2017 Volkswagen Jetta 1.4t S on 2040-cars

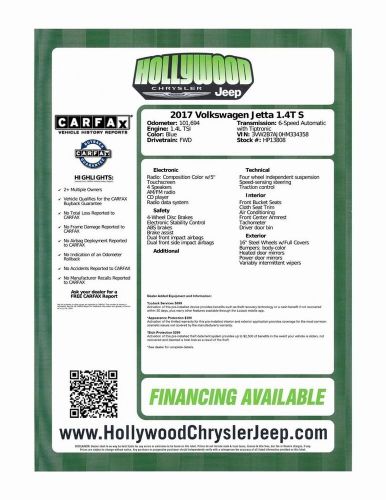

Engine:1.4L TSI

Fuel Type:Gasoline

Body Type:4D Sedan

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 3VW2B7AJ0HM334358

Mileage: 101694

Make: Volkswagen

Trim: 1.4T S

Features: --

Power Options: --

Exterior Color: Blue

Interior Color: Black

Warranty: Unspecified

Model: Jetta

Volkswagen Jetta for Sale

2023 volkswagen jetta 1.5t se(US $22,286.00)

2023 volkswagen jetta 1.5t se(US $22,286.00) 2019 volkswagen jetta 1.4t se(US $15,980.00)

2019 volkswagen jetta 1.4t se(US $15,980.00) 2021 volkswagen jetta(US $16,990.00)

2021 volkswagen jetta(US $16,990.00) 2021 volkswagen jetta 1.4t se(US $16,990.00)

2021 volkswagen jetta 1.4t se(US $16,990.00) 2023 volkswagen jetta 1.5t sport(US $19,890.00)

2023 volkswagen jetta 1.5t sport(US $19,890.00) 2024 volkswagen jetta 1.5t sport(US $20,495.00)

2024 volkswagen jetta 1.5t sport(US $20,495.00)

Auto blog

We drive the Bronco Sport Sasquatch, Hummer EV SUV and more | Autoblog Podcast #846

Fri, Aug 30 2024In this episode of the Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Road Test Editor Zac Palmer. Zac recently went down to Tennessee to drive a prototype of the 2025 Ford Bronco Sport Sasquatch. Meanwhile the two also spent time in the 2024 GMC Hummer EV SUV, 2024 Mercedes-AMG GLA 35 and 2024 Lexus LS 500h out of the fleet in Michigan. In the news, Rivian deals with a fire at its Normal, Illinois plant, Formula 1 comes back strong, and Volkswagen prices the ID.Buzz. Lastly, the two debate what old, executive sedan you should buy in a Spend My Money segment. Send us your questions for the Mailbag and Spend My Money at: Podcast@Autoblog.com. Autoblog Podcast #846 Get The Podcast Apple Podcasts – Subscribe to the Autoblog Podcast in iTunes Spotify – Subscribe to the Autoblog Podcast on Spotify RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Cars we're driving 2025 Ford Bronco Sport Sasquatch 2024 GMC Hummer EV SUV 2024 Mercedes-AMG GLA 35 2024 Lexus LS 500h News Fire at the Rivian factory Formula 1 is back Volkswagen ID.Buzz gets a very high price Spend My Money Feedback Email – Podcast@Autoblog.com Review the show on Apple Podcasts Autoblog is now live on your smart speakers and voice assistants with the audio Autoblog Daily Digest. Say “Hey Google, play the news from Autoblog” or "Alexa, open Autoblog" to get your favorite car website in audio form every day. A narrator will take you through the biggest stories or break down one of our comprehensive test drives. Related Video:  We check out the Rivian R1S and R1T along with 3 other surprises This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

The VW Sport Coupe GTE Concept promises exciting things for brand's future [w/video]

Tue, Mar 3 2015In recent years, it seems as though the Audi allotment of design talent from the Volkswagen Group has gotten braver, while the VW designers have become more conservative. One look at the current Volkswagen range reveals a lot of tidy sheet metal, but hardly any that rank as evocative or emotionally compelling. If the rhetoric around this Sport Coupe GTE Concept turns to action, however, VW's mass-marketed cars could become a lot more interesting to look at. Sharp creases and bold graphics can be found on just about every inch of the concept, and the large wheels at either extreme corner help to sell this as a "four-door coupe" more than most executions of that now hackneyed styling term. And, if you like what you see, then you might want to hold out for quickly approaching versions of this look on production models. Design head Walter de Silva says this language will be "shaping the immediate future" for VW product. Mechanically, the Coupe also previews more hybridization for the VW line. The concept has a plug-in hybrid powertrain, with a turbo 3.0-liter V6 driving the front wheels, and an electric motor sending yet more power to the rear. You can read up on the details in our official post from a few days ago, or just click through the pretty pictures in the gallery above. SPORT COUPE CONCEPT GTE MAKES WORLD DEBUT AT THE GENEVA AUTO SHOW Four-door coupe marks beginning of a new design era at Volkswagen Wolfsburg/Geneva, March 2015 -Volkswagen will debut the Sport Coupe Concept GTE at the 2015 Geneva International Motor Show, heralding a new and progressive Volkswagen design language. "Evolution and revolution come together in the Sport Coupe Concept GTE. This concept is based on Volkswagen design DNA, which has been visibly sharpened even more. It shows how the highest-volume brand of our Group is shaping the immediate future," says Walter de Silva, Head of Design of Volkswagen AG. Dr Heinz-Jakob Neusser, Volkswagen Brand Board Member for Development, elaborates: "This breathtakingly dynamic coupe is unlike any other to appear in this class. The design of the Sport Coupe Concept GTE is an impressive alternative to the classic sedans of the B and C segments-it has the style of a sport coupe that is enriched by the functionality of a large hatchback and the interior space of a sedan." Klaus Bischoff, Head of Design of the Volkswagen Brand, adds: "The Sport Coupe Concept GTE is another milestone of expressive design.

VW planning 20 new plug-in models for China

Thu, Oct 30 2014With just about everything getting super-sized for China, Volkswagen is following suit with its plug-in vehicle plans for the world's most populous country. VW, Europe's largest carmaker, is looking to sell more than 20 different plug-in models in China within the next four years, Reuters says, citing comments Volkswagen Group China head Jochem Heizmann made in Shanghai. The company is hoping that translates to sales of more than 100,000 plug-ins in China by the end of the decade. Go big or go home, right? There's a huge plug-in vehicle opportunity in China, especially given the bad pollution situation in cities like Beijing and Shanghai and the Chinese government's incentives for plug-in vehicle buyers. Volkswagen CEO Martin Winterkorn said at the Beijing Motor Show this spring that the company would spend $25 billion on at least a half-dozen plug-in models for China by 2018. VW will start selling the e-Golf in China this year and the Golf GTE plug-in hybrid in 2015. VW said in August that it would start selling the e-Golf in the US for about $35,500 in November. That's a $6,500 price hike from the base Nissan Leaf.