2014 Volkswagen Golf 2.5 on 2040-cars

4610 E 96th St, Indianapolis, Indiana, United States

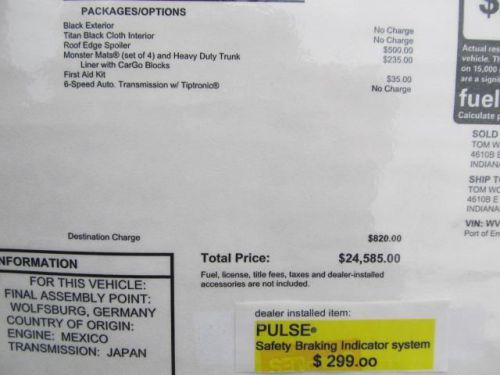

Engine:2.5L I5 20V MPFI DOHC

Transmission:6-Speed Automatic

VIN (Vehicle Identification Number): WVWDB7AJ7EW003784

Stock Num: V17740

Make: Volkswagen

Model: Golf 2.5

Year: 2014

Exterior Color: Black

Interior Color: Titan Black

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 10

Nobody sells more VW's in Indiana than Tom Wood Volkswagen! Why? Because of our huge inventory? Our easy way of doing business? Maybe it is our new facility, the largest of its kind in the United States with its own VW museum? You owe it to yourself to find out why.

Thank you for taking the time to look at this attractive-looking 2014 Volkswagen Golf. This kinda deal on a car with a great cargo-carrying hatch space does not come up for grabs very often, so you better act fast.

Tom Wood Volkswagen is the largest Volkswagen new and Certified Volkswagen dealer in Indiana with a huge selection of New and Certified pre-owned Volkswagen's and award winning customer service.

Volkswagen Golf for Sale

2014 volkswagen golf 2.5(US $24,585.00)

2014 volkswagen golf 2.5(US $24,585.00) 2013 volkswagen golf 2.5 2-door(US $21,190.00)

2013 volkswagen golf 2.5 2-door(US $21,190.00) 2012 volkswagen golf r 2-door(US $26,995.00)

2012 volkswagen golf r 2-door(US $26,995.00) 2014 volkswagen golf 2.0 tdi(US $27,355.00)

2014 volkswagen golf 2.0 tdi(US $27,355.00) 2014 volkswagen golf 2.5(US $21,050.00)

2014 volkswagen golf 2.5(US $21,050.00) 2014 volkswagen golf 2.0 tdi(US $29,085.00)

2014 volkswagen golf 2.0 tdi(US $29,085.00)

Auto Services in Indiana

Widco Transmissions ★★★★★

Townsend Transmission ★★★★★

Tom`s Midwest Muffler & Brake ★★★★★

Superior Auto ★★★★★

Such`s Auto Care ★★★★★

Shepherdsville Discount Auto Supply ★★★★★

Auto blog

Andretti Autosport partners with Volkswagen for Global Rallycross season

Tue, 14 Jan 2014Michael Andretti and Volkswagen have both been involved in Global Rallycross for a couple of years, but not together. Andretti Motorsports Marketing organized the final round of the 2012 GRC series in Las Vegas, and there were rumors then that Andretti was going to get in. Around the same time there were news reports that Volkswagen was preparing a 600-hp Polo Mk5 to race in the SuperCar class; the photo above is racer Anton Marklund in his privateer Marklund Motorsports Polo at the 2013 X-Games round in Los Angeles.

Now it's official: Andretti Autosport will campaign the 2014 GRC season with VWs. That's all that's been said for now, Andretti being busy at the moment launching four entries for IndyCar, two for Indy Lights and two for Pro Mazda. We have a feeling we'll be seeing the MkVII Golf involved, but the cars and the driver lineup will be presented at the Chicago Auto Show on February 6.

