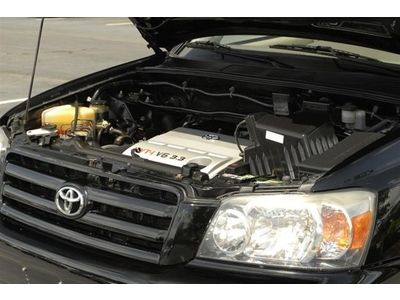

2005 Toyota Highlander 4dr 4x4 V6 L on 2040-cars

Huntersville, North Carolina, United States

Body Type:SUV

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Make: Toyota

Model: Highlander

Warranty: Unspecified

Mileage: 133,935

Sub Model: 4DR 4X4 V6 L

Options: Sunroof

Exterior Color: Black

Power Options: Power Windows

Interior Color: Tan

Number of Cylinders: 6

Toyota Highlander for Sale

2003 toyota highlander base sport utility 4-door 3.0l

2003 toyota highlander base sport utility 4-door 3.0l Hybrid suv 4wd blue 2006 4x4 v6 nav cvt daytime running 3rd row one owner limit

Hybrid suv 4wd blue 2006 4x4 v6 nav cvt daytime running 3rd row one owner limit 2006 toyota highlander limited sport utility 4-door 3.3l

2006 toyota highlander limited sport utility 4-door 3.3l 2002 toyota highlander base sport utility 4-door 2.4l(US $10,500.00)

2002 toyota highlander base sport utility 4-door 2.4l(US $10,500.00) 2008 toyota highlander awd hybrid mint condition new ti

2008 toyota highlander awd hybrid mint condition new ti 2003 toyota highlander; 1 owner; low reserve!

2003 toyota highlander; 1 owner; low reserve!

Auto Services in North Carolina

Your Automotive Service Center ★★★★★

Whistle`s Body Shop ★★★★★

Village Motor Werks ★★★★★

Tyrolf Automotive ★★★★★

Turner Towing & Recovery ★★★★★

Triangle Auto & Truck Repair ★★★★★

Auto blog

Toyota recalls 337,000 RAV4s and HS250h models for tie rod failure

Thu, Sep 1 2016UPDATE: The post has been updated with additional information from NHTSA. The Basics: Toyota is recalling 337,000 2006-2011 model year Toyota RAV4 crossovers built between October 31, 2005 and September 7, 2010 as well as 2010 model year Lexus HS250h cars built between July 6, 2009 and August 26, 2010. The Problem: When either an affected RAV4 or HS250h is given an alignment and the tie rod adjustment nut on the rear control arm isn't tightened properly, the threads on the tie rod can start to rust. If this happens, the nut may break off and throw off the alignment drastically and suddenly. This isn't a case of the car simply pulling to one side, either. This would seriously upset the balance of the car and could cause the driver to lose control and crash. This is also the third time these vehicles have been recalled for the same issue. Injuries/Deaths: It's unknown if this control arm issue has resulted in any injuries or deaths. Autoblog reached out to Toyota for more information, but a company representative told us that the company isn't able to discuss injuries or deaths caused by this issue (if any) at this time. Based on information from NHTSA documents, it does not appear that any crashes, injuries or deaths have been attributed to the defect addressed in the current recall. The Fix: The dealer will completely replace the rear suspension assemblies at no cost to the owner. The tie rods and nuts will also be coated in epoxy to prevent future rusting from occurring. According to Car and Driver, the previous recalls involved tightening nuts, coating decent tie rods in epoxy and completely replacing rusted ones. The car magazine reports that further complaints were filed and the company is now replacing all components regardless of condition. If you own one: Toyota will notify owners of affected cars by mail. Owners can also check whether their cars are affected by entering the VIN at safercar.gov/vin. Owners with questions can also reach Toyota customer service at 1-800-331-4331 or Lexus customer service at 1-800-255-3987. Related Video: Featured Gallery 2012 Toyota RAV4 View 16 Photos News Source: Car and Driver, Toyota, National Highway Traffic Safety AdministrationImage Credit: Toyota Recalls Lexus Toyota Safety lexus hs 250h lexus hs250h

Toyota expands Takata airbag inflator recall

Wed, Mar 2 2016The Basics: Toyota will recall 198,000 examples of the 2008 Corolla and Matrix and the 2008-2010 Lexus SC430. The Problem: The vehicles contain Takata's dual-stage inflators in their front passenger airbags, which could rupture in a crash. Injuries/Deaths: None reported in this population of vehicles. However, experts believe Takata's inflators have links to at least ten fatalities. The Fix: Dealers will replace the part with a newly manufactured one. If You Own One: Toyota will notify owners about the recall by first-class mail in March and will send a remedy letter in June when the parts are ready. TOYOTA EXPANDS TAKATA AIRBAG SAFETY RECALL TORRANCE, Calif., March 2, 2016 – Toyota Motor Sales, USA, Inc. today announced that it is expanding two of its recalls involving Takata front passenger airbag inflators. This will add model years of certain vehicles previously recalled and will cover all remaining dual-stage front passenger inflators of a particular type, as a precautionary measure. Approximately 198,000 Model Year 2008 Corolla and Corolla Matrix and Model Year 2008-2010 Lexus SC430 vehicles will be added to the recalls. The involved vehicles are equipped with a Takata-produced dual-stage front passenger airbag inflator which could potentially be susceptible to rupture when deployed in a crash. All known owners of the affected Toyota / Lexus vehicles will be notified by first class mail. Dealers will replace the airbag inflator or the airbag assembly with a newly manufactured one at no cost. Information about automotive recalls, including but not limited to the list of involved vehicles, is subject to change over time. For the most up-do-date Safety Recall information on Toyota, Lexus or Scion vehicles, customers should check their vehicle's status by visiting toyota.com/recall and entering the Vehicle Identification Number (VIN). Safety Recall inquiry by individual VIN is also available at the NHTSA site: safercar.gov/vin. For any additional questions, customer support is also available by calling Toyota Customer Service at 1-800-331-4331, or Lexus Customer Service at 1-800-255-3987. ###

2015 Toyota Camry ushers in 'sweeping redesign' [w/poll]

Wed, 16 Apr 2014With a dozen years atop the nation's best-selling car charts, you might think that there wouldn't be a lot of incentive for Toyota to rework its Camry, particularly so early in the life of the current model. But despite its unassailable sales totals, the midsize sedan has come in for substantial criticism for its milquetoast dynamics, piecemeal interiors and bland design.

As part of CEO Akio Toyoda's mantra to build more exciting cars, the 2015 Camry has arrived with a fresh new look and content that goes far beyond the Japanese automaker's typically slight mid-cycle redesigns. Featuring some 2,000 new parts, the 2015 Camry casts a 1.8-inch longer shadow and stretches across a widened track (0.4 inches). And it won't be just the widened track that should help deliver a more dynamic performance - Toyota is citing a stiffer chassis thanks to additional spot welds along with a rejiggered suspension, retuned electric power steering and a new two-stage brake booster for improved braking feel.

A new XSE trim promises the sportiest performance yet, including model-specific shock absorbers and springs, stiffer bushings, unique stability control programming and 18-inch wheels to go along with a unique front end treatment featuring mesh grille inserts and a revised fascia.