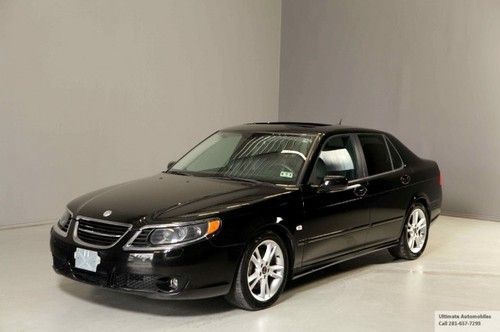

Black Saab Aero 9-5 Sedan on 2040-cars

Rockville Centre, New York, United States

Body Type:Sedan

Vehicle Title:Clear

Engine:4 Cylinder

Fuel Type:Gasoline

For Sale By:Private Seller

Make: Saab

Model: 9-5

Warranty: Vehicle does NOT have an existing warranty

Trim: 2.3t Sedan 4-Door

Options: Sunroof, Leather Seats, CD Player

Drive Type: All wheel drive

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Mileage: 94,000

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Exterior Color: Black

Interior Color: Black

Number of Cylinders: 4

2007 Aero 9-5 four-door sedan. Like-new condition, original owner. This vehicle has been kept in immaculate condition and garaged, and serviced only by Saab. Black turbo 4-cylinder engine with 94k miles. New brakes, new Pirellis, recent tune-up. Optional sports package with sport suspension, xenon headlamps, 2-tone leather seating, tinted windows, moon roof, 6-CD stereo unit, automatic transmission, rear park assist, optional visibility package and rain sensing wipers. All body parts original except back bumper. Very few scratches, one ding. A/C ice cold, All scheduled maintenance, Always garaged, Excellent condition, Fully loaded with all the goodies, Looks & drives great, Mostly highway miles, Must see, New tires, No accidents, One owner, Perfect first car, Satellite radio, Seats like new, Title in hand, Very clean interior, Well maintained

Saab 9-5 for Sale

2004 saab 9-5 arc sedan 4-door 2.3l(US $5,699.00)

2004 saab 9-5 arc sedan 4-door 2.3l(US $5,699.00) 2004 saab 9-5 sport arc sunroof leather heat/cool seats pdc xenons leather 5sped(US $6,680.00)

2004 saab 9-5 sport arc sunroof leather heat/cool seats pdc xenons leather 5sped(US $6,680.00)

2002 saab 9-5 linear wagon 4-door 2.3l

2002 saab 9-5 linear wagon 4-door 2.3l 2004 04 saab 9-5 95 non smoker no reserve 94,000 miles inspected cd a/c leather

2004 04 saab 9-5 95 non smoker no reserve 94,000 miles inspected cd a/c leather 2004 9-5 saab wagon low miles florida car(US $5,900.00)

2004 9-5 saab wagon low miles florida car(US $5,900.00)

Auto Services in New York

Witchcraft Body & Paint ★★★★★

Will`s Wheels ★★★★★

West Herr Chevrolet Of Williamsville ★★★★★

Wayne`s Radiator ★★★★★

Valley Cadillac Corp ★★★★★

Tydings Automotive Svc Station ★★★★★

Auto blog

What brands have Saab owners defected to? Polk investigates

Sun, 02 Sep 2012When a brand goes belly-up, it's natural for analysts to wonder where that brand's consumers will turn. General Motors has mothballed more car brands the last decade than most other automakers' have in their entire portfolios, so "Where did [insert brand here] buyers go?" has been a common question asked of The General. According to reports, it didn't do so well at retaining Oldsmobile owners (who supposedly went to Hyundai), or Hummer and Saturn buyers, but did get some return love from Pontiac owners.

A consultant with Polk has turned the loyalty lens on Saab. The Polk Disposal Loyalty Methodology tracks owners selling vehicles within six months of buying a new one. In 2010 and 2011, Polk found that when Saab died, owners went right up the middle of the mainstream to Honda. It was close, though, with just 0.2 percent separating Honda from number two Volkswagen. Audi comes in third.

After that it's back to the masses with Toyota, Chevrolet and Ford trumping import luxury brands. And if you combine all of the General Motors brands that Saab owners have migrated to, GM more than doubles Honda with a 15.2-percent share, so all the love is not lost.

