2003 Volkswagen Passat Glx on 2040-cars

3512 Spring Garden St, Greensboro, North Carolina, United States

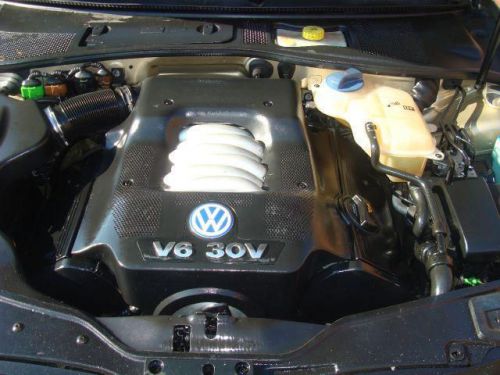

Engine:2.8L V6 30V MPFI DOHC

Transmission:5-Speed Automatic

VIN (Vehicle Identification Number): WVWRH63B93P385909

Stock Num: 226126805

Make: Volkswagen

Model: Passat GLX

Year: 2003

Exterior Color: Gold

Interior Color: Black

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 145464

Leather, Sunroof, Remote power door locks, Reverse tilt passenger mirror provides curb view when vehicle in reverse, Power mirrors, Heated mirrors, 2 one-touch power windows, Remote window operation, Cruise control, Front console with storage, Front and rear cupholders, Front door pockets, Remote trunk release, Retained accessory power, Front seatback storage, Power steering, Universal remote transmitter (for garage door, security system, etc.), 12V front and 12V cargo area power outlet(s), Tilt and telescopic steering wheel, Audio and cruise controls on steering wheel, Interior air filtration, Climate control, Trunk light, Wood trim on center console, Wood trim on dash, Wood trim on doors, Front and rear reading lights, Leather and wood trim on shift knob, Front and rear floor mats, Electrochromatic inside rearview mirror, Dual illuminating vanity mirrors, Mast antenna, Monsoon premium brand speakers, 8 total speakers,200 watts stereo output, AM/FM in-dash single CD player,CD-controller stereo, Speed sensitive volume control, Variable intermittent rain sensing wipers, Rear defogger, Manual rear sunshade, Power glass sunroof, 4-wheel ABS, Front and rear head airbags, Dual front side-mounted airbags, Child seat anchors, Remote anti-theft alarm system, Ventilated front disc / solid rear disc brakes, Rear door child safety locks, Daytime running lights, Engine immobilizer, Front fog/driving lights, 2 front headrests, 3 rear headrests, Rear center 3-point belt, Front and rear seatbelt pretensioners, Traction control, Electronic brakeforce distribution, Emergency interior trunk release, Front multi-adjustable headrests, Rear height adjustable headrests, BASE ENGINE SIZE 2.8 L CAM TYPE Double overhead cam (DOHC), CYLINDERS V6, VALVES 30, TORQUE 206 ft-lbs. @ 3200 rpm, HORSEPOWER 190 hp @ 6000 rpm, TURNING CIRCLE 37.4 ft. FUEL TANK CAPACITY 16.4 gal. RANGE IN MILES (CTY/HWY) 278.8/410.0 mi.EPA MILEAGE EST. (CTY/HWY) 17/25 mpg warranties are available for all cars. just call us or come visit our second location at 2806 Patterson st.

Volkswagen Passat for Sale

2004 volkswagen passat gls(US $6,925.00)

2004 volkswagen passat gls(US $6,925.00) 2003 volkswagen passat gls(US $4,994.00)

2003 volkswagen passat gls(US $4,994.00) 2012 volkswagen passat 2.5 se(US $18,900.00)

2012 volkswagen passat 2.5 se(US $18,900.00) 2002 volkswagen passat gls(US $5,495.00)

2002 volkswagen passat gls(US $5,495.00) 2006 volkswagen passat 2.0t(US $8,500.00)

2006 volkswagen passat 2.0t(US $8,500.00) 2014 volkswagen passat se(US $25,865.00)

2014 volkswagen passat se(US $25,865.00)

