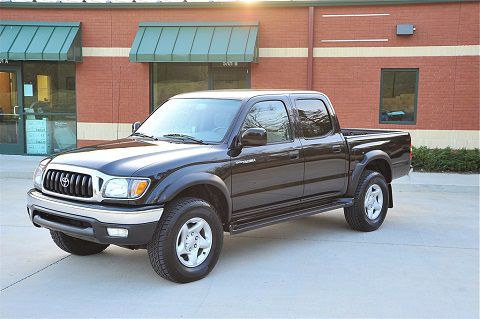

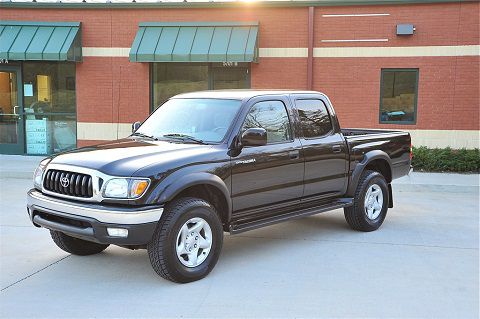

Sell 2003 Toyota Tacoma Low Price 2000$$$ on 2040-cars

San Francisco, California, United States

Very nice Toyota Tacoma double cab -, interior light and cargo holder! Bedliner w/ sport rails. Cloth seats. Automatic /Air/ Cruise / CD / backup camera / bluetooth! Sliding rear window. All service documented. GREAT SHAPE! WONT LAST LONG!! Please Call me Number:(707) 560-4233.

Toyota Tacoma for Sale

Sell 2003 toyota tacoma low price 2000$$$(US $2,000.00)

Sell 2003 toyota tacoma low price 2000$$$(US $2,000.00) 2014 toyota tacoma(US $10,010.00)

2014 toyota tacoma(US $10,010.00) Toyota tacoma pre runner extended cab pickup 4-doo(US $11,000.00)

Toyota tacoma pre runner extended cab pickup 4-doo(US $11,000.00) Toyota tacoma trd off road(US $14,000.00)

Toyota tacoma trd off road(US $14,000.00) Toyota tacoma sx(US $3,000.00)

Toyota tacoma sx(US $3,000.00) Toyota tacoma sr5(US $3,000.00)

Toyota tacoma sr5(US $3,000.00)

Auto Services in California

Zube`s Import Auto Sales ★★★★★

Yosemite Machine ★★★★★

Woodland Smog ★★★★★

Woodland Motors Chevrolet Buick Cadillac GMC ★★★★★

Willy`s Auto Service ★★★★★

Western Brake & Tire ★★★★★

Auto blog

Japan offering $20,000 incentives for hydrogen fuel cell vehicles

Wed, Jul 23 2014That tailwind Toyota may be feeling in Japan won't be from a stiff breeze off the northern Pacific Ocean. The Japanese automaker is getting ready to start selling its first production hydrogen fuel-cell vehicle in its native country next year. And the government is ponying up real big in incentives, Reuters says. The Japanese government will provide incentives worth about $20,000 per fuel-cell vehicle, Reuters reports, citing Prime Minister Shinzo Abe. That sort of government money will bring Toyota's first hydrogen fuel-cell vehicle to the customer at under $50,000. Just so we're clear, Japan's incentives for battery-electric vehicles top out at about $8,500. That sound you hear is a bunch of Nissan executives tearing their hair out. Last month, Toyota said the price for the fuel-cell sedan would be about $69,000 in Japan, and while the company hasn't priced it for US consumption, the word's out that the car may be in the $50,000 range stateside. The fuel-cell sedan, which has a full-tank range of about 300 miles, goes on sale in Japan next April and will start sales in Europe and the US next summer. Honda is also debuting its first production fuel-cell vehicle next year, so Toyota's got company among automakers who are probably all raising a glass and saying "kampai" to the Japanese government right about now.

Is 120 miles just about perfect for EV range?

Tue, Apr 15 2014When it comes to battery-electric vehicles, our friend Brad Berman over at Plug In Cars says 40 miles makes all the difference in the world. That's the approximate difference in single-charge range between the battery-electric version of the Toyota RAV4 and the Nissan Leaf. It's also the difference between the appearance or disappearance of range anxiety. The 50-percent battery increase has zapped any lingering range anxiety, Berman writes. The RAV4 EV possesses a 40-kilowatt-hour pack, compared to the 24-kWh pack in the Leaf. After factoring in differences in size, weight and other issues, that means the compact SUV gets about 120 miles on a single charge in realistic driving conditions, compared to about 80 miles in the Leaf. "The 50 percent increase in battery size from Leaf to RAV has zapped any lingering range anxiety," Berman writes. His observations further feed the notion that drivers need substantial backup juice in order to feel comfortable driving EVs. Late last year, the Union of Concerned Scientists (UCS), along with the Consumers Union estimated that about 42 percent of US households could drive plug-in vehicles with "little or no change" in their driving habits, and that almost 70 percent of US commuters drive fewer than 60 miles per weekday. That would imply that a substantial swath of the country should be comfortable using a car like the Leaf as their daily driver - with first-quarter Leaf sales jumping 46 percent from a year before, more Americans certainly are. Still, the implication here is that EV sales will continue to be on the margins until an automaker steps up battery capabilities to 120 or so miles while keeping the price in the $30,000 range. Think that's a reasonable goal to shoot for?

Toyota sees Camry share loss despite predicting increasing sales

Tue, 02 Apr 2013Toyota may be set to lose share the midsize sedan market. While speaking with Automotive News, Toyota North America CEO Jim Lentz said that if his company kept pace with the current swell in the market for family four doors, Toyota would need to sell around 500,000 Camry models. "I'm not sure we can do much more than 400 [thousand] today," Lentz said.

But that doesn't mean Camry sales are shrinking - on the contrary, Lentz thinks Toyota will likely sell more Camry units in 2013 than it did in 2012, it's just that the company isn't keeping pace with segment's current explosion in popularity. Industry wide, midsized sedan sales have increased by 20 percent. "Are we going to lose [Camry] share? Probably so," Lentz said, "but we will continue to grow in raw volume."

Toyota sold 404,886 Camry units last year, and the company just revised its 2013 sales objective from 2.18 million units earlier this year to 2.2-million plus units, so while things are looking up for the brand and Camry sales may be on the rise, Toyota may not have the muscle to keep up its share in the sedan segment. Whether that's because of a production bottleneck or a predicted sales ceiling isn't clear. We've got a call in and will update this news item if/when we learn more.