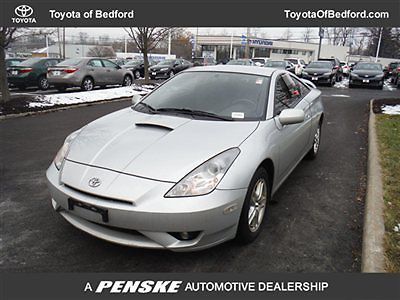

Celica 5 Speed Super Clean No Reserve Nr High Bidder Wins on 2040-cars

Hackensack, New Jersey, United States

Body Type:Hatchback

Engine:I4 1.8L DOHC

Vehicle Title:Clear

For Sale By:Dealer

Year: 1994

Make: Toyota

Model: Celica

Warranty: No

Mileage: 247,271

Sub Model: ST

Doors: 2

Exterior Color: Blue

Fuel: Gasoline

Interior Color: Black

Drivetrain: FWD

Toyota Celica for Sale

2001 toyota celica gt-s: supercharged & stanced(US $13,600.00)

2001 toyota celica gt-s: supercharged & stanced(US $13,600.00) 1977 toyota celica gt original paint stock unrestored

1977 toyota celica gt original paint stock unrestored Toyota celica gt 5- speed(US $7,000.00)

Toyota celica gt 5- speed(US $7,000.00) Toyota celica gt, ask for brandon davis!!! we finance!!!

Toyota celica gt, ask for brandon davis!!! we finance!!! 2003 toyota celica gts hatchback 2-door 1.8l

2003 toyota celica gts hatchback 2-door 1.8l 1985 toyota celica convertible(US $2,585.00)

1985 toyota celica convertible(US $2,585.00)

Auto Services in New Jersey

Vitos Auto Electric ★★★★★

Town Auto Body ★★★★★

Tony`s Auto Svc ★★★★★

Stan`s Garage ★★★★★

Sam`s Window Tinting ★★★★★

Rdn Automotive Repair ★★★★★

Auto blog

Toyota passes BMW as most valuable car brand

Tue, 21 May 2013An annual market study of the strongest brands across various industries has seen Toyota leapfrog BMW as the world's most valuable automotive brand. Toyota's 2013 brand value rose to $24.5 billion, up 12 percent versus 2012 numbers according to market research company Millward Brown's BrandZ Top 100 Most Valuable Global Brands list. BMW's value fell slightly; down by 2 percent to a total of $24 billion.

Mercedes-Benz finished in third place in the automotive category, up 11 percent from 2012 for a valuation of $18 billion. Honda ($12.4 billion, down 2 percent) and Nissan ($10.2 billion, up 3 percent) rounded out the top five for the category. Volkswagen was the only other auto brand that finished in the top 100 overall, in 100th place. Audi made the greatest percentage gain over 2012, up 18 percent to $5.5 billion, but finished outside of the top 100.

Technology companies dominated the overall list, with Apple, Google and IBM ranking one through three. Couture brand Prada was 2013's biggest gainer, rising by 63 percent over 2012.

West Coast labor dispute hampers Japanese automakers' US plants

Wed, Feb 18 2015The ongoing labor dispute between the International Longshore and Warehouse Union and port owners along the West Coast is starting to affect more Japanese automakers building vehicles in the US. The issue already forced Honda and Subaru to take the expensive option of airlifting some parts into the US weeks ago, and according to USA Today, Toyota and Nissan have begun doing so, as well. The choice hasn't been cheap, though, and Subaru's chief financial officer estimated that the decision cost around $60 million more per month than sending components by cargo ship. The effects continue to radiate, according to USA Today, and shortages of some models are possible. Honda is slowing production at its factories in Ohio, Indiana and Canada because the automaker doesn't have enough transmissions and electronics for some vehicles. Toyota already cut back on overtime at some factories. Nissan has only seen a small effect from the issue, though, because of its local suppliers. Dock workers and port owners have been negotiating on a new contract since last year, and the union has organized work slowdowns in response. According to USA Today, the automakers could move shipments to Canada or Mexico, but it would take longer for parts to arrive. News Source: USA TodayImage Credit: Mark Ralston / AFP / Getty Images Earnings/Financials Plants/Manufacturing UAW/Unions Honda Nissan Subaru Toyota shipping port labor dispute

Tier 1 suppliers call GM the worst OEM to work with

Mon, 12 May 2014Among automakers with a big US presence, General Motors is the worst to work for, according to a new survey from Tier 1 automotive suppliers, conducted by Planning Perspectives, Inc.

The Detroit-based manufacturer, which has been under fire following the ignition switch recall and its accompanying scandal, finished behind six other automakers with big US manufacturing operations. Suppliers had issues with trust and communications, as well as intellectual property protection. GM was also the least likely to allow suppliers to raise their prices in the face of unexpected increases in material cost, all of which contributed to 55 percent of suppliers saying their relationship with GM was "poor to very poor."

GM's cross-town competitors didn't fare much better. Chrysler finished in fifth place, ahead of GM and behind Dearborn-based Ford, which was passed for third place this year by Nissan. Toyota took the top marks, while Honda captured second place.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.039 s, 7884 u