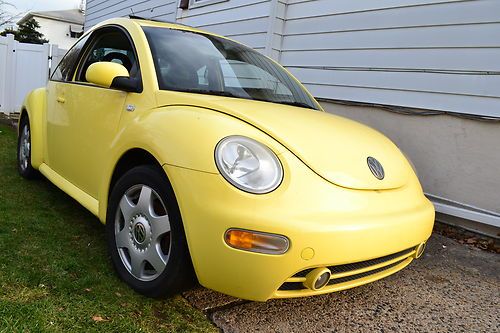

2003 Volkswagen Beetle Gl Convertible 2-door 2.0l on 2040-cars

Strongsville, Ohio, United States

Body Type:Convertible

Vehicle Title:Clear

Engine:automatic

Fuel Type:GAS

For Sale By:Private Seller

Make: Volkswagen

Model: Beetle - Classic

Trim: leather seats

Options: 4-Wheel Drive, Leather Seats, CD Player, Convertible

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Drive Type: front wheel drive

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Mileage: 123,000

Exterior Color: Yellow

Interior Color: Black

Number of Doors: 2

Number of Cylinders: 4

Warranty: Vehicle does NOT have an existing warranty

New brakes , tires and CD player with bluetooth connection.

Back windows and convertible do not operate.

Heated seats.

No known mechanical problems.

Volkswagen Beetle - Classic for Sale

Ultra-rare convertible, comprehensivly restored, 1200cc flat-four, 12-volt elect(US $25,995.00)

Ultra-rare convertible, comprehensivly restored, 1200cc flat-four, 12-volt elect(US $25,995.00) 1998 volkswagen beetle base hatchback 2-door 2.0l

1998 volkswagen beetle base hatchback 2-door 2.0l Sunny yellow super beetle, nicely preserved, highly accurate, staggered stance(US $11,995.00)

Sunny yellow super beetle, nicely preserved, highly accurate, staggered stance(US $11,995.00) 2001 volkswagen beetle gls hatchback 2-door 1.8l low miles.

2001 volkswagen beetle gls hatchback 2-door 1.8l low miles. 2002 volkswagen beetle gls hatchback 2-door 1.9l(US $5,850.00)

2002 volkswagen beetle gls hatchback 2-door 1.9l(US $5,850.00) 1974 volkswagen super beetle deluxe sedan(US $7,500.00)

1974 volkswagen super beetle deluxe sedan(US $7,500.00)

Auto Services in Ohio

Wired Right ★★★★★

Wheel Medic Inc ★★★★★

Wheatley Auto Service Center ★★★★★

Walt`s Auto Inc ★★★★★

Walton Hills Auto Service ★★★★★

Tuffy Auto Service Centers ★★★★★

Auto blog

Cruze Diesel Road Trip reveals the good and bad, but no ugly

Tue, Mar 31 2015Most of us have strong opinions on diesel-powered cars based on our perceptions of and experience with them. I used to thoroughly dislike oil burners for their noise, smoke and lackluster performance, and the fact that they ran on greasy, smelly stuff that was more expensive than gasoline, could be hard to find and was nasty to get on your hands when refueling. Those negatives, for me, trumped diesel's major positives of big torque for strong acceleration and better fuel economy. Are any of those knocks on diesel still valid today? I'm not talking semis, which continue to annoy me when their operators for some reason almost never shut them down. At any busy truck stop, the air seems always filled with the sound – and sometimes smell – of dozens of big-rig diesels idling endlessly and mindlessly. Or diesel heavy-duty pickups. Those muscular workhorses are far more refined than they once were and burn much less fuel than their gasoline counterparts. But good luck arriving home late at night, or departing early morning, without waking your housemates and neighbors with their clattery racket. No, I'm talking diesel-powered passenger cars, which account for more than half the market in Europe (diesel fuel is cheaper there) yet still barely bump the sales charts in North America. Diesel fuel remains more expensive here, too few stations carry it, and too many Americans remember when diesel cars were noisy, smelly slugs. Also, US emissions requirements make them substantially more expensive to certify, and therefore to buy. But put aside (if you can) higher vehicle purchase and fuel prices, and today's diesel cars can be delightful to drive while delivering much better fuel efficiency than gas-powered versions. So far in the US, all except Chevrolet's compact Cruze Diesel come from German brands, and all are amazingly quiet, visually clean (no smoke) and can be torquey-fun to drive. When a GM Powertrain engineering team set out to modify a tried-and-true GM of Europe turbodiesel four for North American Chevy Cruze compacts, says assistant chief engineer Mike Siegrist, it had a clear target in mind: the Volkswagen Jetta TDI 2.0-liter diesel. And they'll tell you that they beat it in nearly every way. "I believe we have a superior product," he says. "It's powerful, efficient and clean, and it will change perceptions of what a diesel car can be." The 2.0L Cruze turbodiesel pumps out 151 SAE certified horses and 264 pound-feet of torque (at just 2,000 rpm) vs.

Volkswagen could outsell GM in China for the first time in nine years

Fri, 27 Dec 2013As of the end of November, Volkswagen had sold 70,000 more cars than General Motors in China in 2013, making it appear inevitable that VW will outsell GM there. The feat would return the German brand to the top of chart in China for the first time in nine years, but even the second-place getter won't be complaining too loudly: both automakers sold more than three million vehicles in a market pegged to hit 16 million sales this year.

Volkswagen said it could have sold more cars if it had had more production capacity in China. The arrival of a new-to-China Audi A4, a China-built A3 sedan, the VW Bora and Skoda Octavia, as well as an $18.2-billion-euro investment in the country to construct new factories, means VW should see its numbers grow in 2014. GM's lineup is expanding next year, too, adding four Chevrolet nameplates and two vehicles to its Baojun brand as it tries to get to five million in sales by 2015.

Among other automakers, Ford benefited from good product and woes for Japanese automakers over a territorial dispute with China, outselling Toyota by almost 32,000 units through the end of November. The Ford Focus is China's best-selling vehicle so far this year.

Anti-UAW VW workers move to form own union

Sat, 30 Aug 2014The struggle over unionization at the Volkswagen factory in Chattanooga, TN, continues to get more complicated. There's now a second union fighting to organize at the plant; although this one is staunchly against the actions of the United Auto Workers. At the same time, the UAW is still signing up voluntary members to its recently created Local 42 at the facility and is reportedly near having a majority of the hourly employees on its side.

The new, anti-UAW union campaign is being spearheaded by employee Mike Burton, according to Reuters, and he calls his group the American Council of Employees. He claims to already have 108 signatures in support of his organization. Burton believes that the UAW is harmful to businesses, and his goal is to force another vote to determine a preferred union among workers.

The UAW was initially defeated (712 to 626) when it attempted a union vote at the Tennessee plant in February. However, UAW secretary-treasurer Gary Casteel told Reuters that Local 42 has already signed up over 700 members. If it can reach a majority of the roughly 1,500 employees, the group hopes VW might consider recognizing it as the factory's union.