1974 Volkswagen Beetle - Classic on 2040-cars

Frederick, Colorado, United States

Transmission:Manual

Fuel Type:Gasoline

For Sale By:Private Seller

Vehicle Title:Clean

VIN (Vehicle Identification Number): 4TAWN74N5WZ033909

Mileage: 999999

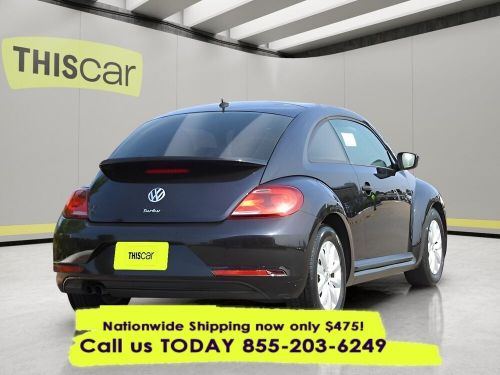

Model: Beetle - Classic

Make: Volkswagen

Interior Color: Black

Previously Registered Overseas: No

Number of Previous Owners: 2

Exterior Color: Burgundy

Car Type: Collector Cars

Number of Doors: 2

Volkswagen Beetle - Classic for Sale

1967 volkswagen beetle - classic(US $22,000.00)

1967 volkswagen beetle - classic(US $22,000.00) 1979 volkswagen beetle - classic(US $20,000.00)

1979 volkswagen beetle - classic(US $20,000.00) 1956 volkswagen beetle - classic(US $10,000.00)

1956 volkswagen beetle - classic(US $10,000.00) 2010 volkswagen beetle - classic 2.5l(US $3,999.00)

2010 volkswagen beetle - classic 2.5l(US $3,999.00) 2017 volkswagen beetle - classic 1.8t s(US $15,893.00)

2017 volkswagen beetle - classic 1.8t s(US $15,893.00) 2013 volkswagen beetle - classic turbo(US $15,800.00)

2013 volkswagen beetle - classic turbo(US $15,800.00)

Auto Services in Colorado

Yoda Man Jim ★★★★★

Tsgauto.Com ★★★★★

Tsg Auto ★★★★★

Tilden Car Care ★★★★★

South Denver Automotive ★★★★★

Royal Automotive ★★★★★

Auto blog

Volkswagen's De Silva says next Scirocco will be 'completely different'

Tue, 02 Apr 2013From our perspective, the reborn Volkswagen Scirocco is a handsome (if squat) little thing. Yet design-wise, it's always struck us as uncomfortably close to the Golf three-door hatchback with which it shares its basic underpinnings. That aesthetic kinship may be part of the reason why Volkswagen has steadfastly refused to import the Scirocco to North America, seeing as how the Golf doesn't regularly set the company's sales charts alight, and it's less expensive.

But that visual similarity might be about to change, says Walter De Silva, who recently told Australia's Car Advice that, "It must be completely different... we don't want to repeat the bodystyle of the Scirocco, we want to change that." Further, the Volkswagen Group's design boss says that the next-generation car isn't terribly far along in development yet - "at the moment, it's only a studio [project]... it's not defined." It's probably just as well, as the new seventh-generation Golf arguably borrows some of its design from the current Scirocco anyway.

So we should expect a much bolder, more differentiated design, right? Well, yes, no and maybe. Back in September, De Silva himself was quoted as saying that the era of flamboyant styling has passed, and that future VW designs will be simpler to better reflect the times and preserve resale value. So... how different could it be?

Recharge Wrap-up: Jaguar Land Rover talks EVs, Batteries should be modular

Wed, Sep 3 2014A new study out of Germany suggests adopting a modular approach to battery offerings in plug-in hybrid and extended range electric vehicles. Automakers could offer the same car with different battery sizes (and different costs, accordingly) to drivers depending on their driving ranges. This would optimize the total cost of ownership for various drivers better than the current approach. Developing a modular battery design and offering appropriate batteries for different customers "is the key for electric powertrains to meet customer expectations and become cost competitive against conventional technologies," according to the report from the Institute of Vehicle Concepts, German Aerospace Center. Learn more at Green Car Congress. Jaguar and Land Rover are looking to offer more electric driving from their vehicles. Wolfgang Ziebart, head of product development for Jaguar Land Rover, said in an interview that its hybrid system is being tweaked for more electric power and "downsized" combustion. He also said the likely target market for EVs would be second and third vehicles, rather than primary vehicles for urban driving. Within that market, Europeans look for something smaller, while American drivers lean toward larger luxury vehicles for their second car. Ziebart uses the Tesla Model S as an example of American tastes, and compares its size to that of the Jaguar XJ. Read more at Automotive News Europe. Thailand will likely approve a Volkswagen factory as early as next week. A German newspaper suggests that Thailand's Board of Investment is set to greenlight the plant, which is planned for a site near the Port of Bangkok. Thailand is a relatively large and growing auto manufacturing country, which seeks to be a major producer of eco-friendly vehicles. The country's "Eco2" program would provide incentives to Volkswagen if it builds clean cars and meets certain production targets. Read more at Reuters. Formula E has chosen Sky Deutschland for broadcasting rights in the German market. The deal includes television rights, as well as online broadcasting. Sky Deutschland has 3.8 million subscribers in Germany and Austria. Showing the races on Germany's largest pay television provider should help generate interest for the series, particularly the Berlin ePrix - the inaugural season's penultimate race - scheduled for May 30, 2015. Read more at the Formula E website.

1000-hp Mk1 VW Golf is terrifyingly cool

Tue, 04 Jun 2013There are plenty of things to love about the Mk1 Volkswgen Golf. The machine's horsepower isn't one of them. From the factory, the little hatch cranked a breathy 112 horsepower from the most robust form of its 1.8-liter four-cylinder engine. Boba motoring, however, has taken that figure and multiplied it by a factor of nearly 10. If 1,000 horsepower sounds terrifying in a machine with a wheelbase of just 94.5 inches, it should. A massive Garrett GTX4202R turbo force-feeds the little mill through a tweaked 16-valve KR head. The crew calls the beast the 16Vampir, and we think that's fitting.

Of course, we'd wager you quit reading right about the time you set your eyes on that headline. Those of you who've stuck around this long can point yourselves below to see the maniacal creation in action. You won't be disappointed.