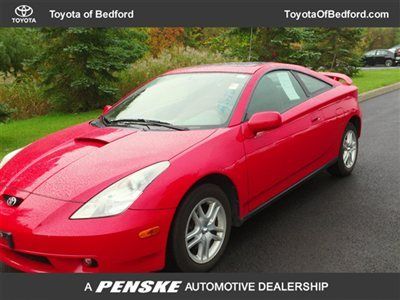

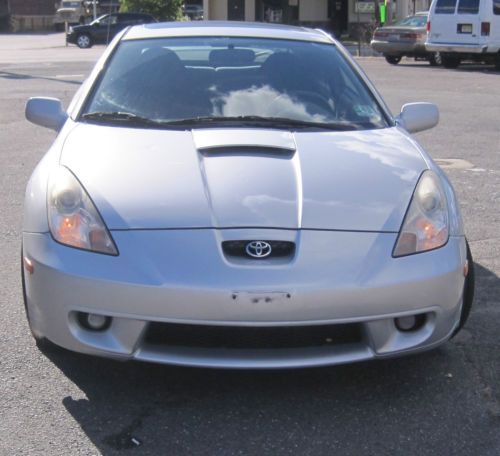

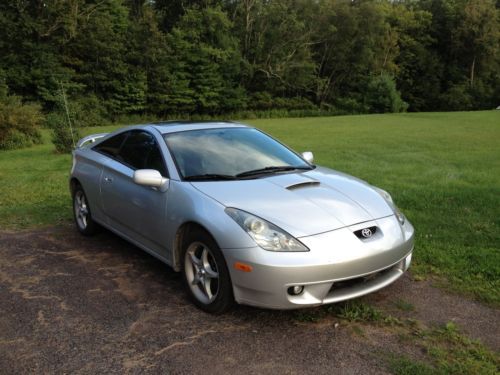

2001 Toyota Celica Gt 2 Dr Coupe Automatic 115k Sunroof 1 Owner Clean Carfax on 2040-cars

Bedford, Ohio, United States

Engine:1.8L 1794CC l4 GAS DOHC Naturally Aspirated

For Sale By:Dealer

Body Type:Hatchback

Transmission:Automatic

Fuel Type:GAS

Year: 2001

Make: Toyota

Options: Cassette, Compact Disc

Model: Celica

Safety Features: Passenger Side Airbag

Trim: GT Hatchback 2-Door

Power Options: Air Conditioning

Drive Type: FWD

Doors: 2

Mileage: 115,737

Engine Description: 1.8L DOHC MPFI 16-VALVE 4

Sub Model: 3dr LB GT Manual

Number of Doors: 2

Exterior Color: Red

Interior Color: Black

Number of Cylinders: 4

Warranty: Vehicle does NOT have an existing warranty

Toyota Celica for Sale

1995 toyota celica gt convertible 2-door 2.2l(US $2,850.00)

1995 toyota celica gt convertible 2-door 2.2l(US $2,850.00) 2002 toyota celica gt hatchback 2-door 1.8l

2002 toyota celica gt hatchback 2-door 1.8l 1998 toyota celica gt convertible 2-door 2.2l

1998 toyota celica gt convertible 2-door 2.2l 2001 toyota celica gts hatchback 2-door 1.8l(US $5,500.00)

2001 toyota celica gts hatchback 2-door 1.8l(US $5,500.00) 1988 toyota celica all trac hatchback 2-door 2.0l awd turbo(US $5,000.00)

1988 toyota celica all trac hatchback 2-door 2.0l awd turbo(US $5,000.00) 2000 toyota celica gt hatchback 2-door 1.8l(US $2,000.00)

2000 toyota celica gt hatchback 2-door 1.8l(US $2,000.00)

