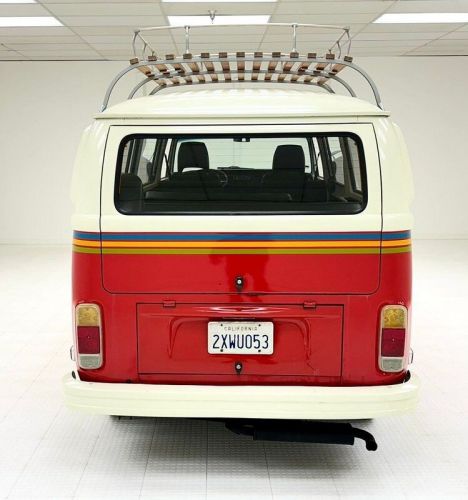

1976 Volkswagen Bus/vanagon Kombi Bus on 2040-cars

Engine:2.0L 4cyl

Fuel Type:Gasoline

Body Type:Van

Transmission:Manual

For Sale By:Dealer

VIN (Vehicle Identification Number): 2262076535

Mileage: 9383

Make: Volkswagen

Trim: Kombi Bus

Features: --

Power Options: --

Exterior Color: Red

Interior Color: Black

Warranty: Unspecified

Model: Bus/Vanagon

Volkswagen Bus/Vanagon for Sale

1985 volkswagen bus/vanagon westfalia camper with ac!(US $24,900.00)

1985 volkswagen bus/vanagon westfalia camper with ac!(US $24,900.00) 2011 volkswagen bus/vanagon(US $12,500.00)

2011 volkswagen bus/vanagon(US $12,500.00) 1993 volkswagen bus/vanagon(US $2,800.00)

1993 volkswagen bus/vanagon(US $2,800.00) 1972 volkswagen bus/vanagon bay window bus rare sliding sunroof!(US $27,900.00)

1972 volkswagen bus/vanagon bay window bus rare sliding sunroof!(US $27,900.00) 1982 volkswagen bus/vanagon westfalia camper restored!(US $24,900.00)

1982 volkswagen bus/vanagon westfalia camper restored!(US $24,900.00) 1968 volkswagen bus/vanagon(US $1,000.00)

1968 volkswagen bus/vanagon(US $1,000.00)

Auto blog

Weekly Recap: Mercedes, Volkswagen spend big as import automakers invest in North America

Sat, Mar 14 2015Import automakers are on a building frenzy in North America as resurgent car sales have prompted companies to expand their manufacturing footprints to meet rising demand. That was evidenced this week when Mercedes-Benz announced plans to build a $500-million factory to produce the Sprinter commercial van, and Volkswagen confirmed a whopping $1-billion investment to expand its massive plant in Mexico. Meanwhile Jaguar Land Rover reportedly wants to build a factory in North America, but not for at least three years, and Hyundai is said to be expanding in the southern United States. The common thread in all of this expansion? Trucks, time and money. Mercedes wants to capitalize on the burgeoning work van segment in the United States and will break ground in 2016 on a 200-acre site in Charleston, SC, to build the next-generation Sprinter. The site will have a paint shop, body shop and an assembly line, and 1,300 people will be employed when production ramps up. Why do this, when Mercedes has immense van operations in Germany? It's cheaper to build in the US for the US market. Building locally allows Mercedes to avoid import taxes, forego a complex shipping process that involves partially disassembling German-built Sprinters and naturally, reduces the time it takes to deliver finished trucks to their buyers. "This plant is key to our future growth in the very dynamic North American van market," Volker Mornhinweg, head of Mercedes-Benz Vans, said in a statement. He was speaking about Mercedes and vans, but another German automotive giant, Volkswagen, had similar motives for its mammoth expansion plans in Puebla, Mexico. The added space and production capacity will allow VW to build a three-row version of the Tiguan, and provide another crossover for its US lineup that's light on SUVs. The current Tiguan has two rows. The factory will be able to churn out 500 units daily of the larger variant, and they will be sold in North and South America. It will arrive in the US in mid-2017, a spokesman told Autoblog. VW also plans to build another crossover, a midsize seven-passenger vehicle, at its growing Chattanooga, TN, site. "Localization has become key to safeguarding our competitive position on the global market, and manufacturing the Tiguan in Mexico will bring production closer to the US market," Michael Horn, CEO of Volkswagen Group of America, said in a statement.

New investor allows Suzuki to fend off VW

Tue, Aug 4 2015After years of legal wrangling, the long-soured partnership between Volkswagen and Suzuki looks finally to be coming out of arbitration, according to Bloomberg. As a sign of the Japanese brand's improved fortunes, hedge fund Third Point LLC recently bought an undisclosed stake in the company. The investor reported seeing a major opportunity in the successful Maruti Suzuki business in India. As an investment, the only major problem that Third Point found with Suzuki was its legal battle with VW. "The company's greatest asset is its low-cost manufacturing process for vehicles for the emerging market consumer," the fund said in a letter, according to Bloomberg. Third Point reportedly also wants a seat on Suzuki's board, despite being a minority shareholder. The alliance between Suzuki and VW goes back to late 2009. In the deal, the Japanese brand was meant to get access to cutting-edge tech, and the German firm got a helping hand towards better establishing itself in India and Southeast Asia. Things didn't go as planned, though. Less than two years later, Suzuki's boss publicly derided the deal. Eventually, the allegations started going back and forth, and the two have been working out a way to untangle practically ever since. Among the biggest issue has been how to get back the 19.9 percent stake that VW purchased. According to Bloomberg, the arbitration is now technically over. With the divorce nearly final, the two sides are just waiting on a decision on how to split things up. Suzuki may even just buy VW's stake to get the shares back.

Automakers not currently promoting EVs are probably doomed

Mon, Feb 22 2016Okay, let's be honest. The sky isn't falling – gas prices are. In fact, some experts say that prices at the pump will remain depressed for the next decade. Consumers have flocked to SUVs and CUVs, reversing the upward trend in US fuel economy seen over the last several years. A sudden push into electric vehicles seems ridiculous when gas guzzlers are selling so well. Make hay while the sun shines, right? A quick glance at some facts and figures provides evidence that the automakers currently doubling down on internal combustion probably have some rocky years ahead of them. Fiat Chrysler Automobiles is a prime example of a volume manufacturer devoted to incremental gains for existing powertrains. Though FCA will kill off some of its more fuel-efficient models, part of its business plan involves replacing four- and five-speed transmissions with eight- and nine-speed units, yielding a fuel efficiency boost in the vicinity of ten percent over the next few years. Recent developments by battery startups have led some to suggest that efficiency and capacity could increase by over 100 percent in the same time. Research and development budgets paint a grim picture for old guard companies like Fiat Chrysler: In 2014, FCA spent about $1,026 per car sold on R&D, compared with about $24,783 per car sold for Tesla. To be fair, FCA can't be expected to match Tesla's efforts when its entry-level cars list for little more than half that much. But even more so than R&D, the area in which newcomers like Tesla have the industry licked is infrastructure. We often forget that our vehicles are mostly useless metal boxes without access to the network of fueling stations that keep them rolling. While EVs can always be plugged in at home, their proliferation depends on a similar network of charging stations that can allow for prolonged travel. Tesla already has 597 of its 480-volt Superchargers installed worldwide, and that figure will continue to rise. Porsche has also proposed a new 800-volt "Turbo Charging Station" to support the production version of its Mission E concept, and perhaps other VW Auto Group vehicles. As EVs grow in popularity, investment in these proprietary networks will pay off — who would buy a Chevy if the gas stations served only Ford owners? If anyone missed the importance of infrastructure, it's Toyota.