2021 Ram 2500 4x4 2500 Crew Diesel Limited-edition(rare Mega Cab) on 2040-cars

Redford, Michigan, United States

Engine:6.7L I6 24VTURBOCHARGED DIESEL ENGINE

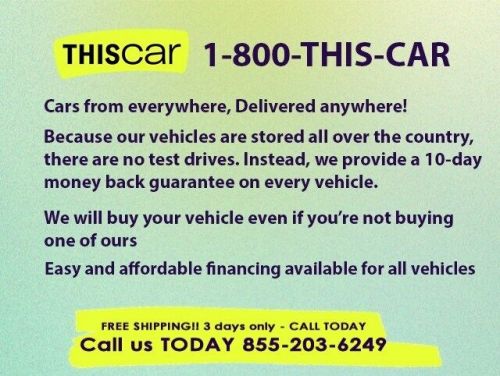

For Sale By:Dealer

Fuel Type:Diesel

Transmission:Automatic

Vehicle Title:Rebuilt, Rebuildable & Reconstructed

Year: 2021

VIN (Vehicle Identification Number): 3C6UR5TL4MG610941

Mileage: 16449

Drive Type: 4X4

Exterior Color: White

Interior Color: Black

Make: Ram

Manufacturer Exterior Color: Bright White Clear Coat

Manufacturer Interior Color: Black

Model: 2500

Number of Cylinders: 6

Number of Doors: 4 Doors

Sub Model: Dodge Ram 2500 Limited HD Diesel 4X4 Turbo Mega Used

Trim: 4X4 2500 CREW DIESEL LIMITED-EDITION(RARE MEGA CAB)

Warranty: Vehicle has an existing warranty

Ram 2500 for Sale

2022 ram 2500 big horn mega cab 4wd(US $59,790.00)

2022 ram 2500 big horn mega cab 4wd(US $59,790.00) 2013 ram 2500(US $28,900.00)

2013 ram 2500(US $28,900.00) 2018 ram 2500 4x4 crew 6.4l power wagon-edition(2500hd)(US $39,995.00)

2018 ram 2500 4x4 crew 6.4l power wagon-edition(2500hd)(US $39,995.00) 2022 ram 2500 limited(US $68,900.00)

2022 ram 2500 limited(US $68,900.00) 2017 ram 2500 laramie pickup 4d 6 1/3 ft(US $33,998.00)

2017 ram 2500 laramie pickup 4d 6 1/3 ft(US $33,998.00) 2021 ram 2500 limited mega cab 4x4 6'4" box(US $47,102.30)

2021 ram 2500 limited mega cab 4x4 6'4" box(US $47,102.30)

Auto Services in Michigan

Young`s Brake & Alignment ★★★★★

Winners Auto & Cycle ★★★★★

Wills Body Shop ★★★★★

West Side Auto Parts ★★★★★

Wealthy Body Shop Inc ★★★★★

Unique Auto Service ★★★★★

Auto blog

FCA goes all-in on Jeep and Ram brands on cheap gas bet

Wed, Jan 27 2016It's no surprise that as SUV and truck sales remain strong in the wake of unusually cheap gas, Jeep and Ram sales are taking off. What is a surprise is that FCA CEO Sergio Marchionne thinks that cheap gas will be a "permanent condition," and feels strongly enough about it to change up North American manufacturing plans. Jeep appears to be the biggest beneficiary of the product realignment. In addition to increasing the sales estimates for the brand worldwide upwards to 2 million units a year by 2018, the brand will get a flood of investment for new product and powertrains. Consider the Wrangler Pickup to be part of the salvo, as well as the Grand Wagoneer three-row announced in 2014 as part of the original five-year plan. The Wrangler four-door will get at least two new powertrains, a diesel and mild hybrid version, in its next generation. That mild hybrid powertrain may utilize a 48-volt electrical system like the one that's being developed by Delphi and Bosch which the suppliers think will be worth a 10 to 15 percent fuel economy gain at a minimum. Down the road, in the 2020s, the Wrangler could adopt a full hybrid system. The diesel powertrain is planned for 2019 or 2020. The Ram 1500 is also pegged to receive a mild hybrid system, again potentially based on 48-volt architecture, sometime after 2020. Lastly, Jeep and Ram will take over some of the production capacity of existing plants. The Sterling Heights, MI, plant that builds the Chrysler 200 will now build the Ram 1500; the Belvidere, IL, facility that produces the Dodge Dart will take over Cherokee output; the big Jeep facility in Toledo, OH, will be used for increased Wrangler demand. In 2015, according to FCA's numbers, car and van demand went down by 10 percent, but SUV demand went up 8 percent and truck demand 2 percent. Considering that these are high-margin vehicles, FCA can't ignore the math. FCA also won't build any new factories to supplement production to meet demand, but instead are reshuffling production priorities. Think of it this way: FCA is gambling on cheap gas being a permanent part of our lives, at least into the 2020s. By doubling down on SUVs and trucks, the company stands to win big, unless a spike in gas prices changes the landscape. FCA isn't talking about a Plan B, so they're all in. It'll be interesting to see how this plays out.

