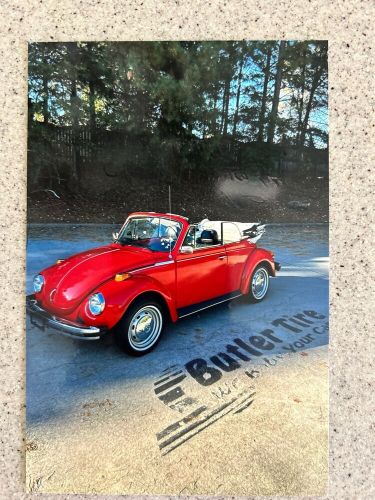

1979 Volkswagen Super Beetle on 2040-cars

Piermont, New York, United States

Transmission:Manual

Vehicle Title:Clean

Engine:1600 cc Fuel Injected

Fuel Type:Gasoline

Year: 1979

VIN (Vehicle Identification Number): 1592042526

Mileage: 22300

Model: Super Beetle

Exterior Color: Yellow

Make: Volkswagen

Drive Type: RWD

Volkswagen Super Beetle for Sale

1979 volkswagen super beetle(US $12,000.00)

1979 volkswagen super beetle(US $12,000.00) 1979 volkswagen super beetle 9997 original miles! - original us car(US $38,000.00)

1979 volkswagen super beetle 9997 original miles! - original us car(US $38,000.00) 1972 volkswagen super beetle base(US $7,400.00)

1972 volkswagen super beetle base(US $7,400.00)

Auto Services in New York

YMK Collision ★★★★★

Valu Auto Center (ORCHARD PARK) ★★★★★

Tuftrucks and Finecars ★★★★★

Total Auto Glass ★★★★★

Tallman`s Tire & Auto Service ★★★★★

T & C Auto Sales ★★★★★

Auto blog

United States drivers buying fewer Mexican-made cars

Tue, May 10 2016Crossovers and pickup trucks are not only growing in market share, they're also more profitable than cars. A crossover on the same platform as a sedan retails for thousands more, despite similar components. It's one of the reasons we've seen automakers rapidly shifting production of their sedans and hatchbacks to Mexico, where cheap labor preserves the thin profit margins on these inexpensive vehicles. But as the market continues to shift in the United States, Mexico is getting burned by its lack of product diversity. The country's auto exports, which are heavy on cars, suffered a 16-percent drop last month, Automotive News reports. In total, year-over-year exports fell from 233,515 to 197,020 last month, while year-to-date exports are down by 7.4 percent, from 922,029 to 854,118. The number one culprit? America – which usually accounts for 75 percent of Mexico's exports – and its appetite for crossovers and pickup trucks bolstered by cheap gas prices. While Mexico does build some light truck models – AN specifically calls out the Ram 2500, Honda HR-V, GMC Sierra, and Toyota Tacoma as export leaders – the vast majority of vehicles rolling out of its factories are sedans and hatchbacks. In fact, the three biggest drops in Mexican exports came from companies whose south of the border factories only build cars – Ford (Fusion/Lincoln MKZ and Fiesta), Mazda (Mazda3), and Volkswagen (Golf and Jetta). Mexican Automotive Industry Association President Eduardo Solis told AN the export shortfall will likely be sorted out sooner rather than later, thanks to a pair of new factories – a Kia car factory and an Audi SUV plant – that are coming online by year's end. The two facilities will add around 100,000 vehicles to the country's export totals, which Solis said should leave the industry on the verge of breaking another export record in 2016. But how sustainable will these record-breaking years be? Slapping an "Hecho en Mexico" sticker on a new German SUV won't be enough to change the fact that Mexico's product mix is tilted too heavily towards body styles that are not growing in volume. Mexico's record-breaking export years probably aren't at an end, but we'd argue they're certainly under threat. News Source: Automotive News - sub. req.Image Credit: Omar Torres / AFP / Getty Images Plants/Manufacturing Ford GMC Honda Mazda RAM Volkswagen Truck Crossover SUV Mexico

