12k Miles 4dr Sdn 2.5l Automatic Certified One Owner Clean Carfax on 2040-cars

Washington, District Of Columbia, United States

Body Type:Sedan

Vehicle Title:Clear

Fuel Type:Gasoline

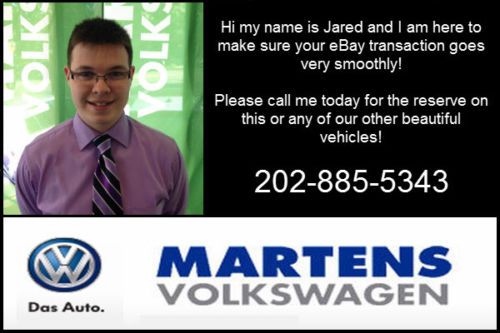

For Sale By:Dealer

Year: 2012

Make: Volkswagen

Model: Passat

Warranty: Vehicle has an existing warranty

Mileage: 11,870

Sub Model: 4dr Sdn 2.5L

Options: CD Player

Exterior Color: Black

Power Options: Power Windows

Interior Color: Tan

Number of Cylinders: 5

Volkswagen Passat for Sale

2003 volkswagen passat glx wagon 4-door 2.8l(US $7,495.00)

2003 volkswagen passat glx wagon 4-door 2.8l(US $7,495.00) , exelent platinum gray, 2012, vw passat(US $17,000.00)

, exelent platinum gray, 2012, vw passat(US $17,000.00) 2007 vw passat 2.0t wagon

2007 vw passat 2.0t wagon 2013 vw passat se

2013 vw passat se 2003 volkswagen passat glx sedan 4-door 2.8l(US $5,999.00)

2003 volkswagen passat glx sedan 4-door 2.8l(US $5,999.00) Grey exterior, black leather interior sedan(US $5,000.00)

Grey exterior, black leather interior sedan(US $5,000.00)

Auto Services in District Of Columbia

Pohanka Collision Center of Crystal City ★★★★★

P G Brake and Front End ★★★★★

MT Vernon Auto Repair ★★★★★

Lim`s Auto Top & Upholstery ★★★★★

Lake Liberty ★★★★★

Beltway Used Auto Parts ★★★★★

Auto blog

Bosch fuel pumps spark recall of 2015 Golf, GTI and Audi A3

Tue, Apr 28 2015A few weeks ago, BMW and Nissan both issued recalls for some of their vehicles to replace Bosch-supplied fuel pumps. The pumps had nickel plating that could flake off and cause a failure. Volkswagen Group is the latest automaker to be affected by the problem and has a campaign for the 2015 Audi A3, VW Golf and GTI. In total, 6,204 units of these models are in need of repair. The problem with the VW Group vehicles is identical to the previous recalls. It's possible for the pump's nickel plating to come off and cause increased friction. Eventually, this can result in the component's failure. According to documents from the National Highway Traffic Safety Administration (as a PDF, here), there are no reports of accidents or injuries from this issue in the VW Group models. Bosch spokesperson Linda Beckmeyer tells Autoblog that these vehicles don't all necessary share an identical fuel pump, but the parts all use the same plating process. The problem also prompted repairs of the 2014 Ford Escape several months ago, she indicated. When asked if the issue could prompt more campaigns, Beckmeyer said that she "can't speak to that" because automakers decide on the recalls. Owners should receive notice of the problem soon, but according to the NHTSA documentation, there currently aren't enough pumps to fix all of these vehicles. "Bosch is working closely with automakers regarding replacement parts," Beckmeyer said. When available, dealers will replace the components free of charge for affected customers. Related Video: RECALL Subject : Improper Plating may cause Fuel Pump to Fail Report Receipt Date: APR 17, 2015 NHTSA Campaign Number: 15V229000 Component(s): FUEL SYSTEM, GASOLINE Potential Number of Units Affected: 6,204 All Products Associated with this Recall Vehicle Make Model Model Year(s) AUDI A3 2015 VOLKSWAGEN GOLF 2015 VOLKSWAGEN GTI 2015 Details Manufacturer: Volkswagen Group of America, Inc. SUMMARY: Volkswagen Group of America, Inc. (Volkswagen) is recalling certain model year 2015 Volkswagen Golf, GTI, and Audi A3 vehicles. Improper nickel plating of components within the fuel pump may result in the fuel pump failing. CONSEQUENCE: If the fuel pump fails, the vehicle will not start, or if the engine is running, it will stop and the vehicle will stall, increasing the risk of a crash. REMEDY: Volkswagen will notify owners, and dealers will inspect the vehicles and replace any affected fuel pumps, free of charge.

