2024 Ram 5500 on 2040-cars

Bluefield, West Virginia, United States

Transmission:Automatic

Vehicle Title:Clean

Engine:6.7L Diesel I6

Fuel Type:Diesel

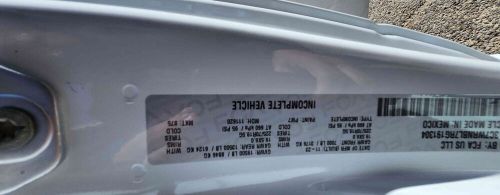

VIN (Vehicle Identification Number): 3C7WRNBL7RG191304

Mileage: 155

Number of Cylinders: 6

Model: 5500

Exterior Color: White

Make: Ram

Drive Type: 4WD

Ram 5500 for Sale

2022 ram 5500 cummins rollback flat bed tow truck(US $89,995.00)

2022 ram 5500 cummins rollback flat bed tow truck(US $89,995.00) 2018 ram 5500 tradesman(US $38,000.00)

2018 ram 5500 tradesman(US $38,000.00) 2024 ram 5500 tradesman(US $76,915.00)

2024 ram 5500 tradesman(US $76,915.00) 2021 ram 5500 diesel rollback flatbed tow truck(US $89,995.00)

2021 ram 5500 diesel rollback flatbed tow truck(US $89,995.00) 2016 ram 5500 hd 4x4 diesel wrecker/tow recovery truck(US $69,995.00)

2016 ram 5500 hd 4x4 diesel wrecker/tow recovery truck(US $69,995.00) 2023 ram 5500 hd slt miller industry flatbed rollback tow truck(US $129,995.00)

2023 ram 5500 hd slt miller industry flatbed rollback tow truck(US $129,995.00)

Auto Services in West Virginia

Whitlock Used Cars & Salvage ★★★★★

Schmidt Brothers Tire & Svc ★★★★★

Middle Creek Garage Inc ★★★★★

Mazda Of Winchester ★★★★★

Doyle Family Auto Connection ★★★★★

Car-Mart ★★★★★

Auto blog

2017 Ram Rebel Mojave Sand preaches subtlety, revived 1500 Ignition Orange Sport doesn't

Mon, Nov 14 2016The traditionally green Los Angeles Auto Show isn't normally the place for pickup trucks, but that's not stopping Ram from bringing a pair of limited-edition trims for its popular 1500 pickup to sunny SoCal. First up, we have the 1500 Rebel Mojave Sand. Limited to just 1,500 units, this truck gets its name from its Mojave Sand exterior paint, which looks nothing like the identically named color Jeep sells on the Renegade. The cute ute's shade has a lot more tan than the almost-white color coming to the Ram Rebel. Of course, the Renegade doesn't get the Rebel's neat black graphics on the performance hood. Inside, the special-edition Rebel replaces the Radar Red seatbacks with all-black thrones, while Light Slate Gray stitching covers the IP, doors, and seats. Black anodized touches round out the cabin changes, and contribute to what is quite frankly a very business-like cabin. It feels out of place for a vehicle like the Rebel, but that doesn't mean it looks bad. If you think the Rebel Mojave Sand looks too muted, the new 1500 Ignition Orange Sport is anything but. A revival of a previous limited-edition package from 2015, the new truck brings back the bright orange exterior color, body color grille surround, black hood decals – which are identical to the Mojave Sand – and black badges. The main exterior difference between 2015 and 2017 are the wheels. Presumably 20-inchers, the five-spoke design is black for 2017 rather than silver. The cabin gets "Copperhead" accents and stitching throughout the cabin, with anodized orange trim pieces on the door panels and trim rings. Prices for the Rebel Mojave Sand start at $46,910 including $1,320 in destination charges. Deliveries should start in December. The Ignition Orange Sport, meanwhile, is only available on the 5.7-liter, V8-powered Crew Cab and kicks off at $45,060, also sans destination. The Jack-O-Lantern-themed trucks are hitting dealers now. Related Video:

