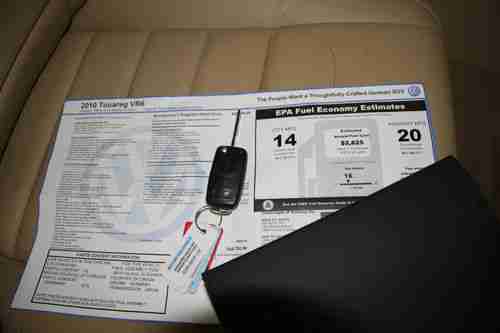

2010 Volkswagen Touareg Vr6 Sport Utility 4-door 3.6l With < 27000 Miles on 2040-cars

Glenwood Springs, Colorado, United States

Body Type:Sport Utility

Engine:3.6L 3597CC 219Cu. In. V6 GAS DOHC Naturally Aspirated

Fuel Type:GAS

For Sale By:Private Seller

Vehicle Title:Clear

Make: Volkswagen

Model: Touareg

Warranty: Unspecified

Trim: VR6 Sport Utility 4-Door

Options: Sirius radio, heated seats, dual climate control, Sunroof, 4-Wheel Drive, Leather Seats, CD Player

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Drive Type: AWD

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Mileage: 26,546

Exterior Color: White Gold Metallic

Interior Color: Pure Beige

Number of Cylinders: 6

Well maintained 2010 VW Toureg VR6. Many options include Luxury Package (Leather seats,wood trim,heated steering wheel and seats, and 19" Terra alloy wheels), 3.6L 280hp vR6 with 4xMotion AWD, Climatronic dual zone auto climate control, 12 way power driver seat, 8 way passenger front seat w/lumbar 60/40 folding rear seat, Multi function steering wheel, multi-function trip computer and compass, cruise control, anti-theft alarm, front and rear Park Distance Control, HomeLink, AM/FM radio with in-dash single CD and trunk mounted 6 disc CD changer, Sirius satellite radio, Bluetooth mobile telephone connectivity, Power windows and locks, Power liftgate, power glass sunroof w/tilt and slide, Power heatable exterior mirrors with turn signal indicators, fog lamps, rain sensing variable intermittent wipers, roof rails, trailer hitch, and more. Also, new Pirelli all weather tires with <1000miles. Would love to keep this vehicle but we need to downsize. Only negative is we do have a lien against the vehicle with Capital One Auto Finance. I am checking to see if it is an assumable loan as the APR is only 1.9%. We are asking $30,000 minus whatever the payoff is at time of purchase. Title options didn't allow this option. There is little negotiating room but not much due to what we owe on the car. Thanks for looking!

Volkswagen Touareg for Sale

2004 volkswagen touareg tdi sport utility 4-door 4.9l powerhouse beauty(US $16,000.00)

2004 volkswagen touareg tdi sport utility 4-door 4.9l powerhouse beauty(US $16,000.00) 2006(06) volkswagen touareg power heated seats! moonroof! clean! must see! save!(US $11,995.00)

2006(06) volkswagen touareg power heated seats! moonroof! clean! must see! save!(US $11,995.00) 2013 vr6 sport 3.6l auto white(US $40,997.00)

2013 vr6 sport 3.6l auto white(US $40,997.00) 2004 volkswagen touareg v8 awd sunroof nav 19's 59k mi texas direct auto(US $15,980.00)

2004 volkswagen touareg v8 awd sunroof nav 19's 59k mi texas direct auto(US $15,980.00) Vw one owner dvd nav awd smoke free very low milage luxury leather trc ctl

Vw one owner dvd nav awd smoke free very low milage luxury leather trc ctl V6 suv 3.6l 4x4 cd 10 speakers am/fm radio radio data system leather moonroof

V6 suv 3.6l 4x4 cd 10 speakers am/fm radio radio data system leather moonroof

Auto Services in Colorado

Windsor Car Care ★★★★★

West Side Auto Body & Towing ★★★★★

Toyexus Service ★★★★★

Tito`s Cash for Cars ★★★★★

Suzuki-Mccloskey ★★★★★

Red Rock Auto Clinic ★★★★★

Auto blog

VW readying CC Shooting Brake?