Cruze Diesel Road Trip reveals the good and bad, but no ugly

Tue, Mar 31 2015Most of us have strong opinions on diesel-powered cars based on our perceptions of and experience with them. I used to thoroughly dislike oil burners for their noise, smoke and lackluster performance, and the fact that they ran on greasy, smelly stuff that was more expensive than gasoline, could be hard to find and was nasty to get on your hands when refueling. Those negatives, for me, trumped diesel's major positives of big torque for strong acceleration and better fuel economy. Are any of those knocks on diesel still valid today? I'm not talking semis, which continue to annoy me when their operators for some reason almost never shut them down. At any busy truck stop, the air seems always filled with the sound – and sometimes smell – of dozens of big-rig diesels idling endlessly and mindlessly. Or diesel heavy-duty pickups. Those muscular workhorses are far more refined than they once were and burn much less fuel than their gasoline counterparts. But good luck arriving home late at night, or departing early morning, without waking your housemates and neighbors with their clattery racket. No, I'm talking diesel-powered passenger cars, which account for more than half the market in Europe (diesel fuel is cheaper there) yet still barely bump the sales charts in North America. Diesel fuel remains more expensive here, too few stations carry it, and too many Americans remember when diesel cars were noisy, smelly slugs. Also, US emissions requirements make them substantially more expensive to certify, and therefore to buy. But put aside (if you can) higher vehicle purchase and fuel prices, and today's diesel cars can be delightful to drive while delivering much better fuel efficiency than gas-powered versions. So far in the US, all except Chevrolet's compact Cruze Diesel come from German brands, and all are amazingly quiet, visually clean (no smoke) and can be torquey-fun to drive. When a GM Powertrain engineering team set out to modify a tried-and-true GM of Europe turbodiesel four for North American Chevy Cruze compacts, says assistant chief engineer Mike Siegrist, it had a clear target in mind: the Volkswagen Jetta TDI 2.0-liter diesel. And they'll tell you that they beat it in nearly every way. "I believe we have a superior product," he says. "It's powerful, efficient and clean, and it will change perceptions of what a diesel car can be." The 2.0L Cruze turbodiesel pumps out 151 SAE certified horses and 264 pound-feet of torque (at just 2,000 rpm) vs.

Volkswagen's De Silva says next Scirocco will be 'completely different'

Tue, 02 Apr 2013From our perspective, the reborn Volkswagen Scirocco is a handsome (if squat) little thing. Yet design-wise, it's always struck us as uncomfortably close to the Golf three-door hatchback with which it shares its basic underpinnings. That aesthetic kinship may be part of the reason why Volkswagen has steadfastly refused to import the Scirocco to North America, seeing as how the Golf doesn't regularly set the company's sales charts alight, and it's less expensive.

But that visual similarity might be about to change, says Walter De Silva, who recently told Australia's Car Advice that, "It must be completely different... we don't want to repeat the bodystyle of the Scirocco, we want to change that." Further, the Volkswagen Group's design boss says that the next-generation car isn't terribly far along in development yet - "at the moment, it's only a studio [project]... it's not defined." It's probably just as well, as the new seventh-generation Golf arguably borrows some of its design from the current Scirocco anyway.

So we should expect a much bolder, more differentiated design, right? Well, yes, no and maybe. Back in September, De Silva himself was quoted as saying that the era of flamboyant styling has passed, and that future VW designs will be simpler to better reflect the times and preserve resale value. So... how different could it be?

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.037 s, 7853 u