Auto Services in Ohio

Whitesel Body Shop ★★★★★

Walker`s Transmission Service ★★★★★

Uncle Sam`s Auto Center ★★★★★

Trinity Automotive ★★★★★

Trails West Custom Truck 4x4 Super Center ★★★★★

Stone`s Auto Service Inc ★★★★★

Auto blog

Chevy Bolt wins 2017 Green Car of the Year

Thu, Nov 17 2016We knew that a plug-in vehicle was going to win the 2017 Green Car of the Year award this year, given that all five finalists have a way to charge up. And when Ron Cogan, the editor and publisher of Green Car Journal, announced the winner – the 2017 Chevy Bolt EV – he said that the car itself represents one of those times in the auto industry when everything is about to change. Similar to the invention of the starter motor, things are about to get different. For now, though, the fact that the Bolt EV won an award sounds like the same old thing all over again. Just this week, it was named Motor Trends Car of the Year and to the Car And Driver Top 10 list. The other four finalists for Green Car of the Year included the Toyota Prius Prime, the Chrysler Pacifica, the Kia Optima (including hybrid and plug-in hybrid models) and the BMW 330e iPerformance. Last year, the winner was the 2016 Chevy Volt. Did Green Car Journal make the right selection this year? See the award ceremony below.

US Congress lets $8,000 hydrogen vehicle tax credit expire

Mon, Dec 22 2014When Toyota introduced the 2016 Mirai last month in preparation for a launch late next year, it said that the hydrogen car will have a $57,500 MSRP and that there will be a federal tax credit available worth up to $8,000. The problem, as we noted at the time, is that that federal credit was set to expire at the end of 2014. The technical language of the current rule says that someone who buys a fuel cell vehicle, "may claim a credit for the certified amount for a fuel cell vehicle if it is placed in service by the taxpayer after Dec. 31, 2005, and is purchased on or before Dec. 31, 2014." With the 113th Congress now finished up for the year and legislators headed home for the holidays, we know one thing for certain: the federal tax credit for hydrogen vehicles was not updated and will end as we're all singing Auld Lang Syne next week. All of this isn't to say that Mirai buyers won't be able to take $8,000 off the price of the car 12 months from now. For proof of that, we only need to look at other alternative fuel tax incentives and realize that this Congress simply isn't moving fast enough to deal with things that are expiring right now. One of the last things that the 113th Congress did in December was to take up the tax credits that expired at the end of 2013 and renew some of them. Jay Friedland, Plug In America's senior policy advisor, told AutoblogGreen that PIA and other likeminded organizations worked with Congress to extended the electronic vehicle charging station (technically: EVSE) tax credit that was part of the Alternative Refueling Tax Credit in IRS Section 30(C) through the end of 2014. "Individuals can deduct 30 percent of the cost of purchasing and installing an EVSE up to $1,000; businesses, 30 percent up to $30,000," he said. "This tax credit is applied to any system placed into service by 12/31/14 and is retroactive to the beginning of the year. So go out and buy your favorite EV driver an EVSE for the holidays," he said. An electric motorcycle credit was killed at the last minute as Congress was getting ready to leave, but H.R. 5771 did extend the Alternative Fuels Excise Tax Credits for liquefied hydrogen and other alternative fuels. These sorts of tax credit battles happen all year long. In July, Blumenthal introduced the Fuel Cell and Hydrogen Infrastructure Act of 2014, which never got out of the Finance Committee. Back to the hydrogen vehicle situation.

Toyota unintended acceleration lawsuit settled for $16M

Mon, 08 Apr 2013Slowly, the many loose threads still dangling after the unintended acceleration issue Toyota faced a few years ago are being resolved. The Orange County District Attorney's office was believed to be the first DA's office to take Toyota to court, its suit alleging that Toyota knew its cars had defects and continued to sell them. The suit sought to "permanently enjoin Toyota from continued unlawful, unfair, deceptive, and fraudulent business practices as it pertains to both consumers and competitors" and asked for $2,500 "for every violation of the Unfair Business Practices Act," plus costs.

That suit has now been settled, Toyota - without admitting fault or wrongdoing - agreeing to pay $16 million to the county. Half of the money will go to the Orange County Gang Reduction Intervention Partnership, another four million dollars to the OC DA's office to investigate economic crime, the remaining four million being used to pay for the case.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.06 s, 7821 u