Mon, 11 Feb 2013This was bound to happen. Volkswagen's relentless drive for big volume has the brand mining seemingly every niche it can find for additional sales worldwide. And with its CLS Shooting Brake, fellow countryman Mercedes-Benz has already shown that a wagon based off of a "four-door coupe" can look dead sexy and command extra dollars. So it follows that the Volkswagen CC (whose existence is all but directly attributable to the success of the original CLS sedan) will also get a load-lugging variant. That's according to the UK's Autocar, which notes that the five-door will come in the CC's next generation.

According to the report, the next CC will be available in front and all-wheel drive variants with the usual assortment of gas and diesel four-cylinders found in the Wolfsburg empire, with the possibility of a gas plug-in hybrid model, too. The rakish estate will ride atop VW's MQB architecture, a shorter variant of which is also found underneath the new Golf. The scalable chassis is set to spread like kudzu throughout the company's lineup, but the CC probably won't happen until after the launch of the next European-market Passat in 2015.

Will we get it in North America? Hard to say. Volkswagen sells the standard CC saloon here, but not in particularly large numbers, and when the company moved to a North American-specific Passat, it dumped the wagon variant. The traditional VW estate apparently continues to pick up sales momentum abroad, however, making the CC Shooting Brake a seemingly natural fit for buyers who still want the utility of a two-box form but can afford to sacrifice a bit of cargo room in the name of style.

Former chairman Piech opposing his nieces' VW board nominations

Fri, May 1 2015Someone needs to option the rights to the Ferdinand Piech story for an HBO series, because it perfectly mixes the corporate intrigue of Mad Men with the family drama of The Sopranos. Plus there are some cool cars. In the latest episode, Piech isn't happy with Volkswagen's appointment of two of his nieces – Julia Kuhn-Piech and Dr. Louise Kiesling – to replace he and his wife on the automaker's supervisory board. The recently ousted chairman could try to stop them. According to German publication Bild, Piech thinks his two relatives lack the necessary automotive experience to serve on the board. Therefore, he suggests one-time Ford Premier Automotive Group boss Wolfgang Reitzle and former Siemens manager Brigitte Ederer to take the seats. However, a VW spokesperson told Automotive News Europe that there were no objections to the women's appointment, except for this story from Germany. Piech's nieces are already officially appointed to the VW supervisory board, and it's approved by the Braunschweig Local Court in Germany. His only real option to challenge them would be to file a lawsuit, according to Automotive News Europe. While the new appointees don't have their uncle's decades of history in the auto industry, they do have business experience. Dr. Kiesling has a degree in vehicle design from the Royal College of Art in London and is the managing director of an Austrian textile maker. Kuhn-Piech works in real estate sits on the supervisory board of German truck maker Man.

$1.4B hedge fund suit against Porsche dismissed

Wed, 19 Mar 2014Investors have canvassed courts in Europe and the US to repeatedly sue Porsche over its failed attempt to take over Volkswagen in 2008 (see here, and here and here), and they have repeatedly failed to win any cases. You can add another big loss to the tally, with Bloomberg reporting that the Stuttgart Regional Court has dismissed a 1.4-billion euro ($1.95B US) lawsuit, the decision explained by the court's assertion that the investors would have lost on their short bets even if Porsche hadn't misled them.

Examining the hedge funds' motives for stock purchases and the bets that VW share prices would fall, judge Carola Wittig said that the funds didn't base their decisions on the key bits of "misinformation," and instead were participating simply in "highly speculative and naked short selling," only to get caught out.

With other cases still pending, the continued streak of victories bodes well for Porsche's courtroom fortunes, since judges will expect new information to consider overturning precedent. If there is any new info, it could come from the potential criminal cases still outstanding against former CEO Wendelin Wiedeking and CFO Holger Härter, who were both indicted on charges of market manipulation.