2003 Beetle Bug Lawaway Plan Available We Give U Time To Pay If U Need It Call on 2040-cars

Volkswagen Beetle-New for Sale

2010 volkswagen beetle base hatchback 2-door 2.5l final edition(US $16,500.00)

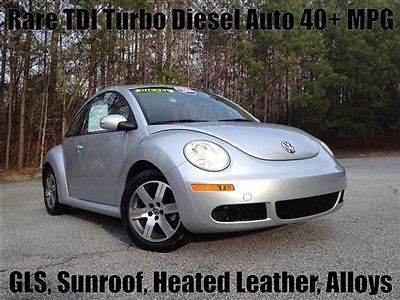

2010 volkswagen beetle base hatchback 2-door 2.5l final edition(US $16,500.00) Rare tdi turbo diesel auto gls sunroof heated leather michelin tires low miles(US $11,481.00)

Rare tdi turbo diesel auto gls sunroof heated leather michelin tires low miles(US $11,481.00) 13 new bug pano automatic spoiler limited vw stratocaster peavey gibson marshall(US $19,900.00)

13 new bug pano automatic spoiler limited vw stratocaster peavey gibson marshall(US $19,900.00) 2012 volkswagen beetle 2.5l s automatic white vw bug offers accepted(US $12,499.00)

2012 volkswagen beetle 2.5l s automatic white vw bug offers accepted(US $12,499.00) 1998 volkswagen beetle base hatchback 2-door 2.0l(US $2,000.00)

1998 volkswagen beetle base hatchback 2-door 2.0l(US $2,000.00) 2013 vw beetle coupe 1300.0 miles we say finance with great rates(US $18,981.00)

2013 vw beetle coupe 1300.0 miles we say finance with great rates(US $18,981.00)

Auto blog

We drive the Bronco Sport Sasquatch, Hummer EV SUV and more | Autoblog Podcast #846

Fri, Aug 30 2024In this episode of the Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Road Test Editor Zac Palmer. Zac recently went down to Tennessee to drive a prototype of the 2025 Ford Bronco Sport Sasquatch. Meanwhile the two also spent time in the 2024 GMC Hummer EV SUV, 2024 Mercedes-AMG GLA 35 and 2024 Lexus LS 500h out of the fleet in Michigan. In the news, Rivian deals with a fire at its Normal, Illinois plant, Formula 1 comes back strong, and Volkswagen prices the ID.Buzz. Lastly, the two debate what old, executive sedan you should buy in a Spend My Money segment. Send us your questions for the Mailbag and Spend My Money at: Podcast@Autoblog.com. Autoblog Podcast #846 Get The Podcast Apple Podcasts – Subscribe to the Autoblog Podcast in iTunes Spotify – Subscribe to the Autoblog Podcast on Spotify RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Cars we're driving 2025 Ford Bronco Sport Sasquatch 2024 GMC Hummer EV SUV 2024 Mercedes-AMG GLA 35 2024 Lexus LS 500h News Fire at the Rivian factory Formula 1 is back Volkswagen ID.Buzz gets a very high price Spend My Money Feedback Email – Podcast@Autoblog.com Review the show on Apple Podcasts Autoblog is now live on your smart speakers and voice assistants with the audio Autoblog Daily Digest. Say “Hey Google, play the news from Autoblog” or "Alexa, open Autoblog" to get your favorite car website in audio form every day. A narrator will take you through the biggest stories or break down one of our comprehensive test drives. Related Video:  We check out the Rivian R1S and R1T along with 3 other surprises This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

TN politicians may push to end VW incentives if plant goes union

Tue, 11 Feb 2014Volkswagen's Chattanooga Assembly Plant is scheduled to vote on whether to unionize in the coming days, but Tennessee state lawmakers are threatening to deny future tax subsidies to the factory, if the vote is successful. The factory is currently the only Volkswagen plant worldwide that is not unionized.

The states's Republican lawmakers have been particularly vocal against the union vote. Tennessee state senator Bo Watson said during a press conference that VW would have a "very tough time" with future incentives if the vote were successful, according to Automotive News. Tennessee House Majority Leader Gerald McCormick said the "heavy hand" of the UAW is not welcome there. VW has drawn criticism from both sides because it has allowed both pro- and anti-union groups to speak to workers and hand out leaflets.

Roughly 1,500 factory employees will vote on whether to unionize from February 12-14. If successful, the Chattanooga factory would be the first in the US organized under a German-style works council system where white- and blue-collar workers directly negotiate factory issues with the company's management.

Volkswagen unveils sportier Passat Performance Concept ahead of Detroit debut

Fri, 11 Jan 2013Ahead of its official unveiling at next week's Detroit Auto Show, Volkswagen has released some preliminary details and images of its Passat Performance Concept - a car that, as its name suggests, adds a little more spice to the automaker's midsize sedan formula. VW makes no mention of any production intent for this road-ready-looking sedan, simply stating that the Performance Concept is a way to "explore this practical four-door's sportier side."

It certainly doesn't look too sporty, the only visual upgrades being larger 19-inch wheels, dual exhaust, bi-xenon headlamps with VW's Advanced Front Lighting system, LED taillmaps and carbon-look mirror caps. Inside, there are carbon interior accents and two-tone leather upholstery. But no matter, the real upgrades for this mightier Passat are found below the sheetmetal.

Powering the Performance Concept is a 1.8-liter turbocharged four-cylinder engine, churning out 250 horsepower and sending its grunt to the ground via a six-speed automatic transmission. For reference, that's 80 more horsepower than the Passat's base 2.5-liter inline-five, but 20 horsepower less than the potent 3.6-liter VR6. As for other performance upgrades, Volkswagen has fitted the car with a lowered sport suspension and revamped electronic steering, which should indeed add a bit more dynamic feedback to the already nice-driving sedan.