Chrysler recalling 67k trucks with manual transmissions

Tue, Dec 30 2014Earlier this month, Chrysler announced the recall of some 280,000 pickup trucks over concerns that their axles could seize up. Now the automaker has announced an entirely separate recall of another 66,819 trucks over the springs that could break in the clutch ignition interlock switch. The recall affects Dodge Ram 1500, 2500 and 3500 pickups, as well as the Dodge Dakota and Mitsubishi Raider. The issue is relevant only to those trucks fitted with manual transmissions, from the 2006 and 2007 model years and manufactured between July 1, 2005, and July 31, 2006. Since a broken spring could, according to statements issued by the National Highway Traffic Safety Administration and FCA US LLC (previously known as the Chrysler Group) prevent the vehicle from starting, or cause it to move unintentionally once the ignition kicks over, the automaker will begin notifying owners of the affected vehicles just before Valentine's Day to bring their trucks into their local dealers to have the clutch ignition interlock switch replaced. FCA emphasizes, however, that the unintended movement would only occur "in rare cases" and only "if recommended starting procedures are not followed." Only one such case is known to have occurred, but it did regrettably result in a fatality. Statement: Clutch Ignition Interlock Switch December 29, 2014 , Auburn Hills, Mich. - FCA US LLC is launching a voluntary global recall of an estimated 66,819 older-model pickup trucks equipped with manual transmissions. The Company will replace their clutch ignition interlock switches at no charge to customers. An investigation by FCA US engineers discovered switches in certain model-year 2006 and 2007 pickups may be equipped with spring wire that differs from wire used in previous switches. The alternate wire may break and, as a result, the vehicles may not start. In rare cases, a vehicle may if recommended starting procedures are not followed Β exhibit unintended movement when its ignition key is turned. The Company is aware of one fatality related to this campaign. It stemmed from the single known accident involving this population of vehicles. The recall covers certain Dodge Dakota, Dodge Ram 1500, 2500, 3500 and Mitsubishi Raider pickups. Switches with the alternate wire were not used in any vehicles produced before July of 2005, or after June of 2006. The Dakota and Raider are no longer in production.

China's Great Wall confirms its interest in Jeep, or all of FCA

Tue, Aug 22 2017HONG KONG/SHANGHAI Chinese automaker Great Wall Motor reiterated its interest in Fiat Chrysler Automobiles NV on Tuesday, but said it had not held talks or signed a deal with executives at the Italian-American automaker. China's largest sport utility vehicle manufacturer made a direct overture to Fiat Chrysler on Monday, with an official saying the company was interested in all or part of FCA, owner of the Jeep and Ram truck brands. Automotive News first reported the news, quoting Great Wall Motor President Wang Fengying as saying she planned to contact FCA to discuss acquiring the Jeep brand specifically. Those comments sent FCA shares higher but also raised questions over the ability of China's seventh-largest automaker by sales to buy larger Western rival FCA, or even Jeep, which some analysts value at as much as one-and-a-half times FCA. Great Wall sought to dampen speculation on Tuesday. It confirmed it had studied Fiat Chrysler, but said there was "no concrete progress so far" and "substantial uncertainty" over whether it would eventually bid. "The company has not built any relationship with the directors of FCA nor has the company entered into any discussion or signed any agreements with any officer of FCA so far," the company said in an English-language stock exchange filing. It did not give further detail. Fiat Chrysler stock dipped on the statement on Tuesday. Great Wall said trading in its Shanghai-listed shares would resume on Wednesday after having been suspended. Fiat Chrysler declined to comment on Great Wall's statement. On Monday, it said it had not been approached and was fully committed to implementing its current business plan. FLUSHING OUT RIVALS? Great Wall Motor, which was early to spot China's love of SUVs, had revenue of $14.8 billion last year and sold 1.07 million vehicles - but that compares with FCA's 2016 revenue of 111 billion euros ($130.6 billion). Analysts said Great Wall would need to raise both debt and equity to complete any deal, meaning its chairman Wei Jianjun could lose majority control. One possible scenario, according to analysts at Jefferies, would see Wei keeping a roughly 30 percent stake, while Great Wall would raise $10-$14 billion in debt and $10 billion in equity - hefty for a group currently worth just $16 billion. Ultimately, politics could be the clincher.