VW has received several tentative bids for Ducati

Thu, Jul 20 2017Italy's Benetton family is vying with motorbike firms and buyout funds for control of Italian motorcycle brand Ducati, which is being sold by Germany's Volkswagen, sources involved in the process told Reuters. Volkswagen, whose Audi division controls Ducati, has received several tentative bids with the Benetton family's investment vehicle Edizione Holding valuing the Monster motorbike maker at $1.2 billion, one of the sources said. As well as Edizione Holding, U.S. buyout fund Bain Capital, which owns a stake in Ski-Doo snowmobiles maker BRB, and two Indian motorbike firms, Eicher Motors and Bajaj Auto, have also bid for Ducati, the sources said. Indian carmaker Eicher controls Royal Enfield, a motorcycle brand established in 1893 which ranks as one of the oldest. Strategic bidders also include U.S. automotive firm Polaris Industries, which earlier this year said it would wind down its struggling Victory Motorcycle brand. A shortlist of bidders for a second stage of the auction could be selected as soon as Saturday, two of the sources said. Volkswagen adviser Evercore has a long list of bidders including private equity funds such as Ducati's previous owner Investindustrial, CVC Capital Partners, Advent and PAI, all hoping to outbid industry players, the sources said. If it gets to the second round, Edizione Holding could seek to form a consortium with a financial investor, two of the sources said, in a bid to secure control of Ducati, whose racers have won the Superbike world championship 14 times, with Carl Fogarty and Troy Bayliss its most successful riders. Audi, Edizione Holding, Investindustrial, Advent and PAI declined to comment, while the other interested groups were not immediately available for comment. PRICING CHALLENGES For some buyout funds, Ducati's valuation of up to $1.4 billion – which sources said is based on a multiple of more than 10 times its core earnings of roughly 100 million euros – is a tall order as they lack the synergies that some motorbike makers could achieve. But Investindustrial founder Andrea Bonomi, who sold Ducati to Audi for about 860 million euros in 2012, is serious about a comeback, one of the sources said. China's Loncin Motor was among a group of industry players that initially showed interest in Ducati, alongside Harley-Davidson. The latter has, however, decided against making a bid due to Ducati's price tag, while it could not be established if Loncin Motor had carried on bidding.

Volkswagen names new chief designer for Bentley

Thu, Jun 4 2015The Volkswagen Group has named one of its own to head up the design department at its Bentley division. The role now falls to Stefan Sielaff, who has been with the group (off and on) since 1990. Sielaff is principally an interior designer, but has been tasked with setting up numerous overall design offices for Volkswagen and Audi over the years. In his new capacity he'll be reporting to the group's chief engineer Rolf Frech (and oddly not to Bentley chief Wolfgang Durheimer), but at the same time, Sielaff will retain his role as head of interior design for the entire VW group, reporting to its chief designer Walter de Silva. Sielaff replaces Luc Donckerwolke, who has headed up Bentley design since 2012 and is leaving the company. We'll be on the lookout to see where Donckerwolke lands next. Crewe/Wolfsburg, 04 June 2015 Stefan Sielaff to head design at the Bentley brand • Sielaff also responsible for Group Interior Design Strategy Stefan Sielaff (53), currently Head of the Volkswagen Design Center in Potsdam, will assume responsibility for design at the Bentley brand effective July 1, 2015 in addition to his present post as Head of Group Interior Design Strategy. As Director of Design at Bentley, Sielaff succeeds Luc Donckerwolke (49), who held this function since 2012. Stefan Sielaff joined the Volkswagen Group in 1990, beginning his career in the interior design department at Audi. From 1995 the design graduate was entrusted with setting up the Group's Design Center Europe in Spain. In 1997 he was placed in charge of the Design Studio in Munich and was appointed Head of Audi Interior Design in the same year. In 2003 Sielaff moved to DaimlerChrysler as Design Director of the Interior Competence Center, returning to the Volkswagen Group in 2006 to become Head of Audi Design before being appointed Head of the Volkswagen Design Center in Potsdam und Head of Group Interior Design Strategy in 2012. In his new function as Director of Design at Bentley, Sielaff reports to Rolf Frech, Board Member for Engineering. In his function as Head of Group Interior Design Strategy he continues to report to Walter de Silva, Head of Group Design. Luc Donckerwolke has decided to leave the company. De Silva said: "Luc Donckerwolke has played a key role in the design of various Group brands. We would like to thank him for his work." Related Video: News Source: Volkswagen Design/Style Hirings/Firings/Layoffs Bentley Volkswagen