VW orders external probe into diesel emission scandal

Sun, Sep 20 2015There are well over 480,000 Volkswagen-made, diesel-powered vehicles currently traveling roads in the United States that do not meet the Environmental Protection Agency's emissions requirements. This, as you can probably imagine, is a very big deal, and has led VW CEO Professor Doctor Martin Winterkorn to release an official statement on the matter. "I personally am deeply sorry that we have broken the trust of our customers and the public," he said. It's important to note that these vehicles run software with a so-called "defeat device" that kicks in when the on-board computer senses that it is being tested for emissions. When the car is operating normally – in other words, when its exhaust isn't being sniffed – the cars do not meet US emissions standards. According to the EPA and the California Air Resources Board, affected cars emit as much as 40 times the allowable level of certain pollutants. "We will cooperate fully with the responsible agencies, with transparency and urgency, to clearly, openly, and completely establish all of the facts of this case," according to Winterkorn, who added, "Volkswagen has ordered an external investigation of this matter." It's not yet known who will carry out this investigation. At present, there are still a number of 2015 Volkswagen models on dealer lots that do not meet emissions requirements. VW has issued a stop sale on vehicles equipped with the 2.0-liter TDI diesel engine. What's more, the German automaker has been barred from selling 2016 model-year vehicles that use this engine, according to The Detroit News. Last year, diesel vehicles made up about 22 percent of all VW sales, which means these restrictions will have a big impact on the brand's sales performance until a remedy is found and the vehicles are approved for sale. Interestingly, the EPA has started a campaign of sorts to test vehicles from other automakers that sell diesel-powered vehicles in the United States to make sure they comply with emissions requirements under all operating circumstances. The EPA says it "will be reviewing [its] compliance protocols and introducing ways in which [it] can effectively test not only for emissions performance but also for the potential presence of defeat devices," according to a statement provided to The Detroit News. Check out the full statement from VW CEO Martin Winterkorn below. Related Video: STATEMENT OF PROF. DR.

Volvo, Daimler, Traton join forces to build electric truck charging network

Tue, Jul 6 2021Volvo Group, Daimler Truck and Volkswagen's AG heavy-truck business the Traton Group announced on Monday a non-binding agreement to build a network of high-performance public charging stations for electric heavy-duty long-haul trucks and buses around Europe. The news was first reported by Reuters. The three major European automakers will invest ˆ500 million (~$593 million USD) to install and operate 1,700 charging points in strategic locations and close to highways. They intend to finalize the agreement by the end of this year and start operations next year, with the hopes of increasing the number of charge points significantly as the companies seek additional partners for the future joint venture. The venture is meant to be a catalyst to prepare for the European Union's goals of carbon-neutral freight transportation by 2050. One of the main deterrents for both individuals and freight companies for switching to EVs has historically been a lack of charging infrastructure. By building that infrastructure, Volvo, Daimler and Traton can also expect to boost their own sales of electric trucks and buses. “It is the joint aim of EuropeÂ’s truck manufacturers to achieve climate neutrality by 2050," Martin Daum, CEO Daimler Truck, said in a statement. "However, it is vital that building up the right infrastructure goes hand in hand with putting CO2-neutral trucks on the road. Together with Volvo Group and the Traton Group, we are therefore very excited to take this pioneering step to establish a high-performance charging network across Europe.” The partnership between Volvo and Daimler isn't unprecedented. In May, the two competitors teamed up to produce hydrogen fuel cells for long-haul trucks to lower development costs and boost production volumes. This latest venture is another signal that major companies are banding together to solve climate-related issues in the industry. European car industry association ACEA has called for up to 50,000 high-performance charging points by 2030. Traton CEO Matthias Gruendler told Reuters that roughly 10 billion euros would be needed to build out Europe's infrastructure to be fully electrified by 2050. According to a statement released by Volvo, this venture is also a call to action for others with a stake in the industry, like automakers or governments, to work together to ensure the rapid expansion needed to reach climate goals.