diesel emissions scandal, although none of them has created a clear picture of where things are headed. Kelley Blue Book has a few more to add to the spreadsheet, though, finding that average auction prices for VW diesels and Internet shoppers perusing them have both gone down in the past four weeks on KBB.com. Auction prices on the site are down an average of 16 percent for VW oil burners, which compares to a decline of 2.9 percent for gas-powered VWs. Shoppers are still on the lookout, though, even if the numbers are slightly reduced. Overall, "new-car shopping activity" for the small-capacity VW diesel offerings is down 2.4 percent, a number held partly in check by searches for the Jetta SportWagen being up by 3.7 percent. Shoppers are looking harder at the Audi A3 diesel, too, its activity up 1.6 percent. The Golf, though, is down 3.7 percent and the Golf SportWagen down 6.2 percent. Shoppers leaving the diesel fold aren't necessarily going for high-mileage options, either, KBB saying that the Ford Fusion and Honda Civic are quick alternatives to the Jetta TDI, while the Mercedes CLA and BMW 2 Series are getting new looks from those interested in the Audi A3 diesel. You can read the full release from KBB below. VOLKSWAGEN DIESEL VEHICLE PRICES DECLINE NEARLY 16 PERCENT, ACCORDING TO KELLEY BLUE BOOK DATA New-Car Shopping Activity Also Impacted by Recent Emissions Issue IRVINE, Calif., October 21, 2015 – Kelley Blue Book www.kbb.com, the only vehicle valuation and information source trusted and relied upon by both consumers and the automotive industry, today reports that average auction prices, along with new-car shopping activity on KBB.com, for Volkswagen diesel vehicles have declined four weeks after the diesel emissions issue was announced. The average auction price for Volkswagen diesel models dropped by nearly 16 percent since the news broke of the emissions crisis.[1] The average auction price for the brand's gasoline-powered vehicles declined by 2.9 percent.1 On KBB.com, Volkswagen new-car shopping activity for affected TDI models has decreased on average by 2.4 percent. "According to Kelley Blue Book Field Analysts, some auctions are still holding off on selling the affected Volkswagen inventory," said Tim Fleming, analyst for Kelley Blue Book.

Volkswagen Golf, Ford F-150 named 2015 North American Car and Truck/Utility of the Year

Mon, Jan 12 2015Congratulations, Volkswagen Golf/GTI and Ford F-150. You've just been named the 2015 North American Car and Truck/Utility of the Year, kicking off the first press day of the Detroit Auto Show. The Golf faced some seriously stiff competition from its runners-up, the Ford Mustang and Hyundai Genesis. But the Golf has been a highly awarded vehicle since its launch, including recently being named Motor Trend's Car of the Year. As for the Truck/Utility award, it wasn't immediately clear that the aluminum-bodied Ford F-150 would win the North American honor, topping the Chevrolet Colorado and Lincoln MKC. The Chevy, after all, has been widely praised since arriving this fall, including taking home MT's Truck of the Year award. In 2014, Chevrolet had a sweep of the NACTOY awards, with the Corvette Stingray and Silverado taking top honors. Here's a look at the 2015 North American Car and Truck/Utility of the Year voting breakdown. As you can see, it wasn't exactly neck and neck. Car of the Year Volkswagen Golf/GTI – 256 points Ford Mustang – 204 points Hyundai Genesis – 110 points Truck/Utility of the Year Ford F-150 – 297 points Chevrolet Colorado – 205 points Lincoln MKC – 68 points The winners were determined by the votes of 57 North American jurors who work in all forms of media – magazine, newspaper, television, online and radio, and their ballots were tabulated in secret by accounting firm Deloitte & Touche. Autoblog editors Sharon Carty and Chris Paukert are members of the North American Car and Truck/Utility of the Year jury. Featured Gallery 2015 Volkswagen Golf TSI View 16 Photos Related Gallery 2015 Ford F-150 View 36 Photos Detroit Auto Show Ford Volkswagen Truck Hatchback 2015 Detroit Auto Show NACTOY