2014 Volkswagen Jetta 2.0l Tdi Sport Wagon 4d on 2040-cars

Engine:4-Cyl, Turbo Diesel, 2.0 Liter

Fuel Type:Gasoline

Body Type:Wagon

Transmission:Auto 6-Spd DSG Tptrnc Spt

For Sale By:Dealer

VIN (Vehicle Identification Number): 3VWPL7AJ0EM620578

Mileage: 106615

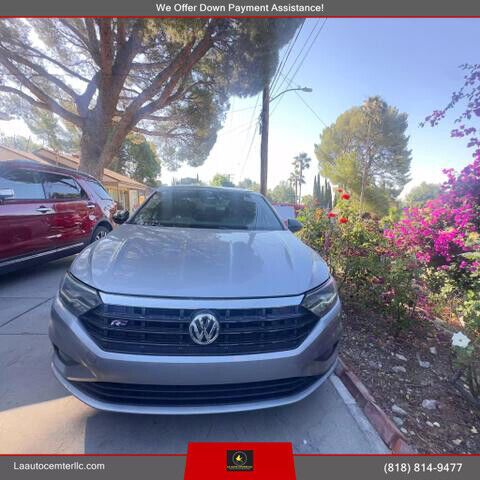

Make: Volkswagen

Trim: 2.0L TDI Sport Wagon 4D

Features: --

Power Options: --

Exterior Color: Black

Interior Color: Black

Warranty: Unspecified

Model: Jetta

Volkswagen Jetta for Sale

2021 volkswagen jetta 1.4t s(US $18,980.00)

2021 volkswagen jetta 1.4t s(US $18,980.00) 2018 volkswagen jetta 1.8t sel(US $14,894.00)

2018 volkswagen jetta 1.8t sel(US $14,894.00) 2020 volkswagen jetta 1.4t r-line sedan 4d(US $14,995.00)

2020 volkswagen jetta 1.4t r-line sedan 4d(US $14,995.00) 2013 volkswagen jetta sportwagen tdi 2.0 manual(US $11,993.00)

2013 volkswagen jetta sportwagen tdi 2.0 manual(US $11,993.00) 2020 volkswagen jetta 1.4t s(US $18,990.00)

2020 volkswagen jetta 1.4t s(US $18,990.00) 2013 volkswagen jetta 2.5l sel(US $14,445.00)

2013 volkswagen jetta 2.5l sel(US $14,445.00)

Auto blog

The best Super Bowl car commercials from the last 5 years

Wed, Jan 28 2015If you've been dipping into the Autoblog feed over the past days and weeks, you wouldn't even have to be a sports fan to know the Super Bowl is coming up. Automakers have been teasing their spots for the big game, dropping them days early, fully-formed onto the Internet and otherwise trying to amp up the multi-million-dollar outlays that they've made for air time on the biggest advertising day of the year. And, we're into it. The lead up to the Super Bowl is almost akin to a mini auto show around these parts; with automakers being amongst the most prolific advertisers on these special Sundays. The crop of ads from 2015 looks as strong as ever, but we thought we'd take a quick look back at some of our favorite spots from the last five years. Take a look at our picks – created from a very informal polling of Autoblog editors and presented in no particular order – and then tell us about your recent faves, in Comments. Chrysler, Imported From Detroit Chrysler, Eminem and a lingering pan shot of "The Fist" – it doesn't get much more Motown than 2011's Imported From Detroit. With the weight of our staffers hailing from in and around The D, it's no wonder that our memories still favor this epic Super Bowl commercial (even though the car it was shilling was crap). Imported really set the tone for later Chrysler ads, too, repeated the formula: celebrity endorsement + dramatic copy + dash of jingoism = pulled car-guy heartstrings. Mercedes-Benz, Soul teaser with Kate Upton One of our favorite Super Bowl commercials (and yours, based on the insane number of views you logged) didn't even technically air during the game. Mercedes-Benz teased its eventual spot Soul with 90-seconds worth of Kate Upton threatening to do her best Joy Harmon impression. (Teaser indeed.) It doesn't win points for cleverness, use of music, acting, or any compelling carness, but it proved that Mercedes' advertisers knew how to make a splash in the Internet Age. And, hey, it's still classier than every GoDaddy commercial. Kia, A Dream Car. For Real Life Like the Mercedes video above, the initial draw here is a pretty lady; in this case the always stunning Adriana Lima. But this Kia commercial really delivers the extra effort we expect while scarfing crabby snacks and homemades, too. First of all, Motley Crue. Second, a cowboy on a bucking rhino. Enjoy yet again.

