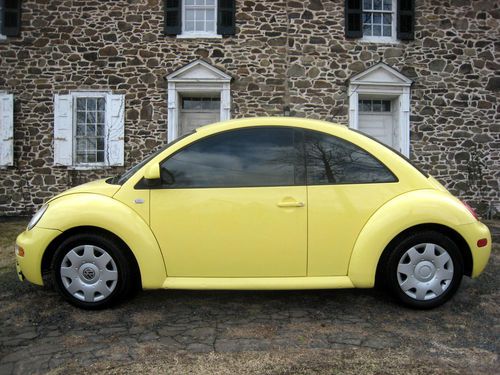

2000 Volkswagen Beetle Gls Hatchback 2-door 2.0l... No Reserve on 2040-cars

New Hope, Pennsylvania, United States

Transmission:Automatic

Body Type:Hatchback

Vehicle Title:Clear

Fuel Type:GAS

For Sale By:Dealer

Make: Volkswagen

Mileage: 118,795

Model: Beetle

Sub Model: GLS

Trim: GLS Hatchback 2-Door

Exterior Color: Yellow

Interior Color: Black

Drive Type: FWD

Number of Cylinders: 4

Warranty: Vehicle does NOT have an existing warranty

Options: CD Player

Number of Doors: 2

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Power Options: Power Locks, Power Windows

Volkswagen Beetle - Classic for Sale

1956 vw volkswagen beetle, bug solid, partially restored, clear title(US $4,900.00)

1956 vw volkswagen beetle, bug solid, partially restored, clear title(US $4,900.00) 1973 vw beetle excellent runing. new tires, new head liner, original parts(US $4,500.00)

1973 vw beetle excellent runing. new tires, new head liner, original parts(US $4,500.00) 1968 voltswagon bug(US $9,000.00)

1968 voltswagon bug(US $9,000.00) 1970 volkswagen beetle convertible(US $9,450.00)

1970 volkswagen beetle convertible(US $9,450.00) 1969 volkswagon custom baja

1969 volkswagon custom baja

Auto Services in Pennsylvania

Zuk Service Station ★★★★★

york transmissions & auto center ★★★★★

Wyoming Valley Motors Volkswagen ★★★★★

Workman Auto Inc ★★★★★

Wells Auto Wreckers ★★★★★

Weeping Willow Garage ★★★★★

Auto blog

Volkswagen rolls out all-new Polo R WRC

Sat, Jan 17 2015Volkswagen may have ruled out producing a road-going Polo more potent than the new GTI, but on the rally stage, the Polo R WRC has proven absolutely dominant. Introduced to the World Rally Championship in 2013, the Polo R won ten out of the baker's dozen rallies in its debut season, and all but one last year to win both titles two years running. That's quite an act to follow, and the task falls to the machine you see here. The new second-generation Polo R WRC was just revealed at Autostadt in Wolfsburg. The rally machine has been substantially reworked for 2015, with a new livery, new bodywork and new oily bits. In fact, Volkswagen says it has revised three quarters of the components, and while it has not yet detailed the "many new ideas [implemented] under the bonnet," it has identified the hydraulic gearbox as "the biggest innovation." Further details are still to come, but this is our first look at the new machine with which Sebastien Ogier, Jari-Matti Latvala and Andreas Mikkelsen – who finished last year's championship in first, second and third, respectively – will tackle this year's championship, starting with the Rally Monte Carlo on January 22-25. FIA World Rally Championship (WRC) New technology, new design: presenting the second generation Polo R WRC - World premiere of the 318-hp Polo R WRC in Wolfsburg - Member of the Board, Dr. Heinz-Jakob Neusser, launches title defence - WRC kicks off with the iconic Rally Monte Carlo from 22–25 January Wolfsburg (15 January 2015). In top form, both technically and visually: Volkswagen presented the second generation of the Polo R WRC in Autostadt, Wolfsburg. The works team from Wolfsburg has its sights set firmly on another successful defence of its titles in the FIA World Rally Championship (WRC) with a new car and a new look. Volkswagen completed a clean sweep of all the World Championship titles when the Polo R WRC made its debut in 2013, before repeating this impressive feat last season. Continuity is the key to the driving line-up for 2015: double world champions Sebastien Ogier/Julien Ingrassia (F/F) and team-mates Jari-Matti Latvala/Miikka Anttila (FIN/FIN) and Andreas Mikkelsen/Ola Floene (N/N) will roll down the starting ramp and head onto the first special stage of the year for Volkswagen at the legendary Rally Monte Carlo on 22 January. "The new Polo R WRC has undergone intense further development, both on the inside and the outside," said Dr.

