1968 Volkswagen Beetle on 2040-cars

Spring Valley, California, United States

Transmission:Manual

Vehicle Title:Rebuilt, Rebuildable & Reconstructed

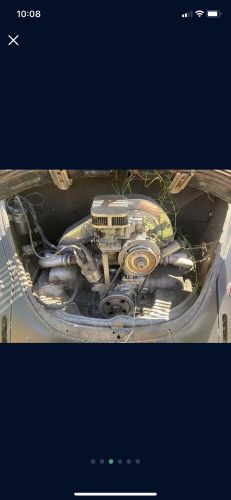

Engine:air cooled, manual, 4 cylinder

VIN (Vehicle Identification Number): 118977266

Mileage: 50000

Model: Beetle

Exterior Color: Black

Make: Volkswagen

Drive Type: RWD

Volkswagen Beetle for Sale

2016 volkswagen beetle s/se(US $12,500.00)

2016 volkswagen beetle s/se(US $12,500.00) 1969 volkswagen beetle(US $17,500.00)

1969 volkswagen beetle(US $17,500.00) 1968 volkswagen beetle(US $6,100.00)

1968 volkswagen beetle(US $6,100.00) 1967 volkswagen beetle(US $16,900.00)

1967 volkswagen beetle(US $16,900.00)

Auto Services in California

Yuba City Toyota Lincoln-Mercury ★★★★★

World Auto Body Inc ★★★★★

Wilson Way Glass ★★★★★

Willie`s Tires & Alignment ★★★★★

Wholesale Import Parts ★★★★★

Wheel Works ★★★★★

Auto blog

Volkswagen to add 50k jobs by 2018

Thu, 04 Apr 2013Volkswagen still has its eyes set on becoming the top global automaker by 2018, and to get there, it's apparently going to need more boots on the ground. Automotive News Europe is reporting that VW is looking to increase its staff by 50,000 over the next five years - an increase of nine percent - which does not include an increase in its US dealer network.

According to the report, a majority of the growth will come from China where the automaker is also looking to double its production capacity in the same time frame. The Volkswagen Group is already expected to rival General Motors for the top sales spot in China this year, and such a rapid expansion in the region could make a good springboard for sales increases in other countries.

Volkswagen Golf Wagon leaked ahead of official unveiling

Sat, 02 Mar 2013Wagons ho! These three images of the upcoming Volkswagen Golf Wagon have leaked online ahead of the car's official debut, which may very well be at the Geneva Motor Show. Looking over the photos doesn't really bring any surprises - after all, this is a VW Golf with a wagon rear end grafted on, or basically what we expect next Jetta SportWagen will be.

We can only share these three images at this time, but fret not, folks. There's little doubt that all the details and images will be flowing from Volkswagen in short order. In the meantime, click on the images above to view them in high resolution.

Bosch fuel pumps spark recall of 2015 Golf, GTI and Audi A3

Tue, Apr 28 2015A few weeks ago, BMW and Nissan both issued recalls for some of their vehicles to replace Bosch-supplied fuel pumps. The pumps had nickel plating that could flake off and cause a failure. Volkswagen Group is the latest automaker to be affected by the problem and has a campaign for the 2015 Audi A3, VW Golf and GTI. In total, 6,204 units of these models are in need of repair. The problem with the VW Group vehicles is identical to the previous recalls. It's possible for the pump's nickel plating to come off and cause increased friction. Eventually, this can result in the component's failure. According to documents from the National Highway Traffic Safety Administration (as a PDF, here), there are no reports of accidents or injuries from this issue in the VW Group models. Bosch spokesperson Linda Beckmeyer tells Autoblog that these vehicles don't all necessary share an identical fuel pump, but the parts all use the same plating process. The problem also prompted repairs of the 2014 Ford Escape several months ago, she indicated. When asked if the issue could prompt more campaigns, Beckmeyer said that she "can't speak to that" because automakers decide on the recalls. Owners should receive notice of the problem soon, but according to the NHTSA documentation, there currently aren't enough pumps to fix all of these vehicles. "Bosch is working closely with automakers regarding replacement parts," Beckmeyer said. When available, dealers will replace the components free of charge for affected customers. Related Video: RECALL Subject : Improper Plating may cause Fuel Pump to Fail Report Receipt Date: APR 17, 2015 NHTSA Campaign Number: 15V229000 Component(s): FUEL SYSTEM, GASOLINE Potential Number of Units Affected: 6,204 All Products Associated with this Recall Vehicle Make Model Model Year(s) AUDI A3 2015 VOLKSWAGEN GOLF 2015 VOLKSWAGEN GTI 2015 Details Manufacturer: Volkswagen Group of America, Inc. SUMMARY: Volkswagen Group of America, Inc. (Volkswagen) is recalling certain model year 2015 Volkswagen Golf, GTI, and Audi A3 vehicles. Improper nickel plating of components within the fuel pump may result in the fuel pump failing. CONSEQUENCE: If the fuel pump fails, the vehicle will not start, or if the engine is running, it will stop and the vehicle will stall, increasing the risk of a crash. REMEDY: Volkswagen will notify owners, and dealers will inspect the vehicles and replace any affected fuel pumps, free of charge.