Anti-union group files lawsuit against VW and UAW

Fri, 14 Mar 2014The fight for unionization at Volkswagen's Chattanooga, TN, factory isn't letting up. Yesterday, the National Labor Relations Board decided to allow anti-United Auto Workers employees at the plant the right to defend voting down the measure. Now, a group called the National Right to Work Foundation has filed a federal lawsuit on behalf of five workers against VW and the UAW for allegedly working together to organize.

The group says in a release that it wants "to block further collusion between the company and the United Auto Workers." It alleges that VW forced workers to attend "mandatory pro-union meetings" and prevented managers from opposing. In a rebuttal on its website, the UAW called the claims "baseless" and said its actions were entirely legal.

One possible problem faces the carmaker in regards to the lawsuit. According to the Detroit Free Press, a recent US Court of Appeals ruling found that neutrality agreements like the one the business had with the UAW could be illegal if the company provided "things of value" to the union. The newspaper also claims that VW held a mandatory employee meeting concerning the election, but workers were free to leave during the UAW's presentation.

VW announces reworked 6.0 W12 TSI engine

Mon, May 11 2015Nobody makes more engines with a dozen cylinders than the Volkswagen Group. They're W12s, of course, owing to the novel shape of their cylinder banks. Now the German industrial giant has announced a comprehensively reworked version of that engine at the same Vienna Motor Symposium where it presented its new 2.0-liter turbo four. The new W12 retains the same arrangement and the same 6.0-liter displacement, but updates it all with the latest powertrain tech. In place of Audi's FSI direct injection and Bentley's TMPI multi-point injection, the engine has adopted a new TSI system. It's also got a pair of new twin-scroll turbochargers, APS-coated cylinders, a new cooling system, active engine mounts, cylinder deactivation, and a stop/start system. And – crucially for application in the upcoming Bentayga – it has an oil circuit designed for off-road use. The revised package now produces 600 horsepower and 664 pound-feet of torque. Considerably more than the 567 hp and 516 lb-ft offered in the Bentley Continental GT W12, but less than the GT Speed, which we suspect will get an even more powerful version of this new engine. It's also more powerful than even the top version of Audi and Bentley's 4.0-liter twin-turbo V8, to make the W12 a more compelling option. Of course that's just as far as the Continental GT is concerned. The W12 has also found use in the Continental GTC and Flying Spur, as well as the Volkswagen Phaeton and Audi A8, and could find further applications under the Flying B emblem and elsewhere in the future. VW says that in the right application (say, in the production version of the Bentley EXP 10 Speed 6 concept, for example), the new twelve-pot could deliver 0-62 times of under four seconds and a top speed in excess of 186 miles per hour. Volkswagen at the 36th International Vienna Motor Symposium Dr. Heinz-Jakob Neusser: "The car of the future will continue to fascinate people" - CO2 reduction, electromobility and digitalisation are the greatest challenges facing the automotive industry - The future of the internal combustion engine will be characterised by high rpm diesel and high-performance three-cylinder TSI engines - Laser roughening – innovative coating process in large-scale production - New 6.0 W12 TSI with 447 kW (608 PS) – performance and refinement - New generation of EU6 TDI engines for light-duty vehicles Dr.