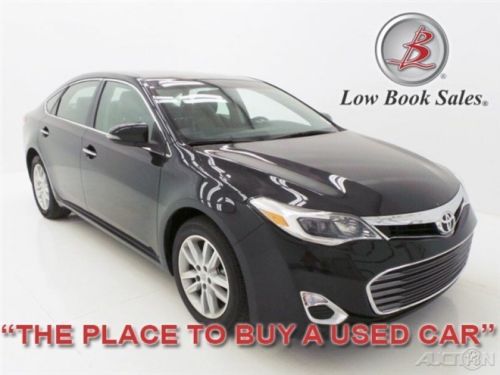

Why Buy A Lexus When You Can Have A Toyota Avalon? Premium Car, Very Nice! on 2040-cars

Charlotte, North Carolina, United States

Toyota Avalon for Sale

2011 toyota avalon sport sunroof heated leather 43k mi texas direct auto(US $23,980.00)

2011 toyota avalon sport sunroof heated leather 43k mi texas direct auto(US $23,980.00) We finance! 2013 xle used certified 3.5l v6 24v automatic fwd sedan

We finance! 2013 xle used certified 3.5l v6 24v automatic fwd sedan Touring 3.5l cd fwd alloys leather sunroof heated seats(US $17,500.00)

Touring 3.5l cd fwd alloys leather sunroof heated seats(US $17,500.00) Clean, runs good, reliable transportation, questions please call 1-877-265-3658

Clean, runs good, reliable transportation, questions please call 1-877-265-3658 2000 toyota avalon xl sedan 4-door 3.0l(US $15,000.00)

2000 toyota avalon xl sedan 4-door 3.0l(US $15,000.00) 2011 toyota avalon loaded back up camera we finance clean car fax lo miles mint(US $17,975.00)

2011 toyota avalon loaded back up camera we finance clean car fax lo miles mint(US $17,975.00)

Auto Services in North Carolina

Z-Mech Auto ★★★★★

Xtreme Detail ★★★★★

Wheels N Bumpers Car Wash ★★★★★

Weavers Body Shop & Front End ★★★★★

United Muffler Shop ★★★★★

Trotter Auto Glass Plus ★★★★★

Auto blog

2015 Toyota Sienna

Thu, 25 Sep 2014It's hard to love a minivan, but it's very, very easy to use one. More than any other kind of vehicle - save a panel van, perhaps - the minivan is the most appliance-like of four-wheeled transportation devices. And most minivan buyers don't need to love their purchases; they just need to use them. So when it comes to a minivan's driving dynamics, who cares?

Well, we do. So we perked right up when Toyota talked about refinements it made to the 2015 Sienna, starting with some 142 added spot welds made to the body structure. Normally not stop-the-presses stuff, but Toyota says the added reinforcements prompted Sienna engineers to recalibrate the springs and shocks for improved handling, and our very limited wheel time along the (admittedly benign) roads on the Big Island of Hawaii revealed the 2015 Sienna SE model's handling to be tidier and more engaging than you'd expect for a porky, 4,560-pound, eight-passenger box on wheels.

Driving Notes

US Congress lets $8,000 hydrogen vehicle tax credit expire

Mon, Dec 22 2014When Toyota introduced the 2016 Mirai last month in preparation for a launch late next year, it said that the hydrogen car will have a $57,500 MSRP and that there will be a federal tax credit available worth up to $8,000. The problem, as we noted at the time, is that that federal credit was set to expire at the end of 2014. The technical language of the current rule says that someone who buys a fuel cell vehicle, "may claim a credit for the certified amount for a fuel cell vehicle if it is placed in service by the taxpayer after Dec. 31, 2005, and is purchased on or before Dec. 31, 2014." With the 113th Congress now finished up for the year and legislators headed home for the holidays, we know one thing for certain: the federal tax credit for hydrogen vehicles was not updated and will end as we're all singing Auld Lang Syne next week. All of this isn't to say that Mirai buyers won't be able to take $8,000 off the price of the car 12 months from now. For proof of that, we only need to look at other alternative fuel tax incentives and realize that this Congress simply isn't moving fast enough to deal with things that are expiring right now. One of the last things that the 113th Congress did in December was to take up the tax credits that expired at the end of 2013 and renew some of them. Jay Friedland, Plug In America's senior policy advisor, told AutoblogGreen that PIA and other likeminded organizations worked with Congress to extended the electronic vehicle charging station (technically: EVSE) tax credit that was part of the Alternative Refueling Tax Credit in IRS Section 30(C) through the end of 2014. "Individuals can deduct 30 percent of the cost of purchasing and installing an EVSE up to $1,000; businesses, 30 percent up to $30,000," he said. "This tax credit is applied to any system placed into service by 12/31/14 and is retroactive to the beginning of the year. So go out and buy your favorite EV driver an EVSE for the holidays," he said. An electric motorcycle credit was killed at the last minute as Congress was getting ready to leave, but H.R. 5771 did extend the Alternative Fuels Excise Tax Credits for liquefied hydrogen and other alternative fuels. These sorts of tax credit battles happen all year long. In July, Blumenthal introduced the Fuel Cell and Hydrogen Infrastructure Act of 2014, which never got out of the Finance Committee. Back to the hydrogen vehicle situation.

Consumer Reports calls on Toyota to recall older Camry Hybrid models

Thu, 31 Jul 2014Consumer Reports is calling on Toyota to issue an official recall of 178,000 Camry Hybrid sedans from model years 2007 to 2011, claiming that a pair of issues affecting the brakes are so dire they demand a more official action than what the company has undertaken so far.

The first issue, as CR tells it, relates to a clog in the brake-fluid reservoir filter, which if left untreated could lead to a number of dashboard warning lights. The "front brake assist could be temporarily lost," too, according to Toyota's own notice to dealers and owners of affected models. The company has issued a "service campaign" that will fit a new brake-fluid reservoir free of charge to any affected model brought to a dealer by June 30, 2017.

The other issue plaguing the fuel-sipping Camrys is being treated via a warranty extension, and focuses on the ABS brake actuator, a particularly expensive (both in terms of parts, at $1,000, and labor, around $3,000) item that is necessary for the anti-lock braking to function. There's also a related issue with the brake pedal's "stroke sensor," which like the actuator can lead to a very difficult-to-depress brake pedal. The warranty extension increases the coverage of the actuator to 10 years or 150,000 miles (whichever comes first).