Turkey buys rights to Saab 9-3 for domestic car

Mon, Oct 19 2015Just in time for Halloween, a Saab is rising from the dead. National Electric Vehicle Sweden, which controls the Swedish automaker, is selling the intellectual property rights for the second-generation 9-3 to the Scientific and Technological Research Council of Turkey (TUBITAK). This government-supported agency intends to turn the sedan into the "Turkish National Car," according to NEVS. Using the aging 9-3 as a backbone, Turkey intends to strengthen the nation's auto industry by producing an extended-range electric vehicle by 2020, Daily Sabah reports. The goal is for 85-90 percent of the components to come from the country. "From design to production, Turkey will be the center for all parts and processes regarding the first domestically produced car," Interim Science, Industry and Technology Minister Fikri Isik said to Daily Sabah. TUBITAK considered developing its own vehicle from scratch but calculated at least $1 billion in costs. Without going into specific detail, Isik said that buying the rights to the existing Saab turned out to be a better option. Despite having sold the 9-3 IP, NEVS is signing on to help with a business plan and to create the necessary supply and distribution chains for the EV. NEVS previously tried to revive the 9-3 itself by briefly continuing production and attempting to launch an electric version. Earlier this year, it partnered with Dongfeng to develop green vehicles. The company has been beset with financial problems, embroiled in a seemingly interminable post-bankruptcy reorganization progress. NEVS has been chosen by TUBITAK as its partner for developing a Turkish National Car TUBITAK, (the Scientific and Technological Research Council of Turkey) which has been assigned to develop "Turkish National Car" and realize this important mission, has chosen National Electric Vehicle Sweden AB, Nevs, as the industrial partner for the project. The cooperation has started in June 2015 between Nevs and TUBITAK and future industrial synergies in terms of development and manufacturing shall be generated with this cooperation. In the short term perspective this cooperation shall put Nevs' assets to work and shall give Turkey quick access to extensive automotive knowledge and experience. Nevs shall also provide its know-how in the developing of the business plan and establishing of the supply and distribution chains to TUBITAK.

NEVS, the company that took over Saab, gets new majority owner

Wed, Jan 16 2019Chinese real estate conglomerate Evergrande Group, a key investor behind troubled electric vehicle startup Faraday Future, has acquired a 51 percent stake in NEVS. That's the Chinese-backed Swedish electric vehicle company that purchased the assets of Saab out of bankruptcy in 2012. The investment by subsidiary Evergrande Health Industry Group was valued at the equivalent of $930 million and is expected to help NEVS develop new EVs. Evergrande said it paid the first installment of $430 million on Jan. 15, with the remainder due by the end of the month. The remaining 49 percent stake is controlled by a holding company controlled by NEVS founder Kai Johan Jiang. "It means that NEVS will get a financial (sic) strong main owner who is very interested in developing our vision about green mobility transport solutions for the future," NEVS CEO Stefan Tilk said in a statement. NEVS, short for National Electric Vehicle Sweden, owns production facilities in Trollhattan, Sweden, and Tianjin, China, with another under construction in Shanghai. In late 2017 the company launched what apparently was limited production of the 9-3 EV, an electric vehicle based — you guessed it — on the old Saab 9-3 platform. The company now says it will be built in Tianjin starting later this year, with components coming from Trollhattan. It boasts a 186-mile range, in-car WiFi and a cabin air filter for the notoriously smoggy Chinese air. It also showed a battery-electric 9-3X concept at CES Asia in 2017, which is likely to be its next model pegged for production. The South China Morning Post, citing local media reports, says two of NEVS' models meet the standards for mass production in China. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Definitely the best promotional video we've ever seen. Evergrande Health first came to Faraday Future's rescue back in 2017 with a promised $2 billion investment, but the two sides later went into arbitration in Hong Kong over a dispute about money following the first infusion of $800 million, leading the automaker to cut staff and wages last year, casting the future of FF into doubt. At the end of 2018, Faraday announced it had entered into a new restructuring agreement with an Evergrande Health subsidiary that sees them end litigation and jettison the previous investment agreement, taking Evergrande's investment in the company to 32 percent.