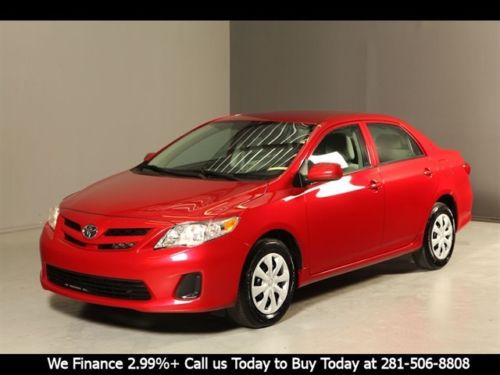

2014 Toyota Corolla Le Sedan 4-door 1.8l on 2040-cars

Santa Ana, California, United States

|

We are a California Licensed Dealer, Dealer # 85787. Buyer is responsible for Ca. Sales Tax, License, and Current Registration. If purchased in Ca. I can process DMV registration for you. If registering vehicle in another state, we can send you title and you can process in home state.

|

Toyota Corolla for Sale

Clean carfax 11k miles power windows locks ac premium sound 5-speed 37+ mpg i4 !(US $13,980.00)

Clean carfax 11k miles power windows locks ac premium sound 5-speed 37+ mpg i4 !(US $13,980.00) 2011 toyota corolla le sedan 4-door 1.8l(US $12,995.00)

2011 toyota corolla le sedan 4-door 1.8l(US $12,995.00) 2009 toyota corolla s 1.4l 4-cyl(US $10,500.00)

2009 toyota corolla s 1.4l 4-cyl(US $10,500.00) Lt silver 4door power locks, windows & mirrors, remote sec.sys, good mpg, cruise(US $5,095.00)

Lt silver 4door power locks, windows & mirrors, remote sec.sys, good mpg, cruise(US $5,095.00) 2003 toyota corolla ce sedan 4-door 1.8l

2003 toyota corolla ce sedan 4-door 1.8l 1989 toyota corolla, no reserve

1989 toyota corolla, no reserve

Auto Services in California

Young`s Automotive ★★★★★

Yas` Automotive ★★★★★

Wise Tire & Brake Co. Inc. ★★★★★

Wilson Motorsports ★★★★★

White Automotive ★★★★★

Wheeler`s Auto Service ★★★★★

Auto blog

2014 Toyota Aygo marks the spot [w/video]

Tue, 04 Mar 2014Following the leaked pictures we showed you yesterday, we have the full battery of images and info of the all-new Toyota Aygo, in addition to our gallery of live photos from the floor of the Geneva Motor Show.

Like its cousins from Peugeot and Citroën, the Aygo foregoes a diesel engine in favor of a highly efficient gas powerplant. The 1.0-liter naturally aspirated 4-cylinder turns out 68 horsepower and 70 pound-feet of torque. When it hits the market, it'll be with either a five-speed manual transmission or a five-speed, X-Shift automated manual. The former will help the Aygo return 57.3 miles per gallon and hit 62 miles per hour in 14.2 seconds. Opting for the X-Shift variant will net drivers 56 mpg, with 62 arriving in a leisurely 15.5 seconds.

We'll admit, aside from the fuel efficiency, there's nothing terribly great about those numbers. Still, with its compact dimensions - it's only 136 inches long - and a curb weight of no more than 2,000 pounds, it should prove tossable in the bends.

Japan may aid carmakers facing U.S. tariff threat

Wed, Sep 12 2018TOKYO — Japan is considering giving carmakers fiscal support including tax breaks to offset the impact from trade frictions with the United States and a sales-tax hike planned for next year, government sources told Reuters on Wednesday. Going into a second round of trade talks with the United States on Sept. 21, Japan is hoping to avert steep tariffs on its car exports and fend off U.S. demands for a bilateral free trade agreement that could put it under pressure to open politically sensitive markets, like agriculture. "If the trade talks pile pressure on Japan's car exports, we would need to consider measures to support the auto industry," a ruling party official said on condition of anonymity because of sensitivity of the matter. The auto industry accounts for about 20 percent of Japan's overall output and around 60-70 percent of the country's trade surplus with the United States, making it vulnerable to U.S. action against Japanese exports. Japan's biggest automakers and components suppliers fear they could take a significant hit if Washington follows through on proposals to hike tariffs on autos and auto parts to 25 percent. Policymakers also worry that an increase in the sales tax from 8 percent to 10 percent planned for October 2019, could cause a slump in sales of big-ticket items such as cars and home. Prime Minister Shinzo Abe has twice postponed the tax hike after the last increase from 5 percent in 2014 dealt a blow to private consumption, which accounts for about 60 percent of the economy. To prevent a pullback in demand after the tax hike, the government may consider large fiscal spending later when it draws up its budget for next year, government sources said. "One option may be to greatly reduce or abolish the automobile purchase tax," one of the government sources said. The government is also considering cuts in the automobile tax and automobile weight tax to help car buyers, the source added. Reporting by Izumi Nakagawa and Tetsushi KajimotoRelated Video: Image Credit: Getty Government/Legal Isuzu Mazda Mitsubishi Nissan Subaru Suzuki Toyota Trump Trump tariffs trade

US Congress lets $8,000 hydrogen vehicle tax credit expire

Mon, Dec 22 2014When Toyota introduced the 2016 Mirai last month in preparation for a launch late next year, it said that the hydrogen car will have a $57,500 MSRP and that there will be a federal tax credit available worth up to $8,000. The problem, as we noted at the time, is that that federal credit was set to expire at the end of 2014. The technical language of the current rule says that someone who buys a fuel cell vehicle, "may claim a credit for the certified amount for a fuel cell vehicle if it is placed in service by the taxpayer after Dec. 31, 2005, and is purchased on or before Dec. 31, 2014." With the 113th Congress now finished up for the year and legislators headed home for the holidays, we know one thing for certain: the federal tax credit for hydrogen vehicles was not updated and will end as we're all singing Auld Lang Syne next week. All of this isn't to say that Mirai buyers won't be able to take $8,000 off the price of the car 12 months from now. For proof of that, we only need to look at other alternative fuel tax incentives and realize that this Congress simply isn't moving fast enough to deal with things that are expiring right now. One of the last things that the 113th Congress did in December was to take up the tax credits that expired at the end of 2013 and renew some of them. Jay Friedland, Plug In America's senior policy advisor, told AutoblogGreen that PIA and other likeminded organizations worked with Congress to extended the electronic vehicle charging station (technically: EVSE) tax credit that was part of the Alternative Refueling Tax Credit in IRS Section 30(C) through the end of 2014. "Individuals can deduct 30 percent of the cost of purchasing and installing an EVSE up to $1,000; businesses, 30 percent up to $30,000," he said. "This tax credit is applied to any system placed into service by 12/31/14 and is retroactive to the beginning of the year. So go out and buy your favorite EV driver an EVSE for the holidays," he said. An electric motorcycle credit was killed at the last minute as Congress was getting ready to leave, but H.R. 5771 did extend the Alternative Fuels Excise Tax Credits for liquefied hydrogen and other alternative fuels. These sorts of tax credit battles happen all year long. In July, Blumenthal introduced the Fuel Cell and Hydrogen Infrastructure Act of 2014, which never got out of the Finance Committee. Back to the hydrogen vehicle situation.