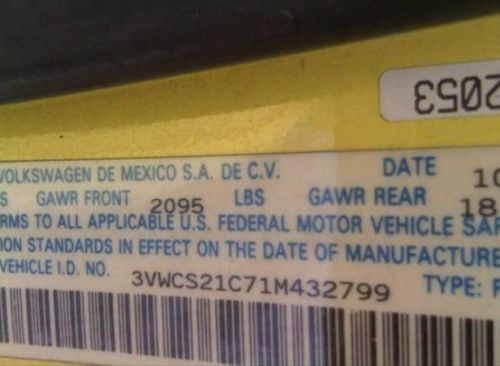

2001, New Beetle Volkswagen, Yellow, Automatic, 75,000 Miles on 2040-cars

Opa-Locka, Florida, United States

|

It's a 2001 beetle. The car was flooded. The car doesn't start. The car is sold as is. There is no such a reservation on this car. The buyer is responsible to pick up the car in 48 hours after the auction is closed. Body wise, look through the pictures, it's in good condition, interior as well. The car has 75,000 miles, which is decently low.

|

Volkswagen Beetle-New for Sale

2013 volkswagen 2.0t turbo w/sun/snd/nav(US $19,799.00)

2013 volkswagen 2.0t turbo w/sun/snd/nav(US $19,799.00) !!2006 volkswagen new beetle automatic - 84,400 mileage!! good condition!!(US $8,900.00)

!!2006 volkswagen new beetle automatic - 84,400 mileage!! good condition!!(US $8,900.00) Heated seats, monsoon stereo, mp3 jack, new tires, alloy wheels, keyless entry(US $7,500.00)

Heated seats, monsoon stereo, mp3 jack, new tires, alloy wheels, keyless entry(US $7,500.00) 2005 vw beetle gls convertible(US $8,800.00)

2005 vw beetle gls convertible(US $8,800.00) Beetle convertible salvage rebuildable repairable damaged project wrecked fixer(US $3,995.00)

Beetle convertible salvage rebuildable repairable damaged project wrecked fixer(US $3,995.00) 2006 vw beetle tdi 5 speed

2006 vw beetle tdi 5 speed

Auto Services in Florida

Workman Service Center ★★★★★

Wolf Towing Corp. ★★★★★

Wilcox & Son Automotive, LLC ★★★★★

Wheaton`s Service Center ★★★★★

Used Car Super Market ★★★★★

USA Auto Glass ★★★★★

Auto blog

US prepares to sue Fiat Chrysler over diesel emissions testing

Thu, May 18 2017NEW YORK - The Justice Department plans to file a civil lawsuit against Fiat Chrysler Automobiles NV over excess diesel emissions as early as this week if no agreement is reached with the Italian-American automaker, two sources briefed on the matter said on Wednesday. The Environmental Protection Agency in January accused FCA of illegally using undisclosed software to allow excess diesel emissions in about 104,000 cars and SUVs, the result of a probe that stemmed from regulators' investigation of rival Volkswagen AG. The EPA and California Air Resources Board have been in talks with FCA about the excess emissions and whether the agencies would approve the sale of 2017 FCA diesel models. A federal judge in California has set a May 24 hearing on a series of lawsuits filed by owners of vehicles against Fiat Chrysler and the Justice Department is expected to file its action by then if no agreement is reached. FCA said on Wednesday it believed that any litigation would be "counterproductive" to ongoing discussions with the EPA and California Air Resources Board. The company added that "in the case of any litigation, FCA US will defend itself vigorously, particularly against any claims that the company deliberately installed defeat devices to cheat U.S. emissions tests." The Justice Department took the same procedural step in early 2016 against Volkswagen, nearly four months after the German company admitted using software to emit excess diesel emissions in nearly 500,000 vehicles. The Justice Department has had an ongoing criminal investigation into FCA's conduct since last year, Reuters reported in January. The probe has turned up internal emails written in Italian and other documents about engine development and emissions issues, sources briefed on the probe said. U.S. regulators said FCA failed to disclose engine management software in 104,000 U.S. 2014-2016 Jeep Grand Cherokees and Dodge Ram 1500 trucks with 3.0-liter diesel engines. The European Commission has launched legal action against Italy for failing to respond to allegations of emission-test cheating by Fiat Chrysler in a procedure that could lead to the country being taken to court. The EPA has said the maximum possible fine against FCA could be $4.6 billion. In February, FCA said it had received requests for information and subpoenas from U.S. federal and state authorities, including the Securities and Exchange Commission, for diesel issues.

VW boss confirms Subaru-aping Golf Alltrack for US

Fri, Nov 21 2014Subaru needs to watch out, because the Japanese brand with a utilitarian image has a big bull's eye on its back. Not only is Acura considering going 100-percent all-wheel drive in a bid to mimic the successful automaker, Volkswagen has just confirmed that the Golf Alltrack is coming to the US as another competitor for Subaru's popular Outback crossover. Volkswagen Group of America CEO Michael Horn has confirmed the addition of the higher-riding, all-wheel drive version of the Golf SportWagen to Automotive News, indicating that the model will arrive in the US in 2016. "That's what our dealers, our customers, are asking us for," he said to the industry publication. The Golf Alltrack, which debuted at the Paris Motor Show in early October, has an extra 0.75 inches of ride height and protective black cladding all the way around. Its biggest mechanical differentiator from other Golfs is its Haldex all-wheel drive system, a setup that can completely unhook from the rear axle when not needed to save fuel. In Europe, the Alltrack is available with a turbocharged 1.8-liter with 178 horsepower and two diesels offering between 109hp and 182 hp. However, Horn made no mention of likely powertrains for the US. Horn tells Automotive News that all-wheel drive tooling is currently being installed at the Puebla, Mexico, factory where the standard Golf Sportwagen is built. VW might have tipped its hand about this possibility several months ago when press shots of the wagon were released for the US with TDI and 4Motion badges. Horn says he expects even the front-wheel drive version to be a sales hit here, suggesting it may eventually account for 50 percent of the Golf range's volume.

Volkswagen drops "GTi" lawsuit against Suzuki

Tue, 02 Oct 2012Way back in 2004, Volkswagen took umbrage with Suzuki being granted permission to use the nameplate "SWIFT GTi" for a performance variant of its small-car offering (2012 equivalent seen here). Now, eight years and surely some very steep legal bills later, VW has finally dropped its claim against Suzuki.

The General Court of the European Union stated, back in March of this year, that Suzuki's GTi registration could not be confused with VW's "Golf GTI." Volkswagen had appealed that ruling, though has now reportedly called off the dogs. In fact, Germany's Die Welt reports that the appeal has been dead for several weeks now.

This news comes amongst continued arbitration acrimony between the two automakers, all revolving around VW's forced divestiture of nearly 20-percent stake it purchased in Suzuki some two years ago.