2023 Toyota Sienna Xle on 2040-cars

Delavan, Wisconsin, United States

Engine:2.5L I4

Fuel Type:Gasoline

Body Type:4D Passenger Van

Transmission:CVT

For Sale By:Dealer

VIN (Vehicle Identification Number): 5TDJSKFC4PS089669

Mileage: 131

Make: Toyota

Trim: XLE

Features: --

Power Options: --

Exterior Color: Black

Interior Color: Black

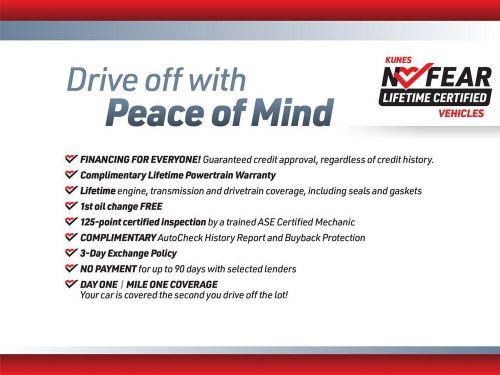

Warranty: Unspecified

Model: Sienna

Toyota Sienna for Sale

2017 toyota sienna xle 8 passenger 4dr mini van(US $100.00)

2017 toyota sienna xle 8 passenger 4dr mini van(US $100.00) 2015 toyota sienna xle(US $16,980.00)

2015 toyota sienna xle(US $16,980.00) 2022 toyota sienna xle(US $27,000.00)

2022 toyota sienna xle(US $27,000.00) 2006 toyota sienna(US $2,500.00)

2006 toyota sienna(US $2,500.00) 2021 toyota sienna xle(US $40,597.00)

2021 toyota sienna xle(US $40,597.00) 2015 toyota sienna xle 8-passenger(US $19,999.00)

2015 toyota sienna xle 8-passenger(US $19,999.00)

Auto Services in Wisconsin

Wildes Transmission ★★★★★

Waller`s Auto Glass Express ★★★★★

Van Hoof Service ★★★★★

Transmission Shop ★★★★★

Tracey`s Automotive ★★★★★

T & N Tire Service ★★★★★

Auto blog

Hybrid, Plug-in Hybrid and EV Buyer's Guide: Which one do you want?

Fri, Nov 10 2017If you're shopping for a new vehicle these days, there's a litany of acronyms, buzzwords, and technobabble to further complicate an already difficult decision. But if you're looking at a green powertrain, you have three basic choices to compare: hybrid, plug-in hybrid and "EV" or, electric vehicle. So what are they and which one — if any — is right for you? Research your next new vehicle using Autoblog's Car Finder. Gasoline-Electric Hybrids By now, most people are familiar with the concept of a hybrid car. Thank Toyota's Prius for that. At its most basic, a hybrid vehicle has two powertrains, one gasoline and one electric, which work together for maximum efficiency. At low speeds, the engine can shut off entirely, relying solely on the battery for propulsion. The battery is either charged as you drive by converting kinetic energy into potential energy via a complex regenerative braking system, or directly off of the gas motor. This is a very hands-off, behind-the-scenes system as all the driver has to is put in gas and drive as normal. Hybrids come in all shapes and sizes and, according to the EPA, range in fuel economy from 58 mpg for the Hyundai Ioniq Blue all the way down to 13 mpg for the Ferrari LaFerrari Aperta. Best For: Anyone who want to see their fuel consumption go down without many sacrifices. You can easily find a hybrid sedan, hatchback, crossover, SUV or even a pickup truck (i f you can find one). Best of all, a hybrid requires no special equipment to be installed at home, or added work for the driver. Hybrids do cost more than traditionally-powered competitors, so make sure to compare projected fuel savings with how much extra a hybrid will cost – it may take a surprisingly long time to break even. The EPA provides a handy calculator for this very purpose. Our Favorite Hybrids: 2017 Toyota Prius 2018 Hyundai Ioniq Hybrid 2017 Ford Fusion Hybrid Plug-In Hybrids Sometimes referred to as a PHEV, or plug-in hybrid electric vehicle, this is a baby-step towards full electrification. Armed with a much larger battery pack than a hybrid, PHEVs can go between 12 ( Mercedes-Benz GLE550e) and 97 ( BMW i3 w/Range Extender) miles on electricity alone depending on the model and your driving style. Like a normal hybrid, the driver is largely unaware of which power source is currently in use, even as they switch over — either because the battery is drained, or the driving circumstances require more power.

2014 Toyota Highlander

Tue, 17 Dec 2013Midsize crossovers like the Toyota Highlander tend to play a thankless role in the life of today's modern family.

That's really too bad. With the ability to hold several hyperactive kids and tons of cargo while keeping everyone safe and comfortable in all kinds of climate conditions day in and day out, they're true heroes in the lives of hundreds of thousands of families across the country. Yet their car-apathetic owners often immediately forget about them as soon as their work is done. And nearly all midsize crossovers are thoroughly ignored by enthusiasts whose eyes begin to glaze over at first mention of the phrase "third row."

Toyota is looking to soften the blow somewhat by giving its midsize crossover, the Highlander, a big redesign for the 2014 model year. With a bold new look, updated suspension and a refreshed interior focused on comfort and convenience, Toyota aims to make the Highlander sportier to drive and more striking in appearance, because, as the marketing team explains, "families are going places and they want to get there in style."

Toyota finds profit in Europe thanks to hybrid sales

Thu, Jun 5 2014In the land of diesel, Toyota appears to be making money its own way and thereby making more of it. The Japanese automaker is taking on Europe's diesel-centric ways by substantially boosting sales of hybrids on the continent. That, along with cost cutting measures, has increased the company's European profitability, Automotive News says, citing recent remarks by Toyota's European operations chief Didier Leroy. Toyota, which lost money in Europe between 2008 and 2011, started turning things around two years ago by cutting labor at places like UK factories while consolidating production of models such as the Auris and Yaris hybrid vehicles. During the most recently completed financial year, Toyota Europe reported earnings that were up 75 percent from the year before, despite revenue being up just five percent. The company also aims to sell at least 1 million vehicles in Europe by next year and is boosting sales in countries like Russia. Late last year, Didier told Bloomberg News that Toyota's European market share was rising about one percentage point a year, while production at Toyota's factories in countries like France, Turkey and the UK were running at full capacity. Toyota estimated at the time that hybrids accounted for about a fifth of Toyota's European sales.