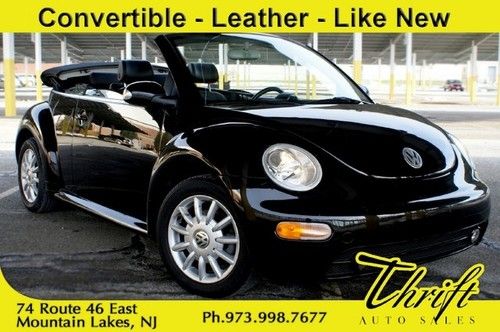

Vw,beetle,convertible on 2040-cars

Auburndale, Florida, United States

Body Type:Convertible

Vehicle Title:Clear

Engine:1.8L I-4 EFI DOHC T/

Fuel Type:Gasoline

For Sale By:Dealer

Make: Volkswagen

Model: Beetle-New

Trim: GLS Turbo

Options: Leather Seats, Convertible

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Drive Type: FWD

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows

Mileage: 56,695

Sub Model: GLS

Exterior Color: White

Number of Doors: 2

Interior Color: Tan

Warranty: Unspecified

Number of Cylinders: 4

Volkswagen Beetle-New for Sale

We finance 1999 beetle coupe gls 5spd 1 owner clean carfax pwrlcks/wndws/mrrs ac(US $5,000.00)

We finance 1999 beetle coupe gls 5spd 1 owner clean carfax pwrlcks/wndws/mrrs ac(US $5,000.00) 2001 volkswagen beetle tdi - turbocharged diesel(US $6,500.00)

2001 volkswagen beetle tdi - turbocharged diesel(US $6,500.00) 2005 volkswagen new beetle convertible gls(US $8,961.00)

2005 volkswagen new beetle convertible gls(US $8,961.00) 2003 vw beetle convertible new timing belt one owner manual trans no reserve

2003 vw beetle convertible new timing belt one owner manual trans no reserve 2013 volkswagen beetle coupe 2.5l(US $18,988.00)

2013 volkswagen beetle coupe 2.5l(US $18,988.00) One-owner~non-smoker~very low miles~leather~heated seats~dealer maintained!(US $13,960.00)

One-owner~non-smoker~very low miles~leather~heated seats~dealer maintained!(US $13,960.00)

Auto Services in Florida

Yogi`s Tire Shop Inc ★★★★★

Window Graphics ★★★★★

West Palm Beach Kia ★★★★★

Wekiva Auto Body ★★★★★

Value Tire Royal Palm Beach ★★★★★

Valu Auto Care Center ★★★★★

Auto blog

Volkswagen Golf R Variant ready to haul ass, stuff

Thu, Nov 20 2014Volkswagen seems to be playing a cruel trick on the American automotive public at the Los Angeles Auto Show. It's displaying its sexy Golf R Variant with no clear intention of actually selling the model here. The hot wagon launches in Europe in the spring, but the automaker makes absolutely no mention of the model's prospects in the US. Hopefully, its appearance in LA at least indicates VW is considering bringing it stateside. The great thing about this wagon is that it has everything that the regular Golf R offers, but there's even more room to carry stuff. The same 2.0-liter turbocharged four-cylinder engine makes 296 horsepower and 280 pound-feet of torque with a six-speed dual-clutch gearbox and 4Motion all-wheel drive. Performance is very close, too, with the Variant R taking 5.1 seconds to get to 62 miles per hour versus the 4.9 seconds the standard R needs to read 60 mph. The two of them also have the same tech goodies like ESC Sport stability control and multiple damping modes. The real advantage to opting for the estate is its ability to carry up to 57.2 cubic feet of cargo in the back. This hot rod wagon would seem to be perfect for the family that needs to haul some extra junk in the trunk, but doesn't want to sacrifice performance. Whether the Variant R makes it to the US remains a mystery, though. Scroll down to read the specs and feel a twinge of jealousy.

VW sales increase 0.6% in September despite diesel scandal

Thu, Oct 1 2015Volkswagen was spared in the month of September from posting a sales disaster, but in reality, the impending doom and gloom is likely just postponed until October. According to VW, it delivered 26,141 vehicles to its dealerships last month, which represents a 0.6-percent gain over the same period a year ago. While up, that meager increase represents the smallest uptick of all major brands in the United States, which is currently in the middle of the best vehicular sales year in the last decade. Audi, the German automaker's mainstream luxury unit, saw a bigger gain at 16.2 percent with 17,340 total units sold, thanks in large part to the popularity of its crossover models. These numbers can't totally be taken at face value, however. In 2014, Labor Day weekend was counted as part of August's sales figures; in 2015, that traditional car-buying holiday fell early in September and is therefore partly responsible for the huge increases from all brands doing business in the United States. Remember, the diesel emissions scandal didn't hit the news until September 18, which means VW was free to sell its 2.0-liter TDI engine for the majority of the month. In other words, October is going to be the real indicator of sales reckoning as it will be the first full month that the brand can't sell its popular diesel models and the first since its emissions scandal broke. Still, TDI sales were down last month. VW reports a total of 3,060 sales of vehicles equipped with TDI engines, which represents 11.7 percent of total volume. That's nearly cut in half from the TDI's year-to-date volume percentage of 20.4 percent. "We would like to thank dealers and customers for the support of the Volkswagen brand," said Mark McNabb, chief operating officer for Volkswagen of America in a statement. "Volkswagen will continue to work diligently to regain trust and confidence in our brand." It's not yet clear exactly when VW will issue a fix to make its 2.0-liter TDI engine emissions legal, or when the EPA will recertify those models for sale. Once those two things happen, dealers will again be free to sell vehicles equipped with the powertrain, but even then it remains to be seen how consumers react when the sales ban is lifted. Scroll down below for all the sales data from Volkswagen in September.

IIHS says these are the safest cars of 2013

Wed, 02 Jan 2013The Insurance Institute for Highway Safety (IIHS) has revealed its annual list of Top Safety Picks, an award that highlights automobiles it says offer "superior crash protection." A new and still more significant award, the Top Safety Pick+ honor, is given to those vehicles that earn good ratings for occupant protection in four out of five areas of measure. And while some 117 vehicles were given the TSP seal of approval for 2013, just 13 passed muster for TSP+.

To be fair, IIHS only evaluated 29 vehicles with its new testing procedures for TSP+ (we'd expect that the number of qualified cars will rise substantially for 2014). Luxury and Near Luxury midsize cars were the first groups evaluated, followed by midsizers in the Moderately Priced Cars category - unsurprisingly, it's only midsize cars that you'll find among the class this year.

Only two luxury sedans made the list of 13 for 2013: the Acura TL and Volvo S60. The other 11 cars on the list included entries from domestic, Japanese and German car makers: Dodge Avenger, Chrysler 200, Ford Fusion, Honda Accord (sedan and coupe), Kia Optima (but not its close kin, the Hyundai Sonata, strangely), Nissan Altima, Subaru Legacy and Outback, Suzuki Kizashi and the Volkswagen Passat all made the grade.