2010 Prius on 2040-cars

Colts Neck, New Jersey, United States

|

2010 Prius

Bought brand new and dealer maintained by Freehold Toyota. Oil changes religiously, two new front tires last month. Female teacher owned, the only reason we are selling it is we just has a baby and we are getting a bigger car thats a 4x4. Now for the Boo boo's. The rear passengers side bumper was scratched when I backed into a car at school which was illegally parked. The side of the car behind the rear door got scratched up during the snow storm. I rubbed against a fake pot planter which was snow covered on the outside of a gas pump. There is around 59,850 miles on the car. Might go up a little but I doubt it. I tried to price the car accordingly, the guy at the local garage wanted 450 to 500 to fix those two problems. It is showing up as 2 owners because I was not married when I first purchased the vehicle. I am the original owner and it was just a last name change. If you have any questions give me a call at 732.672.1733 The car was always maintained by the dealer and there hasn't been any problems with it at all. |

Toyota Prius for Sale

5dr hb two toyota prius low miles 4 dr hatchback cvt 1.8l l4 fi dohc 16v classic

5dr hb two toyota prius low miles 4 dr hatchback cvt 1.8l l4 fi dohc 16v classic 2013 toyota prius iii hybrid bluetooth keyless go gas saver one owner

2013 toyota prius iii hybrid bluetooth keyless go gas saver one owner Ii low miles automatic 1.8l dohc 16-valve vvt-i atkinson-cycle i4 hybrid gold

Ii low miles automatic 1.8l dohc 16-valve vvt-i atkinson-cycle i4 hybrid gold !no reserve! 2 owners! no accidents! clean! hybdrid! must sell! leather!

!no reserve! 2 owners! no accidents! clean! hybdrid! must sell! leather! 2014 toyota prius damaged repairable economical only 8k miles priced to sell!!(US $9,950.00)

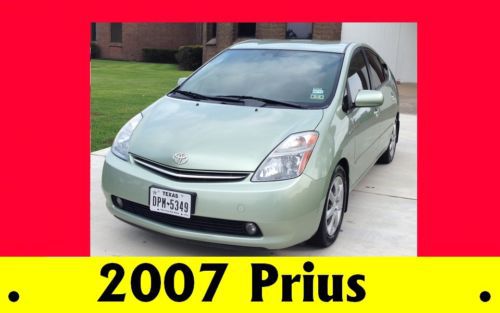

2014 toyota prius damaged repairable economical only 8k miles priced to sell!!(US $9,950.00) 2007 toyota prius camera jbl smart key serviced car bluetooth 09 08 07 2007 2008(US $9,990.00)

2007 toyota prius camera jbl smart key serviced car bluetooth 09 08 07 2007 2008(US $9,990.00)

Auto Services in New Jersey

Zambrand Auto Repair Inc ★★★★★

W J Auto Top & Interiors ★★★★★

Vreeland Auto Body Co Inc ★★★★★

Used Tire Center ★★★★★

Swartswood Service Station ★★★★★

Sunrise Motors ★★★★★

Auto blog

Toyota confirms 2014 Highlander is in a New York state of mind

Wed, 13 Mar 2013Toyota has confirmed that it will be showing off the all-new 2014 Highlander at the New York Auto Show later this month. It's been a while since we've heard about the updated Highlander, but given just how long this thing has been on the market, we certainly hope that the list of changes will be more extensive than the new 2014 Toyota Tundra that debuted in Chicago last month.

Currently, the Highlander is offered in both naturally aspirated and hybrid versions, with front- and all-wheel drive. We don't expect the formula to change too much, since sales of the Japanese CUV are still steady - well in line with newer players in the segment like the Ford Explorer, Nissan Pathfinder and GM's Lambda triplets (Chevrolet Traverse, GMC Acadia and Buick Enclave).

We'll have the full skinny on the new Highlander in the coming weeks. For now, scroll down to read Toyota's incredibly brief press blast.

Toyota settles for $3M after being found liable in sudden acceleration case

Sat, 26 Oct 2013A jury has decided that faulty software was to blame for a crash involving a 2005 Toyota Camry that killed one woman and injured another. This is the first time Toyota has been found liable by a jury in a lawsuit involving sudden acceleration claims. Toyota has maintained that driver error is the most likely cause for cases of sudden acceleration.

Shortly after the jury in the case, which took place in Oklahoma and centered around a crash that injured 76-year-old Jean Bookout and killed her passenger, Barbara Schwarz, reached a verdict that would see Toyota paying $3 million in compensatory damages, a confidential settlement was reached. The jury, which had found Toyota liable for "reckless disregard" for public safety, had yet to decide what punitive damages Toyota would face.

Toyota said in a statement, "While we strongly disagree with the verdict, we are satisfied that the parties reached a mutually acceptable agreement to settle this case. We will continue to defend our products vigorously at trial in other legal venues."

US Congress lets $8,000 hydrogen vehicle tax credit expire

Mon, Dec 22 2014When Toyota introduced the 2016 Mirai last month in preparation for a launch late next year, it said that the hydrogen car will have a $57,500 MSRP and that there will be a federal tax credit available worth up to $8,000. The problem, as we noted at the time, is that that federal credit was set to expire at the end of 2014. The technical language of the current rule says that someone who buys a fuel cell vehicle, "may claim a credit for the certified amount for a fuel cell vehicle if it is placed in service by the taxpayer after Dec. 31, 2005, and is purchased on or before Dec. 31, 2014." With the 113th Congress now finished up for the year and legislators headed home for the holidays, we know one thing for certain: the federal tax credit for hydrogen vehicles was not updated and will end as we're all singing Auld Lang Syne next week. All of this isn't to say that Mirai buyers won't be able to take $8,000 off the price of the car 12 months from now. For proof of that, we only need to look at other alternative fuel tax incentives and realize that this Congress simply isn't moving fast enough to deal with things that are expiring right now. One of the last things that the 113th Congress did in December was to take up the tax credits that expired at the end of 2013 and renew some of them. Jay Friedland, Plug In America's senior policy advisor, told AutoblogGreen that PIA and other likeminded organizations worked with Congress to extended the electronic vehicle charging station (technically: EVSE) tax credit that was part of the Alternative Refueling Tax Credit in IRS Section 30(C) through the end of 2014. "Individuals can deduct 30 percent of the cost of purchasing and installing an EVSE up to $1,000; businesses, 30 percent up to $30,000," he said. "This tax credit is applied to any system placed into service by 12/31/14 and is retroactive to the beginning of the year. So go out and buy your favorite EV driver an EVSE for the holidays," he said. An electric motorcycle credit was killed at the last minute as Congress was getting ready to leave, but H.R. 5771 did extend the Alternative Fuels Excise Tax Credits for liquefied hydrogen and other alternative fuels. These sorts of tax credit battles happen all year long. In July, Blumenthal introduced the Fuel Cell and Hydrogen Infrastructure Act of 2014, which never got out of the Finance Committee. Back to the hydrogen vehicle situation.