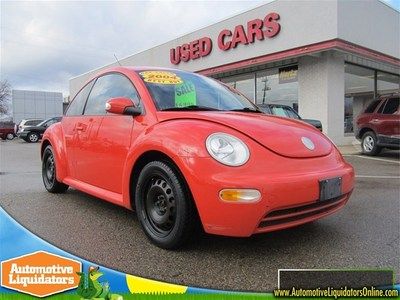

2.0l Manual - Orange On Black - Leather - Power Toys on 2040-cars

Columbus, Ohio, United States

Engine:2.0L 1984CC 121Cu. In. l4 GAS SOHC Naturally Aspirated

For Sale By:Dealer

Body Type:Hatchback

Fuel Type:GAS

Transmission:Manual

Warranty: Vehicle does NOT have an existing warranty

Make: Volkswagen

Model: Beetle

Options: CD Player

Trim: GL Hatchback 2-Door

Power Options: Power Locks

Drive Type: FWD

Vehicle Inspection: Inspected (include details in your description)

Mileage: 140,835

Number of Doors: 2

Sub Model: 2dr Cpe GL A

Exterior Color: Orange

Number of Cylinders: 4

Interior Color: Black

Volkswagen Beetle-New for Sale

Vw beetle manual hatchback 2.5l 5 clyinder engine excellent condition must sell

Vw beetle manual hatchback 2.5l 5 clyinder engine excellent condition must sell 2003 volkswagen new beetle gls 1.8 turbo -!- sporty -!- leather -!- sunroof -!-(US $8,950.00)

2003 volkswagen new beetle gls 1.8 turbo -!- sporty -!- leather -!- sunroof -!-(US $8,950.00) 2004 volkswagen new beetle gls 2.0 manual 73 k mls(US $6,650.00)

2004 volkswagen new beetle gls 2.0 manual 73 k mls(US $6,650.00) 01 beetle gls tdi diesel at sunroof leather we finance!!!(US $6,995.00)

01 beetle gls tdi diesel at sunroof leather we finance!!!(US $6,995.00) 2007 volkswagen beetle auto cd audio cruise ctrl 72k mi texas direct auto(US $9,980.00)

2007 volkswagen beetle auto cd audio cruise ctrl 72k mi texas direct auto(US $9,980.00) Gls conv manual convertible 2.0l abs leather

Gls conv manual convertible 2.0l abs leather

Auto Services in Ohio

Yonkers Auto Body ★★★★★

Western Reserve Battery Corp ★★★★★

Walt`s Auto Inc ★★★★★

Valvoline Instant Oil Change ★★★★★

Valvoline Instant Oil Change ★★★★★

Tritex Corporation ★★★★★

Auto blog

VW outsells GM in China for first time in 8 years

Fri, 26 Oct 2012In case you didn't know, Volkswagen is hell-bent on becoming the largest automaker in the world. The German carmaker has inched closer to that goal, having outsold General Motors in China last quarter for the first time in eight years.

Volkswagen's sales in China, its largest marker, increased by 21 percent last quarter to 704,991 units. Those numbers almost tripled GM's third-quarter growth, and were enough to beat out the American automaker's 664,765 sales. GM, however, still leads in year-to-date sales in China by a slim margin of around 77,000 units. The Asian nation also happens to be GM's largest market, and according to the report in Automotive News, China's car market may grow to be larger than the US, Japan and Germany combined in three years' time.

About the news his company was bested in China by VW last quarter, GM CEO Dan Akerson is quoted saying, "It's not whether you're the biggest car manufacturer. It's whether you want to be the most profitable." It should be noted of these figures that GM includes truck figures, yet excludes Hong Kong and Macau from its Chinese sales numbers, while VW does just the opposite. Through September of this year, Volkswagen had 5 of the 10 best selling vehicles in China. GM boasted three of the cars on that list.

New investor allows Suzuki to fend off VW

Tue, Aug 4 2015After years of legal wrangling, the long-soured partnership between Volkswagen and Suzuki looks finally to be coming out of arbitration, according to Bloomberg. As a sign of the Japanese brand's improved fortunes, hedge fund Third Point LLC recently bought an undisclosed stake in the company. The investor reported seeing a major opportunity in the successful Maruti Suzuki business in India. As an investment, the only major problem that Third Point found with Suzuki was its legal battle with VW. "The company's greatest asset is its low-cost manufacturing process for vehicles for the emerging market consumer," the fund said in a letter, according to Bloomberg. Third Point reportedly also wants a seat on Suzuki's board, despite being a minority shareholder. The alliance between Suzuki and VW goes back to late 2009. In the deal, the Japanese brand was meant to get access to cutting-edge tech, and the German firm got a helping hand towards better establishing itself in India and Southeast Asia. Things didn't go as planned, though. Less than two years later, Suzuki's boss publicly derided the deal. Eventually, the allegations started going back and forth, and the two have been working out a way to untangle practically ever since. Among the biggest issue has been how to get back the 19.9 percent stake that VW purchased. According to Bloomberg, the arbitration is now technically over. With the divorce nearly final, the two sides are just waiting on a decision on how to split things up. Suzuki may even just buy VW's stake to get the shares back.

EU formally questions French government assistance of Peugeot's finance arm

Fri, 28 Dec 2012Recently, the finance arm of PSA/Peugeot-Citroën was in such debt trouble that it was pricing itself out of the car loan market. The rates it was paying to service its debt, which was rated one step above junk, were so high that it was forced to charge car-buying customers higher rates than they could find elsewhere. This was adding to Peugeot's already impressive woes by sending revenue out the door to competitors.

Two months ago a deal was worked out with the French government whereby the state would provide 7 billion euro ($9 billion USD) in bonds to guarantee the finance arm's loans. The French government could nominate someone to join the Peugeot board, Peugeot would guarantee more French jobs, and on top of that deal, other banks would provide non-guaranteed loans. The government would take no equity stake in the car company.

Although not yet finalized, the arrangement is meant to create some breathing room for Peugeot Finance to lower its interest rates for customers, and a government-nominated board member, Louis Gallois, was recently named to Peugeot's supervisory board. The arrangement was also openly questioned by at least three competitors: Ford, Renault - which is 15-percent owned by the French government after it received state aid - and the German state of Lower Saxony, itself a 15-percent shareholder in Volkswagen.