United States drivers buying fewer Mexican-made cars

Tue, May 10 2016Crossovers and pickup trucks are not only growing in market share, they're also more profitable than cars. A crossover on the same platform as a sedan retails for thousands more, despite similar components. It's one of the reasons we've seen automakers rapidly shifting production of their sedans and hatchbacks to Mexico, where cheap labor preserves the thin profit margins on these inexpensive vehicles. But as the market continues to shift in the United States, Mexico is getting burned by its lack of product diversity. The country's auto exports, which are heavy on cars, suffered a 16-percent drop last month, Automotive News reports. In total, year-over-year exports fell from 233,515 to 197,020 last month, while year-to-date exports are down by 7.4 percent, from 922,029 to 854,118. The number one culprit? America – which usually accounts for 75 percent of Mexico's exports – and its appetite for crossovers and pickup trucks bolstered by cheap gas prices. While Mexico does build some light truck models – AN specifically calls out the Ram 2500, Honda HR-V, GMC Sierra, and Toyota Tacoma as export leaders – the vast majority of vehicles rolling out of its factories are sedans and hatchbacks. In fact, the three biggest drops in Mexican exports came from companies whose south of the border factories only build cars – Ford (Fusion/Lincoln MKZ and Fiesta), Mazda (Mazda3), and Volkswagen (Golf and Jetta). Mexican Automotive Industry Association President Eduardo Solis told AN the export shortfall will likely be sorted out sooner rather than later, thanks to a pair of new factories – a Kia car factory and an Audi SUV plant – that are coming online by year's end. The two facilities will add around 100,000 vehicles to the country's export totals, which Solis said should leave the industry on the verge of breaking another export record in 2016. But how sustainable will these record-breaking years be? Slapping an "Hecho en Mexico" sticker on a new German SUV won't be enough to change the fact that Mexico's product mix is tilted too heavily towards body styles that are not growing in volume. Mexico's record-breaking export years probably aren't at an end, but we'd argue they're certainly under threat. News Source: Automotive News - sub. req.Image Credit: Omar Torres / AFP / Getty Images Plants/Manufacturing Ford GMC Honda Mazda RAM Volkswagen Truck Crossover SUV Mexico

VW quite interested in solid-state batteries for EVs

Tue, Mar 24 2015Volkswagen is about to make a decision about which advanced battery technology the automaker will seriously investigate to give its electric vehicles more range. VW will decide by July if it will use solid-state batteries made by US-based QuantumScape Corp. in future EVs, according to Bloomberg News. Last year, VW bought a five-percent stake in QuantumScape, which was founded by ex-Stanford University researchers. The lure is that QuantumScape's solid-state batteries may provide a single-charge range of as long as 430 miles. That's more than three times the current range of the VW e-Golf electric vehicle the company recently started selling to the public and is substantially longer than the single-charge range of the Tesla Model S electric sedan. The batteries are also fireproof, making VW's potential decision one with an eye towards more vehicle safety. Solid-state battery technology, in which solid lithium electrodes are used instead of liquid electrodes such as those in lithium-ion batteries, are the subject of research at other automakers and suppliers as well. Toyota says they could be here by 2020. Recently, the cordless vacuum cleaner maker Dyson acquired a $15-million equity stake in Michigan-based battery maker Sakti3 with the idea of using the startup's solid-state batteries in its products. General Motors also has a minority stake in Sakti3, which was spun off from the University of Michigan.