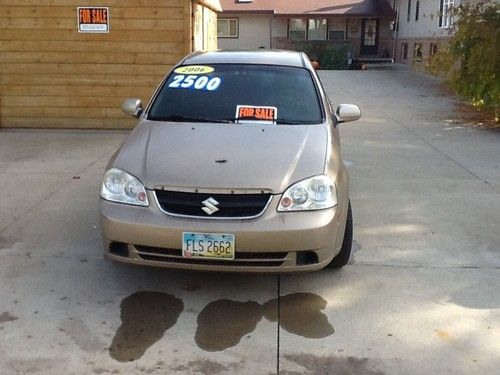

2006 Suzuki Forenza Base Sedan 4-door 2.0l on 2040-cars

Staten Island, New York, United States

|

|

Suzuki Forenza for Sale

2006 suzuki forenza no reserve

2006 suzuki forenza no reserve Susuki forenza 06' low miles & clean title(US $6,500.00)

Susuki forenza 06' low miles & clean title(US $6,500.00) Suzuki forenza(US $2,500.00)

Suzuki forenza(US $2,500.00) 2007 suzuki forenza base sedan 4-door 2.0l(US $2,800.00)

2007 suzuki forenza base sedan 4-door 2.0l(US $2,800.00) Suzuki forenza 2005(US $3,500.00)

Suzuki forenza 2005(US $3,500.00) 2004 suzuki forenza ex sedan 4-door 2.0l

2004 suzuki forenza ex sedan 4-door 2.0l

Auto Services in New York

Wheel Fix It Corp ★★★★★

Warner`s Auto Body ★★★★★

Vision Kia of Canandaigua ★★★★★

Vision Ford New Wholesale Parts Body Shop ★★★★★

Vince Marinaro Automotive Inc ★★★★★

Valu Muffler & Brake ★★★★★

Auto blog

Spiders Force Suzuki To Recall Midsize Cars

Wed, Aug 27 2014Spiders have forced Suzuki to recall more than 19,000 midsize cars. The automaker says spider webs can clog a fuel vapor vent hose in some 2010 to 2013 Kizashi cars, cutting off air flow. If that happens, it can cause the gas tank to deform, causing cracks, fuel leaks and possible fires. The recall was prompted by seven reports of the problem. Service centers will replace the vent line with one that has a filter on the end. They'll also replace gas tanks if necessary. The problem hasn't caused any accidents or injuries in the U.S., Suzuki said in documents posted Wednesday by the National Highway Traffic Safety Administration. Owners will be notified this month. Those with questions can call Suzuki customer service at (800) 934-0934. American Suzuki Motor Corp. filed for Chapter 11 bankruptcy protection in November of 2012 and stopped selling automobiles in the U.S. The recall is the second caused by spiders this year. In April Mazda recalled 42,000 Mazda6 midsize cars in the U.S. with 2.5-liter engines for a similar problem. The recalled cars were from the 2010 through 2012 model years. Recalls Suzuki Safety spider

Suzuki Hayabusa's return is teased in video

Fri, Jan 29 2021Hang on to your kidneys, the planet's fastest production motorcycle is on its way back. Suzuki has released a teaser video for a new Hayabusa on its global and UK social media channels. Only a few glimpses of the superbike can be seen, but it's enough to get our adrenal glands pumping. Debuting in 1999 during Japan's motorcycle speed wars, the Suzuki Hayabusa immediately rocketed to the forefront, nabbing the world record for fastest street bike. Not only has it been clocked at speeds as high as 194 mph, it's held on to that title for for two decades. Notably, the Hayabusa, named after a peregrine falcon known for reaching 200 mph during its hunting dives, did not compromise everyday comfort and handling in pursuit of all-out speed. However, Suzuki had to dump the bike from its U.S. lineup in 2021, and in Europe it's been absent since 2018 due to emissions regulations. It appears, though, that sabbatical was only temporary. The teaser video gives us a couple of peeks at new hardware. Its iconic five-gauge instrument pod is still there, but updated with a TFT screen in center position. The readouts indicate a number of electronic technologies will return, including S-DMS engine power modes, traction control, lift (anti-wheelie) control, and a quickshifter. An inclinometer showing the angle of lean on either side sits in the middle. Flanking the TFT are a tach and speedometer in their traditional positions on the left and right, respectively, with the latter's needle pegged at 180 mph. Fuel levels and engine temperature sit on opposite ends. Accompanying the visuals are a finely tuned roar and plenty of wind noise as the 'Busa flies around a speedway-type banked circuit. The official reveal will take place on February 5 online at 7 a.m. U.K. time — that's 2 a.m. Eastern. You can watch the unveiling on a virtual forum called the Suzuki Motorcycle Global Salon., which requires registration. Unfortunately, there's not word on whether the Hayabusa will come to the U.S.

Suzuki heads rolling over fuel economy scandal

Wed, Jun 8 2016Suzuki Motor Corporation executives admitted last month that the company had been falsifying fuel-economy tests for some of its vehicles. Today, it was announced that chairman Osamu Suzuki will not become CEO and executive vice president Osamu Honda will step down from his position at the next shareholder meeting, which takes place June 29. Executive bonuses for 2015 will also be eliminated or cut in half. The company is also promising to change its corporate culture so as to allow whistle blowers to get their messages heard. "Suzuki has a top-down culture and it's been difficult for voices from lower down to go to the management," Toshihiro Suzuki (Osamu's son) told reporters, according to Bloomberg. Both Suzuki family members will take a pay cut for the last half of 2016 (Osamu at 40 percent, Toshihiro at 30). Over 2 million Suzuki vehicles were involved in the fuel economy fakery. Japan's transport ministry is taking a closer look at company-submitted data after Mitsubishi and then Suzuki were found to have misled regulators and the public. Related Video: News Source: BloombergImage Credit: KAZUHIRO NOGI/AFP/Getty Images Government/Legal Green Hirings/Firings/Layoffs Suzuki Fuel Efficiency resignation osamu suzuki