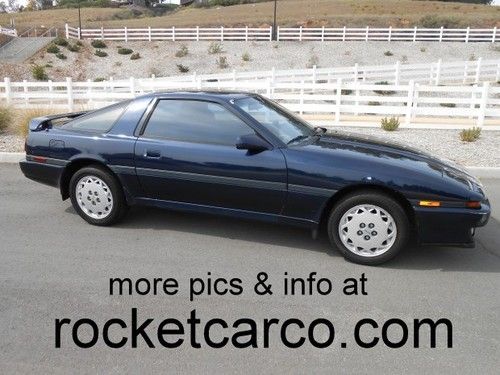

1987 Toyota Supra Turbo- 61000mi- Pearl Wht / Burg. All Orig - Garaged Since New on 2040-cars

Miami, Florida, United States

Engine:Single Turbo

For Sale By:Private Seller

Mileage: 61,000

Make: Toyota

Model: Supra

Options: Cassette Player

Trim: Base Turbo

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Drive Type: Rear wheel

Toyota Supra for Sale

1988 toyota supra non turbo

1988 toyota supra non turbo Toyota supra 2jz gte mkiii, 2jzgte, supra, rx7, gtr, fast, with pics

Toyota supra 2jz gte mkiii, 2jzgte, supra, rx7, gtr, fast, with pics 1989 toyota supra base targa - turbo conversion(US $3,500.00)

1989 toyota supra base targa - turbo conversion(US $3,500.00) Toyota supra mkiv(US $17,995.00)

Toyota supra mkiv(US $17,995.00) 1988 toyota supra base hatchback 2-door 3.0l automatic removable top dohc

1988 toyota supra base hatchback 2-door 3.0l automatic removable top dohc 1987 toyota supra turbo hatchback 2-door 3.0l

1987 toyota supra turbo hatchback 2-door 3.0l

Auto Services in Florida

Your Personal Mechanic ★★★★★

Xotic Dream Cars ★★★★★

Wilke`s General Automotive ★★★★★

Whitehead`s Automotive And Radiator Repairs ★★★★★

US Auto Body Shop ★★★★★

United Imports ★★★★★

Auto blog

2014 Toyota Highlander greets the world with NYC debut

Wed, 27 Mar 2013Toyota has pulled the wraps off its all-new, 2014 Highlander in New York this morning, giving Americans a first look at what is sure to be a heavyweight in the mid-size crossover segment.

The new third-generation Highlander will come with the buyer's choice of three different powertrain options. The base model will be powered by a 2.7-liter four-cylinder engine coupled to a six-speed automatic transmission with front-wheel-drive. Next up the ladder is a 3.5-liter V6, also mated to the 6AT, which can be had with either front-or all-wheel-drive. Finally, the Highlander Hybrid will be equipped with all-wheel drive, its 3.5-liter V6 mated to an electric motor, all hooked up to a continuously variable transmission (CVT). The automaker has not released any specs for fuel economy or output yet, though we're promised increases in both power and efficiency.

While not a revolution in terms of styling, Toyota has cleaned up the bodywork for the new model, offering a crisp, conservative look for the slightly larger Highlander. The vehicle is some three inches longer and an inch-and-a-half wider than the outgoing model, yet it has a lower roofline. Black plastic-clad wheel arches make an attempt to butch up the crossover, though to our eyes, the Highlander still has the look of a minivan around the rear view.

Toyota NA CEO says his excitement for hydrogen sedan is rising

Fri, Apr 4 2014Toyota has an undeniable vested interest in seeing its hydrogen sedan succeed when it goes on sale in the US next year, so it's no surprise that the company's North American CEO, Jim Lentz, says that he's got more hope for the car now than ever before. And if we remember ways that others in the company, like Bob Carter, have loudly sung hydrogen's praises, we have to assume that positivity is running awful high in Torrance. In fact, Lentz said that the US side of the company is far more excited by the H2 car than colleagues in Japan. Speaking at The Wall Street Journal's ECO:nomics conference in Santa Barbara, CA this week, Lentz said: After we've seen the product, understand its range, its driving dynamics, its refueling, we're a lot more bullish than Japan - probably about fivefold more bullish. It's just a question of how many can be produced now. Well, we've driven this car, and we still feel that Toyota is placing a big bet on the technology. One important issue is cost, but Lentz would not say exactly how much the car costs to make or what it will be priced at. He did say, though, that the production cost has dropped by 95 percent from the $1 million price tag the car wore ten years ago. That hints at a production cost of around $50,000. Lentz also said he thinks it will take at least a decade for hydrogen vehicles to hit sales of 500,000 per year in the US. Speaking to Bloomberg, he said: Their acceptance could get off to a quicker start than the hybrids did. I think you're going to see a lot more marketing of the concept of fuel cell much sooner than you did for hybrids, because basically the whole industry is behind it.

2018 Ford Expedition vs other big SUVs: How it compares on paper

Fri, Nov 10 2017With our Alex Kierstein rightly impressed in his first-drive review of the new 2018 Ford Expedition, we decided to dig a little deeper into the numbers, and we came up with the spreadsheet below to highlight how the new 2018 Expedition compares on paper to its main full-size SUV competitors: the 2018 Chevy Tahoe and Suburban (and therefore the 2018 GMC Yukon), 2018 Toyota Sequoia and 2018 Nissan Armada. We also threw in the new, even bigger 2018 Chevrolet Traverse since, as you'll see, its massive dimensions should put it on the radar for anyone who needs loads of passenger and cargo space but doesn't care as much about towing. A few notes about the chart above. First, the 6.2-liter V8 that's included with the new-for-2018 Tahoe RST trim level is the standard engine on the GMC Yukon Denali. You can apply most of the Tahoe's numbers to the entire Yukon and Yukon XL lineup. Second, though we highlighted categories where the Traverse led, we also highlighted the runner-up full-size SUV, since this was ultimately about that segment. Traverse numbers are broadly applicable to the new Buick Enclave. Related Video: Chevrolet Ford GMC Nissan Toyota SUV Comparison consumer ford expedition gmc yukon chevy traverse toyota sequoia nissan armada chevrolet tahoe ford expedition max