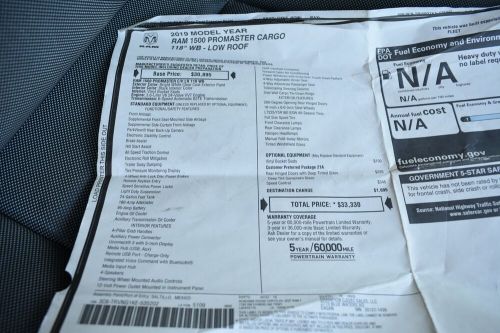

2019 Ram Promaster 1500 118 Wb on 2040-cars

Walker, Louisiana, United States

Engine:6

Fuel Type:Gasoline

Body Type:--

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 3C6TRVNG1KE535202

Mileage: 63904

Make: Ram

Trim: 1500 118 WB

Features: --

Power Options: --

Interior Color: Gray

Warranty: Unspecified

Model: ProMaster

Ram ProMaster for Sale

2017 ram promaster 3500 136 wb(US $500.00)

2017 ram promaster 3500 136 wb(US $500.00) 2021 ram promaster tradesman(US $17,900.00)

2021 ram promaster tradesman(US $17,900.00) 2020 ram promaster cargo van high roof 159" wb(US $21,902.30)

2020 ram promaster cargo van high roof 159" wb(US $21,902.30) 2021 ram promaster 2500 136 wb(US $42,900.00)

2021 ram promaster 2500 136 wb(US $42,900.00) 2022 ram promaster 1500 standard(US $98,000.00)

2022 ram promaster 1500 standard(US $98,000.00) 2019 ram promaster tradesman slt cargo van(US $14,961.10)

2019 ram promaster tradesman slt cargo van(US $14,961.10)

Auto Services in Louisiana

The Tint Shop ★★★★★

Service Plus Auto Glass ★★★★★

Premier Towing & Automotive ★★★★★

Orr Nissan ★★★★★

Northside Towing ★★★★★

Morris Tire Service, Inc. ★★★★★

Auto blog

Italian coachbuilder wraps a modern-day Citroen van in a retro skin

Tue, Oct 6 2020Italian coachbuilder Caselani resurrected an obscure, often-forgotten model from Citroen's past to offer van buyers an additional retro-styled option. Called Type HG, it's based on the current-generation Citroen Jumpy. One of the French carmaker's best-known vintage vans is the Type H, which was built with only minor changes from 1947 to 1981. It's aged into a sought-after classic that's popular as a food truck and as a camper from Paris to Sydney. Few realize Citroen planned to release a smaller model named Type G which looked almost exactly like the H but used an air-cooled flat-twin engine shared with the 2CV. Several prototypes were made, but the project was canned in favor of the 2CV-based, nine-horsepower AU van released in 1951. It's this little-known prototype that only exists in Citroen's official heritage collection and in the minds of the most indoctrinated French car enthusiasts that Caselani chose to bring into the 21st century. And, because the Type G (shown below) was a shrunken copy of the Type H from a design standpoint, making a body kit that fits the Citroen Jumpy was relatively simple. Caselani liberally borrowed styling cues from its modern version of the Type H, which is based on the larger Citroen Jumper sold as the Ram ProMaster in the United States. It adds a new-look front end with a vertical grille, chromed chevrons, and round headlights positioned as far out of the body as regulations permit, corrugated body panels, and a redesigned rear end. Whitewall tires are optionally available. Caselani offers the Type HG as a passenger van, a crew-cab van, and a panel van. Pricing starts at 29,400 euros before taxes are factored in, a sum that represents about $35,000 and that corresponds to a short-wheelbase panel model powered by a 100-horsepower, four-cylinder turbodiesel engine. Alternatively, motorists who already own a Jumpy can purchase the transformation kit on its own for 14,800 euros (about $17,500). For added peace of mind, Caselani pointed out the conversion was created with Citroen's input, and the brand authorized the kit. We know what you're thinking: what on earth is a Jumpy? Glad you asked! It's a van positioned in the middle of Citroen's commercial range. It slots between the Berlingo, which competes in the same segment as the Ford Transit Connect, and the Jumper, which is marketed as an alternative to the Ford Transit.

FCA and Cummins named in diesel emissions class-action lawsuit

Mon, Nov 14 2016Chrysler is now the first United States-based carmaker to be sued for allegedly skewing emissions results. In a move that sounds eerily similar to the troubles of European manufacturers, Chrysler is claimed to have hid diesel engine characteristics causing emissions as much as 14 times higher than permitted by regulations. According to Bloomberg, the lawsuit alleges that Chrysler, together with its diesel engine partner Cummins, has concealed the nitrogen oxide output of certain Ram vehicles produced between 2007 and 2012. The NOx pollutants were meant to be broken down in a process called regeneration in the truck's NAC system, or NOx Absorption Catalyst, which predated the 2013-introduced SCR, or Selective Catalytic Reduction system. By design, the NAC captures and stores NOx emissions, converting them to nitrogen and oxygen through a catalytic process. The lawsuit claims the Cummins engine's system has a limited capacity to store the emissions, and as a result the pollutants escape, increasing emissions, worsening fuel consumption and wearing down the catalytic converter. The later, cleaner SCR system uses a urea-water injection, and it gradually replaced the NAC on Cummins 6.7-liter engines, as it was first implemented in 2011 and made standard in 2013. As Bloomberg notes, the model years of Ram trucks involved in the lawsuit predate the earliest Volkswagen "Dieselgate" models by two years. The lawsuit, filed on behalf of 500,000 truck owners, accuses Chrysler and Cummins of fraud, false advertising and racketeering. As an underlying motive, the filing mentions a 2001 change in EPA emissions standards. Announced to become effective in 2010, the EPA requirements drove Chrysler and Cummins to try and reach those already by 2007. However, the NAC system is said to have fallen short of these goals, and the filing claims that Chrysler and Cummins chose to "rig" the engines instead. The affected vehicles predate the 2014 merger of Chrysler and Fiat. FCA US has released a statement regarding the lawsuit, saying it will contest the lawsuit "vigorously". News Source: BloombergImage Credit: Getty Editorial Government/Legal Green Chrysler Dodge RAM Emissions Diesel Vehicles FCA cummins diesel

Chrysler Group moves around execs in wake of recent departure

Tue, 16 Apr 2013Chrysler is busy shuffling executives around in the wake of Ram head Fred Diaz's departure. The automaker has named Reid Bigland (pictured, right) as Diaz's successor in the role of president and CEO of Ram, though Bigland will continue his duties as the head of US sales and the president and CEO of Chrysler Canada. Bigland first came to Chrysler in 2006 from Freightliner Custom Chassis Corporation, so the guy knows a thing or two about trucks.

Meanwhile, Timothy Kuniskis will take over as president and CEO of Dodge. Previously, he served as the head of Fiat in North America and has been with Chrysler in one capacity or another since 1992. His old title now falls to Jason Stoicevich, who will also continue to work as the director of the automaker's California Business Center. Finally, Bruno Cattori will take over as the president and CEO of Chrysler Mexico.

Diaz left his position to take over as a divisional vice president of sales and marketing with Nissan. You can read the full press release on the Chrysler personnel changes below for more information.