Ram 2500 Off-Road Pack targets Ford's FX4, Chevy's Z71

Thu, Feb 11 2016If you were a Ford or Chevrolet customer looking for a heavy duty pickup with some improved off-road chops, the process is relatively simple: tick the box for the FX4 or Z71 packages and be on your merry way. These packages are simple affairs, adding upgraded shocks, underbody protection, and unique wheels alongside a slew of cosmetic improvements. Now, Ram is getting in on the game. Making its debut at the Chicago Auto Show, a new 4x4 Off-Road Package will be offered on the 2500 model regardless of engine, bed length, or trim level. The only restriction is cab size – you'll need to order the Crew or Mega Cab in order to get the new option pack. Despite being a new package, Ram's formula is more or less the same as that used by the FX4 and Z71. Mechanical changes are limited to new Bilstein monotube shocks (Ford turns to Rancho, while the shock absorbers on Chevy's Z71 are unbranded) and a standard limited-slip differential (also offered on the Big Horn and Lone Star trims). Firestone supplies the LT tires, which look to strike a balance between off-road ability and on-road comfort, while there's the normal array of underbody protection. And like Ford and Chevy, Ram has fit a prominent decal on the rear fender. Pricing isn't finalized yet, but Ram specifically calls the 4x4 Off-Road Pack "a value-priced option." That'd make a lot of sense, considering how Ford and Chevy have priced similar equipment packs. Neither the FX4 nor the Z71 pack are high-priced options, with the former ringing up at $295 on the F-250 and the latter maxing out at $620, depending on which Silverado HD you chose. Look for the Ram 2500 4x4 Off-Road Pack to hit dealers during the third quarter of 2016. Related Video: Ram Truck Brand Announces New Ram 2500 Heavy Duty 4x4 Off-road Package New Ram 2500 4x4 Off-road Package designed for customers who need essential off-road upgrades combined with 3/4 -ton pushing, pulling and hauling capabilities Part of "America's Off-road Truck Leader" lineup Features stability control upgrades, all-terrain tires and rugged exterior appearance New package includes limited-slip differential, underbody protection and Bilstein shocks Available "RamBox Holster" rack accessory for RamBox-equipped trucks February 11, 2016 , Auburn Hills, Mich. - Ram Truck capitalizes on a core piece of the 3/4 -ton segment with new Ram 2500 4x4 Off-road Package, which includes a list of must-have upgrades for the occasional off-roader.

The best Super Bowl car commercials from the last 5 years

Wed, Jan 28 2015If you've been dipping into the Autoblog feed over the past days and weeks, you wouldn't even have to be a sports fan to know the Super Bowl is coming up. Automakers have been teasing their spots for the big game, dropping them days early, fully-formed onto the Internet and otherwise trying to amp up the multi-million-dollar outlays that they've made for air time on the biggest advertising day of the year. And, we're into it. The lead up to the Super Bowl is almost akin to a mini auto show around these parts; with automakers being amongst the most prolific advertisers on these special Sundays. The crop of ads from 2015 looks as strong as ever, but we thought we'd take a quick look back at some of our favorite spots from the last five years. Take a look at our picks – created from a very informal polling of Autoblog editors and presented in no particular order – and then tell us about your recent faves, in Comments. Chrysler, Imported From Detroit Chrysler, Eminem and a lingering pan shot of "The Fist" – it doesn't get much more Motown than 2011's Imported From Detroit. With the weight of our staffers hailing from in and around The D, it's no wonder that our memories still favor this epic Super Bowl commercial (even though the car it was shilling was crap). Imported really set the tone for later Chrysler ads, too, repeated the formula: celebrity endorsement + dramatic copy + dash of jingoism = pulled car-guy heartstrings. Mercedes-Benz, Soul teaser with Kate Upton One of our favorite Super Bowl commercials (and yours, based on the insane number of views you logged) didn't even technically air during the game. Mercedes-Benz teased its eventual spot Soul with 90-seconds worth of Kate Upton threatening to do her best Joy Harmon impression. (Teaser indeed.) It doesn't win points for cleverness, use of music, acting, or any compelling carness, but it proved that Mercedes' advertisers knew how to make a splash in the Internet Age. And, hey, it's still classier than every GoDaddy commercial. Kia, A Dream Car. For Real Life Like the Mercedes video above, the initial draw here is a pretty lady; in this case the always stunning Adriana Lima. But this Kia commercial really delivers the extra effort we expect while scarfing crabby snacks and homemades, too. First of all, Motley Crue. Second, a cowboy on a bucking rhino. Enjoy yet again.