Auto Services in North Carolina

Westside Motors ★★★★★

VIP Car Service ★★★★★

Vann York Toyota Scion ★★★★★

Skip`s Volkswagen Service ★★★★★

Sharky`s Auto Glass ★★★★★

Randy`s Automotive Repair ★★★★★

Auto blog

Least satisfying vehicle rankings seek to highlight the worst cars of the year

Sun, Feb 5 2023Consumer Reports polls its members on all sorts of topics related to how they buy and use products ranging from mobile phones to humidifiers for indoor plants. Cars are regularly one of CR’s most interesting topics, and its recent study on the least satisfying vehicles to own offers insights into the cars people wish they hadnÂ’t purchased. CR polled thousands of members with questions about what they liked and disliked about the vehicle theyÂ’d owned for a few years. When asked if they would definitely repurchase the same car, the following vehicles came back as the least likely to be purchased a second time: Kia Forte: 51% would buy again Nissan Altima: 51% would buy again Nissan Kicks: 49% would buy again Volkswagen Taos: 48% would buy again Kia Seltos: 48% would buy again Jeep Compass: 46% would buy again Mercedes-Benz GLA: 45% would buy again Infiniti QX50: 40% would buy again Mercedes-Benz GLB: 39% would buy again Volkswagen Atlas Cross Sport: 38% would buy again When Autoblog tested the VW Atlas Cross Sport in March 2022, we liked the styling and the price was right, but it lagged rivals in driving excitement and interior quality. A number of recalls donÂ’t help the Cross SportÂ’s cause much, either, as some models have more than a dozen actions by the National Highway Traffic Safety Administration. Even the 2023 model already has four recalls. The annoyance of recalls and the hassle of just-average reliability ratings could have played into the Cross SportÂ’s place as the least satisfying vehicle. On the other end of the spectrum, the Chevrolet Corvette earned the top spot as CR's most satisfying car. The Porsche 911, Rivian R1T, Ford Maverick Hybrid, and Hyundai Ioniq 5 round out the top-five most satisfying vehicles to own. Given the rabid following the 911 has built over the years and the insane performance Chevy derived from the latest Corvette, itÂ’s not surprising to see them in the top spots. Related video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Green Infiniti Jeep Kia Mercedes-Benz Nissan Volkswagen Car Buying Used Car Buying Consumer Reports worst cars

Volkswagen says goodbye to Eos, Routan in 2015 updates

Wed, 23 Jul 2014Usually automakers announce changes to their lineup individually on a vehicle-by-vehicle basis, but sometimes it all comes at once - especially when the changes are ones we either expected or might not otherwise notice. That's the path Volkswagen has gone with changes to its US lineup for 2015.

The biggest change is what we already knew: that the new Golf arrives for the 2015 model year, bringing with it the new GTI, Golf R, e-Golf and Golf SportWagen (to replace the previous Jetta wagon). But there are some new details as well.

For starters, Volkswagen has finally confirmed that both the Eos and the Routan - both long rumored to be on their way out - will be exiting this year. The Eos hardtop convertible, pictured above, will linger for one last year, its Sport trim replaced by a new Final Edition with 18-inch wheels, two-tone leather interior and enhanced equipment.

J.D. Power customer survey of dealers counts Cadillac, Buick as big winners

Mon, 14 Apr 2014Cadillac and Buick have taken the trophies in J.D. Power's latest Customer Service Index Study examining satisfaction with dealer service. Surveying more than 90,000 owners and lessees of 2009-2013 model-year cars, the study found that those with pre-paid maintenance packages were ten percent more likely to buy their next car from the same brand.

Dealer satisfaction scores have improved overall, Cadillac nabbed the luxury segment ahead of Audi and Lexus, taking the crown that Lexus held last year. Buick keeps the mass-market dealer satisfaction win in the family, finishing ahead of Volkswagen and last year's winner GMC. The study also found that service department use of tablets increased customer satisfaction, as did "best practices" like "providing helpful advice." Who knew?

You can find details on those and more findings in the press release below.